WEGOVY: A Leader in the Obesity and Weight Loss Treatment

Mar 12, 2025

Table of Contents

With the growing global health concern regarding obesity, Novo’s WEGOVY (semaglutide) has emerged as a leading solution in the weight loss treatment market. WEGOVY is a GLP-1 receptor agonist used alongside a low-calorie diet and increased physical activity. This obesity medication is administered as a weekly subcutaneous injection, offering convenience and consistency in obesity management.

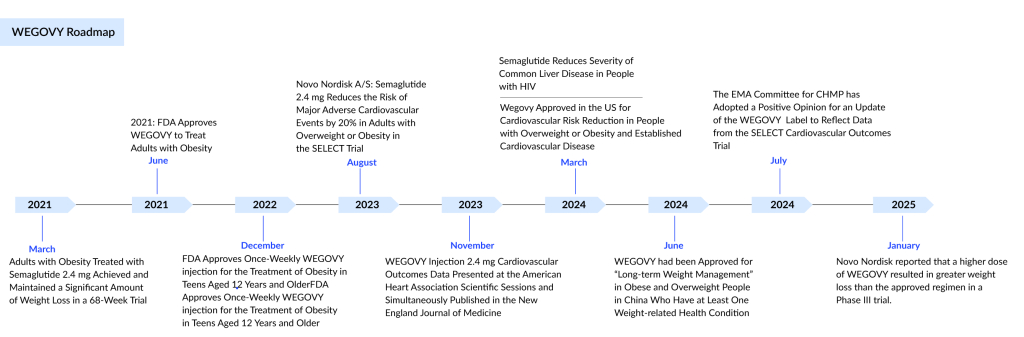

In June 2021, the FDA approved WEGOVY injections for long-term weight management in adults. This obesity drug’s approval marked a significant milestone in the field of obesity treatment. WEGOVY has been a dominant force in the lucrative obesity market, which is poised to reach $12 billion by 2034 in the US, as per DelveInsight.

Downloads

Article in PDF

Recent Articles

- AbbVie Presents Phase III CANOVA Study Results; Novartis’ Iptacopan Shows Promise in Phase III St...

- FDA Grants Priority Review to Merck’s Application for KEYTRUDA Plus Padcev; Roche and Carmot Ther...

- Clinical

- The Race to Redefine Obesity Treatment

- Lilly’s ZEPBOUND Clears Hurdle in Sleep Apnea Treatment

As per the estimates, semaglutide captured ~60% of the $2.8 billion weight loss treatment market in 2023 thanks to its superior weight loss effectiveness. Novo Nordisk’s obesity care products saw a remarkable 147% sales surge, fueled by WEGOVY’s rapid adoption and 70% commercial formulary access within six months of launch. To meet rising demand, the company increased lower-dose WEGOVY supply in January 2024. In February 2025, Novo Nordisk reported a 30% Q4 2024 sales growth, reaching $12 billion, contributing to a 26% annual sales increase to nearly $41 billion. The company also posted $18 billion in operating profits for 2024, as per its latest press release.

WEGOVY’s Label Expansion in Cardiovascular

Novo Nordisk’s rapidly expanding WEGOVY weight loss medication has received new cardiovascular approval from the FDA in March 2024, which could boost its already impressive reputation even further. It is now the first obesity medication to be approved by the FDA for lowering the risk of cardiovascular death, heart attack, and stroke in adults with cardiovascular disease who are obese or overweight.

The FDA approved obesity drug WEGOVY based on Novo’s SELECT cardiovascular outcomes study, which evaluated Wegovy over five years in 17,604 patients who were obese or overweight, had existing cardiovascular disease, and had no history of diabetes.

WEGOVY treatment reduced the risk of major adverse cardiovascular events by 20% compared to a placebo when combined with standard blood pressure and cholesterol management, as well as lifestyle changes like diet and exercise. The benefits of the obesity drug persisted for up to five years, regardless of initial body mass index or kidney function. WEGOVY also led to a 15% decrease in the risk of cardiovascular death and a 19% reduction in the risk of death from any cause.

