New Technologies Conquering Drug Delivery Obstacles in Acute Ocular Pain Treatment Landscape

Jan 16, 2023

Table of Contents

Ocular pain is among the most common complaints in emergency clinics for medical attention. Most of the older population is affected by eye pain from post-ocular surgeries and debilitating eye conditions. Eye pain can be broadly classified as acute and chronic; eye pain exceeding 3 months is considered chronic. Moreover, nociceptive pain is the direct foundation of acute ocular pain. Nociceptive pain is associated with transient pain and activates the nociceptors due to actual or threatened damage to non-neural tissue and implies an intact somatosensory nervous system that affects the eyes. Generally, acute ocular pain arises from ocular trauma or during cataract or refractive surgery. However, other eye conditions like glaucoma, dry eye disease, conjunctivitis, uveitis, and corneal abrasion contribute to eye pain and inflammation. Furthermore, it is strenuous to determine the incidence of acute ocular pain as it is hidden within numerous eye conditions.

As per the latest published “Acute Ocular Pain (AOP) Epidemiology” report, DelveInsight estimated that acute ocular pain affected around 4.1 million people in the US, 3.9 million people in the EU4 and the UK, 870K people in Canada, and nearly 450K people in Korea, in 2021.

Downloads

Article in PDF

Recent Articles

Traditional acute ocular pain treatment options with significant unmet needs

The acute ocular pain treatment landscape comprises topical anesthetics, corticosteroids, ointment, gels, or drops. However, the association with side effects and other shortcomings of these therapies have made it arduous for doctors to prescribe or dispense them to patients directly. Topical anesthetics being effective, have high rates of permanent corneal blindness. Additionally, corticosteroids have well-known side effects that include cataract formation, elevated intra-ocular pressure or glaucoma with damage to the optic nerve, and defects in visual acuity and fields of vision. Nevertheless, topical NSAIDs have rare side effects, including significant corneal reactions such as epithelial defects, reduced rates of corneal healing, and stromal ulceration. Furthermore, three major concerns with the current acute ocular pain treatment are adherence to the need to administer eye drops frequently, lesser contact time, and the potential of the acute ocular pain drug to reach the target site.

Are we managing the pain efficiently?

The last decade has bestowed our progress and advances in understanding neurophysiology on the ocular surface, leading to better acute ocular pain treatment approaches. To help alleviate the pain, the US FDA has recently approved therapies like DEXTENZA, INVELTYS, and LOTEMAX SM to treat ocular inflammation and pain following ophthalmic surgery and cataract surgery.

DEXTENZA, developed by Ocular Therapeutics, is the first FDA-approved intracanalicular insert to deliver a tapered dose of steroid (dexamethasone) to the ocular surface for up to 30 days. Moreover, it is resorbable and does not require removal. Additionally, Kala Pharmaceutical’s INVELTYS and Bausch’s LOTEMAX SM are loteprednol etabonate ophthalmic suspension and gel formulations, respectively, that inhibit the inflammatory response to various inciting agents. Previously in 2016, US FDA approved BromSite, a nonsteroidal anti-inflammatory drug (NSAID), to treat postoperative inflammation and prevent ocular pain in cataract surgery patients. Additionally, the company and government launched various insurance plans, copay, and reimbursement programs to help the patient manage the out-of-pocket cost.

