Emerging Therapies for Retinal Vein Occlusion Treatment: What Lies Ahead?

May 27, 2024

Retinal vein occlusion is the second most prevalent retinal vascular disease after diabetic retinopathy. Without treatment, it often results in a gradual decline in vision, ultimately causing permanent blindness. It ranks among the leading causes of vision loss globally, and this visual impairment significantly impacts quality of life and daily activities.

Retinal vein occlusion is one of the most frequently occurring retinal vascular disorders in elderly patients that develops predominantly in individuals over age 65 years. The main risk factor for RVO includes age. With an increase in the geriatric population, the prevalence of RVO is also projected to increase.

As per DelveInsight analysis, in 2022, there were 2.7 million total prevalent cases of RVO in the 7MM, which are expected to increase by 2034.

Downloads

Article in PDF

Recent Articles

- Leo Pharma’s Hand Eczema Clinical Trial Updates; GSK’s PD-1 inhibitor Jemperli Approval; Ro...

- Analyzing the Most Promising Drugs That Will Lose Patent in the US & EU in 2022

- Phase III RUBY Trial of Jemperli Plus Chemotherapy Updates; FDA Approves Roche’s Vabysmo for RVO;...

- What are the options available for the treatment of Retinal vein occlusion?

- Could Amgen’s Biosimilar Wezlana Pose a Challenge to Johnson & Johnson’s Stelara

RVO is categorized into central RVO (CRVO) and branch RVO (BRVO) according to the site of blockage in the retinal vein. CRVO is divided further into nonischemic and ischemic types according to the perfusion status based on fluorescein angiography. BRVO consists of a major branch RVO and a macular branch RVO.

According to DelveInsight’s analysis, in the US, in 2022, of the total diagnosed RVO cases, nearly 170K cases were classified as CRVO, while approximately 765K cases were classified as BRVO. These cases are expected to change by 2034.

There is no treatment available to reverse RVO. Most people with this condition will have permanent changes to their vision. The main goal of the treatment should be to stabilize vision by sealing off leaking blood vessels.

Unfortunately, it’s not possible to unblock retinal veins. However, the doctor can address any health issues related to RVO. Vision may return in some eyes affected by RVO, with about one-third experiencing some improvement, one-third remaining stable, and one-third gradually getting better, which can take over a year to determine. In some instances, the blockage may cause fluid buildup in the retina, while in others, it may lead to the development of new blood vessels.

Currently, there are only a few FDA-approved drugs for retinal vein occlusion treatment. These include LUCENTIS (ranibizumab, Roche/Novartis), EYLEA (aflibercept, Regeneron Pharmaceutical/Bayer/Santen), OZURDEX (dexamethasone intravitreal implant, AbbVie), and the recently approved VABYSMO (faricimab, Roche/Chugai Pharmaceutical). Additionally, AVASTIN (bevacizumab) and intravitreal triamcinolone are used off-label to help maintain or improve vision.

LUCENTIS (ranibizumab) is a VEGF inhibitor developed by Roche and marketed by Novartis in North America and Chugai Pharmaceuticals in Japan. In June 2010, the FDA approved LUCENTIS for treating macular edema following retinal vein occlusion. This prescription medication is administered by injection into the eye. It has been linked to risks such as retinal detachment and severe eye infections, and should not be used in patients with eye infections. LUCENTIS works by binding to and inhibiting VEGF-A, a protein crucial for angiogenesis and vessel hyperpermeability. As the first approved VEGF inhibitor for retinal vein occlusion, LUCENTIS had a long period of market exclusivity, which was gradually challenged by the global approval of EYLEA.

In October 2014, the FDA approved EYLEA (aflibercept), a drug developed by Regeneron, for treating macular edema resulting from retinal vein occlusion (both BRVO and CRVO). EYLEA, an anti-VEGF inhibitor injection for the eye, is designed to inhibit the growth of new blood vessels and reduce vascular permeability by blocking VEGF-A and placental growth factor (PLGF), which are key players in angiogenesis. Regeneron’s EYLEA made significant competitive strides in the retinal vein occlusion treatment market, which was previously dominated by Roche.

Previously, the debate focused solely on two of Roche’s flagship products, LUCENTIS and AVASTIN—a cancer drug repurposed for eye treatments, offering a more affordable alternative to the approved LUCENTIS. However, the landscape shifted significantly for Roche with the competitive advances made by Regeneron’s EYLEA, which received FDA approval in 2012 for treating macular edema following CRVO.

In 2023, VABYSMO (faricimab), developed by Roche and Chugai using CrossMab technology to target two pathways (VEGF and angiopoietin inhibitor) involved in various retinal conditions, received market approval from the FDA. It is expected to achieve significant market presence by 2024, following anticipated approvals in Europe and Japan. VABYSMO offers improved dosing, a reduced treatment burden, and better vision loss outcomes due to its novel mode of action. As a result, Roche has found an excellent replacement for LUCENTIS, which is losing its patent exclusivity and market dominance.

