Mapping the Biggest Pharmaceutical Companies by Continents

Feb 11, 2022

Table of Contents

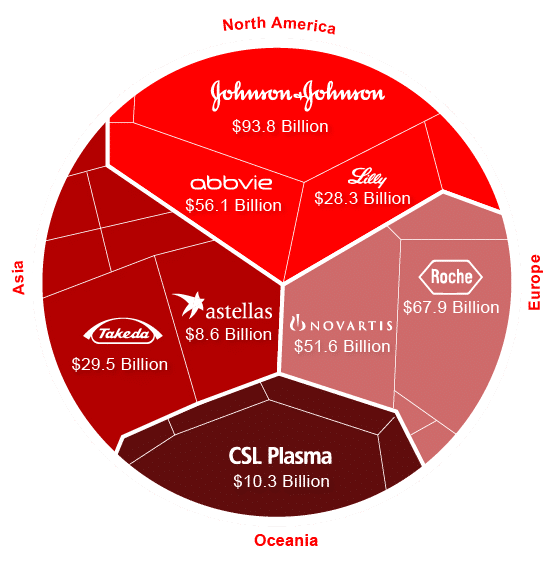

Today, the most important factor affecting the world’s economy is the Global Pharmaceutical Industry. This industry is at the forefront driving about one trillion dollars annually. Pharmaceutical companies are driving a major share of the global economy with the rapidly advancing technological and scientific base, plus an exponential demand for medicines in the market. It is observed that the American pharmaceutical industry holds up for almost 40% of the revenue. On the other hand, Asia is fastly catching up and high revenues in prescription sales are also seen from the European pharmaceuticals. Just after the COVID-19 pandemic hit the world, the global pharmaceutical industry came in solitude combining efforts from companies from various continents coming together in every possible way. As 2020-21 progressed, revenue shares of major pharmaceuticals & drug makers multiplied many folds. Let’s take a look at drug giants classified based on their continents of origin and how they swept the pharmaceutical market in 2021, as well as their revenue shares that surfaced the market.

Continent: North America

Company: Johnson & Johnson

Downloads

Article in PDF

Recent Articles

- Idera’s drug; CRISPR increase risk; Juvenescence grabbed USD 50M; AstraZeneca, Lilly termin...

- CRISPR to cure sickle cell; FDA rejected; Stem cells use; Celgene spinoff

- Transthyretin Amyloidosis (ATTR) Competitive Landscape, Market Insights, Epidemiology and Market

- US drug approvals plummet in 2016

- Astellas ditches UMN Pharma; J&J, Actelion land on a price; Bayer’s pledge; Biogen to fork o...

Revenue in 2021: USD 93.8 billion

Headquarters: New Brunswick, New Jersey, United States

Founded: 1886

About Johnson & Johnson

Johnson & Johnson (J&J) is an American pharmaceutical company that offers a wide range of products via three key business divisions: Pharmaceutical, Medical Devices, and Consumer Health. The key therapeutic areas on which the company focuses through its pharmaceutical division include immunology, infectious diseases, neuroscience, oncology, cardiovascular and metabolism, and pulmonary hypertension. Whereas J&J’s primary medical device emphasis areas are orthopedics, surgery, interventional solutions (cardiovascular and neurovascular), and eye health. Moreover, its consumer health division is specialized in skin health/beauty, over-the-counter pharmaceuticals, infant care, dental care, women’s health, and wound care for consumer health.

Key Products Revenue Share

Johnson & Johnson is one of the most profitable pharmaceutical company across the globe. More than 50% of the revenue comes from its pharmaceutical division. In 2021, it generated a revenue of USD 52 billion through pharmaceutical sales. The rest of the division, i.e. medical devices and consumer health contributed USD 27 billion and USD 14.6 billion of revenue respectively.

The pharmaceutical sales across the world were mainly driven by the sales of the company’s lead assets in oncology such as Darzalex (daratumumab) (USD 6 billion), a biologic for the treatment of multiple myeloma, and Imbruvica (ibrutinib) (USD 4.3 billion), a prescription drug for the treatment of various cancers. In addition, the company’s blockbuster immunological drugs such as Stelara (ustekinumab) (USD 9.1 billion) and Remicade (infliximab) (USD 3.1 billion) biologics for the treatment of a number of immune-mediated inflammatory and autoimmune diseases also contributed to the revenue. Moreover, Janssen’s COVID-19 Vaccine (USD 2.3 billion) further adds to the growth of the company.

