A New Dawn in Alzheimer’s Disease Treatment: Eli Lilly’s Donanemab Wins FDA Approval

Jul 08, 2024

Table of Contents

The world of Alzheimer’s disease treatment witnessed a groundbreaking moment recently as the FDA approved Eli Lilly’s donanemab, marketed as KISUNLA. This new drug brings hope to millions of patients and their families struggling with this debilitating disease. Let us delve into the fascinating journey of donanemab, from its inception to its game-changing approval.

The Birth of a Breakthrough

Eli Lilly’s donanemab is a monoclonal antibody specifically designed to target amyloid-beta plaques in the brain, which are strongly associated with Alzheimer’s disease. This innovative approach aims to slow the progression of cognitive decline in patients with early symptomatic Alzheimer’s disease, offering a glimmer of hope where options have been limited.

Downloads

Article in PDF

Recent Articles

The story of donanemab began in the early 2010s, when Lilly’s scientists, building on decades of research, zeroed in on the potential of targeting amyloid plaques. Early studies showed promise, sparking a series of clinical trials that tested the drug’s efficacy and safety. Despite numerous challenges, the persistence and dedication of Lilly’s team paved the way for this revolutionary treatment.

Donanemab: Clinical Triumphs

In the TRAILBLAZER-ALZ 2 Phase III study, patients who were less advanced in their disease showed the strongest results with KINSUNLA. Participants were divided into two groups: those with low to medium levels of tau protein (less advanced) and the overall population, which included those with high tau levels. Treatment with KINSUNLA significantly slowed clinical decline in both groups. Those in the less advanced group experienced a 35% slowing of decline compared to the placebo on the integrated Alzheimer’s Disease Rating Scale (iADRS), which measures memory, thinking, and daily functioning. In the overall population, the slowing of decline was 22%, also statistically significant. Moreover, KINSUNLA reduced the risk of progressing to the next clinical stage by up to 39% compared to placebo.

Among the overall population, KINSUNLA reduced amyloid plaques by an average of 61% at 6 months, 80% at 12 months, and 84% at 18 months compared to baseline. One of the study’s treatment goals was to reduce amyloid plaques to minimal levels, consistent with a visually negative scan using amyloid positron emission tomography (PET). Participants who achieved these levels could switch to a placebo for the remainder of the study.

Navigating Regulatory Waters

KINSUNLA, like other approved Alzheimer’s disease drugs, presents notable safety concerns, including brain swelling and hemorrhaging, known as amyloid-related imaging abnormalities (ARIA). Its label mandates more frequent brain MRI scans compared to its competitor, LEQEMBI, which is perceived to have a more favorable safety profile. KINSUNLA’s regulatory journey was challenging yet compelling; the FDA initially rejected its accelerated approval request due to concerns about limited long-term data. However, the agency later granted full approval after an advisory committee unanimously endorsed the drug’s efficacy and safety.

