9 Promising Obesity Drugs Set to Launch by 2030

May 12, 2025

Table of Contents

The pharmaceutical industry is witnessing a seismic shift, fueled by the meteoric rise of GLP-1 agonist molecules. Once a niche class of diabetes drugs, GLP-1 agonists have become the cornerstone of a global race to conquer obesity, a disease that has more than doubled in prevalence since 1990 and now affects over 42% of U.S. adults and nearly a billion people worldwide. The promise? A shot at transforming pharma giants into trillion-dollar titans and rewriting the future of healthcare.

Obesity has emerged as a major global health crisis, closely associated with a host of chronic conditions such as type 2 diabetes, heart failure, kidney disease, and various cancers. According to the World Obesity Atlas 2025, the number of adults living with obesity is projected to more than double between 2010 and 2030, rising from 524 million to 1.13 billion worldwide. In the United States, nearly half of all adults are now classified as obese, highlighting the urgent need for effective strategies and interventions.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Intensity Therapeutics Publishes Compelling Clinical Data for INT230-6 in Advanced Cancers; UCB W...

- Assessing the Growing Role & the Demand of Chronic Disease Management Apps

- BeiGene’s BRUKINSA Gets FDA Accelerated Approval; GSK’s Positive Results in DREAMM-8 ...

- An Insight Into the Weight Loss and Obesity Market

- WEGOVY: A Leader in the Obesity and Weight Loss Treatment

DelveInsight’s obesity market report says that over 191 million adults in the 7MM had obesity, defined as a BMI of 30 or higher, in 2024, and this figure is expected to climb to 221 million by 2034. This escalating trend underscores obesity as a complex, chronic disease characterized by abnormal or excessive fat accumulation, which significantly increases health risks and places a substantial burden on individuals, healthcare systems, and society as a whole

The obesity drug sector has exploded with innovation and investment. In 2024, life sciences stocks surged by 4.2%, adding USD 386 billion in value to reach a staggering USD 9.6 trillion, much of it driven by obesity-focused pharma companies. The global GLP-1 receptor agonist market is projected to soar from USD 28.19 billion in 2025 to USD 63.54 billion by 2032, reflecting a compound annual growth rate of 12.3%. Analysts predict the broader obesity market could reach between USD 105 billion and USD 158 billion by the early 2030s, with GLP-1s at its core.

Riding the wave of success from obesity drugs like WEGOVY and ZEPBOUND, which together generated USD 10.8 billion in sales and, according to DelveInsight, are forecasted to hit USD 22.5 billion by 2034, pharmaceutical companies are scrambling to expand their pipelines. More than 80 molecules are currently in development for obesity, with over 25 companies testing GLP-1s either as monotherapies or in combination with other agents. The obesity drugs sector is marked by fierce competition and relentless innovation, as companies seek to maximize efficacy and differentiate their offerings.

Rising Challenges and the Future of Obesity Clinical Trials

Despite the hype, significant challenges remain. High development costs, manufacturing complexities, and persistent supply constraints threaten to limit access and affordability, especially in emerging markets. Furthermore, coverage barriers and inconsistent insurance reimbursement have prevented many patients from accessing these breakthrough obesity drugs.

While four injectable GLP-1 receptor agonists have already secured regulatory approval, the market is hungry for more convenient oral alternatives. Oral GLP-1s promise to boost patient acceptance and adherence, addressing a critical barrier, as only 1–3% of eligible US adults currently receive pharmacologic treatment for obesity. Next-generation obesity drugs are exploring combinations of GLP-1 with other entero-pancreatic hormones, such as GIP, glucagon, and amylin, to amplify weight loss and cardiometabolic benefits. Notably, dual and triple agonists like tirzepatide and retatrutide are showing early promise of weight loss results that rival bariatric surgery. With the obesity pipeline expanding rapidly, ongoing obesity clinical trials will be crucial to shaping the next phase of therapeutic innovation.

