Insights into the Evolving Landscape of Antibody-Drug Conjugate (ADC) & the Key Companies in the Segment

Jan 12, 2022

Table of Contents

In the year 2000, the first-ever Antibody-drug Conjugate (ADC) – Mylotarg, was launched by Pfizer and was considered a miracle in cancer treatment. And it appeared like there was no looking back for these antibody-drug conjugates. But it took almost another 11 years for the next ADC to launch in the market – Adectris by Seagen Inc. After twenty years of ongoing clinical trials of ADC research and development, it is now that this field constitutes almost 50 major pharmaceutical companies continuously working to develop a plethora of antibody-drug conjugates targeted to treat a wide range of tumor types.

At present, there are 11 FDA-approved antibody-drug conjugates in the oncology market. ADCs are designed using many elements, including a monoclonal antibody targeting the cancer-antigen, a payload anti-cancer medicine (chemotherapy drug), a “linker” to cleave off payload into cancerous cells a conjugation technology that binds the payload and linker to the antibody. It is a challenging procedure to develop target antibody-drug conjugates, but scientists still have achieved it. It is a miraculous technology that is helping companies that are dealing with tough-to-treat cancers.

Downloads

Article in PDF

Recent Articles

- AstraZeneca and Daiichi Sankyo’s Enhertu US Approval; Basilea’s ZEVTERA FDA Approval; Genmab’s Pr...

- AZ, Daiichi inks an oncology deal; Moderna begins Phase III trial of its COVID-19 vaccine; No goo...

- Business CockTail

- IntraBio’s AQNEURSA Niemann-Pick Disease Approval; FDA Approves Novel Schizophrenia Drug After 35...

- Evaluating the Key Trends and Developments in the Global Next-Generation Sequencing Market

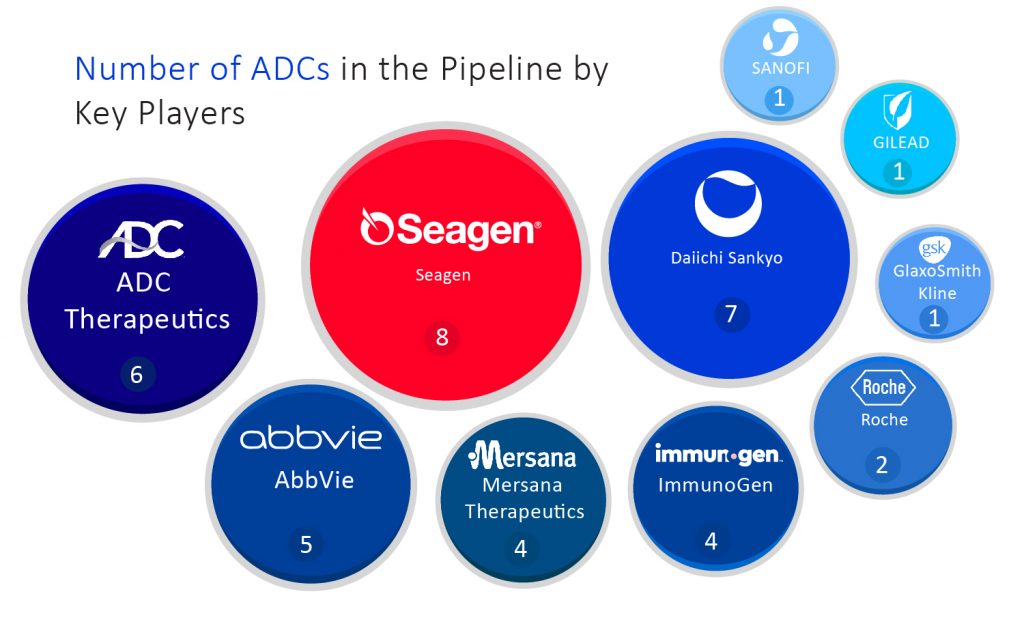

Following mentioned are some of the companies that are currently proactive in developing antibody-drug conjugates-

Seagen Inc.

Seagen Inc., an American biotechnology company that is considered one of the most prominent leaders of the antibody-drug conjugate field with one of the deepest ADC pipelines in the industry. Currently, they have 8 ADCs in the pipeline. Seagen grabbed two bladder cancer FDA approvals for its ADC product Padcev and is working towards establishing markets for Padcev and Adcetris. Both of these ADCs are designed for Hodgkin lymphoma treatment. Another ADC, namely tisotumab vedotin, was granted FDA approval for cervical cancer treatment on September 20, 2021.

It has many additional antibody-drug conjugate products in the pipeline, including disitamab vedotin. It is a HER2-targeted ADC very recently licensed from China’s RemeGen. Seagen already has another HER2-targeted drug in its portfolio, Tukysa, which was approved in April 2020, but the RemeGen deal brings it against potential rivalry to two of the highest-selling antibody-drug conjugates, AstraZeneca and Daiichi Sankyo’s Enhertu and Roche’s Kadcyla. The recent approval in tisotumab vedotin has also accelerated the cervical cancer market opportunities for Seagen. This drug is being tested in combination with many other drugs in the first-line treatment setting, including Keytruda. With other ADCs in the pipeline, Seagen is also anticipated to break into the triple-negative breast cancer market.

