HER2-low Cancers Market Summary

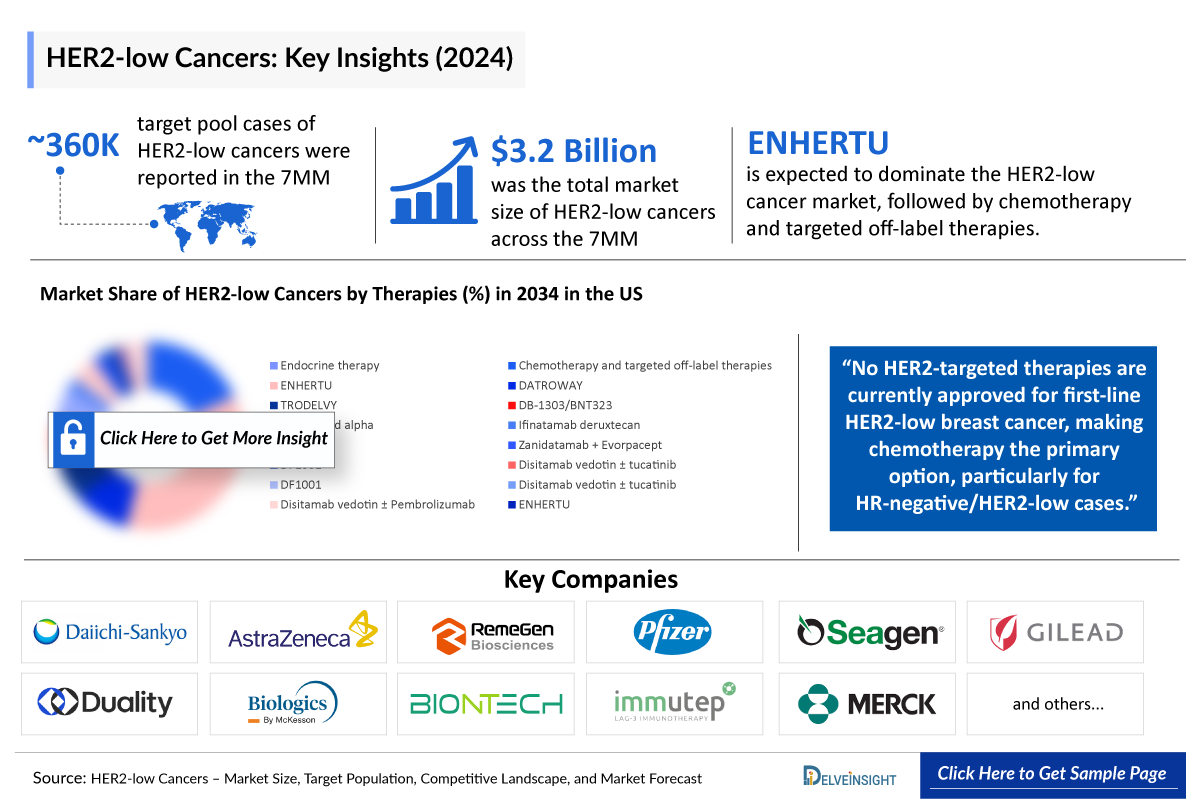

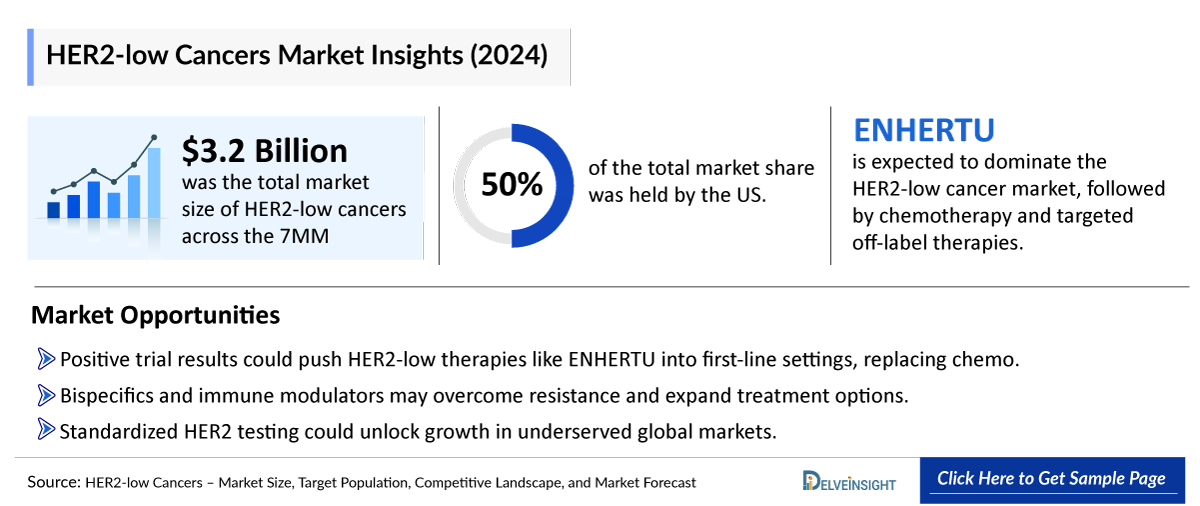

- The HER2-low cancers market in the 7MM is valued at approximately USD 3,530 million in 2025.

- The HER2-low cancers market is projected to grow at a CAGR of 11%, reaching USD 8,997 million by 2034 in leading countries (US, EU4, UK and Japan).

HER2-low cancers Market and Epidemiology Analysis

- In 2024, the HER2-low cancers market size was highest in the US among the 7MM, accounting for approximately USD 1,600 million, which is further expected to increase by 2034.

- Among the total targeted HER2-low cancer patient pool across the 7MM, the highest number of cases comprised breast cancer, followed by colorectal cancer, and the lowest number of cases comprised ovarian cancer.

- As the population ages, the breast cancer prevalence in the elderly is rising, with HER2-low cases comprising over 50% of traditional breast cancers.

- No HER2-targeted therapies are currently approved for first-line HER2-low breast cancer, leaving chemotherapy as a key treatment, especially for HR-negative/HER2-low cases.

- Before 2022, HER2-low patients were treated as HER2-negative, relying on chemotherapy or endocrine therapy. The game-changer came in August 2022 with the FDA approval of ENHERTU (trastuzumab deruxtecan), based on the DESTINY-Breast04 trial.

- Recent FDA approval of ENHERTU in HER2-low/ultralow breast cancer has validated HER2-low as a key therapeutic target. The shift toward earlier-line treatment settings is expected to drive further regulatory momentum.

- The HER2-low classification is now being explored in gastric, urothelial, and other solid tumors, broadening the therapeutic scope. Companies like Pfizer and Dragonfly are making efforts to establish HER2-low as a treatable target across multiple indications.