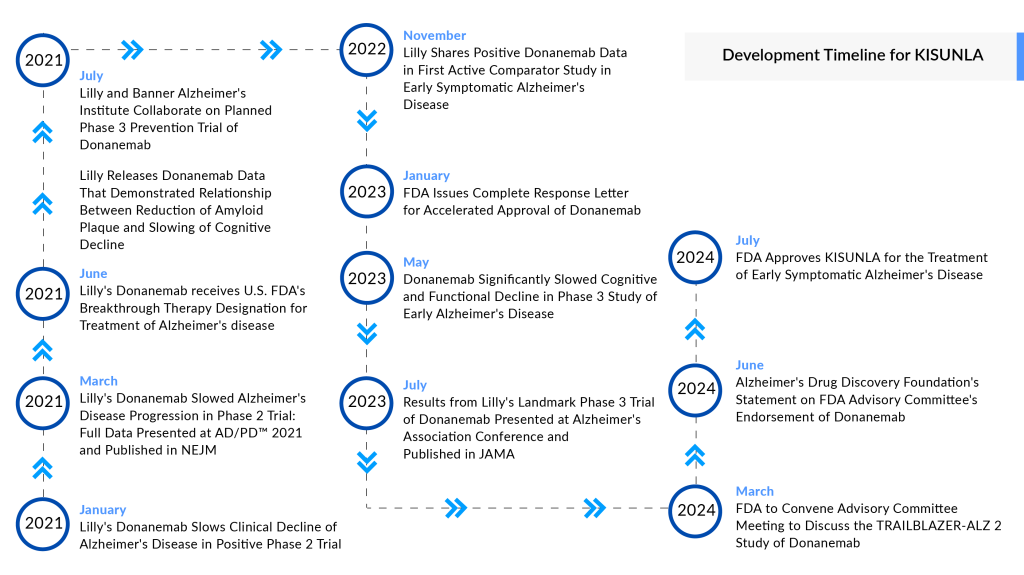

Designated as a breakthrough therapy for Alzheimer’s disease, KISUNLA’s journey was bolstered by the promising results from the Phase II TRAILBLAZER-ALZ study, which demonstrated a slowed progression of the disease. Following these findings, Eli Lilly initiated a rolling submission of a Biologics License Application (BLA) for donanemab. Additionally, donanemab has received several expedited regulatory designations from the FDA, including Fast Track, Priority Review, and Breakthrough Therapy status, which facilitated its approval process within the Alzheimer’s disease treatment market.

Thus, the approval of KINSUNLA marks a significant milestone in Alzheimer’s disease treatment, providing a new option for patients with early symptomatic disease. A unique aspect of KINSUNLA is that patients can discontinue treatment once amyloid plaques are sufficiently reduced, a milestone achieved by nearly half of the study participants within 12 months. This feature has the potential to lower treatment costs and reduce the burden of infusions. However, it also raises questions about the long-term durability of KINSUNLA effects.

Donanemab: Cost and Coverage

KISUNLA’s potential to lower treatment burden and costs, combined with its capability to slow the progression of AD, positions it as a valuable addition to the limited treatment options for this debilitating condition. Its approval comes at a timely juncture, particularly as Biogen and Eisai’s earlier drugs, LEQEMBI and ADUHELM, have helped delineate Alzheimer’s treatment coverage pathways within the Centers for Medicare & Medicaid Services. Medicare is expected to cover KISUNLA’s cost in the US, following the Centers for Medicare and Medicaid Services’ earlier commitment to funding new Alzheimer’s medications with full FDA approval. However, as part of this framework, the company is expected to enroll patients in real-world data collection registries to validate the ongoing efficacy of their products. Physicians will also be required to gather data on how effectively the drugs perform in real-world settings.

As of now, the list price for KISUNLA will be approximately USD 32,000 for a course of therapy lasting a year. It is administered as a monthly 30-minute infusion, which is less frequent than the every two-week infusion schedule for competitor drugs. Additionally, Eli Lilly offers a free support program called Lilly Support Services for KISUNLA to help patients navigate treatment, including coverage determination assistance and other resources. The company also intends to donate KISUNLA to the Lilly Cares Foundation, a nonprofit organization that provides medications at no cost to qualified Americans who meet financial eligibility.

Though the price of KISUNLA is not necessarily lower than other Alzheimer’s drugs; however, its potential for treatment discontinuation, reduced infusion burden, and available support services could lead to lower overall treatment costs and out-of-pocket expenses for eligible patients, making it a more cost-effective option in the long run.

A New Challenger: Implications for Biogen

KISUNLA enters a treatment arena already occupied by LEQEMBI, a similar drug approved. Both medications target the same pathology, but KISUNLA offers a potential advantage – it requires monthly infusions compared to LEQEMBI’s bi-weekly schedule. This could make KISUNLA a more convenient option for patients struggling with the demands of treatment.

