Myelofibrosis Treatment Market Heats Up with GSK’s Momelotinib Entry

Sep 22, 2023

On September 15, the FDA authorized GSK’s oral medication momelotinib, now known as Ojjaara, for the treatment of myelofibrosis in adults with anemia. Myelofibrosis is a disorder where normal bone marrow tissue is slowly substituted by fibrous, scar-like material. It is categorized as a form of chronic leukemia and is grouped within myeloproliferative diseases, ultimately leading to the gradual deterioration of bone marrow function.

As per DelveInsight analysis, the total prevalent population of myelofibrosis in the 7MM comprised approximately 40K cases in 2022 and is projected to increase during the study period (2019–2032). As per the estimates, in 2022, the highest number of prevalent cases were observed in the US. Patients with myelofibrosis frequently develop anemia, requiring them to cease treatment and increase their reliance on transfusions.

The vast majority of myelofibrosis patients eventually develop anemia, causing them to discontinue treatments and require transfusions,” said Nina Mojas, Senior Vice President, Oncology Global Product Strategy, GSK. We are excited to add Ojjaara to our cancer portfolio and address a substantial medical need in the community, given the high unmet need. We are excited to contribute to better results in this difficult-to-treat blood malignancy.

Downloads

Article in PDF

Recent Articles

- Retinal Degeneration : The Current Pipeline Scenario

- FDA Extended the Review Period for Momelotinib; FDA Approves Roche’s Columvi; Avita Medical Obtai...

- Potential Diagnostic solutions that may significantly contribute to COVID-19 detection

- Stada’s €5.3B; Pfizer takes 30 cents; GSK, Exscientia ink deal; Trillium hunts for partners; Clem...

- Roche-UCB’s $120M collaboration; Omega snags $85M; ExeVir raises $27M; GSK culls pipeline m...

Ojjaara is an oral medication with a unique mode of action that effectively inhibits three critical signaling pathways: the JAK1 and JAK2 cascades, as well as the ACVR1 pathway. By blocking JAK1 and JAK2, Ojjaara reduces splenomegaly and enhances patients’ overall well-being. Simultaneously, its ACVR1 activity lowers hepcidin levels, a significant contributor to anemia. The drug was most recently developed by Sierra Oncology and acquired by GSK for USD 1.9 billion in 2022.

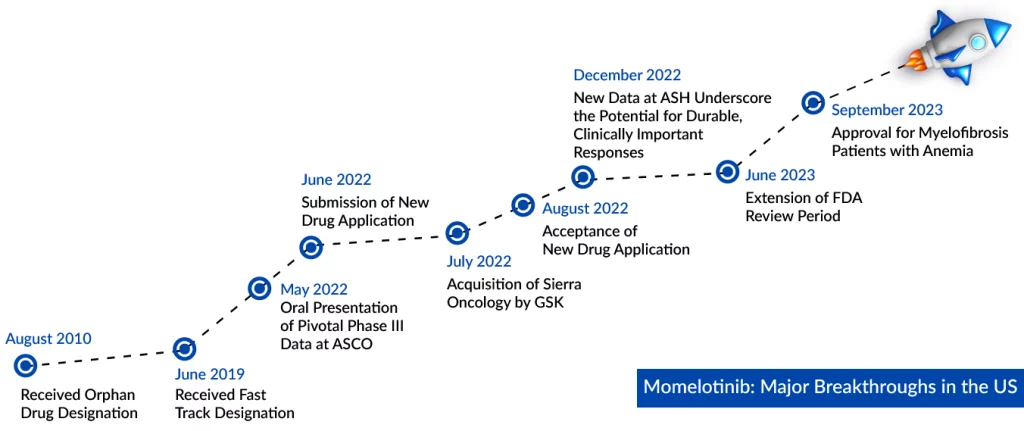

In 2019, the FDA granted Fast Track Designation to momelotinib for the treatment of patients with intermediate/high-risk myelofibrosis who have previously received a JAK inhibitor. The drug also has Orphan drug designation from the FDA and EMA. In June 2022, the company presented Phase III data at ASCO 2022 and at the European Hematology Association Hybrid Congress 2022. Based on the positive results, the company submitted an NDA to the FDA in the second quarter of 2022. Data from MOMENTUM, along with data from more than 820 myelofibrosis patients previously treated with momelotinib, is the basis of the global registration strategy for momelotinib.