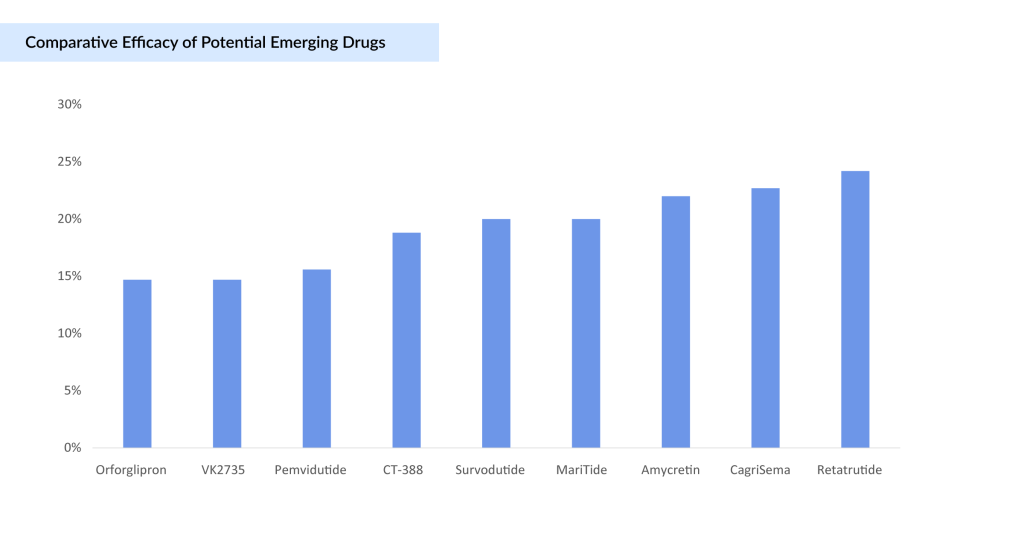

The graph below compares the efficacy of all potential drugs expected to be launched by 2030.

NovoNordisk’s Cagrisema

CagriSema, a novel obesity treatment developed by Novo Nordisk, combines semaglutide (2.4 mg) with cagrilintide (2.4 mg), a long-acting amylin analogue. This fixed-dose combination aims to enhance weight loss by reducing appetite, slowing gastric emptying, and lowering blood glucose levels. In the Phase III REDEFINE 1 trial, CagriSema demonstrated a 22.7% mean weight loss after 68 weeks, surpassing both monotherapies and placebo. Notably, 40.4% of participants achieved a ≥25% weight loss, indicating a robust therapeutic effect. However, this outcome fell short of the anticipated 25% weight reduction, potentially limiting its competitive edge against Eli Lilly’s ZEPBOUND, which reported up to 20.9% weight loss in the SURMOUNT-1 trial.

In the subsequent REDEFINE 2 trial, which focused on adults with obesity or overweight and type 2 diabetes, CagriSema achieved a 15.7% mean weight loss after 68 weeks, compared to 3.1% with placebo. These results underscore the efficacy of CagriSema in a specific patient population, though the weight loss observed was lower than that in the REDEFINE 1 trial. The trial also reported that the most common adverse events were mild to moderate gastrointestinal issues, consistent with the GLP-1 receptor agonist class, and these diminished over time.

Despite the promising efficacy and safety data, the market response has been cautious. Novo Nordisk’s stock experienced significant declines following the release of the REDEFINE 1 trial results, partly due to investor expectations not being met. The company now plans to file for regulatory approval in early 2026, slightly later than initially anticipated. This timeline adjustment is to ensure supply chain readiness, according to the company’s full-year report, and is conducting additional studies to further assess CagriSema’s efficacy and safety.

Given the regulatory process and potential review timelines, a US market launch for CagriSema is expected in 2027.