Pharmaceutical Pipeline 2022

Johnson & Johnson’s pharmaceutical pipeline is looking promising for the year 2022. The company is looking for potential approval in the US and EU to strengthen its position in the pharmaceutical market. The drugs in the pipeline for potential approval include Cabenuva (for HIV pediatric), Carvykti (for relapsed refractory Multiple Myeloma), and Imbruvica {for Frontline Chronic Lymphocytic Leukemia (I + V fixed duration)}.

Apart from these, there are several other drugs that are in planned submission for US/EU including Aprocitentan (difficult to treat Hypertension), Imbruvica (Treatment naïve patients with Mantle Cell Lymphoma in combination with Bendamustine and Rituximab), Teclistamab (relapsed refractory Multiple Myeloma), VAC18193 (RSV adult vaccine), and VAC31518 (COVID-19 vaccine).

Furthermore, Imbruvica, Carvykti, Aprocitentan, Darzalex are in the late stage of development for various indications along with several other drugs. The launch of these drugs will positively impact the growth of the company.

Company: AbbVie

Revenue in 2021: USD 56.1 billion

Headquarters: North Chicago, Illinois, the United States

Founded: 2013

About AbbVie

AbbVie is a research-based biopharmaceutical firm that develops and sells pharmaceutical products. It focuses on chronic autoimmune diseases in rheumatology, gastroenterology, and dermatology, oncology, including Blood Cancers, virology, including Hepatitis C Virus and Human Immunodeficiency Virus (HIV), neurological disorders, such as Parkinson’s Disease, metabolic diseases, including Thyroid Disease and complications associated with Cystic Fibrosis, pain associated with Endometriosis, and other serious health conditions.

Key Products Revenue Share

The company manufactures around 30 products but mainly depends on its immunological sector. Last year, the immunological sector grabbed a revenue of USD 25.2 billion. Several of AbbVie’s drugs generate billions of dollars in revenue each year. But Humira (adalimumab) is by far AbbVie’s greatest revenue source. With the best-selling drug Humira under its roof, the firm has had a monopoly in the pharmaceutical drug market for a long time.

Humira (adalimumab) is approved for the treatment of adults with moderate to severely active Rheumatoid Arthritis, severe active Ankylosing Spondylitis, severe Axial Spondyloarthritis without radiographic evidence of AS, moderate to Severe Chronic Plaque Psoriasis, active and progressive Psoriatic Arthritis, moderately to severely active Crohn’s Disease, moderately to severely active Ulcerative Colitis, moderately to severely active Hidradenitis Suppurativa, and non-infectious intermediate, posterior and Panuveitis in adults. In addition, Humira is also approved for pediatric patients suffering from active enthesitis-related Arthritis, severe Chronic Plaque Psoriasis, moderately to severely active Crohn’s disease, and active Polyarticular Juvenile Idiopathic Arthritis.

In 2021, the company generated a whopping amount, USD 20.6 billion alone, by the sales of Humira. The other immunological drugs, Skyrizi and Rinvoq generated only USD 2.9 billion and USD 1.6 billion in revenue through their sales, respectively. Apart from Humira, the company’s best-selling drug is Imbruvica. Imbruvica collected a sum of USD 5.4 billion through its sale. The other drug from the same sector, Venclexta generated revenue of only USD 1.8 billion.

Pharmaceutical Pipeline 2022

AbbVie has a strong pipeline with more than 50 drugs in various stages of development, with a focus on oncology and immunology. However, as the Humira patent expiration date approaches, AbbVie is speeding up the trials of its other lead assets. AbbVie key drugs, including Rinvoq, Navitoclax, Imbruvica, Venclexta, and Skyrizi, are in the late stage of development for various indications. Their approval will give AbbVie a boost in the pharmaceutical market as they are already approved for several indications. Apart from these, AbbVie is also evaluating other drugs from various therapeutic areas that will join the respective market soon.