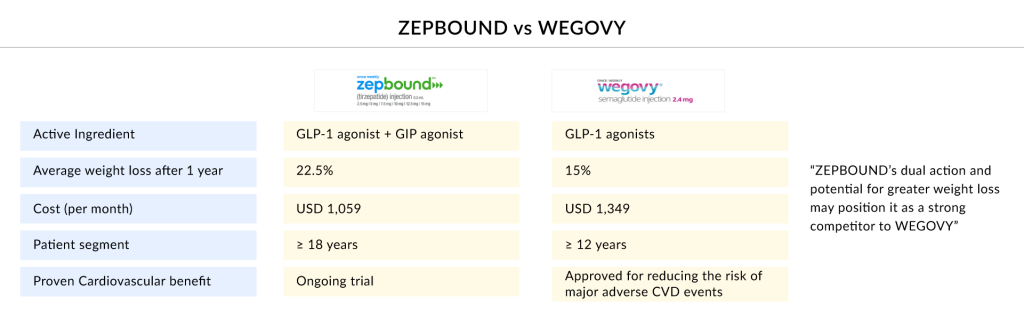

The recent approval could significantly intensify the competition between Novo’s product and Eli Lilly’s ZEPBOUND. Novo’s growth has been driven by the success of WEGOVY and other semaglutide-based drugs since WEGOVY’s debut in 2021. Due to high demand, the company has struggled with supply shortages. After a prior pause in marketing, Novo reintroduced WEGOVY in January and has since more than doubled its supply of starter doses.

Approval in China Added Another Feature in Cap to WEGOVY

Novo Nordisk’s diabetes medication OZEMPIC (semaglutide) has been available in China for three years and is quickly approaching blockbuster sales in the world’s second most populous country. Building on this success, the Danish company is now set to intensify its efforts with its obesity treatment, WEGOVY.

On June 25, 2024, China’s National Medical Products Administration (NMPA) granted WEGOVY approval for marketing as a treatment for individuals with a body mass index (BMI) of 30 or higher, or between 27 and 30 for those with one weight-related risk factor. In China, it will be sold under the name NovoCare. The obesity medication is the same semaglutide compound used in OZEMPIC.

This WEGOVY weight loss drug approval is creating a new multimillion-dollar opportunity for the Danish pharmaceutical company. However, this approval arrived at the wrong time as the semaglutide patent will expire in two years and the competition from biosimilars in China is intensifying. Whereas, in Europe and the United States, Novo holds the exclusive rights to semaglutide until 2031 and 2032, respectively.

Novo has initiated a legal campaign to prolong its patent, yet over 15 generic versions of semaglutide are currently being developed in China, with multiple ones already in advanced trial stages. To back WEGOVY’s debut in China, Novo has been heavily investing in its local manufacturing infrastructure. In March, the pharmaceutical company revealed a ¥4 billion (over $500 million) investment in its Tianjin facility. Scheduled for completion by 2027, the expansion aims to boost production capacity to satisfy the growing demand for its products in China.

Meanwhile, Novo is bolstering its manufacturing presence in the US to help safeguard its market share in the event of losing semaglutide patent exclusivity. Last year, Novo significantly increased its OZEMPIC sales in China to 4.82 billion kroner ($693 million). However, the company now encounters competition in this area, as the NMPA recently approved Eli Lilly’s dual-action GLP-1/GIP diabetes medication, MOUNJARO (tirzepatide), which will be marketed in China under the name MuFengDa.

WEGOVY’s Triumph at American Diabetes Association 2024

Research presented at the American Diabetes Association’s 2024 Scientific Sessions and published in the Journal of the American College of Cardiology found that Novo Nordisk’s highly successful obesity medication, WEGOVY, led to more significant weight loss in women compared to men with a prevalent form of heart failure.

The results are from Novo’s STEP-HFpEF program, which included 1,145 patients with obesity-related heart failure with preserved ejection fraction in two trials. These studies mainly aimed to evaluate the impact of a 2.4-mg dose of semaglutide on health status, measured by the Kansas City Cardiomyopathy Questionnaire Clinical Summary Score (KCCQ-CSS), and on weight loss.

