Which Key Player Holds the Potential to Corner the Rheumatoid Arthritis Therapeutics Market?

Oct 04, 2024

Table of Contents

Rheumatoid Arthritis is a chronic, inflammatory autoimmune disease that leads to progressive and destructive polyarthritis and affects approximately 1% of the population. The rheumatoid arthritis population is characterized by chronic pain and joint destruction that usually progress from distal to more proximal joints.

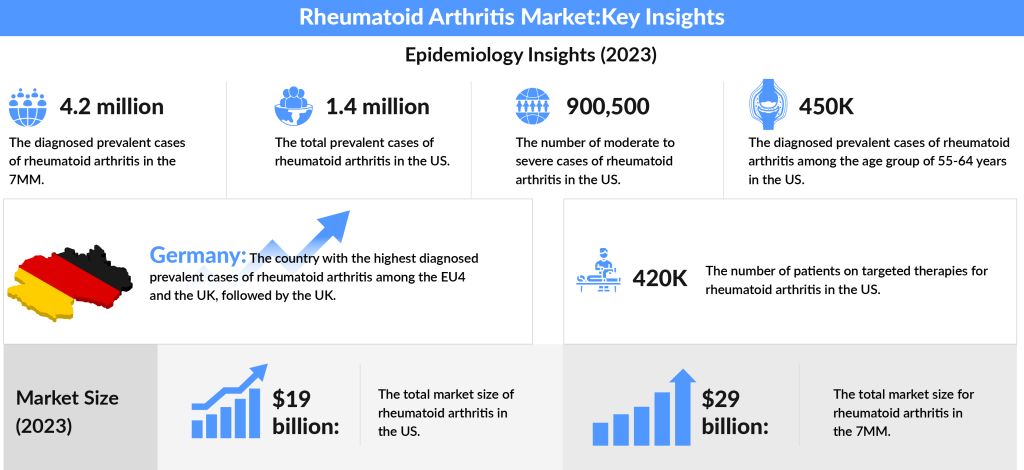

In 2023, the total diagnosed prevalent cases of rheumatoid arthritis across the 7MM (the United States, Japan, EU4, and the UK) were estimated to be around 4.2 million, with expectations for this number to rise during the study period. Focusing on the U.S., approximately 1.4 million individuals were living with RA in 2023.

Downloads

Article in PDF

Recent Articles

- Harnessing the Power of Immunomodulators: Applications and Implications

- Biologics Spark Market Interest In The Nasal Polyposis Treatment Space

- Savara Introduced aPAP ClearPathTM; RaySearch Released RayStation 2024A; FDA Approved Expanded La...

- Sanofi’s Rare Disease Drug Xenpozyme’ Approval; FDA Approves Novartis’ Pluvicto; AstraZenec...

- ANCA-associated Vasculitis Treatment Market: Unraveling the Complexities

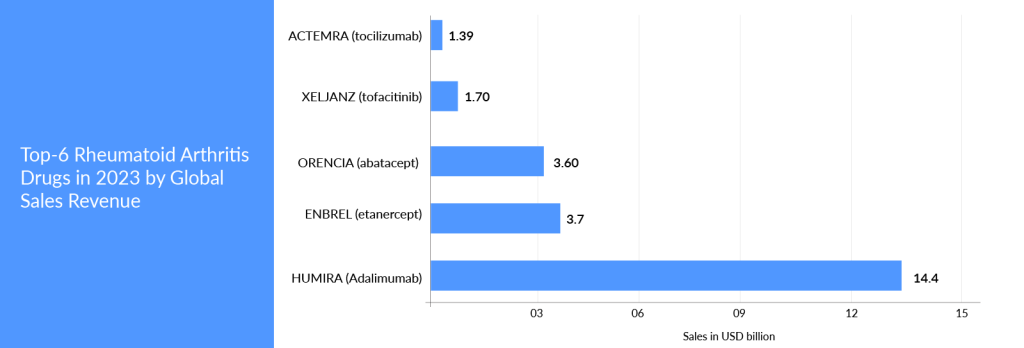

Furthermore, to understand how big the market opportunity lies in this autoimmune segment, six of the top 50 bestselling medications worldwide are now being used to treat rheumatoid arthritis. Large-cap pharmaceutical and biotech firms such as AbbVie, Amgen, Roche, Pfizer, Johnson & Johnson, and Bristol Myers Squibb dominate the market. Some of these pharmaceutical behemoths have also safeguarded their assets with strong patents, preventing biosimilars and generics from entering the market.