Company: Eli Lilly and Company

Revenue in 2021: USD 28.3 billion

Headquarters: Indianapolis, Indiana, the United States

Founded: 1876

About Eli Lilly

Eli Lilly and Company is a pharmaceutical company. The company is involved in the discovery, development, manufacturing, marketing, and sales of pharmaceutical products worldwide. The key focus areas of the company include Alzheimer’s, COVID-19, Cancer, Diabetes, Immunology, and Pain. The lead assets of the company include its diabetic drugs Humalog, Humulin, Jardiance, and Trulicity, its oncologic drugs Cyramza, Retevmo, Tyvyt, and Verzenio, its immunological drugs Olumiant and Taltz, and its neuroscience drug Emgality. The other therapies from the company’s portfolio include Bamlanivimab, etesevimab, Cialis, and Forteo.

Key Products Revenue Share

The diabetes sector is among the most prominent sector for the company with respect to pharmaceutical market growth. The majority of revenue comes from the sales of diabetic drugs. In 2021, the diabetic sector of Eli Lilly grabbed a revenue of USD 12.5 billion. The major chunk of it was grabbed by its lead assets Trulicity. Trulicity made a sale of USD 6.4 billion across the world due to its increased demand. Another drug from the same segment that contributed to the growth is Jardiance. Jardiance is a part of Eli Lilly’s and Boehringer Ingelheim’s collaboration. It collected an amount of USD 1.4 billion through its worldwide sales. Furthermore, several of Eli Lilly’s diabetic drugs, including Humalog, Humulin, and Basaglar didn’t perform well and there was a drop in sales of these drugs mainly due to lower realized prices.

Apart from diabetic drugs, the company’s oncological and immunological drugs were the second and third best-seller drugs. Together they constituted a revenue of USD 8.3 billion. In addition, its COVID-19 antibodies, including the sales of bamlanivimab, generated a revenue of USD 2.2 billion, whereas Forteo contributed USD 801.9 million to the company’s growth.

Pharmaceutical Pipeline 2022

Eli Lilly’s pharmaceutical pipeline landscape is completely packed for 2022, with a number of drugs in the late stages of development. Eli Lilly evaluates its key drugs such as Jardiance, Emgality, Olimiant, Retevmo, and Tyvyt in various indications for regulatory submissions and actions. Apart from these, the company is also testing some novel drug candidates, including Donanemab and Pirtobrutinib, for regulatory submissions.

Furthermore, Eli Lilly is also planning to announce the positive results from the Phase 3 studies of some of the drugs and initiate Phase 3 clinical trials of around 9 drugs. If everything goes well for the company, then it will make a huge profit from the last year.

Continent: Europe

Company: F. Hoffmann-La Roche AG (Roche)

Revenue in 2021: USD 67.9 billion

Headquarters: Basel, Switzerland

Founded: 1896

About Roche

F. Hoffmann-La Roche AG, commonly referred to as Roche worldwide is a Swiss multinational healthcare company operating around the world. The company’s key operations are divided into two categories – Pharmaceuticals and Diagnostics. F. Hoffmann-La Roche is a full-time associate of the European Federation of Pharmaceutical Industries and Associations (EFPIA). The company when founded in the year 1896, mainly focused on producing several vitamin preparations. Roche excels in almost every field of pharmaceuticals, whether it is cancer treatment, treatment against viral diseases, or even for treatment of metabolic diseases. It is evaluated that Roche holds the world’s biggest expenditures in the pharmaceutical R&D sector. On the other hand, Roche Diagnostics’ focal point is the manufacturing of diagnostic equipment and reagents. The diagnostic equipment is used for medical diagnostic applications and several other types of research. Roche Professional Diagnostics is located in Rotkreuz, Switzerland.

Key Products Revenue Share

Currently, there are almost 100+ marketed drugs being manufactured and sold by Roche. These drugs occupy a major pharmaceuticals market share i.e. around a jaw-dropping USD 48.6 billion in terms of sales revenue. Their pharmaceutical segment covers oncology (USD 22 billion), immunology (USD 9 billion), neuroscience (USD 6.7 billion), hemophilia A (USD 3.26 billion), ophthalmology (USD 1.46 billion), and other infectious diseases (USD 3.6 billion), based drugs. The oncology bestsellers included Perjeta, Tecentriq, Avastin, Herceptin, Rituxan, and others. Immunology drugs include names such as Actemra, Xolair, Esbriet, neuroscience drugs Ocrevus, Evrysdi, single but mega-blockbuster Hemophilia A drug, Hemlibra, whereas other infectious diseases included drugs such as Ronapreve, Rocephin, and others. The growing demand for new medicines, including Hemlibra, Ocrevus, Tecentriq, Evrysdi, Phesgo also served as a driving factor for Roche’s therapeutics demand in the pharmaceuticals market.