- Several novel therapies are in development, including TROP2-directed ADCs (TRODELVY, DATROWAY), bispecific antibodies (zanidatamab), and immune-modulating agents (eftilagimod alpha). The success of these candidates could diversify the treatment landscape and intensify competition.

- Among emerging therapies, eftilagimod alpha's subcutaneous administration offers a significant advantage in terms of patient convenience and compliance. The ability to self-administer the drug at home reduces the need for frequent hospital visits, potentially improving the quality of life for patients with metastatic breast cancer.

- Dragonfly Therapeutics’ DF1001, a first-in-class dual NK and T cell engager, is designed for heavily pretreated patients with HER2-low tumors, offering a novel immunotherapeutic approach.

- Prominent HER2-low cancer companies in this space include AstraZeneca and Daiichi Sankyo (DATROWAY), Pfizer (disitamab vedotin), Gilead Sciences (TRODELVY), Duality Biologics and BioNTech (DB-1303/BNT323), Bliss Biopharmaceutical (BB-1701), Daiichi Sankyo and Merck (ifinatamab deruxtecan).

- Looking ahead, HER2-low cancer therapies are poised for significant growth, driven by a robust pipeline, precision medicine advancements, and rising cancer incidence.

HER2-low cancers Market size and forecast

- 2025 HER2-low cancers Market Size: USD 3,530 million

- 2034 Projected HER2-low cancers Market Size: USD 8,997 million

- HER2-low cancers Growth Rate (2025-2034): 11% CAGR

- Largest HER2-low cancers Market: United States

DelveInsight's "HER2-low Cancers – Market Size, Target Population, Competitive Landscape, and Market Forecast–2034” report delivers an in-depth understanding of the HER2-low Cancers, historical and forecasted epidemiology as well as the HER2-low Cancers market trends in the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

HER2-low Cancers market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM HER2-low Cancers market size from 2020 to 2034. The report also covers current HER2-low cancer treatment practices/algorithms, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

