Cancer Diagnostics Market

Cancer Diagnostics Market By Type (Product Type [Reagent & Kits and Instruments], and Services), Technique (Molecular Diagnostics [Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Fluorescent In-Situ Hybridization (FISH), Microarray, and Immunohistochemistry], Diagnostics Imaging [Ultrasound & Radiology, Mammography, MRI Scan, CT Scan, and Nuclear Medicine Scans], Endoscopy, and Biopsy [Standard Biopsy and Liquid Biopsy]), Cancer Type (Breast Cancer, Colorectal Cancer, Lung Cancer, Prostate Cancer, and Others), End-User (Hospitals, Diagnostics Labs, and Others), and Geography, is expected to grow at a significant CAGR forecast till 2030 owing to the growing burden of cancer across the globe and rise in various product launches for efficient detection of cancer.

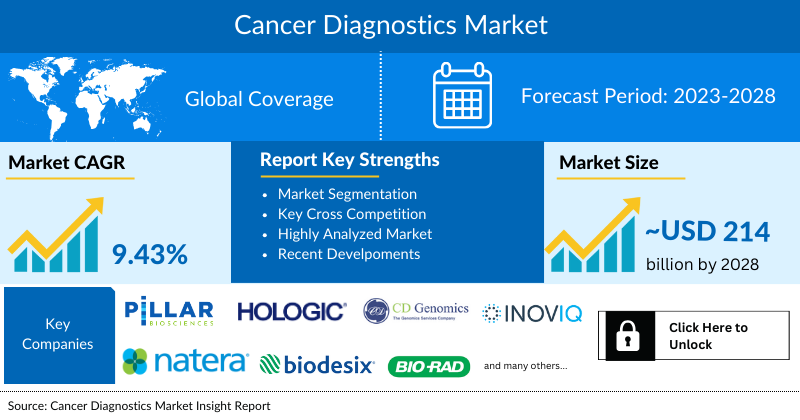

The global cancer diagnostics market was valued at USD 125.13 billion in 2023, growing at a CAGR of 9.43% during the forecast period from 2024 to 2030, to reach USD 214.88 billion by 2030. The increase in demand for cancer Diagnostics products and services is predominantly attributed to the spike in cancer cases reported worldwide. In addition, growing manufacturers' focus to develop advanced cancer diagnostic products, the establishment of various cancer diagnostic labs, and rising government initiatives to raise awareness regarding early detection and management of cancer among patients, and others are anticipated to drive the global cancer diagnostics market during the forthcoming years.

Cancer Diagnostics Market Dynamics

The market for cancer diagnostics is gaining momentum at present due to the surge in cancer cases across the globe. According to the data published by GLOBOCAN in the year 2020, approximately 19,292,789 new cases of cancer were reported worldwide. Furthermore, as per the World Health Organization (WHO) 2021 data, cancer accounted for an estimated 10 million deaths across the globe in the year 2020. Thus, for proper cancer management, early detection of cancer is necessary which would lead to an increased demand for cancer diagnosis thereby propelling the market.

Additionally, as per the above-mentioned data, tobacco use, alcohol use, unhealthy diet, physical inactivity, carcinogenic infections, and air pollution are some of the risk factors for cancer. For instance, in the year 2018, about 13% of cancer diagnosed were attributed to carcinogenic infections such as Helicobacter pylori, human papillomavirus (HPV), hepatitis B virus, hepatitis C virus, and Epstein-Barr virus, as per the WHO, 2021.

Furthermore, technical innovation in the development of a variety of cancer diagnostic products would also contribute to the market in the forthcoming years. Integration of Artificial Intelligence (AI) technology in cancer care to improve the accuracy, speed, and efficiency of cancer detection will also boost the cancer Diagnostics market. For instance, in November 2021, FDA granted 510(k) clearance for Lunit AI solution to detect breast cancer.

Hence, all the aforementioned factors are projected to bolster the cancer diagnostics market during the forecasted period.

However, side effects associated with cancer imaging devices and the high cost of cancer diagnostic products are likely to impede the global cancer diagnostics market.

Cancer Diagnostics Market Segment Analysis

Cancer Diagnostics Market By Type (Product Type [Reagent & Kits and Instruments], and Services), Technique (Molecular Diagnostics [Polymerase Chain Reaction (PCR), Next Generation Sequencing (NGS), Fluorescent In-Situ Hybridization (FISH), Microarray, and Immunohistochemistry], Diagnostic Imaging [Ultrasound & Radiology, Mammography, MRI Scan, CT Scan, and Nuclear Medicine Scans], Endoscopy, and Biopsy [Standard Biopsy and Liquid Biopsy]), Cancer Type (Breast Cancer, Colorectal Cancer, Lung Cancer, Prostate Cancer, and Others), End-User (Hospitals, Diagnostic Labs, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the product type segment of the cancer diagnostics market, the reagents & kits type held a significant market share of 66% which is expected to continue during the forecasted period. This is owing to the wide availability of reagents & kits for detecting cell signaling, cell proliferation and viability, tumor suppressor gene, bioactive proteins, and others in cancer cells.

Furthermore, approval of novel reagents and kits, which aid in the early detection and proper management of various cancer types, by the regulatory bodies, is also expected to boost the market growth for this segment.

For instance, on August 05, 2021, Pillar Biosciences, an innovative next-generation sequencing (NGS) solutions in-vitro diagnostics (IVD) company, received the Premarket Approval (PMA) for its oncoReveal™ Dx Lung and Colon Cancer Assay, an NGS tissue-based companion diagnostic test for the qualitative detection of somatic mutations in DNA derived from non-small cell lung cancer (NSCLC) and colorectal (CRC) cancer tumors.