This approval marks a milestone as Ojjaara becomes the inaugural authorized treatment for individuals with myelofibrosis, whether newly diagnosed or previously treated, and suffering from anemia. Additionally, it effectively addresses the critical symptoms of the condition. The approval, initially expected in March 2023, was delayed by three months until June 2023, as the FDA required extra time for an in-depth review of supplementary data accompanying the application. Notably, Momelotinib remains unapproved in all other markets.

The FDA granted approval to momelotinib, relying on data obtained from the pivotal MOMENTUM study and a specific subgroup of adult patients experiencing anemia as part of the SIMPLIFY-1 phase III trial. The primary objective of MOMENTUM was to compare the safety and efficacy of momelotinib to danazol in managing and reducing major symptoms of myelofibrosis in patients who were symptomatic and had previous JAK inhibitor exposure. Remarkably, the MOMENTUM trial achieved all of its primary and key secondary goals, demonstrating a statistically significant response in individuals treated with momelotinib compared to danazol, particularly in terms of constitutional symptoms, splenic response, and transfusion independence. Conversely, SIMPLIFY-1 was designed to assess the effectiveness and safety of momelotinib versus ruxolitinib in individuals with myelofibrosis who had not received JAK inhibitor therapy before. The safety and efficacy data for SIMPLIFY-1 were based on a subset of patients with anemia.

According to Ojjaara’s product label, the recommended dosage for adults suffering from anemia due to intermediate- or high-risk myelofibrosis, including primary or secondary forms, is a once-daily 200-mg oral dose. While the drug doesn’t come with a boxed warning, it does come with important precautions related to thrombocytopenia and neutropenia, hepatotoxicity, cardiac events, and the potential for secondary malignancies, especially in individuals with a history of smoking.

This recent regulatory approval adds to GSK’s growing list of oncology achievements. Just last month, the FDA expanded the label for Jemperli (dostarlimab-gxly) to encompass primary advanced or recurrent endometrial cancer, making it the first immuno-oncology asset and PD-1 inhibitor approved for initial use in this particular indication. This approval places Jemperli in a slightly more advantageous position compared to Merck’s blockbuster drug, Keytruda (pembrolizumab), which is also approved for endometrial cancer, albeit primarily for later-line treatments.

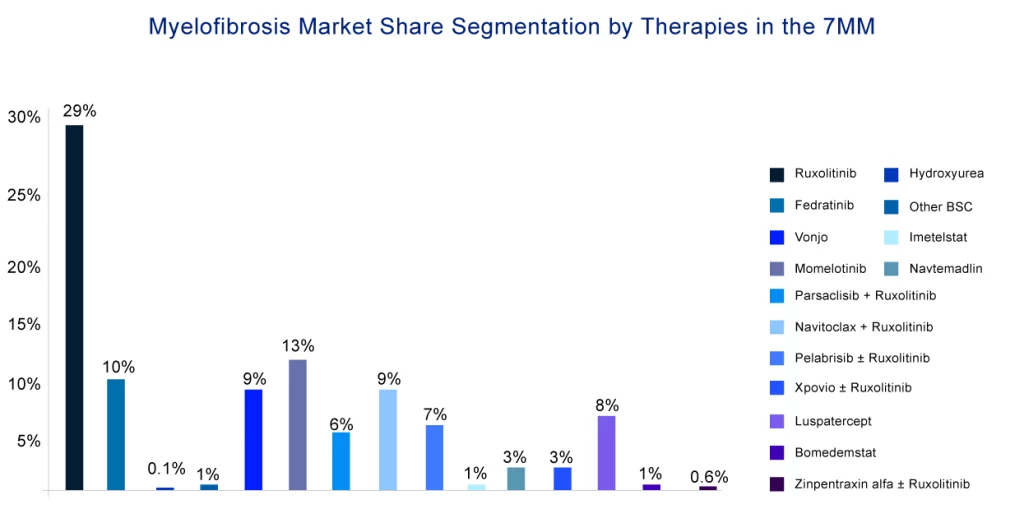

Not only this, the approval of momelotinib has also heated up the myelofibrosis treatment space. The emerging pipeline is full of late-stage drugs including key players like Geron (imetelstat), AbbVie (navitoclax), Incyte Corporation (parsaclisib), Celgene/BMS (luspatercept-aamt), MorphoSys (pelabresib), Imago Biosciences (bomedemstat), and others which are testing their candidates in this rare indication. Momelotinib will face very tough competition from these therapies in the near future.