Over the past few years, a dramatic improvement in outcomes of rheumatoid arthritis has been observed due to the direct consequence of paradigm shifts in the treatment. Conventional DMARDs (csDMARDS) and methotrexate (MTX) are part of the first treatment strategy. Methotrexate remains the anchor drug in rheumatoid arthritis; its usage as monotherapy is also the basis for combination therapies with other csDMARDs, biologics DMARDs (bDMARDs), and targeted synthetic DMARDs (tsDMARDs). Patients refractory to csDMARDS or with severe symptoms are usually treated with a wide variety of DMARDs classes like anti-TNF, T-cell inhibitors, B-cell inhibitors, interleukin inhibitors, and targeted synthetic DMARDs like JAK inhibitors. It is worth mentioning that, in rheumatoid arthritis, the US FDA has become more cautious about eliminating agents that could result in many complications and deaths.

Will the Expiring Patent of HUMIRA Give an Upper Hand to Competitors?

HUMIRA, AbbVie’s flagship product, is a classic example of maintaining a market monopoly for an extended period. This product has been a golden goose for AbbVie since its first approval. However, AbbVie’s concerns began after HUMIRA’s patent protection lapsed internationally. The primary patent in the United States and Europe expired in 2016 and 2018, respectively. Owing to HUMIRA’s popularity and buzz among physicians, several adalimumab biosimilars have been approved (the US, the EU-5, and Japan) and launched (the EU-5 and Japan). Introducing biosimilars has significantly affected HUMIRA’s sales in Europe and Japan.

Despite losing its core patent, AbbVie was expected to maintain its monopoly in the United States until 2023 by leveraging additional patents and establishing multiple agreements with biosimilar producers, preventing market competition.

On January 31, 2023, Amgen announced that AMJEVITA (adalimumab-atto), a biosimilar to HUMIRA (adalimumab), is now available in the United States. AMJEVITA was the first biosimilar to HUMIRA approved by the FDA in 2016.

The introduction of AMJEVITA marks a significant moment in the U.S. drug market, highlighting the challenges in providing life-altering medications at affordable prices. HUMIRA’s monopoly has been largely attributed to congressional statutes and federal regulations that allowed AbbVie to raise its list prices by 600 percent since its launch at $522 per 40 milligram syringe. An analysis by the Foundation for Research on Equal Opportunity indicates that most of HUMIRA’s revenue came from price increases rather than substantial product improvements.

Following the expiration of HUMIRA’s formula patent in 2016, a “patent thicket” consisting of 132 additional patents delayed Amgen’s biosimilar launch by over seven years. As of now, Amgen and seven other competitors are set to launch their biosimilars at various times this year, but they will pay AbbVie royalties for the privilege of entering the market.

Amgen’s ENBREL (etanercept) is another blockbuster that has circumvented market competition by having long-term patent protection and winning the war of several patent disputes. ENBREL’s primary patent in the United States expired in October 2012, and patents in Europe expired in February 2015.

Many biosimilars are authorized in Europe and Japan. The US FDA also approved biosimilars of ENBREL; however, Amgen successfully kept its copycats off the pharmacy shelves due to its strong patent portfolio and by winning patent challenges. ENBREL’s exclusivity will be maintained by 2029, and this product will enjoy more than 30 years of exclusivity in the United States.