Donanemab’s approval may prompt a reevaluation of LEQEMBI’s market position and could influence ongoing research and development strategies within the industry.

Unlike LEQEMBI, which requires ongoing treatment, KINSUNLA allows patients to discontinue therapy once their amyloid levels, a key marker of Alzheimer’s disease, fall below a certain threshold. This unique feature of KINSUNLA could potentially reduce overall treatment costs in the long run despite its higher initial price. While the upfront cost of KINSUNLA is higher, its ability to halt treatment upon reaching therapeutic milestones could make it a more cost-effective option over time.

Donanemab: Comparative Performance

When compared to other amyloid-targeting therapies, donanemab has shown similar or superior efficacy, with a more favorable safety profile in certain aspects. For instance, donanemab demonstrated a significant reduction in amyloid plaques over 18 months, with up to 84% reduction from baseline. This compares favorably with Biogen and Eisai’s LEQEMBI, which also targets amyloid plaques but has different safety and efficacy profiles.

LEQEMBI has shown promise in reducing cognitive decline, but donanemab’s unique trial design, which includes a limited-duration dosing regimen, offers a distinct advantage. Patients on donanemab can complete treatment once amyloid plaques are reduced to minimal levels, potentially reducing long-term treatment costs and improving patient compliance compared to the continuous dosing required by LEQEMBI.

ADUHELM, another drug in this category, was approved in 2021 but was discontinued by its manufacturer, Biogen, the following year due to insufficient evidence of patient benefit. Biogen has since shifted focus to developing a leading portfolio to address various aspects of the disease and better patient needs.

Furthermore, donanemab targeting patients based on tau levels—particularly those with low to medium tau—could lead to more personalized and effective treatment strategies. This nuanced approach may enhance the overall efficacy and safety profile, providing a competitive edge over LEQEMBI.

Strengthening Lilly’s Position in Alzheimer’s Disease Treatment

The approval of donanemab solidifies Lilly’s leadership in the Alzheimer’s research and treatment arena. It enhances the company’s reputation and paves the way for further innovations in neurodegenerative diseases, reinforcing Lilly’s commitment to improving patient outcomes.

Alzheimer’s Disease Market Reaction and Future Prospects

Investors’ initial reaction to KISUNLA’s FDA approval was a bit of a head-scratcher. Eli Lilly’s stock price dipped slightly despite the momentous news. This hesitation stems from a wait-and-see approach. Key questions linger, like how negotiations with insurers will play out and how many patients will qualify for KISUNLA treatment. Competition from LEQEMBI also adds to the uncertainty. The high cost of the drug could limit patient access, and future Alzheimer’s disease treatment therapies could erode KISUNLA’s market share. Only time will tell if KISUNLA becomes a commercial success, but its approval undeniably bolsters Eli Lilly’s position in the burgeoning Alzheimer’s treatment market.

Donanemab’s success is likely to inspire increased investment in Alzheimer’s research and development. With a major treatment gap and historically low clinical trial success rates, this breakthrough serves as a beacon of hope, encouraging continued innovation and collaboration in the quest to conquer Alzheimer’s. The promising results from donanemab will likely galvanize researchers and pharmaceutical companies to explore new avenues and mechanisms of action in the fight against Alzheimer’s.

Furthermore, donanemab ability to significantly slow cognitive decline in a targeted patient population based on tau levels sets a new benchmark for personalized medicine in neurodegenerative diseases. This approach could lead to more tailored and effective treatment regimens, spurring further research into biomarkers and individualized therapies.

The approval of donanemab may also accelerate the development of combination therapies, where multiple drugs targeting different aspects of Alzheimer’s pathology are used together. This could potentially address the complex nature of the disease more comprehensively than single-agent treatments. Overall, donanemab approval marks not just a victory for patients but also a significant leap forward in Alzheimer’s research, promising a new era of innovation and hope in the battle against this devastating disease.