Also, rising research and development activities by the key manufacturers are another factor projected to contribute to the segmental growth of the cancer Diagnostics market. For instance, in the year 2020, BD started a clinical trial to verify the clinical effectiveness of the HPV Nucleic Acid Genotyping Assay Kit for cervical cancer.

Thus, all the above-mentioned factors are expected to propel the cancer diagnostics market in the upcoming years.

|

Report Metrics |

Details |

|

Study Period |

2021 to 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2024 to 2030 |

|

CAGR | |

|

Cancer Diagnostics Market Size |

~USD 214 billion by 2030 |

|

Key Cancer Diagnostics Companies |

Pillar Biosciences, Inc., Hologic Inc., CD Genomics, Natera, Inc., Agendia Inc., Biodesix Inc., INOVIQ Ltd., HTG Molecular Diagnostics Inc., Bio-Rad Laboratories, Inc., Koninklijke Philips N.V., FUJIFILM Holdings Corporation, Abbott, General Electric Company, Thermo Fisher Scientific Inc., NeoGenomics Laboratories, F. Hoffmann-La Roche Ltd, Agilent Technologies Inc, Guardant Health, Illumina, Inc., QIAGEN, and others |

North America is expected to dominate the overall Cancer Diagnostics Market:

Among all the regions, North America occupied a major share of 42% in the overall Cancer Diagnostics market in 2020 and will continue to dominate during the forecasted period. This domination is due to significant factors such as the rise in cancer cases, the presence of key manufacturers, well-established healthcare infrastructure, and rising awareness regarding cancer and its proper management, among others.

For instance, as per the GLOBOCAN 2020 data, approximately, 2,281,658 people were diagnosed with cancer in the US in 2020.

Furthermore, the rise in smoking among adults in the country could be a potential factor for lung cancer development which would, in turn, increase the cancer diagnostics market.

For instance, as per the CDC 2020 data, an estimated 34.1 million adults in the United States smoked cigarettes in 2019.

Moreover, approval of products to enhance imaging technology for various cancer detection would also contribute to the market. Recently, on November 29, 2021, FDA approved Cytalux (pafolacianine), a targeted fluorescent imaging agent intended to assist surgeons in identifying ovarian cancer lesions.

Hence, the interplay of all the above-mentioned factors will augment the cancer diagnostics market in the country during the forecasted period.

Key Cancer Diagnostics Companies In The Market

Some of the key Cancer Diagnostics companies operating in the market include Pillar Biosciences, Inc., Hologic Inc., CD Genomics, Natera, Inc., Agendia Inc., Biodesix Inc., INOVIQ Ltd., HTG Molecular Diagnostics Inc., Bio-Rad Laboratories, Inc., Koninklijke Philips N.V., FUJIFILM Holdings Corporation, Abbott, General Electric Company, Thermo Fisher Scientific Inc., NeoGenomics Laboratories, F. Hoffmann-La Roche Ltd, Agilent Technologies Inc, Guardant Health, Illumina, Inc., QIAGEN, and others.

Recent Developmental Activities in the Cancer Diagnostics Market:

- In May 2025, Vigilant Ops announced its support for Epredia's E1000 Dx™ Digital Pathology Solution in achieving cybersecurity compliance. The E1000 Dx recently received FDA 510(k) clearance, marking a significant step forward in advancing digital pathology for cancer diagnostics.

- In March 2025, Epredia, a global leader in precision cancer diagnostics and a subsidiary of PHC Holdings Corporation (TSE: 6523), announced that it has received U.S. Food and Drug Administration (FDA) 510(K) clearance for its E1000 Dx Digital Pathology Solution (E1000 Dx). The E1000 Dx features a high-speed, automated whole-slide imaging digital scanner, medical-grade viewer, and advanced image management software, enabling the creation of high-resolution digital images of up to 1,500 tissue samples daily.

- In November 2021, Hologic, Inc. commercially launched its new Genius™ Digital Diagnostics System in Europe. The Genius Digital Diagnostics System is the next generation of cervical cancer screening that combines deep learning-based artificial intelligence (AI) with advanced volumetric imaging technology to help identify pre-cancerous lesions and cervical cancer cells in women.

- In June 2021, NeoGenomics completed its acquisition of Inivata Ltd, a global, commercial-stage liquid biopsy platform company headquartered in Cambridge, England.

- In August 2020, HTG Molecular Diagnostics, Inc. signed a commercialization and distribution agreement (Master Agreement) with QIAGEN Manchester Limited, a wholly-owned subsidiary of QIAGEN N.V. for companion diagnostic (CDx) assays based on HTG EdgeSeq, HTG’s novel RNA platform.

Key Takeaways from the Cancer Diagnostics Market Report Study

- Market size analysis for current market size (2023), and market forecast for 5 years (2024-2030).

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key companies dominating the Global Cancer Diagnostics Market.

- Various opportunities available for the other competitor in the Cancer Diagnostics Market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Cancer Diagnostics market growth in the coming future?

Target Audience who can be benefited from the Cancer Diagnostics Market Report Study

- Cancer Diagnostics providers

- Research organizations and consulting companies

- Cancer Diagnostics-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders in Cancer Diagnostics

- Various End-users who want to know more about the Cancer Diagnostics Market and the latest technological developments in the Cancer Diagnostics market.