Novel drug delivery systems enhancing ocular residence time and bioavailability

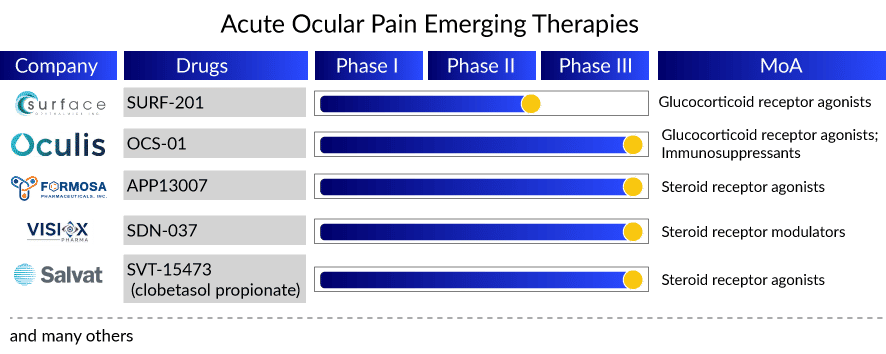

With so much happening in the current acute ocular pain treatment landscape, the upcoming acute ocular pain therapies hold advantageous technologies that counter several issues in current acute ocular pain treatment options, like compliance and contact time with layers of ocular tissue. Soon enough, by 2025, new candidates, OCS-01 (Oculis SA), SURF-201 (Surface Ophthalmics), APP13007 (Formosa Pharmaceuticals), SDN-037 (Visiox Pharma), DEXYCU (EyePoint Pharmaceuticals), and SVT-15473 (Salvat Laboratories) are expected to enter the acute ocular pain treatment market back to back, giving cut-throat competition to each other. Key pharma acute ocular pain companies utilize different drug delivery techniques and platforms to stand out in the crowd.

In this context, efforts have been made by Formosa Pharmaceuticals and Salvat Laboratories toward improving the ocular bioavailability of corticosteroids by formulating ophthalmic nanosuspension and nanoemulsion. Formosa utilized its proprietary activus pure nanoparticle technology (APNT) formulation platform that ensures enhanced penetration to the target acute ocular pain treatment compartment, while Salvat’s IMPACT-SVT, a patented nanoemulsion drug delivery technology, improves drug penetration and bio-adhesion, provides excellent comfort.

Similarly, Oculis’ OCS-01 ophthalmic suspension has successfully utilized its proprietary SNP technology to increase the solubility and residence time of the active drug on the surface of the eye, delivering an improved and clinically effective anti-inflammatory effect while reducing the frequency of topical administration. Adding to this list, Surface Pharmaceutical’s Klarity, betamethasone, and mycophenolate sodium vehicle support a healthy ocular surface and deliver a positive experience for dry eye and post-ocular surgery patients.

SDN-037 utilizes tight junction modulation (TJM) extended-release technology to deliver a very low dose of 0.04% w/v with reduced frequency. Furthermore, DEXCYU priorly approved intra-ocular injection for post-ocular surgery inflammation is a single injection administered at the end of cataract surgery that continues to show its action for about a month; if approved for ocular pain, it will be a boon for cataract surgery patients.

With the potential approval of these acute ocular pain therapies, DelveInsight estimates that the total acute ocular pain market (6MM + Canada + Korea) is expected to reach approximately USD 615 million by 2032 at a CAGR of ~8%.

The benefits of corticosteroids’ anti-inflammatory properties remain of interest to pharma giants. However, despite the promising action, the side effects associated with corticosteroids cannot be ignored. Moreover, the current acute ocular pain pipeline primarily addresses pain after ocular surgeries and cataracts. Hence, new acute ocular pain therapies that address other ocular injuries and counter the shortcomings associated with corticosteroids are much needed in the acute ocular pain treatment market.

FAQs

Eye pain can be broadly classified as acute and chronic; eye pain exceeding 3 months is considered chronic. Moreover, nociceptive pain is the direct foundation of acute ocular pain.

Ocular pain encompasses a wide range of symptoms, from acute sharp pain in the eye to mild discomfort or itching in the eyes. Acute ocular pain refers to eye pain that occurs for a short period of time (e.g., post-surgical, mild dry disease, acute anterior uveitis, etc.). Acute ocular pain symptoms and signs include red eye, photophobia, vision loss, or diplopia.

Acute ocular pain diagnosis is based on a previous medical and medication history, as well as a physical examination of the eye, which is then confirmed by tests such as computed tomography (CT), magnetic resonance imaging (MRI), histopathologic examination for cancer detection, and eye culture to check for a bacterial infection.

Rather than ophthalmology, approaches to treating ocular pain come from neuroscience, neurology, and pain management. AOP caused by surgery, injury, infection, or inflammation in the front of the eye is usually treated with a topical steroid, NSAID, systemic NSAID, lubricant ointment, gel, or drops, bandage contact lens, or a few doses of oral opiate or topical anesthetic.

Key players in the acute ocular pain treatment market include Ocular Therapeutix, Kala Pharmaceuticals, Oculis SA, Surface Ophthalmics, Formosa Pharmaceuticals, Salvat Laboratories, Visiox Pharma, and EyePoint Pharmaceuticals. The expected entry of promising agents, including SURF-201, APP13007, OCS-01, SVT-15473, SDN-037, and DEXYCU, can transform the current standard of care and the acute ocular pain treatment market during the forecast period.

Downloads

Article in PDF