The Diagnostics Division reported annual sales of USD 19.2 billion in 2021. It comprised Core Lab (USD 8 billion), Molecular Lab (USD 5.2 billion), Point of Care Lab (USD 2.7 billion), Diabetes Care (USD 1.8 billion), and Pathology Labs (USD 1.3 billion). The growth in diagnostic equipment is mainly due to sales of COVID-19-related products, most notably SARS-CoV-2 PCR test and the SARS-CoV-2 Rapid Antigen test Routine testing, which was greatly affected by the pandemic during 2020, rebounded across all regions in 2021. As a direct result, sales grew in all the mainland regions – Europe, Middle East, and Africa region as well as Asia-Pacific region.

Pharmaceutical Pipeline 2022

An extremely vigorous novel therapeutic pipeline with 80+ new molecular entities in Roche’s pipeline covers a broad range of diseases, therapeutic areas with highly innovative technologies incorporated in research. These are applied in order to create and produce active molecules involved in drug making. Currently, in Roche’s pipeline, there are 45 drugs in Phase I clinical trials, 21 drugs in Phase II clinical trials, 11 drugs in Phase III clinical trials, and 3 drugs under registration. The clinical pipeline includes therapeutic areas such as Oncology, Inflammation/Immunology, Neuroscience, Infectious diseases, Ophthalmology, Metabolics, and several others.

Company: Novartis International AG

Revenue in 2021: USD 51.6 billion

Headquarters: Basel, Switzerland

Founded: 1996

About Novartis

Novartis International AG is often considered to be one of the largest pharmaceutical companies in the world. A Swiss multinational pharmaceutical corporation, it is based in Basel, Switzerland. In the year 1996, two Swiss companies namely Sandoz and Ciba-Geigy merged to form Novartis. It is a leading medicines and drugs company globally, where innovations, recent scientific research, and digital technologies are combined together to give rise to transformative treatments in therapeutic areas of great medical need. Novartis is a full member of the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA), the European Federation of Pharmaceutical Industries and Associations (EFPIA), and the Pharmaceutical Research and Manufacturers of America (PhRMA).

Key Products Revenue Share

Novartis has been a key player in the development of many blockbuster drugs that created huge revenues for the company. They are constantly manufacturing, marketing, and distributing almost 103 drugs in the pharmaceutical market. Cosentyx dealing with Psoriasis treatment turned out to be the drug giant’s best-selling pharmaceutical drug in the year 2021 with USD 4.7 billion of sales generated. The second best-seller and third best-seller drugs were Entresto (fixed-dose combination used in heart failure) and Gilenya (immunomodulating medication for Multiple Sclerosis treatment) generating revenues of USD 3.5 billion and USD 2.7 billion respectively. Whereas Tasigna (Chronic Myelogenous Leukemia treatment) and Promacta (medication used to treat thrombocytopenia and severe aplastic anemia) generated a revenue of USD 2 billion each.

Novartis has many recent FDA approvals such as on October 29, 2021, Scemblix for patients with Philadelphia chromosome-positive chronic myeloid leukemia, and then on 22nd December 2021, Leqvio, a first-in-class siRNA to lower cholesterol was FDA approved. Many more product launches are going to help strengthen the pharmaceutical market for Novartis in the coming years

Pharmaceutical Pipeline 2022

Currently, the Novartis pipeline is sufficiently loaded with almost 150+ R&D projects and one-third of the Novartis total pipeline projects targets for priority diseases area which include 60+ drugs. These pipeline projects targeting priority diseases constitute malaria (9 projects), COVID-19 (5), asthma (4) and oncology (23), and others. There are 43 pipeline therapies in Phase I clinical trials, 64 pipeline therapies in Phase II clinical trials, and 54 pipeline therapies in ongoing Phase III clinical trials. The robust pipeline constitutes for drugs like CNP 520 for Alzheimer’s Disease, KAE 609, KAF 156 for Malaria, QBW 251 for Cystic Fibrosis, ZPL 389 for Atopic Dermatitis, Rydapt for Acute Myeloid Leukemia, and many others.