Alzheimer’s Disease Competitive Landscape

The Alzheimer’s disease market in the US is projected to grow significantly in the coming years, driven by the increasing prevalence among the aging population. Symptomatic treatments currently dominate the market, with limited availability of disease-modifying therapies. Key drug categories include amyloid β protein inhibitors, nuclear factor kappa B (NF-κB) inhibitors, tau aggregation inhibitors, acetylcholinesterase (AChE) inhibitors, N-methyl-D-aspartate receptor (NMDA-R) antagonists, tyrosine kinase inhibitors, and other neurotransmitter modulators. Numerous partnerships have been established among industry players to expand research efforts and product offerings. Major Key players in the Alzheimer’s disease market include AB Science, AC Immune, Novo Nordisk, Novo Nordisk, Biogen, Eisai, Eli Lilly, and AriBio, among others, contributing to evolving market dynamics.

Voices from the Field

Key leaders have expressed a mix of enthusiasm and cautious optimism about donanemab.

“These recent approvals generate hope for continued advances. For researchers, our next horizon is to develop new treatments that address different components of the disease and that work together to have an even bigger effect on slowing or stopping disease progression for all communities.”

Maria C. Carrillo, Ph.D., chief science officer and medical affairs lead, Alzheimer’s Association.

“This is real progress. Today’s approval allows people more options and greater opportunity to have more time.”

Joanne Pike, DrPH, Alzheimer’s Association president and CEO

“It is important to note that these drugs are not cures, and they can have serious side effects. Disease Modifying Therapies are only suitable for a small number of people who are in the early stages of Alzheimer’s disease. There will be countless people for whom this drug will not be helpful. We must continue to advocate for and resource non-pharmacological interventions and supports for people with all types of dementia and their families.”

Dr Laura O’Philbin, the ASI Research and Policy Manager

A New Chapter in Alzheimer’s Disease Treatment

The approval of KISUNLA (donanemab) offers a new beacon of hope for millions of Alzheimer’s patients and their families. The disease, which currently affects around 6.3 million individuals in the US, is expected to become even more prevalent in the coming years due to an aging population, increased awareness, and advancements in diagnostic techniques. The burden of Alzheimer’s on patients is immense, manifesting in memory loss, cognitive decline, and, ultimately, the loss of independence. For caregivers, the emotional, physical, and financial toll can be overwhelming.

According to DelveInsight’s analysis, the US market for Alzheimer’s disease is expected to reach approximately USD 21 billion by 2032, with an anticipated compound annual growth rate (CAGR) of more than 20% during the study period. This growth will be driven primarily by the expected approval of novel therapies, enhanced market access, and increasing prevalence of the disease. KINSUNLA is forecasted to lead with an estimated market value of around USD 8 billion by 2032. Following this, Hydromethylthionine mesylate (HMTM)/TRx0237 and ANAVEX2-73/blarcamesine, along with other treatments, is expected to contribute significantly to the market.

With the potential to significantly impact patients, the market, and future research, donanemab stands as a testament to the power of innovation and perseverance in the face of one of medicine’s greatest challenges.

As we celebrate the advancement represented by KISUNLA, it is crucial to continue supporting the diverse needs of all Alzheimer’s patients and their caregivers, ensuring comprehensive care and advancing research for more inclusive and effective treatments. The battle against Alzheimer’s is far from over, but each new development brings us closer to a future where this devastating disease can be effectively managed, if not entirely eradicated.

Downloads

Article in PDF

Recent Articles

- Gene and Cell Therapies in CNS Disorders: Miracle Cure? Opportunities Galore!

- Chimerix Submits Dordaviprone NDA for Accelerated Approval in Recurrent H3 K27M-Mutant Diffuse Gl...

- Rising of Orphan Drug Development

- Amgen to Purchase Horizon Therapeutics; IND Clearance to Vertex’s VX-522; FDA Fast-Track Designat...

- Exploring the Current Alzheimer’s Disease Drug Development Pipeline