After two decades and $200 billion in revenue, HUMIRA, an injectable treatment for rheumatoid arthritis and various other autoimmune conditions, has finally lost its monopoly. RINVOQ, AbbVie’s Janus kinase inhibitor (JAKi), was approved in 2019 to treat rheumatoid arthritis. Furthermore, SKYRIZI is expanding in the autoimmune domain to compensate for any decline in AbbVie’s profits. With this multifaceted route, AbbVie is adopting a more secure strategy for the company’s growth. RINVOQ and SKYRIZI are excelling in their respective authorized domains. RINVOQ has only been on the market for a few years, yet, it has already taken a sizable share of the patient market. The product is also giving tough competition to Pfizer’s XELJANZ.

With the Complete Savings Card, commercially insured patients are eligible to pay as little as USD 5 per month. RINVOQ has achieved 95% Medicare coverage. DelveInsight analysts estimate that if RINVOQ continues to leverage the rheumatoid arthritis field similarly, it will potentially become one of AbbVie’s most valuable assets over the next decade. The company expects that SKYRIZI and RINVOQ will have the same impact as HUMIRA in the upcoming years.

In 2006, the European Medicines Agency (EMA) became the first regulatory agency to approve biosimilars and provide biosimilar guidance documents. The HUMIRA and ENBREL case proves several gaps in the United States market and has trailed behind Europe in biosimilar expansion and adoption. In recent years, Europe’s considerably higher approval rating has widened its advantage over the United States. Patents of blockbuster therapies are likely to expire in the coming years. Companies wanting to join the rheumatoid arthritis market may have a commercial opportunity to fetch patients access to key drugs at a reasonable cost.

Rheumatoid Arthritis Emerging Therapies in Development

Companies like R-Pharm, Taisho Pharmaceuticals, GlaxoSmithKline, Aclaris Therapeutics, Bristol Myers Squibb, Eli Lilly, Taiho Pharmaceutical, Cyxone, Gilead Sciences, Kiniksa Pharmaceuticals, Istesso, Applied Molecular Transport, Horizon Therapeutics, Genosco (Oscotec), Hope Biosciences, Abivax, and many others are evaluating their lead assets for rheumatoid arthritis.

In Japan, ozoralizumab (next-generation anti-TNF nanobody) is being tested for rheumatoid arthritis. The corporation has already submitted the NDA. R-Pharm’s Olokizumab is already on the market in Russia and another Eastern European country under the brand name Artlegia. The firm intended to start filing in the US, EU, and globally; however, there is uncertainty about its future in the 7MM. Talking about its clinical safety and efficacy, the most recent Credo 1, 2, and 3 studies have demonstrated clinical and physical improvements for individuals with rheumatoid arthritis who had insufficient responses to methotrexate and inhibitor treatment. CREDO1 results reveal that six months of therapy with Olokizumab significantly improves disease activity and physical performance in patients currently taking methotrexate for rheumatoid arthritis. Olokizumab plus methotrexate was not shown to be inferior to adalimumab plus methotrexate in CREDO2. That has not been demonstrated with tocilizumab or sarilumab. Tocilizumab and sarilumab were studied in comparison to adalimumab monotherapy. In June 2023, Ozoralizumab exhibited favorable pharmacokinetics over a 52-week period in patients with rheumatoid arthritis. The drug demonstrated stability across various patient characteristics. Data published in Arthritis Research & Therapy indicates that Ozoralizumab has a long half-life and sustained efficacy throughout the 52 weeks in rheumatoid arthritis patients.

To investigate the pharmacokinetics of Ozoralizumab (Ablynx NV), Takeuchi and colleagues analyzed data from the OHZORA and NATSUZORA studies, both randomized multicenter trials assessing the drug in rheumatoid arthritis patients over a 52-week period from 2018 to 2020. Participants in the OHZORA trial had previously shown a weak response to methotrexate, while those in the NATSUZORA trial had been using conventional synthetic disease-modifying antirheumatic drugs but discontinued treatment due to safety concerns.

In 2022, Cyxone plans to begin a Phase IIb trial of rabeximod. This asset was previously studied for Covid-19. However, its Phase II results in COVID-19 were disappointing due to a lack of statistical significance. As of now, the company is focused on rheumatoid arthritis. The company had already completed a Phase IIa study in rheumatoid arthritis and had not published any data related to rheumatoid arthritis. It has a unique mechanism of action, a convenient RoA, and a favorable tolerability profile (per the company).