Read our blog to find out Which Pharma Company Tops the Chart in 2020

Continent: Asia

Company: Astellas Pharma

Revenue in 2021: USD 8.6 billion (Upto Q3, 2021)

Headquarters: Chuo City, Tokyo, Japan

Founded: 2005

About Astellas Pharma

A Japanese multinational pharmaceutical company, Astellas was founded in the year 2005. It was established by merging the former Yamanouchi Pharmaceutical Co., Ltd. and the former Fujisawa Pharmaceutical Co., Ltd., Headquartered in Tokyo. It is considered to be one of the biggest Asian pharmaceutical firms. Astellas is dedicated to improve healthcare across the world by providing reliable and innovative pharmaceutical products. Astellas’ main priority areas of interest in the R&D involve diabetes, infectious diseases, oncology, gastrointestinal diseases, and central nervous system diseases. Astellas’ franchise areas constitute immunology (transplantation), urology, cardiology, and infectious diseases.

Key Products Revenue Share (Upto Q3)

Astellas is currently selling its products in almost 70+ countries and territories worldwide. On top of that, their sales ratio is 80% overseas (other than Japan). Astellas is doing wonders if the oncology drug sector is taken under consideration. Their main products generating huge revenues for the company are mostly oncology drugs.

The key products for sales include the drug Xtandi, a major blockbuster drug that generated a revenue of jaw-dropping USD 3.5 billion in the first 9 months of 2021. This drug focuses on prostate cancer therapeutic area (the leading cause of cancer in men), also it is sold in collaboration with another pharma giant Pfizer. The next drug to grab a substantial market share was Xospata, an anti-cancer drug that is a tyrosine kinase inhibitor. Xospata generated USD 222 million. Another cancer drug – Padcev for bladder cancer treatment, an antibody-drug conjugate (ADC), brought about USD 126 million from around the world.

On the other hand, Astellas’ different therapeutic area drugs also thrived including Myrbetriq used for overactive bladder treatment, gaining a gigantic USD 1 billion revenue for the first 3 quarters in 2021. In addition to that, Prograf (includes Advagraf, Graceptor, and ASTAGRAF XL) for prevention of post-transplant organ rejection claimed to acquire sales of a whopping 1.2 billion USD. It is an immunosuppressive drug, to lower the risk of organ rejection after allogeneic organ transplantation. Lastly, Evrenzo seems to have occupied 18 million USD for anemia treatment.

Company: Takeda Pharmaceutical Company Limited

Revenue in 2021: 29.5 billion USD

Headquarters: Nihonbashi, Chuo, Tokyo, Japan

Founded: 1781

Pharmaceutical Pipeline 2022

A robust Astellas Pipeline constitutes about 25+ pipeline therapies in different developmental stages aiming to target several classes of diseases. These include Immuno-oncology drugs – ASP1951, ASP7517, ASP0739, and many others, ophthalmology pipeline drug – ASP7317 for blindness and regeneration, genetic regulation pipeline drugs – AT132, AT845, and many others for different target areas.

About Takeda Pharmaceutical Company

Takeda Pharmaceutical Company is the largest pharmaceutical company in Asia. It was founded in the year 1781 and was incorporated on January 29, 1925. The company focuses on gastroenterology, metabolic disorders, inflammation, neurology, and oncology via its independent subsidiary, Takeda Oncology. Takeda can be considered as a research-based global company that pivots around innovations in drugs and medicines. The main focus of this company revolves around pharmaceutical drugs only. Being the largest Asian pharmaceutical firm, it is also a global pioneer of the Healthcare Industry.

Key Products Revenue Share (April – December 2021)

Being one of the most profitable pharmaceutical companies in the world, Takeda has over 54 marketed drugs which generate a tremendous amount of revenue for the drug giant. Total Gastroenterology drugs provided a massive revenue of USD 5.8 billion, which includes the company’s most successful gut selective, major blockbuster drug – Entyvio, Takecab-F, Gattex, Dexilant, Pantoloc, and others. Plasma Derived Therapy (PDT) Immunology is another therapeutic area driving mass sales accumulating USD 3.2 billion, constituting only two hit drugs, Immunoglobulin and Albumin. In addition to that, Rare diseases therapeutic area which has drugs like Elaprase, Replagal, Vpriv, Natpar and rare Hematology drugs such as Advate, Adynovate, Feiba, Recombinate altogether account for USD 4 billion of sales. Furthermore, superhit Oncology drugs like Velcade, Leuplin, Ninlaro, Adcetris, and others plus Neurology drugs such as Vyvanse (best seller neurology), Trintellix, Intuniv, and others serve for USD 3.1 billion each.