Additionally, in June 2009, the FDA granted approval for OZURDEX (an intravitreal implant containing dexamethasone) for addressing macular edema stemming from BRVO or CRVO. This medication is administered via intravitreal injection. As the solitary approved drug in its specific corticosteroid category, OZURDEX has established a significant presence in the competitive market for retinal vein occlusion treatment. Enjoying patent exclusivity until 2023, it serves as a second-line therapy for persistent edema in eyes that respond poorly to anti-VEGF injections, thus facing minimal competition. Nevertheless, the non-sanctioned use of intravitreal triamcinolone encroaches on this exclusive domain with limited impact.

Despite the progress made in retinal vein occlusion drug treatments, a significant number of individuals with RVO still experience declining vision. The ultimate issue seems to be the death of photoreceptor cells. Future investigations into treatments for retinal vein occlusion might prioritize therapies aimed at protecting nerves and regenerating photoreceptors to enhance the vision of patients with compromised sight from this condition.

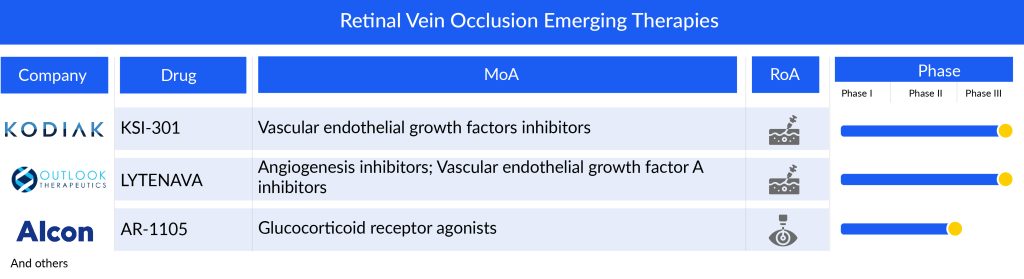

Various therapies are being developed and the pipeline for retinal vein occlusion includes therapies like Kodiak Sciences’ tarcocimab tedromer (KSI-301), Outlook Therapeutics’ LYTENAVA (bevacizumab)/ONS-5010, Taiwan Liposome Company’s TLC399 (ProDex), Alcon’s AR-1105 (dexamethasone implant), and others.

Tarcocimab tedromer (KSI-301) being developed by Kodiak Sciences, with enhanced therapeutic absorption and distribution in the eye and a novel design will maintain effective drug levels in ocular tissues for a longer period than the existing anti-VEGF agents. It will give tough competition to other similar therapies, upon its entry in the year 2027, in the US.

LYTENAVA (bevacizumab)/ONS-5010, an investigational ophthalmic formulation of bevacizumab, is projected to be the first and only FDA-approved, on-label, responsibly priced bevacizumab for ophthalmic indication, is anticipated to generate a market share of USD 2.3 million in the first year of its launch (2027), in the US. It will not only dismiss AVASTIN in the retinal vein occlusion treatment space but will create significant trouble for other anti-VEGFs.

TLC399, developed by Taiwan Liposome Company, is a specialized formulation of dexamethasone sodium phosphate (DSP), designed for intravitreal injection to address macular edema from RVO. This formulation utilizes the proprietary BioSeizer technology, which employs multilayer lipid membranes to encase therapeutic compounds, ensuring prolonged drug release. The BioSeizer nanoparticles are engineered to steadily release the medication as each layer gradually breaks down over time.

Encouraging Phase II trial outcomes have been released, and further updates are anticipated. Additionally, the company is exploring the potential of TLC399 in treating diabetic macular edema, potentially in combination with intravitreal anti-VEGF medications.

In addition to these emerging performers, there are a few early-stage retinal vein occlusion drugs worth mentioning like ANXV by Annexin Pharmaceuticals, Autologous Bone Marrow CD34+ Stem Cells by The Emmes Company, and EYP-1901 (vorolanib) by EyePoint Pharmaceuticals which can change the entire market scenario if approved as they may provide the much-needed cure for retinal vein occlusion.

The anticipated launch of these emerging therapies for retinal vein occlusion are poised to transform the market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the retinal vein occlusion treatment market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

In a nutshell, potential therapies are being investigated for retinal vein occlusion treatment. Even though it is too soon to comment on the promising candidate to enter the market, it is safe to assume that the future of this retinal vein occlusion treatment market is promising. Eventually, the drugs, if approved, will create a significant difference in the landscape of retinal vein occlusion treatment in the coming years.

However, the expiration of patent rights alongside the introduction of biosimilars such as BYOOVIZ (ranibizumab) from Samsung Bioepis and Biogen, and ONGAVIA from Teva Pharmaceuticals, will significantly widen the gap in the tightly regulated retinal vein occlusion treatment market. This will also present considerable challenges for new therapies trying to enter the retinal vein occlusion treatment market.

Downloads

Article in PDF

Recent Articles

- A Market Space Beyond Lucentis and Eylea for Retinal Vein Occlusion Treatment

- What are the options available for the treatment of Retinal vein occlusion?

- Could Amgen’s Biosimilar Wezlana Pose a Challenge to Johnson & Johnson’s Stelara

- Analyzing the Most Promising Drugs That Will Lose Patent in the US & EU in 2022

- Roche’s Vabysmo Third US Approval Spiced Up the Battle With Regeneron and Bayer’s Eylea