Novo Nordisk’s Amycretin

Amycretin is emerging as a promising new player in the obesity and type 2 diabetes treatment landscape. Developed by Novo Nordisk, amycretin is a novel, long-acting, unimolecular agonist targeting both GLP-1 and amylin receptors, designed for both oral and subcutaneous administration. By harnessing the dual action of GLP-1, known for its blood sugar regulation, and amylin, a hormone that suppresses appetite and slows gastric emptying, amycretin aims to deliver robust weight loss and metabolic benefits.

In recent Phase Ib/IIa clinical trials, amycretin has demonstrated impressive weight loss outcomes. Participants receiving the highest dose (20 mg weekly) achieved an average body weight reduction of 22% over 36 weeks, while lower doses (1.25 mg and 5 mg) resulted in 9.7% and 16.2% weight loss over 20 and 28 weeks, respectively. Notably, those on placebo experienced weight gain, a rare finding in obesity studies and one that may further underscore amycretin’s efficacy.

The safety profile of amycretin has so far aligned with other incretin-based therapies. The most common side effects were gastrointestinal, with the majority being mild to moderate in severity. No major safety concerns have been flagged in early data, though detailed safety results are still awaited from ongoing and future studies.

While detailed safety data and long-term efficacy remain to be seen, amycretin’s early clinical results have reignited optimism for Novo Nordisk’s obesity franchise. The company is moving forward with larger clinical trials to further evaluate amycretin’s potential and clarify its place in an increasingly competitive field.

These early results come at a critical time for Novo Nordisk, which is under pressure to reinforce its innovation pipeline following underwhelming results from its other next-generation candidate, CagriSema. Amycretin’s strong early performance, especially its 22% weight loss in just 36 weeks, positions it as a potential rival to Eli Lilly’s ZEPBOUND and the triple agonist retatrutide, both of which are setting new standards in the obesity drug market.

Lilly’s Orforglipron

Orforglipron is an investigational, once-daily, small-molecule oral glucagon-like peptide-1 receptor agonist under development by Eli Lilly. Licensed from Chugai Pharmaceutical in 2018, orforglipron represents a significant advancement in the treatment of type 2 diabetes and obesity. Unlike many existing GLP-1 receptor agonists, orforglipron can be taken any time of day without food or water restrictions, offering greater convenience for patients.

Lilly’s Phase II clinical trial results, published in the New England Journal of Medicine, demonstrate that orforglipron achieved up to a 14.7% mean weight reduction at 36 weeks in adults with obesity or overweight. At the 26-week primary endpoint, the trial showed statistically significant dose-dependent body weight reductions for all doses ranging from 8.6% (19.8 lb. or 9.0 kg) to 12.6% (29.3 lb. or 13.3 kg), compared to 2.0% (4.6 lb. or 2.1 kg) for placebo. These weight reductions continued to improve at 36 weeks, with all doses achieving body weight reductions ranging from 9.4% (21.6 lb. or 9.8 kg) to 14.7% (34.0 lb. or 15.4 kg) compared to 2.3% (5.3 lb. or 2.4 kg) for placebo.

Orforglipron has shown statistically significant efficacy results and a safety profile consistent with injectable GLP-1 medicines in a successful Phase III trial. Orforglipron is the first small molecule GLP-1 to complete a Phase III trial, lowering A1C by an average of 1.3% to 1.6% across doses. The investigational once-daily oral pill also reduced weight by an average of 16.0 lbs (7.9%) at the highest dose in a key secondary endpoint. The overall safety and tolerability profile of orforglipron in ACHIEVE-1 was consistent with injectable GLP-1 therapies.

Currently, Lilly is conducting Phase III studies to evaluate orforglipron for the treatment of type 2 diabetes and weight management in adults with obesity or overweight with at least one weight-related medical problem. It is also being studied as a potential treatment for obstructive sleep apnea and hypertension in adults with obesity.

The safety profile of orforglipron has been similar to other incretin-based therapies. Gastrointestinal side effects were the most commonly reported adverse events, were generally mild to moderate in severity, and usually occurred during the dose escalation period.