Pharmaceutical Pipeline 2022

Takeda oncology has almost 20+ oncology pipeline therapies that are under different phases of development, it constitutes drugs in Phase III clinical trials such as Brigatinib, Cabozantinib, Ponatinib, Relugolix, and others. In Phase II clinical trial is Pevonedistat, whereas in Phase I/II there are Modakafusp Alfa, Subasumstat, TAK-007, TAK-605, TAK-186, and many other oncology drugs. Lastly, in Phase I clinical trial, drugs like TAK-500, TAK-940, and others are under investigation.

Takeda’s pipeline therapies deal with other therapeutics fields as well constituting Rare Genetics & Hematology investigational drugs such as Takhzyro, Vonvendi, Adynovate, and more. Gastroenterology drugs such as Vocinti, Alofisel, PDT investigational drugs such as Cuvitru, Hyqvia, and others are in Takeda’s therapeutic pipeline.

Continent: Oceania

Company: CSL Limited

Revenue in 2021: USD 10.3 billion

Headquarters: Melbourne, Australia

Founded: 1916

About CSL Limited

CSL Limited develops, manufactures, and sells human pharmaceutical and diagnostic products derived from human plasma. Pediatric and adult vaccines, infection, pain medicine, skin disorder treatments, antivenoms, anticoagulants, and immunoglobulins are among the products offered by the company. The company operates through 2 business units namely, CSL Behring and Seqirus.

CSL Behring unit mainly develops or manufactures therapies to treat hemophilia, critical care products for shock in trauma treatment, immunoglobulins for infection treatment, and autoimmune diseases. On the other hand, the Seqirus unit produces and distributes biotherapeutic products for the treatment and prevention of serious human medical conditions, such as influenza vaccines, prescription medicines, anti-venoms, and in-licensed pharmaceuticals.

Key Products Revenue Share

The company’s main source of revenue is from its CSL Behring unit. More than 80% (USD 8.5 billion) of the total revenue came from this unit in 2021. The immunoglobulin products contributed the maximum revenue of USD 4.2 billion to this led by Hizentra. Hizentra sales increased by 15%, owing to the increased preference for and patient benefits of home administration, as well as continued uptake for Chronic Inflammatory Demyelinating Polyneuropathy treatment.

Moreover, specialty products made sales of USD 1.7 billion led by increasing demand for Haegarda (for routine prophylaxis to prevent Hereditary Angioedema (HAE) attacks) and Kcentra (for urgent reversal of acquired coagulation factor deficiency induced by Vitamin K antagonist). In addition, hemophilia products contributed USD 1.1 billion through their sales across the world led by key drug Idelvion (for Hemophilia B).

Pharmaceutical Pipeline 2022

CSL through its CSL Behring unit will continue to broaden the geography and develop novel drugs for rare and specialty diseases around the world in our immunology, hematology, and respiratory therapeutic areas. Currently, the company is evaluating Haegarda, Hizentra, Idelvion, and many more in the late stages for various indications. Apart from these, around 10 drugs are in the early stage of development. The company is planning to launch its late-stage products in the pharmaceutical drug market soon to solve the problem of many people suffering from rare diseases.

Way Ahead

In 2020, the global impact of the Covid-19 pandemic was unprecedented. But the pharmaceutical industry found the solution and fought back against the virus. There are several pharmaceutical and biotech companies in the healthcare market; some are established players dominating the pharmaceutical drug market, while many more are still emerging. Countries such as Brazil, India, Egypt, Russia, and Columbia are among the emerging healthcare countries. Furthermore, collaborations and mergers will give these pharmaceutical companies a boost in their growth. Moreover, with rising demand for effective and standard healthcare, rising healthcare expenditure, and a growing focus of global organizations on providing better healthcare services to the masses, pharmaceutical and biotech companies are expected to thrive and provide better therapies in the coming years.

Downloads

Article in PDF

Recent Articles

- NF-κB Inhibitors- A Promising Future

- The Current Scenario for Interstitial Cystitis(IC)

- Merck launches Biosimilars, ABITEC announces extension, First human clinical trial, FDA awards 2g...

- CRISPR to cure sickle cell; FDA rejected; Stem cells use; Celgene spinoff

- New method for classification of CNS tumors