OPDIVO vs. KEYTRUDA: The Battle for Japan’s PD-1 Inhibitor Market Dominance

Jun 14, 2024

Bristol Myers Squibb’s PD-1 inhibitor, OPDIVO, has deep roots in Japan. In July 2014, MHLW approved OPDIVO to treat melanoma, marking it the first approved PD-1 inhibitor globally. About two years later, KEYTRUDA gained approval in Japan for the same indications (melanoma and NSCLC). This set the stage for fierce competition between OPDIVO and KEYTRUDA, as both vied to become Japan’s top-selling PD-1 inhibitor.

Analyzing OPDIVO’s Pre-2022 Sales Decline and KEYTRUDA’s Market Ascendancy

KEYTRUDA and OPDIVO have received approval for 12 indications in Japan, with 8 of these indications being common to both drugs.

Downloads

Article in PDF

Recent Articles

- Incyte meets endpoint in second atopic dermatitis trial; NeoTX lands USD 45 M series C; Five Prim...

- Merck’s Keytruda Wins Another FDA Approval; Sanofi Pauses Trial of Myasthenia Gravis Drug, tolebr...

- Tesaro’s Zejula; Mylan on EpiPen; Ohio sues drugmakers; ATUM, Horizon Discovery Announce deal

- Merck’s Keytruda sales; Valeant on name change; Pfizer – BMS; Amgen puts Repatha outcomes for deal

- The Business Cocktail

As the first PD-1 inhibitor approved in Japan and worldwide, OPDIVO secured six approvals by 2017, including for melanoma, NSCLC, RCC, cHL, HNSCC, and gastric cancer. Meanwhile, KEYTRUDA only received approvals for four indications: melanoma, NSCLC, cHL, and urothelial carcinoma. OPDIVO initially dominated the PD-(L)1 market in Japan, benefiting from its earlier approval. However, this led to a significant development in October 2016 when Chuikyo’s drug pricing subcommittee approved an emergency price reduction for OPDIVO. This unprecedented decision resulted in a major price cut in November 2016, an exceptional move in procedural terms. Traditionally, drug prices were reviewed biennially alongside medical service fee revisions, but OPDIVO underwent an urgent repricing process specifically targeting this drug. This process resulted in a substantial reduction in February 2017 under the market expansion repricing system. Further recalculations due to changes in indication and dosage led to additional price cuts in 2018, significantly impacting its sales trajectory.

Another factor contributing to OPDIVO’s decline was its approval in multiple indications within smaller subsegments. Within NSCLC, OPDIVO was approved for second-line treatment in 2015, and it took another 5 years before it received approval for first-line treatment in Japan. In contrast, KEYTRUDA targeted larger patient populations more effectively. Merck strategically focused on NSCLC, securing approvals both as a monotherapy and in combination therapies. KEYTRUDA was approved for first-line and second-line treatment in 2016. In 2018, it also received approvals for first-line treatment in combination with chemotherapy for non-squamous, squamous, and Stage III NSCLC, significantly boosting its sales.

Merck’s commitment to KEYTRUDA included substantial investments to enhance its pipeline, such as acquiring biotech companies with valuable expertise. By prioritizing collaborations that integrated PD-1 inhibitor drugs into clinical trials as part of combination therapies, Merck improved their commercial development and secured a greater number of indication approvals, reinforcing KEYTRUDA’s dominant position in the market.

How OPDIVO Outpaced KEYTRUDA in Japan’s Pharmaceutical Market

In 2021, Merck’s KEYTRUDA and Ono Pharmaceutical’s OPDIVO vied for dominance in Japan’s pharmaceutical sales, with both drugs achieving comparable revenue figures despite quarterly pricing challenges. However, in 2022, OPDIVO surged ahead to claim the top spot in sales, outpacing KEYTRUDA by a significant margin.

OPDIVO’s remarkable sales growth in 2022 was fueled by its expanded label in RCC, GEJ Cancer, cancer of unknown primary, and cHL. Gastric cancer is more prevalent in Japan, with approximately 140,000 cases annually, further bolstering OPDIVO’s position, especially since KEYTRUDA lacked approval for gastric cancer.

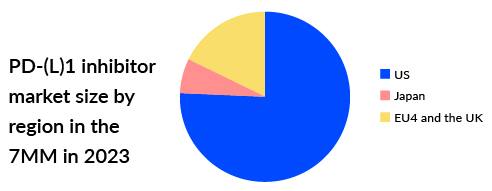

Recognizing the unique market dynamics, Ono Pharmaceutical strategically focused on developing OPDIVO for specific indications prevalent in Japan and East Asia, including gastrointestinal cancers, stomach cancers, liver cancers, colorectal cancers, and esophageal cancers. This targeted approach enabled OPDIVO to reclaim its leadership in Japan’s pharmaceutical landscape. Meanwhile, KEYTRUDA’s strength remains in markets where it is the preferred choice, especially for NSCLC in Western countries. The company’s strategy to maintain its dominance in these areas shows a deep understanding of regional preferences and disease patterns, keeping it competitive despite OPDIVO’s success in Japan.

Clash of Titans: The Fierce Battle between KEYTRUDA and OPDIVO in Japan’s Cancer Market

In the upcoming years, Merck plans to expand the use of KEYTRUDA by launching it in combination with chemotherapy, vibostolimab ± chemotherapy for NSCLC, SCLC, and melanoma in neoadjuvant/adjuvant, 1L, and 2L+ settings. Additionally, Merck is targeting gastric cancer with KEYTRUDA combined with trastuzumab and chemotherapy for HER2+ and KEYTRUDA with chemotherapy for HER2- gastric cancer. Beyond these indications, Merck is conducting over 30 trials in Japan for KEYTRUDA, both as a monotherapy and in combinations.

However, OPDIVO is not far behind. Ono Pharmaceutical and Bristol Myers Squibb are also conducting multiple combination trials, including with YERVOY in gastric cancer, NSCLC, HCC, and CRC, with relatlimab in melanoma, and with chemotherapy in urothelial cancer. Many of Ono’s trials focus on the adjuvant setting to capture a larger patient share.

The competition between KEYTRUDA and OPDIVO remains intense. Historically, the lead has shifted between the two, with OPDIVO currently holding the top position. This ongoing battle will depend heavily on each company’s strategies, launch timings, and promotional efforts. With an expected expansion in different indications along with different settings, the leadership in this PD-(L)1 inhibitor market can change from year to year, reflecting the dynamic nature of their competitive strategies.

Downloads

Article in PDF

Recent Articles

- Malignant Pleural Mesothelioma Upcoming Therapies

- Dengvaxia study; Opdivo racks up; FDA issues plant; Teva’s Rimsa fraud; Mission bags Fox grant

- Incyte meets endpoint in second atopic dermatitis trial; NeoTX lands USD 45 M series C; Five Prim...

- A Quick Review of Antibody-Drug Conjugates (ADCs) in Lung Cancer: HER2, TROP-2, HER3, MET, and CE...

- OPDIVO Approved for Resectable NSCLC; Palvella Gets $2.6M FDA Grant; First Patient Dosed in UGN-1...