HER2-Low Cancers Understanding

HER2-low Cancers Overview

HER2, a transmembrane tyrosine kinase receptor encoded by the ERBB2 gene, plays a key role in cell growth, differentiation, and survival. It belongs to the epidermal growth factor receptor family and is assessed using standard molecular methods—HER2 protein overexpression is evaluated via IHC, while gene amplification is determined by FISH. HER2-low is classified as an IHC score of 1+ or 2+ without amplification by ISH (FISH-negative). HER2/neu primarily signals through the MAPK and PI3K pathways, driving malignant transformation when amplified or overexpressed. Its expression is observed in various cancers, including breast, colorectal, ovarian, endometrial cancer, bladder, gastric, and biliary tract cancers, with breast cancer being the most common.

The emergence of novel ADCs has transformed the treatment landscape for HER2-low tumors, significantly improving survival. ENHERTU is a cutting-edge ADC composed of a HER2-targeting monoclonal antibody and the topoisomerase I inhibitor.

Further details are provided in the report…

HER2-low Cancers Epidemiology

The epidemiology covered in the report provides historical as well as forecasted HER2-low Cancer epidemiology segmented by total targeted HER2-low cancers patient pool, treatment eligible pool of HER2-low cancers, total incident cases of breast cancer, age-specific cases of HER2-low breast cancers, and stage-specific cases of HER2-low breast cancers in the 7MM, covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from HER2-low Cancers Epidemiological Analyses and Forecast

- In the US HER2-low cancer patient pool, ovarian cancer has the lowest incidence.

- In 2024, HER2-low breast cancer targeted pool accounted 64,000, these cases are expected to increase during forecast period.

- Among the age-specific HER2-low breast cancer, 60-69 age group has major contribution about 30%.

- In EU4 and the UK, among the stage-specific breast cancers cases, Stage I accounted for the highest number of cases with approximately 31,000 in 2024.

- In Japan, the total number of Urothelial Carcinoma, HER2-low targeted pool was approximately 15,000 in 2024.

HER2-low Cancers Epidemiology Segmentation

- Total targeted HER2-low cancers patient pool

- Treatment eligible pool of HER2-low cancers

- Total incident cases of breast cancer

- Age-specific cases of HER2-low breast cancers

- Stage-specific cases of HER2-low breast cancers

HER2-low Cancers Drug Analysis

The drug chapter segment of the HER2-low cancers report encloses a detailed analysis of HER2-low cancer marketed and emerging (Phase III and Phase II and Phase I/II) pipeline drugs. It also helps to understand HER2-low cancers clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

HER2-low Cancers Marketed Drugs

ENHERTU (trastuzumab deruxtecan): Daiichi Sankyo and AstraZeneca

ENHERTU is a HER2-directed ADC. Designed using Daiichi Sankyo’s proprietary DXd ADC Technology, ENHERTU is the lead ADC in the oncology portfolio of Daiichi Sankyo and the most advanced program in AstraZeneca’s ADC scientific platform. It received FDA approval in August 2022 and 2025, EMA approval in 2023 and 2025, and PMDA approval in 2023. As per AstraZeneca's full-year 2024 clinical trial appendix, published in February 2025, the company anticipates a regulatory decision for ENHERTU (DESTINY-Breast06) in Japan for the treatment of HER2-low and ultralow metastatic breast cancer in the second half of 2025.

HER2-low Cancers Emerging Drugs

DATROWAY (datopotamab deruxtecan/Dato-DXd): AstraZeneca and Daiichi Sankyo

Datopotamab deruxtecan is an investigational TROP2-directed ADC. Designed using Daiichi Sankyo’s proprietary DXd ADC Technology, datopotamab deruxtecan is one of six DXd ADCs in the oncology pipeline of Daiichi Sankyo and one of the most advanced programs in AstraZeneca’s ADC scientific platform. Recently, in January 2025, DATROWAY received approval in the US for the treatment of adult patients with unresectable or metastatic HR-positive, HER2-negative (IHC 0, IHC 1+ or IHC 2+/ISH-) breast cancer who have received prior endocrine-based therapy and chemotherapy for unresectable or metastatic disease.

In March 2025, Daiichi Sankyo’s DATROWAY has been launched in Japan for the treatment of adult patients with HR positive, HER2-negative (IHC 0, IHC 1+ or IHC 2+/ISH-) unresectable or recurrent breast cancer after prior chemotherapy.