In June 2021, Abivax announced the results of the Phase IIa induction clinical study of ABX464 conducted on 60 patients. The primary endpoint of this study was achieved, demonstrating good tolerance of the 50 mg dose of ABX464 administered once daily during the 12 weeks of induction treatment. Although the sample size of this study was not planned to show a significant difference in the efficacy endpoints, the 50 mg group was found to be statistically superior to the placebo on the key secondary endpoint (ACR20) at Week 12 for the per-protocol population. In March 2022, Abivax reported data from the Phase IIa maintenance study in rheumatoid arthritis after 1-year treatment. Of the 40 patients, 23 have completed the first year of treatment (as of February 28, 2022), and all have achieved at least an ACR20 response, with 19 and 12 patients had achieved an ACR50 and ACR70 response, respectively. Phase IIb study is being considered and initiated depending on the resources and funding availability. It is worth mentioning that ABX464 has demonstrated promising outcomes in ulcerative colitis. And unlike JAKi, TNF-a, and ILs, where multiple candidates are being investigated/approved and competing for market share, ABX464 is the only medicine currently being examined with this mechanism of action.

Zunsemetinib (ATI-450) from Aclaris Therapeutics was another important rheumatoid arthritis contender. Zunsemetinib is a new oral MK2 inhibitor that has outperformed JAK inhibitors in efficacy and safety during the Phase II trial. The oral mode of administration is more convenient than biological DMARDs. The results of Phase II reveal that zunsemetinib has a clean safety profile, with no major side events like infection, VTE, or PE, which plagued standard-of-care medicines like TNF-a and JAKi. However, the trial faced a setback. In November 2023, Aclaris announced that its Phase II investigation of zunsemetinib (ATI-450) failed to meet the primary endpoint of ACR20 response at both the 20 mg and 50 mg doses. The trial also did not achieve any secondary endpoints, with no significant differentiation between the drug and a placebo across all efficacy measures at week 12. As a result, Aclaris is halting further development of zunsemetinib and ceasing recruitment for a Phase IIa study in patients with psoriatic arthritis. Following this disappointing data release, the company’s stock price plummeted over 86% on Monday, placing it in the penny stock range. While Aclaris Therapeutics plans to give its MK2 inhibitor zunsemetinib another opportunity, unfortunately, nearly half of the biotech’s workforce will not be as fortunate.

Pfizer is researching PF-06650833, as well as Ritlecitinib, for rheumatoid arthritis. PF-06650833 is a novel drug (Interleukin-1 Receptor Associated Kinase 4 Inhibitor); some adverse events were identified in the research; effectiveness was satisfactory. Regarding ritlecitinib, another JAK inhibitor, the PII safety, and effectiveness results seem promising. The company is conducting another Phase II research, along with rheumatoid arthritis; this asset has shown promising benefits in a late-stage investigation of alopecia areata. Because it is a JAK inhibitor, it may have a more difficult route to approval than predicted due to increased safety concerns. However, management is confident that its assets provide a favorable risk/benefit profile.

Recent Developments

- In September 2024, Celltrion announced that the U.S. Food and Drug Administration (FDA) has approved a Phase 3 clinical trial for its Remicade biosimilar, Zymfentra (CT-P13 SC, infliximab), aimed at treating rheumatoid arthritis.

- In July 2024, SetPoint Medical revealed positive topline results from its RESET-RA clinical study, which is evaluating the SetPoint System as a pioneering neuroimmune modulation treatment for adults with moderate-to-severe rheumatoid arthritis who are incomplete responders or intolerant to biologic or targeted synthetic disease-modifying anti-rheumatic drugs (DMARDs).

- In March 2024, SetPoint Medical also announced that it received Breakthrough Device Designation from the FDA for its neuroimmune modulation platform targeting individuals with relapsing-remitting multiple sclerosis (RRMS). This designation facilitates enhanced communication with the FDA and prioritizes regulatory review, supporting reimbursement and patient access upon approval.