Approximately half of the participants were women, who, at the start of the study, had higher body mass index and C-reactive protein levels, as well as a greater left ventricular ejection fraction. Additionally, women experienced more severe heart failure symptoms compared to men at baseline.

After 52 weeks of treatment, semaglutide caused considerable weight loss in both men and women, with men losing an average of 10.2% of their body weight and women losing 12.6%. Even when compared to placebo, the semaglutide weight loss effect was notably more significant in women, who experienced an adjusted mean reduction of 9.6% in body weight, versus 7.2% in men. This difference was statistically significant, with a p-value of 0.006 for the interaction.

Regarding cardiovascular outcomes, semaglutide proved equally effective for both genders, improving the KCCQ-CSS score by 7.6 points in women and 7.5 points in men. Additionally, semaglutide led to significant improvements in the six-minute walk distance, with no differences observed between the sexes.

What Lies Ahead for WEGOVY?

Semaglutide is a GLP-1 receptor agonist that stimulates insulin release from the pancreas in response to blood sugar levels. It is marketed as OZEMPIC for type 2 diabetes treatment and as WEGOVY for chronic weight management. Novo Nordisk has recently expanded WEGOVY’s approval to include reducing the risk of cardiovascular death, heart attack, and stroke in adults with obesity and cardiovascular disease.

Additionally, the Danish pharmaceutical company is exploring semaglutide as a potential treatment for kidney disease. Results from the Phase III FLOW trial showed a 20% decrease in overall mortality among type 2 diabetes patients with chronic kidney disease.

Currently, Novo’s WEGOVY is facing stiff competition in the obesity treatment space from Eli Lilly’s ZEPBOUND. ZEPBOUND, which was initially developed for type 2 diabetes, has recently received approval for obesity. According to DelveInsight’s analysis, ZEPBOUND is expected to experience rapid growth and potentially dominate around 35% of the obesity market by 2032. In February 2025, the company reported a 30% increase in sales for Q4 2024, reaching $12 billion for WEGOVY. This helped total sales for 2024 grow by 26%, reaching nearly $41 billion, with operating profits of $18 billion, as announced in a press release.

Furthermore, WEGOVY will also face tough competition from other obesity companies in the coming years as well. The current obesity development pipeline includes more than 100 clinical-stage assets in trials, primarily featuring GLP-1 receptor agonists, either used alone or in combination with GIP agonists.

Obesity companies such as Novo Nordisk (Semaglutide oral), Eli Lilly and Company (Tirzepatide), Saniona (Tesomet), Raziel Therapeutics (RZL-012), Empros Pharma (EMP16), D&D Pharmatech (DD01), and others are evaluating their anti-obesity medication in different stages of obesity clinical trials to grab some market share.

Apart from these, several non-entero-pancreatic hormone treatments are being assessed, providing alternative options for weight loss because of their unique mechanisms. These new obesity therapies reflect the growing variety of approaches in obesity treatment, targeting the complex nature of the condition.

In this setting, numerous pharmaceutical companies, such as Biolexis Therapeutics, Arrowhead Pharmaceuticals, and Viking Therapeutics, have shared their pre-clinical findings at the American Diabetes Association (ADA) 2024 session. Their presentations play a vital role in tackling the most complex issues of the new era in obesity management, highlighting a unified effort to enhance therapeutic approaches and boost patient outcomes.

Downloads

Article in PDF

Recent Articles

- Invokana matches; Xultophy beats; Lilly and BI follow; Tresiba matches

- Obesity: A Worldwide Pandemic with Advancing Management Options

- FDA Approves LUMAKRAS with VECTIBIX for KRAS G12C-Mutated Colorectal Cancer; PYC Receives FDA Rar...

- BeiGene’s BRUKINSA Gets FDA Accelerated Approval; GSK’s Positive Results in DREAMM-8 ...

- Nordisk ties up with Dicerna; Pfizer’s drug gets FDA nod