According to AstraZeneca’s full-year 2024 clinical trial appendix, published in February 2025, the company anticipates the data from Phase I of the TROPION-PanTumor01 (NCT03401385) trial to be available in the second half of 2025.

DB-1303/BNT323 (trastuzumab pamirtecan): Duality Biologics and BioNTech

BNT323/DB-1303 is a third-generation topoisomerase-1 inhibitor-based ADC-targeting HER2, which was built from DualityBio’s proprietary Duality Immune Toxin Antibody Conjugates (DITAC) platform. The candidate has exhibited antitumor activity in both HER2-positive and HER2-low tumor models as well as in several solid tumor indications, including patients with breast, gastric, endometrial, biliary tract cancers, and other advanced solid tumors.

BNT323/DB-1303 is currently being evaluated in an ongoing Phase I/II study (NCT05150691) in patients with advanced/metastatic solid tumors and a pivotal Phase III study (NCT06018337) in patients with HR-positive and HER2-low, metastatic breast cancer that has progressed on hormone and/or Cyclin-dependent Kinase 4/6 (CDK4/6) therapy.

|

Company |

Highest Phase |

Indication |

|

AstraZeneca and Daiichi Sankyo |

III |

Metastatic HR-positive, HER2-low, or negative breast cancer |

|

RemeGen and Pfizer (Seagen) |

III |

HER2 Expression (2–3L HER2 low Urothelial Cancer and 1L HER2 (≥IHC1+) Metastatic Urothelial Cancer); HER2-low 2L or 3L breast cancer and HER2-Low G/GEJ |

|

Gilead Sciences |

III |

HR-positive/HER-negative (HER2 IHC0 or HER2-low) inoperable, locally advanced, or metastatic breast cancer |

|

Daiichi Sankyo and Merck |

II |

Recurrent or metastatic solid tumors (biliary, bladder, breast, colorectal cancer, endometrial) |

|

Bliss Biopharmaceutical (Hangzhou) |

II |

HER2-positive or HER2-low unresectable or metastatic breast cancer |

|

Zymeworks/Jazz Pharmaceuticals/ ALX Oncology |

I/II |

Advanced HER2-expressing cancer including HER2-low breast cancer |

|

Dragonfly Therapeutics |

I/II |

HER2 Low gastric cancer, NSCLC, breast cancer, and esophageal cancer |

|

Mersana Therapeutics |

I |

Advanced or metastatic breast cancer with HER2-low (IHC 1+ or IHC 2+/ISH–) or HER2-negative (IHC 0) disease, including TNBC |

HER2-low Cancers Drug Class Analysis

ADCs have transformed HER2-low cancer treatment, with a breakthrough in 2022 when ENHERTU became the first approved therapy for HER2-low metastatic breast cancer. This game-changing advancement is reshaping precision oncology, setting new treatment benchmarks. Beyond introducing a vital option for tumors with low HER2 expression, ENHERTU secured a stronger position in the treatment sequence, now approved for HER2-low metastatic breast cancer after the failure of one or more endocrine therapies.

In January 2025, the FDA expanded ENHERTU’s approval to include patients with unresectable or metastatic hormone receptor-positive, HER2-low, or HER2-ultralow breast cancer based on the DESTINY-Breast06 trial. This approval removed the prior chemotherapy requirement, enabling earlier use after endocrine-based therapy. The trial demonstrated a significant PFS advantage with ENHERTU over standard chemotherapy (13.2 months vs. 8.1 months). Exploratory analysis confirmed comparable efficacy between HER2-low and HER2-ultralow patients. ENHERTU’s safety profile remained consistent with previous trials, with no new concerns identified. With this expanded indication, ENHERTU is emerging as a potential new standard of care for HR-positive, HER2-low, or HER2-ultralow metastatic breast cancer. However, it carries a black boxed warning for ILD and embryo-fetal toxicity. Due to the black box warning, we have given a lower score for safety.

HER2-low Cancers Market Outlook

The current HER2-low cancer treatment options, including gastric, endometrial, and other cancers, are evolving as research continues to uncover more about the role of HER2 in these malignancies. Traditional monoclonal antibodies and small molecular Tyrosine Kinase Inhibitors (TKIs) have little therapeutic effect on breast cancer with HER2-low expression.