AbbVie’s BCL-XL/BCL-2 inhibitor Navitoclax is predicted to give stiff competition to GSK’s momelotinib. In 2019, the FDA and EMA granted Orphan Drug Designation to navitoclax for the treatment of myelofibrosis. The company anticipates the regulatory submission of navitoclax as first-line therapy in 2023 and relapsed/refractory myelofibrosis by 2024. AbbVie expects the regulatory approval for 1L by 2023 and for relapsed/refractory by 2024. The company is also expecting Phase III data readout in 1L by 2023 and in relapsed/refractory myelofibrosis by 2024. At the American Association of Cancer Research (AACR) 2022 annual meeting, AbbVie presented positive results from a Phase II trial evaluating navitoclax in combination with ruxolitinib in myelofibrosis patients that previously had a suboptimal response or disease progression with ruxolitinib monotherapy.

Another competitor to momelotinib in the pipeline is Incyte’s Parsaclisib. Parsaclisib has demonstrated potency and selectivity in preclinical studies and has potential therapeutic utility in treating patients. The PI3Kδ pathway mediates oncogenic signaling in B-cell malignancies. Based on positive Phase II data, the company has started two pivotal ongoing trials of ruxolitinib in combination with parsaclisib (PI3Kδ) in first-line myelofibrosis (LIMBER-313) and myelofibrosis patients with a suboptimal response to ruxolitinib monotherapy (LIMBER-304). The top-line data from the trials in suboptimal responders are anticipated in H1 2023. At EHA 2022, Incyte presented the subgroup analysis of efficacy and safety data from the Phase II INCB 50465-201 trial (NCT02718300).

Celgene/Bristol Myers Squibb’ lead product REBLOZYL is also a potential candidate in the myelofibrosis pipeline. REBLOZYL, an erythroid maturation agent, is a recombinant fusion protein consisting of a modified form of the extracellular domain (ECD) of the human activin receptor Type IIB (ActRIIB) linked to the human immunoglobin G1 (IgG1) Fc domain. In 2020, EMA and FDA granted ODD to luspatercept for myelofibrosis treatment. In 2020, the drug received approval from the US FDA and the European Commission for treating transfusion-dependent anemia in patients with myelodysplastic syndrome and is sold under the brand name REBLOZYL. It is also approved for anemia in adult patients with beta-thalassemia who require regular red blood cell (RBC) transfusions. Recently, REBLOZYL received FDA approval as a primary treatment for anemia in patients with very low to intermediate-risk myelodysplastic syndromes, even if they haven’t previously used an erythropoiesis-stimulating agent (ESA). The drug is currently in Phase III INDEPENDENCE trial for myelofibrosis patients requiring RBC transfusions; the data from this trial is expected by 2023/2024.

With the launch of these upcoming myelofibrosis therapies, the market will indeed see a huge boost in the coming years. But, as all these therapies are in the late stage of development and there is enough time to get into the myelofibrosis treatment market, it is estimated that momelotinib will maintain its position and grab a major chunk of the market till then.

According to the DelveInsight estimates, the US is predicted to account for the highest myelofibrosis market size across the 7MM. Besides, the upcoming therapies for myelofibrosis are expected to combat the current unmet needs faced by patients with myelofibrosis and add to the overall growth of the myelofibrosis treatment market size.

Downloads

Article in PDF

Recent Articles

- Raynaud’s Disease -A debilitating condition

- Pfizer’s ABRYSVO Outpaces GSK’s AREXVY with Expanded FDA Approval – But Can It Sustain the Momentum?

- Humira’s patent; Teva laying off; GSK aims; Thermo acquires Patheon; J& J’s Invokana

- Valeant’s asset-sale; Sanofi coughs up $19.8M; Sanofi’s Genzyme; India’s Alkem;...

- FDA Approves GSK’s Arexvy for RSV; CHMP’s Opinion on Gilead’s Hepcludex® for HDV; FDA Clearance t...