The Evolving Landscape of ER+ Breast Cancer Treatments

Aug 08, 2024

Table of Contents

Breast cancer is a complex disease that occurs when abnormal cancerous cells in the breast grow uncontrollably, forming tumors. This condition typically originates in the ducts or lobules of the breast. Various signals, including hormonal signals, often influence the growth of cancer cells. Understanding the specifics of estrogen receptor-positive (ER+) breast cancer is crucial for grasping its market dynamics, treatment options, and future outlook.

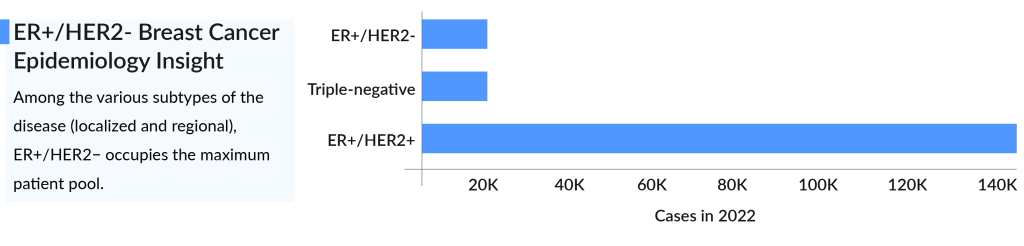

According to DelveInsight, the total incident population of newly diagnosed ER+ breast cancer in the United States was 256K in 2021, and in 2023, it was 297K. Among the various subtypes of the disease, ER+/HER2 represents the largest patient pool with approximately 140K cases. This is followed by around 24,000 cases of Triple-negative breast cancer and about 20K cases of ER+/HER2+ in 2022. Conversely, HR-/HER2+ had the fewest cases.

Downloads

Article in PDF

Recent Articles

- Novartis’ Canakinumab for NSCLC; Novartis’s Zolgensma Updates; Trodelvy Prospects in New Breast C...

- Introducing a new brand identity, and a new website: DelveInsight.

- FDA Grants Orphan Status to MDL-101 for LAMA2-CMD; Pfizer’s ABRYSVO Approved for High-Risk Adults...

- PD-1 and PD-L1 inhibitors – Competitive Landscape, Pipeline and Market Analysis, 2015 – A D...

- Biogen’s Aduhelm; FDA Approves Sanofi’s Enjaymo; NHS & Orchard Signs a Deal; Bri...

Understanding ER+ Breast Cancer

ER+ Breast Cancer is defined by cancer cells possessing estrogen receptors, which drive tumor growth in response to estrogen. This receptor-positive subtype is prevalent in many breast cancer cases and is a key factor in determining treatment strategies. Effective management often involves therapies that target estrogen receptors to impede cancer progression. ER+ Breast Cancer understanding is vital for developing personalized treatment plans and enhancing patient outcomes by addressing the specific hormonal influences on tumor development.

Hormone Receptor Status

Breast cancer is classified based on hormone receptor status into:

- Estrogen Receptor-Positive (ER+): Cancer cells have receptors that respond to estrogen, which can promote tumor growth.

- Progesterone Receptor-Positive (PR+): Cancer cells respond to progesterone.

- Hormone Receptor-Negative (HR−): Cancer cells lack hormone receptors and do not depend on estrogen or progesterone for growth.

Additionally, breast cancer can also be categorized based on the presence of the human epidermal growth factor receptor 2 (HER2):

- HER2-Positive (HER2+): Cancer cells overexpress HER2 protein, leading to a more aggressive disease.

- HER2-Negative (HER2−): Cancer cells do not have high levels of HER2, often resulting in a slower growth rate.

Together, ER+ and HER2− classifications encompass a significant portion of breast cancer cases, influencing treatment strategies and market dynamics.

Current Market Landscape

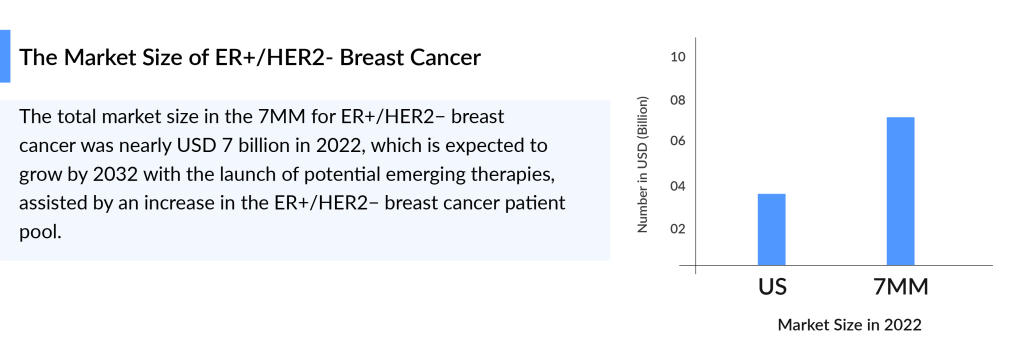

The global Breast Cancer Therapeutics Market is projected to grow significantly. In 2022, the ER+/HER2- breast cancer market across the 7MM was about USD 7.4 billion. In the US, the first-line market size was around USD 3.8 billion in 2022, with continued growth anticipated through 2032. The ER+/HER2− segment is particularly notable, representing a substantial patient population with specific treatment needs.