For a long time, HER2-low breast cancer has been included in the treatment sequence of HER2- breast cancer, including HR+/HER2- and TNBC. ENHERTU has demonstrated promising results in patients with HER2-low expression (IHC 1+ or 2+/ISH-). Based on the practice-changing results of the DESTINY-Breast04 trial, ENHERTU has been approved by the US FDA in August 2022 and has also been recommended in National Comprehensive Cancer Network (NCCN) guidelines for patients with previously treated HER2-low metastatic breast cancer. The statistical design of this trial allowed for confirming the benefit of ENHERTU over chemotherapy both in HR-positive patients and the overall study population, including HR-negative patients (i.e., TNBC). Additionally, in January 2023, ENHERTU received approval from the European Union as a monotherapy for the treatment of adult patients with unresectable or metastatic HER2-low breast cancer, specifically those who had previously undergone chemotherapy in the metastatic setting or experienced disease recurrence during or within six months of completing adjuvant chemotherapy. This was followed by approval in Japan in March of the same year.

Recently, in January 2025, ENHERTU was granted approval by the US FDA for the treatment of adult patients with unresectable or metastatic HR-positive, HER2-low, or HER2-ultralow (IHC 0 with membrane staining) breast cancer, as determined by an FDA-approved test, who have progressed on one or more endocrine therapies in the metastatic setting. Subsequently, in February 2025, ENHERTU received approval in Europe for HR-positive, HER2-low, or HER2-ultralow breast cancer patients who have received at least one endocrine therapy in the metastatic setting and are not deemed suitable for further endocrine therapy as the next-line-of-treatment.

For patients with HR-negative/HER2-low breast cancer, treatment commonly involves first-line chemotherapy, plus immunotherapy if PD-L1 positive, followed by sequential lines of single-agent chemotherapy. As for HR-positive breast cancer, given the PFS advantage over chemotherapy, PARP inhibitors is considered for patients with germline BRCA mutation.

The future of HER2-low cancer treatment is set to be significantly influenced by the development of innovative therapies, particularly ADCs like DATROWAY, TRODELVY, trastuzumab pamirtecan, BB-1701, DF1001, and emiltatug ledadotin. These ADCs are designed to target HER2-low-expressing cancer cells, delivering potent cytotoxic agents directly to the tumor, thereby improving efficacy while minimizing damage to healthy tissue. Additionally, HF158K1/HF-K1, an immunoliposome containing doxorubicin, offers a novel approach by encapsulating the chemotherapy drug in liposomes for targeted delivery. Another promising treatment, Eftilagimod alpha, is an APC-activating soluble LAG-3 protein that aims to enhance the immune system’s response against cancer. Together, these therapies hold the potential to revolutionize the treatment landscape for HER2-low cancers.

- Overall, HER2-low Cancers market is further expected to increase in the forecast period (2025–2034).

- The total market size of HER2-low cancers in the 7MM was nearly USD 3,200 million in 2024 and is projected to grow during the forecast period (2025-2034).

- Apart from breast cancer, gastric cancer and biliary tract cancer may offer the most commercial potential for HER2-low cancer-based therapy.

- Of the target indications, breast cancer and gastric cancer are anticipated to generate the most revenue by 2034 due to the highest level of clinical development and authorization of HER2-low cancers therapies.

- Among all therapies, ENHERTU is expected to capture the largest market, followed by Chemo & targeted off-label therapies.

- The approval of ENHERTU for HER2-low breast cancer has significantly transformed its market trajectory, leading to a double of sales. This growth is attributed to its groundbreaking efficacy in treating HER2-low metastatic breast cancer, a category previously underserved by HER2-targeted therapies.

HER2-low Cancers Drugs Uptake

This section focuses on the rate of uptake of the potential drugs expected to be launched in the market during the study period 2020–2034. The analysis covers HER2-low cancer market uptake by drugs, patient uptake by therapies, and sales of each drug. The emerging pipeline of HER2-low cancer is primarily focused on treating HER2-low breast cancer patients. With zanidatamab already approved for HER2-positive biliary tract cancer, its potential expansion into breast cancer could provide a valuable new treatment option.

HER2-low Cancers Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I/II stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for HER2-low Cancers emerging therapies.

Latest KOL Views on HER2-low Cancers

To keep up with current market trends, we take KOLs and’ SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on HER2-low Cancers’ evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers and University such as National Cancer Center, Keio University School of Medicine, University of Nottingham, University of California Los Angeles, and other organizations. Their opinion helps understand and validate current and emerging therapies or market trends in HER2-low Cancers. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

What KOLs are saying on HER2-low Cancers Patient Trends?