Under the license agreement with Chugai Pharmaceutical Co., Ltd, Lilly has worldwide development and commercialization rights to orforglipron. Chugai is eligible to receive tiered royalty payments on future worldwide net sales, as well as up to USD 140 million contingent upon the achievement of success-based regulatory milestones and up to USD 250 million in sales-based milestones, contingent upon commercial success.

Lilly’s Retatrutide

Retatrutide (LY3437943), a novel investigational drug by Eli Lilly, is making waves in the obesity treatment landscape. Functioning as a triple agonist of the glucose-dependent insulinotropic polypeptide (GIP), glucagon-like peptide 1 (GLP-1), and glucagon receptors, retatrutide is poised to redefine weight management. While ongoing studies continue to evaluate its safety, efficacy, and optimal dosing, early clinical trial results have revealed its remarkable potential to induce substantial weight loss in individuals with obesity, exceeding results seen with existing therapies.

Phase II clinical trials have showcased retatrutide’s impressive efficacy in reducing body weight. Participants in these trials experienced weight reductions of up to 24.2% over 48 weeks. Such results position retatrutide as a potential game-changer, offering hope for a more effective approach to combating obesity.

In the Phase II trial, participants received varying doses of retatrutide (1 mg, 4 mg, 8 mg, or 12 mg) or a placebo. At 48 weeks, the least-squares mean percentage change in body weight in the retatrutide groups was -8.7% (1 mg), -17.1% (combined 4 mg), -22.8% (combined 8 mg), and an astounding -24.2% (12 mg), compared to -2.1% in the placebo group.

These results translated to significant proportions of participants achieving clinically meaningful weight loss:

- 5% or More Weight Reduction: 92% (4 mg), 100% (8 mg), 100% (12 mg), and 27% (placebo)

- 10% or More Weight Reduction: 75% (4 mg), 91% (8 mg), 93% (12 mg), and 9% (placebo)

- 15% or More Weight Reduction: 60% (4 mg), 75% (8 mg), 83% (12 mg), and 2% (placebo)

These data underscore retatrutide’s potential to deliver unprecedented weight loss in a significant portion of individuals with obesity.

The most commonly reported adverse events in the retatrutide groups were gastrointestinal, including nausea, diarrhea, and vomiting. These events were generally dose-related, mostly mild to moderate in severity, and could be partially mitigated by using a lower starting dose. Additionally, some participants experienced dose-dependent increases in heart rate, which peaked at 24 weeks and declined thereafter.

While the Phase II results are undeniably exciting, it’s crucial to acknowledge that further research and clinical trials are necessary to fully elucidate the long-term safety and efficacy of retatrutide. These ongoing studies will provide valuable insights into the optimal use of this triple agonist for managing obesity and related metabolic disorders.

While its long-term safety and efficacy are still under investigation, the Phase II results provide compelling evidence that this triple agonist could revolutionize the way we approach obesity and its associated health risks. As research continues, retatrutide stands as a beacon of hope for individuals seeking effective and sustainable weight management solutions.

Boehringer Ingelheim’s Survodutide

Survodutide (BI 456906), co-invented by Boehringer Ingelheim and Zealand Pharma, is an investigational glucagon/GLP-1 receptor dual agonist. This innovative drug activates both the GLP-1 and glucagon receptors, which play pivotal roles in regulating metabolic functions. As part of Boehringer Ingelheim’s research and development portfolio in cardio-renal-metabolic diseases, survodutide is poised to offer a novel approach to weight management and metabolic health.

The Phase II trial data reveal impressive weight loss outcomes for survodutide, with participants achieving nearly 19% weight reduction in individuals with overweight or obesity. This demonstrates the drug’s strong potential as an effective therapeutic option for significant weight management.

After 46 weeks of treatment, the results were particularly notable at higher dosages:

- Up to 40% of participants receiving the highest two doses achieved weight loss of 20% or more (compared to 0% with placebo).

- 67% of individuals on the 4.8 mg dose experienced weight reduction of 15% or more (versus just 4.3% on placebo)

These clinically meaningful outcomes suggest survodutide may represent an important advancement in pharmacological approaches to weight management.