Daiichi Sankyo

In collaboration with AstraZeneca, Daiichi Sankyo’s Enhertu was a blockbuster Antibody-drug Conjugate when it was launched in the market for metastatic HER2-positive breast cancer treatment. This drug also got FDA approval last January for HER2-positive stomach cancer in patients who previously got Herceptin. Daiichi Sankyo and AstraZeneca are testing Enhertu in various other cancers such as lung cancer, colorectal cancer, and other solid tumors. Daiichi Sankyo currently has 7 ADCs in the pipeline, including targets for B7-H3, GRP20, CDH6, and TA-MUC1.

ADC Therapeutics

Last year’s April was the month when Switzerland-based ADC Therapeutics got approval for its first Antibody-drug Conjugate product Zynlonta for relapsed or refractory diffuse large B-cell lymphoma (DLBCL) treatment. The company mainly focuses on ADC development; just as its name suggests, it has almost 6 ADC products lined up in the pipeline. Zynlonta is a CD19-targeted ADC that is considered competition for other CD19-targeted treatments such as Novartis’s CAR-T treatments, Gilead Sciences, and Bristol Myers Squibb.

ADC Therapeutics is also hoping to expand Zynlonta’s reach and is currently underway many clinical trials for several types of lymphoma treatment. The company’s second ADC asset is camidanlumab tesirine (cami), which is a CD25-targeted drug for Hodgkin lymphoma. In addition to that, the longer-term pipeline for the company constitutes ADCs targeting tumor antigens AXL, KAAG1, and DLK1.

Roche

Drug giant Roche’s very first ADC, Kadcyla, was approved by FDA in 2013 for HER2-positive metastatic breast cancer treatment after previous treatment with Roche’s own Herceptin and chemotherapy. It was developed in collaboration with Immunogen’s ADC technology. The second Antibody-drug Conjugate owned by Roche was named Polivy, which was approved in 2019 by FDA. It was used alongside bendamustine and Roche’s Rituxan for diffuse large B-cell lymphoma (DLBCL) treatment. Roche is hoping for a spectacular expansion of Polivy as it strives to fuel Kadcyla’s growth. AstraZeneca and Daiichi Sankyo’s competitor HER2 ADC, Enhertu, pose the greatest competitive challenge to Roche. Currently, Roche has 2 Antibody-drug Conjugate products in the pipeline.

Gilead Sciences

Gilead Sciences acquired Immunomedics in 2020, which also bagged it an Antibody-drug Conjugate in the pipeline of the latter – Trodelvy. In April 2020, FDA granted approval to Trodelvy for metastatic triple-negative breast cancer treatment. Breast cancer is the main target for Trodelvy, but it will face continuous competition from the triple-negative breast cancer market among antibody-drug conjugates. In addition to breast cancer, Trodelvy recently was given a green flag by the FDA for third-line metastatic bladder cancer treatment in addition to breast cancer. It is also being tested in multiple trials either by academics or pharmaceutical industries for different types of cancer, including breast, non-small cell lung, bladder, head and neck, endometrial and ovarian cancers. Gilead Sciences has 1 Antibody-drug Conjugate in the pipeline.

Other potential Antibody-drug Conjugate therapies are owned by GlaxoSmithKline, which has 1 key ADC product in the pipeline. In August 2020, GSK won FDA approval for Blenrep, which is approved for multiple myeloma treatment for patients who have failed four previous treatments. Mersana Therapeutics has a lineup of 4 ADC in the pipeline. It has two antibody-drug conjugates working towards ovarian cancer and non-small cell lung cancer treatment. The lead candidate is upifitamab rilsodotin and secondary product XMT-1592, both target NaPi2b antigen expressed in the above-mentioned cancers.

Antibody-drug Conjugate’s complex design could be able to work in long-term cancer treatment. Also, it becomes challenging for such a complex drug to be recreated or copied in the form of biosimilars. The lack of biosimilars in the Antibody-drug Conjugate market will create freedom of pricing for the ADC developing pioneers. A major mix of top-notch pharmaceuticals has set their foot in the Antibody-drug Conjugate treatment landscape, which includes other names such as Abbvie, Immunogen, Sanofi, Bayer AG, Celldex Therapeutics Inc., Concortis Biotherapeutics, Seattle Genetics Inc, Synthon Holding B.V., Takeda Pharmaceutical Company Ltd., and several others. These companies can transform the Antibody-drug Conjugate market outlook and achieve various milestones in the coming years due to the presence of an exceptionally growing market.

Downloads

Article in PDF

Recent Articles

- Collaboration provides new insight into cancer treatment

- Bright Peak, Ajinomoto to Create Novel Immunocytokines; FDA’s Rejection to Lilly/Pfizer’s T...

- Birinapant licensing; AvantGen, IGM pairs up for anti-SARS-CoV-2 antibodies; BeiGene, Novartis to...

- Most Common Cancers

- Liso-cel (lisocabtagene maraleucel) Shines in Second-Line, Yielding Long-Lasting Complete Respons...