Marketed Drugs for ER+/HER2− Breast Cancer

Several critical therapies are currently available for ER+/HER2− breast cancer, including:

- KISQALI (ribociclib): Developed by Novartis, KISQALI is a kinase inhibitor indicated for adult patients with HR+, HER2− advanced or metastatic breast cancer. It is used in combination with an aromatase inhibitor as initial endocrine-based therapy.

- IBRANCE (palbociclib): Developed by Pfizer, IBRANCE is another kinase inhibitor approved for treating adult patients with HR+, HER2− advanced or metastatic breast cancer. It is used in combination with an aromatase inhibitor (AI) as initial endocrine-based therapy in postmenopausal women or men.

- AFINITOR (everolimus): Also from Novartis, AFINITOR is a kinase inhibitor used for postmenopausal women with advanced HR+, HER2− negative breast cancer in combination with exemestane after failure of treatment with letrozole or anastrozole.

- LYNPARZA (olaparib): Developed by AstraZeneca, LYNPARZA is a poly (ADP-ribose) polymerase (PARP) inhibitor used in patients with deleterious or suspected deleterious gBRCAm, HR+ HER2− metastatic breast cancer who have been treated with chemotherapy. It is also indicated for the adjuvant treatment of high-risk early breast cancer.

Clinical Trials and Recent Developments

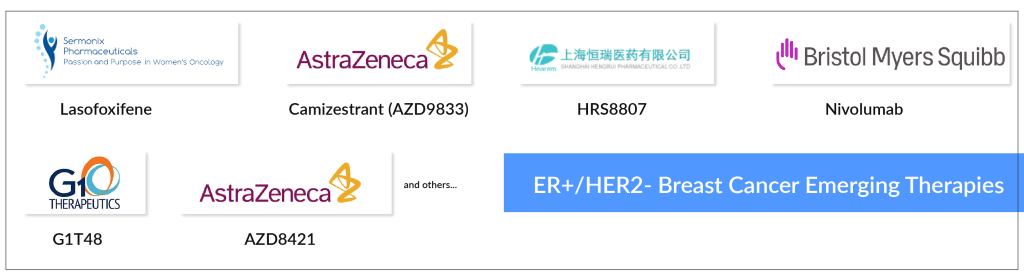

The drug chapter segment of the ER+/HER2− breast cancer pipeline includes detailed analyses of marketed drugs and late-stage pipeline drugs (Phase III and Phase II). This section also covers clinical trial details, pharmacological actions, agreements and collaborations, approval and patent details, advantages and disadvantages of each drug, and the latest news and press releases.

Latest Drug Approvals and Pipeline Drugs

Recent Drug Approvals

- ORSERDU (Elacestrant): Stemline Therapeutics

- Approval: January 2023

- Indication: Treatment of postmenopausal women or adult men with ER+, HER2-, ESR1-mutated advanced or metastatic breast cancer with disease progression following at least one line of endocrine therapy.

- Significance: ESR1 mutations are a known driver of resistance to standard endocrine therapy and have been challenging to treat.

- TRUQAP (Capivasertib) plus FASLODEX (fulvestrant): AstraZeneca

- Approval: June 2024 in the European Union

- Indication: Treatment of adults with ER+, HER2−, locally advanced or metastatic breast cancer harboring at least one PIK3CA, AKT1, or PTEN alteration previously managed with endocrine-based treatment.

- Supporting Data: Phase III CAPItello-291 trial.

Recent Clinical Trial Updates

- IBRANCE (palbociclib) Clinical Trials:

- ASCO 2022: Phase III trial of IBRANCE in combination with letrozole did not improve the overall survival rate in patients.

- Approval: FDA in March 2017 based on Phase II data showing improved progression-free survival.

- Latest Data: There was no statistically significant difference in overall survival between patients treated with Ibrance plus letrozole and letrozole alone.

- Challenges: Data collection issues with a large proportion of patients needing more survival data.

- Amcenestrant (Sanofi):

- Termination: August 2022, following disappointing Phase III AMEERA-5 trial results.

- Combination: Tested with Pfizer’s Ibrance.

- Initial Promise: Phase I/II trial demonstrated an objective response rate of 34% in ER+ breast cancer patients.

- Final Setback: Phase II AMEERA-3 trial showed amcenestrant monotherapy was not significantly better than endocrine treatment.

ER+ Breast Cancer Market Outlook

The ER+ breast cancer therapies Market continues to evolve with new drug approvals and ongoing clinical trials. The focus remains on improving progression-free survival and addressing the challenges of drug resistance, particularly in cases with ESR1 mutations. Companies are investing heavily in research and development to expand treatment options, and real-world evidence continues to support the efficacy of combination therapies.

The discontinuation of certain promising drugs like amcenestrant highlights the challenges faced in drug development. However, new approvals such as ORSERDU and the combination of capivasertib plus fulvestrant offer hope for better management of advanced and metastatic ER+ breast cancer.

Conclusion

Overall, the ER+ breast cancer therapies market is poised for growth with advancements in targeted therapies, continued innovation in drug development, and a strong focus on addressing unmet needs in treatment resistance.

Downloads

Article in PDF

Recent Articles

- Business Cocktail

- Takeda scores; PhRMA launches; Valeant’s Obagi; Ex-Novo executive signs

- Novartis ventures; Bill Gates invests; Arcus Biosciences gains; Denali and Odonate seek funding; ...

- Business cocktail

- Carl Zeiss Meditec AG’s Acquisition of Dutch Ophthalmic Research Center; Johnson & Johnson’s ...