Survodutide’s novel mechanism of action, involving dual agonism of the GCG/GLP-1 receptors, sets it apart from other weight loss medications. This dual action may have direct effects on energy expenditure in the liver, in addition to reducing appetite. This unique approach could lead to more comprehensive metabolic benefits and improved weight management outcomes.

Treatment with survodutide has not shown unexpected safety or tolerability issues. Serious adverse events were reported by 4.2% of participants on survodutide, compared to 6.5% of those on placebo. However, treatment discontinuation due to adverse events occurred in 24.6% and 3.9% of participants, respectively, mainly due to gastrointestinal adverse events. It’s worth noting that most treatment discontinuations occurred during the rapid dose-escalation phase, suggesting that a more gradual dose-escalation strategy could potentially mitigate these issues. Overall, the adverse events reported were similar to those expected with the GLP1-R agonist class of drugs.

Bodyweight reductions with survodutide had not reached a plateau at week 46, suggesting additional weight loss could be achieved with a longer treatment duration.

Viking Therapeutic’s VK2735

Viking Therapeutics is emerging as a significant player in the competitive obesity market with its drug candidate, VK2735. The company has reported positive results from its Phase II VENTURE study, demonstrating significant weight loss and an encouraging safety profile. VK2735 has shown outstanding efficacy at 12 weeks of treatment.

The Phase II VENTURE trial successfully achieved its primary and secondary endpoints, with subjects receiving VK2735 demonstrating statistically significant reductions in body weight compared with placebo. Key findings include:

- Up to 14.7% reduction in mean body weight from baseline after 13 weekly doses.

- Progressive weight loss throughout the 13-week treatment period, with no evidence of plateauing.

- Encouraging safety and tolerability profile, with the majority of observed adverse events reported as mild or moderate.

- Well-balanced treatment and study discontinuation rates compared with placebo.

- 95% of gastrointestinal (GI) related adverse events were reported as mild or moderate. GI-related adverse events were most prevalent during the first week of treatment, with observed rates generally declining through the remainder of the study.

Viking completed an End-of-Phase II meeting with the FDA and received feedback on proposed Phase III study plans and the overall development program for VK2735. The company expects to initiate Phase III trials evaluating subcutaneous VK2735 in obesity in the second quarter.

In addition to the subcutaneous formulation, Viking is also developing an oral tablet formulation of VK2735, which could represent an attractive treatment option for people who may prefer to initiate treatment with oral therapy or for those seeking to maintain the weight loss they have already achieved. A differentiating feature of the tablet formulation of VK2735 is that it offers the potential to transition subjects from the subcutaneous formulation to an oral formulation of the same molecule. Viking believes this may reduce the risk of unexpected safety or tolerability challenges and could be an appealing option for both patients and clinicians.

Oral Tablet Formulation Results

- Up to 6.8% placebo-adjusted mean weight loss (8.2% from baseline) after 28 days of dosing with an oral tablet of VK2735.

- Encouraging tolerability through 100 mg daily dosing with oral VK2735; mild GI-related adverse event profile.

Viking has entered into a broad, multi-year manufacturing agreement with CordenPharma, an industry-leading CDMO, covering both the active pharmaceutical ingredient (API) and final finished product supply for VK2735. The agreement secures dedicated capacity for the annual manufacture and supply of multiple metric tons of VK2735 API. In addition, CordenPharma will provide fill/finish capacity for both the injectable and oral formulations of VK2735.

Amgen’s MariTide

Amgen’s MariTide is capturing the spotlight in the rapidly evolving obesity drug landscape, offering a groundbreaking approach that could rival, and potentially surpass, the efficacy of today’s leading therapies. As a first-in-class bispecific molecule, MariTide combines a GLP-1 receptor agonist with a GIP receptor antagonist, leveraging a unique dual mechanism that is reshaping expectations for medical weight loss.