- In March 2024, the FDA approved TYENNE® (tocilizumab-aazg), the first biosimilar to ACTEMRA (tocilizumab), for both intravenous (IV) and subcutaneous (SC) administration. TYENNE is indicated for adults with moderately to severely active RA who have not responded adequately to one or more DMARDs, adults with giant cell arteritis, and patients aged two years and older with active polyarticular juvenile idiopathic arthritis or active systemic juvenile idiopathic arthritis.

- In February 2024, the FDA approved SIMLANDI (adalimumab-ryvk), a citrate-free, high-concentration interchangeable biosimilar to HUMIRA® (adalimumab).

- In October 2023, the FDA accepted Rise Therapeutics’ investigational new drug (IND) application, allowing the initiation of a Phase I clinical trial for R-2487 to treat rheumatoid arthritis. This study will assess the drug’s exposure, tolerability, safety, and clinical activity through single and repeat doses of the cellular immunotherapy R-2487.

Conclusion

Rheumatoid arthritis therapies have garnered positive and negative attention from medical and political parties. Still, there is no denying that rheumatoid arthritis is a massive market with commercial potential if adequately addressed. If TNF-alpha inhibitors do not work, rheumatologists will move patients to another treatment option. The rising trend of switching after one agent may also continue. The current domination of TNF-alpha inhibitors suggests that rheumatologists are comfortable with them, owing to their favorable long-term safety and physician familiarity. New therapies entering the rheumatoid arthritis market will be assessed against these comparators. They must demonstrate better safety and efficacy benefits to be regarded in the same line of treatment as TNF-alpha inhibitors. It is worth noting that some of the blockbuster drugs for rheumatoid arthritis are already facing biosimilar competition, and few will soon face patent expiration/protection, affecting current patients’ share of existing therapies, particularly in European countries where biosimilar acceptance is higher. In addition, with a negative opinion against JAK inhibitors in the United States, key players may focus more on the major European market, where the attitude toward JAK inhibitors is different, at least for the time being.

FAQ

Rheumatoid arthritis (RA) is a chronic, inflammatory autoimmune disease that leads to progressive and destructive polyarthritis and is characterized by chronic pain and joint destruction that usually progress from distal to more proximal joints. RA is the result of an immune response in which the body’s immune system attacks its own healthy cells, and the specific causes of RA are still unknown.

Rheumatoid arthritis is caused by autoimmunity when the body is unable to differentiate between non-self cells. The immune system attacks joints and causes inflammation and degeneration of cells.

RA is a chronic disease that causes joint pain, stiffness, swelling, and decreased movement of the joints. Small joints in the hands and feet are most affected. Sometimes RA can affect other organs, such as the eyes, skin, or lungs.

RA is diagnosed by a combination of the patient’s symptoms, results of the doctor´s examination, assessment of risk factors, family history, a joint assessment by ultrasound sonography, and assessment of laboratory markers such as elevated levels of CRP and ESR in serum and detection of RA-specific autoantibodies.

Large-cap pharmaceutical and biotech firms such as AbbVie, Amgen, Roche, Pfizer, Johnson & Johnson, and Bristol Myers Squibb dominate the Rheumatoid Arthritis therapeutics market. Moreover, to further improve the treatment scenario and strengthen their most in the market, companies like GSK, Taisho Pharmaceutical Holding Co Ltd, R-Pharm, Cyxone, Istesso, Abivax, Gilead Sciences, Aclaris Therapeutics, Inc. Therapeutics, and many others are evaluating their lead assets for Rheumatoid Arthritis.

Downloads

Article in PDF

Recent Articles

- Savara Introduced aPAP ClearPathTM; RaySearch Released RayStation 2024A; FDA Approved Expanded La...

- Kinase Inhibitors: Challenging the established Biologics as the new standard of care in autoimmun...

- Biologics Spark Market Interest In The Nasal Polyposis Treatment Space

- FDA Approves AstraZeneca’s Enhertu; Bayer Wins FDA Approval for Prostate Cancer Therapy, Nubeqa; ...

- Rheumatoid Arthritis: Causes, Risk Factors, Treatment Approaches and Market Landscape