-

“Trastuzumab deruxtecan is considered as a game changer. According to some of the earliest clinical trials such as DESTINY, this potent medication showed promise quite early in its development. This medication, an antibody–drug conjugate, has a high activity level. The antibody–drug conjugate is a different way to deliver targeted chemotherapy payloads to the cells preferentially that overexpress or have a specific target while trying to spare the toxicity from normal tissues that do not express as much of the target as the pertuzumab and trastuzumab-based therapies, which are just monoclonal antibodies.”

- MD, The Center for Women’s Oncology, US

-

“Redefining and re-categorizing HER2 status through not only immunohistochemistry/fluorescence in situ hybridization but also evaluating ERRB2 copy number gain or protein overexpression levels measured using DNA or RNA sequencing might help identify populations with HER2-expressing tumors who would ideally benefit from anti-HER2 treatment.”

- Researcher, Keio University School of Medicine, Japan

HER2-low Cancers Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

HER2-low Cancers Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

ENHERTU Patient Savings Program for commercially insured patients

If a patient has commercial insurance, the ENHERTU Patient Savings Program may help them with out-of-pocket costs.

Eligible patients may pay as little as USD 0 per ENHERTU prescription, up to USD 26,000 annually, to help with ENHERTU out-of-pocket costs. The annual benefit can be used for the cost of the drug itself and may cover up to USD 100 in infusion costs per administration. There are no income requirements to participate in the program.

Eligibility criteria include

- The patient must be a resident of the United States or Puerto Rico.

- Patients must have commercial insurance that covers ENHERTU but not the full cost of the medication.

- Patients are ineligible if prescriptions are paid by any state or other federally funded programs, including, but not limited to, Medicare Part B, Medicare Part D, Medicaid, Medigap, VA, or TRICARE, or where prohibited by law.

- Offer is invalid for all transactions and claims submitted more than 120 days following the date of service.

Note: Detailed assessment will be provided in the final report.

Scope of the HER2-low Cancers Market Report

- The report covers a descriptive overview of HER2-low cancers, explaining its signs and symptoms, risk factors, and currently available therapies.

- Comprehensive insight has been provided into HER2-low Cancers epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for HER2-low Cancers is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the HER2-low Cancers market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM HER2-low Cancers market.

HER2-low Cancers Report Insights

- HER2-low Cancers Report Insights

- Patient Population

- Therapeutic Approaches

- HER2-low Cancers Pipeline Analysis

- HER2-low Cancers Market Size and Trends

- Market Opportunities

- Impact of Upcoming Therapies

HER2-low Cancers Report Key Strengths

- Ten-Year Forecast

- 7MM Coverage

- HER2-low Cancers Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

HER2-low Cancers Report Assessment

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Question Answered in the HER2-low Cancers Report

- What was the HER2-low Cancers market share (%) distribution by indications in 2020 and what it would look like in 2034?

- What would be the HER2-low Cancers total market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings about the market across the 7MM and which country will have the largest HER2-low Cancers market size during the study period (2020–2034)?

- At what CAGR, the HER2-low Cancers market is expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the HER2-low market outlook across the 7MM during the study period (2020–2034)?

- What would be the HER2-low Cancers market growth till 2034 and what will be the resultant market size in the year 2034?

- What are the disease risks, burdens, and unmet needs of HER2-low Cancers?

- What is the historical HER2-low Cancers patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan?

- What would be the forecasted targeted patient pool of HER2-low Cancers at the 7MM level?

- What will be the growth opportunities across the 7MM concerning the patient population about HER2-low Cancers?

- At what CAGR the population is expected to grow across the 7MM during the study period (2020–2034)?

- How many emerging therapies are in the mid-stage and late stage of development for HER2-low Cancers?

- What are the key collaborations (Industry–Industry, Industry–Academia), Mergers and acquisitions, and licensing activities related to HER2-low Cancers?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the key designations that have been granted for HER2-low breast based therapies?

- What are the 7MM historical and forecasted market of HER2-low Cancers?

Reasons to Buy HER2-low Cancers Market Report

- The report will help in developing business strategies by understanding trends shaping and driving HER2-low Cancers.

- To understand the future market competition in the HER2-low Cancers market and an Insightful review of the SWOT analysis of HER2-low Cancers.

- Organize sales and marketing efforts by identifying the best opportunities for HER2-low Cancers in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for HER2-low Cancers market.

- To understand the future market competition in HER2-low Cancers market.