In Phase II trials, MariTide demonstrated up to approximately 20% average weight loss at 52 weeks in people living with obesity or overweight, without evidence of a plateau, suggesting even greater results with longer treatment. For those with type 2 diabetes, who typically experience less weight loss on GLP-1 therapies, MariTide still achieved an impressive approximately 17% average weight loss and lowered HbA1c by up to 2.2 percentage points over the same period.

Analysts are modeling up to 30% average weight loss in one year—a transformative outcome that rivals the benefits seen with bariatric surgery. For a 250-pound person, this could mean losing 75 pounds, a result previously thought possible only through surgical intervention.

Unlike other incretin-based drugs such as Eli Lilly’s ZEPBOUND (tirzepatide), which activates both GLP-1 and GIP receptors, MariTide activates GLP-1 while blocking GIP. This surprising approach, validated by Amgen’s human genetics research, may help mitigate the risk of weight rebound—a common challenge with current therapies—and could deliver more durable weight loss.

MariTide is the first obesity treatment with monthly or less frequent dosing to demonstrate such robust efficacy in a Phase II study. Delivered via a single, patient-friendly autoinjector, this long-acting formulation is poised to offer a major convenience advantage over weekly injectables like WEGOVY and ZEPBOUND, potentially improving adherence and patient satisfaction.

Beyond weight loss, MariTide delivered clinically meaningful improvements in cardiometabolic parameters, including reductions in blood pressure, triglycerides, and high-sensitivity C-reactive protein (hs-CRP), with no significant increases in free fatty acids. These results suggest MariTide could help address the broader health risks associated with obesity, not just weight alone.

The most common side effects were mild to moderate gastrointestinal symptoms, such as nausea and vomiting, primarily associated with the first dose and substantially reduced with dose escalation. Discontinuation rates due to adverse events were low (~11% overall, <8% for GI events), and no new safety signals were identified.

MariTide’s innovative design as a peptide-antibody conjugate, a monoclonal antibody linked to two peptides, sets it apart from other therapies. The molecule’s long half-life and dual action may offer greater durability and reduce the likelihood of weight regain after discontinuation.

Amgen has launched the MARITIME Phase III clinical program to further evaluate MariTide in obesity and related conditions. While competition is fierce, with Novo Nordisk and Eli Lilly advancing next-generation candidates, MariTide’s differentiated mechanism, monthly dosing, and potential for bariatric-level weight loss make it a formidable contender.

With more than 15 million Americans already prescribed GLP-1s as of 2024 and demand for effective, convenient obesity treatments surging, MariTide’s arrival could mark a new era in metabolic medicine, offering hope to millions seeking transformative, sustainable weight loss.

Roche’s CT-388

CT-388, a dual GLP-1/GIP receptor agonist under development by Roche, is emerging as a promising contender in the fight against obesity and type 2 diabetes (T2D). This novel therapeutic aims to regulate blood sugar and reduce appetite by selectively targeting and activating GLP-1 and GIP receptors, which play critical roles in nutrient-derived signaling to control food intake, energy absorption, and assimilation. Preclinical data suggest that this dual-targeting effect could result in meaningful and durable glucose reduction and weight loss, combined with a favorable safety profile.

Data from a Phase Ib clinical trial have revealed that a once-weekly subcutaneous injection of CT-388 produced statistically significant weight loss in healthy adults with obesity compared with placebo over 24 weeks. The study met its primary endpoints, demonstrating:

A clinically meaningful and statistically significant mean placebo-adjusted weight loss of 18.8% (p < 0.001) after 24 weeks.

- 100% of CT-388 treated participants achieved >5% weight loss.

- 70% of CT-388 treated participants achieved >15% weight loss.

- 45% of CT-388 treated participants achieved >20% weight loss.

Normalization of glycemia in all patients with pre-diabetes at baseline, indicating a strong impact on glucose homeostasis.

CT-388 belongs to the class of incretin-based medicines that aim to regulate blood sugar and reduce appetite. A key differentiator of CT-388 lies in its design to produce potent activity on both the GLP-1 and GIP receptors, along with minimal-to-no β-arrestin recruitment on either receptor. The absence of or minimized β-arrestin recruitment leads to reduced receptor internalization and potentially prolonged pharmacological activity.

CT-388 was found to be well tolerated, with no new or unexpected safety signals detected. The most commonly reported adverse events (AEs) were mild to moderate gastrointestinal-related AEs, consistent with the known safety profile of GLP-1 receptor agonists.

The results of the Phase Ib trial are extremely encouraging, suggesting that CT-388 has the potential to be a highly effective therapy for both obesity. Additional research is required to further assess the safety and efficacy of CT-388 in larger, more diverse populations and to determine its long-term effects on weight management, glycemic control, and cardiovascular outcomes.

With its unique pharmacology and impressive clinical data, CT-388 may soon emerge as an essential option in the landscape of metabolic diseases.

Alt Immune’s Pemvidutide

Pemvidutide, a novel peptide-based GLP-1/glucagon dual receptor agonist developed by Altimmune, is garnering attention as a potential game-changer in the treatment of obesity and MASH (metabolic dysfunction-associated steatohepatitis). By simultaneously activating GLP-1 and glucagon receptors, pemvidutide mimics the complementary effects of diet and exercise, suppressing appetite and increasing energy expenditure. Additionally, glucagon directly influences hepatic fat metabolism, potentially leading to rapid reductions in liver fat and serum lipids.

The MOMENTUM Phase II obesity trial demonstrated compelling weight loss and a favorable safety profile. Key findings from the 48-week study include:

- Significant Weight Loss: Subjects receiving pemvidutide achieved mean weight losses of 10.3%, 11.2%, and 15.6% at the 1.2 mg, 1.8 mg, and 2.4 mg doses, respectively, compared to 2.2% for placebo. Weight loss continued to increase at the 2.4 mg dose through the end of treatment.

- High Percentage of Responders: Over 30% of subjects on the 2.4 mg dose achieved 20% or more weight loss at 48 weeks.

- Lean Mass Preservation: A key differentiator of pemvidutide is its ability to preserve lean mass during weight loss. MRI-based body composition analysis revealed that subjects in the pemvidutide groups experienced an average lean mass loss of only 21.9%, meaning that 78.1% of the weight loss was attributable to fat. This is particularly important as loss of lean mass can have negative effects on metabolism and physical function.

- Improved Cardiometabolic Parameters: Pemvidutide resulted in robust reductions in serum lipids and improvements in blood pressure without imbalances in cardiac events, arrhythmias, or clinically meaningful increases in heart rate.

Pemvidutide demonstrated a favorable safety profile in the MOMENTUM trial.

Pemvidutide’s dual action on GLP-1 and glucagon receptors sets it apart from other obesity therapies. Activation of GLP-1 receptors suppresses appetite, while activation of glucagon receptors increases energy expenditure and promotes hepatic fat metabolism. This combination of effects is believed to result in more comprehensive metabolic benefits.

Altimmune has completed its End-of-Phase II meeting with the FDA and has agreed on the design of a Phase III registration program for pemvidutide in the treatment of obesity.

Conclusion

As the global obesity epidemic surges toward unprecedented levels, with around 220 million people projected to be affected by 2030 in the 7MM, the pharmaceutical industry finds itself in a high-stakes innovation race that may redefine chronic disease management. The GLP-1 agonist class, once confined to diabetes care, has erupted into a battleground of biotechnological ingenuity, where molecular finesse, delivery convenience, and metabolic synergy dictate market supremacy.

Among the contenders, Eli Lilly’s retatrutide and Amgen’s MariTide are setting a new benchmark with weight reductions exceeding 24%, rivaling or surpassing bariatric surgery, an extraordinary feat in non-surgical treatment history. MariTide’s monthly dosing and unique GIP antagonism signal a shift from mimicry to reinvention of incretin science, possibly solving the long-standing issue of weight rebound.

Novo Nordisk, though still dominant, faces mixed momentum. CagriSema, while promising, has underdelivered against the market’s lofty expectations and now trails ZEPBOUND in real-world perception. Yet, amycretin’s early 22% weight loss in just 36 weeks has sparked renewed optimism, suggesting Novo is not yet outpaced in this therapeutic marathon.

Meanwhile, orforglipron’s oral GLP-1 format may finally unlock mass adoption by removing injection-related barriers, while Survodutide, CT-388, and Pemvidutide demonstrate that dual and triple agonists, with novel combinations of GLP-1, glucagon, and GIP, can outperform monotherapies in both efficacy and metabolic breadth.

What differentiates winners in this space is no longer just weight loss percentage but mechanistic novelty, durability of effect, lean mass preservation, and patient-centric delivery (oral pills, monthly autoinjectors). Innovation now aims not only to shed pounds but also to remodel metabolism, targeting fat distribution, cardiometabolic parameters, and long-term sustainability.

The global fight against obesity is entering a transformative new phase, fueled by the meteoric rise of GLP-1 agonists. What was once a challenging and underserved therapeutic space is now the epicenter of a pharmaceutical gold rush, with the promise of reshaping not just waistlines but the very future of healthcare. The momentum is undeniable, and the implications are seismic.

This isn’t just a race for market share, it’s a race to redefine the standard of care in metabolic health. As demand surges and pipelines swell, the real prize lies beyond weight loss: in diabetes prevention, cardiovascular outcomes, and even neurodegenerative disease. The ripple effects of GLP-1 therapies are poised to touch every corner of medicine.

The first trillion-dollar franchise in pharma history is no longer a fantasy, it’s on the horizon. But the crown won’t go to the first to market. It will go to the player who can deliver the most scalable, durable, and clinically expansive solution in this high-stakes metabolic revolution.

FAQs

Beyond simple weight reduction, newer agents focus on preserving lean mass, improving cardiometabolic markers, and extending dosing intervals. Oral GLP-1s, such as orforglipron, and monthly injectables, like MariTide, could significantly enhance adherence compared to current weekly injection regimens.

Candidates like Eli Lilly’s retatrutide and Amgen’s MariTide are raising the bar, with Phase II trials showing weight loss exceeding 24%, a level comparable to that achieved with bariatric surgery. Meanwhile, NovoNordisk’s Cagrisema and Amycretin, Lilly’s Orforglipron and Retatrutide, Boehringer Ingelheim’s Survodutide, Viking Therapeutic’s VK2735, Amgen’s MariTide, Roche’s CT-388, and Alt Immune’s Pemvidutide are emerging as key contenders with unique mechanisms and delivery options.

MariTide combines GLP-1 receptor agonism with GIP antagonism, a novel approach validated by human genetics research. Its monthly dosing, coupled with up to 20% average weight loss at 52 weeks, positions it as one of the first contenders to rival bariatric surgery outcomes.

Altimmune’s pemvidutide not only induces significant fat loss but also preserves lean mass, a critical factor for long-term metabolic health. Its dual GLP-1/glucagon action also improves liver fat metabolism, making it especially promising for patients with obesity and liver-related conditions like MASH.

In 2024, life sciences stocks surged by 4.2%, adding USD 386 billion in market value, much of it driven by obesity-focused companies. However, cautious reactions to trial data, like the mixed reception of CagriSema’s results, highlight how high expectations can sway investor confidence.

Downloads

Article in PDF

Recent Articles

- Assessing the Growing Role & the Demand of Chronic Disease Management Apps

- The Race to Redefine Obesity Treatment

- Pharma Rivalry Intensifies: Novo Nordisk Looks to Wrest Metsera from Pfizer

- OZEMPIC’s New Approval Cements Novo’s Lead in GLP-1 Market

- FDA Approves LUMAKRAS with VECTIBIX for KRAS G12C-Mutated Colorectal Cancer; PYC Receives FDA Rar...