Graves’ Disease Treatment Revolution: What’s Next in Line?

Jan 17, 2025

Affecting around 1 in 200 people, Graves’ disease is the most common cause of an overactive thyroid. More than 12% of the US population will develop a thyroid condition during their lifetime and an estimated 20 million Americans have some form of thyroid disease.

As per DelveInsight’s estimates, Graves’ disease is the primary cause of hyperthyroidism, responsible for 60–80% of cases. Despite this prevalence, it is relatively uncommon, impacting roughly 1.2% of the US population. According to the estimates, the total prevalent cases of Graves’ disease in the 7MM were ~7 million in 2023. The prevalence of Graves’ disease in Japan is significantly lower than in Europe and the United States.

Women are 7-8 times more likely to develop Graves’ than men, often between the ages of 30 and 50. Despite its intense symptoms, Graves’ disease is treatable with medication, radioiodine therapy, or sometimes surgery, allowing patients to regain balance and energy.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Pilatus Biosciences Advances PLT012 Into the Clinic Following FDA IND Clearance; ENHERTU + pertuz...

- Thyroid awareness month

- J&J Enters gMG Arena with IMAAVY Approval, Challenging AstraZeneca, Argenx, and UCB

- FcRn Inhibitors for Autoimmune Disorders: A Promising Therapeutic Approach

- Graves’ Disease Drug Pipeline: 6 Late-Stage Therapies to Watch

Current Approach for Graves’ Disease Treatment

Graves’ disease is typically treated using one of three approaches: antithyroid drugs (thionamides), radioactive iodine therapy, or surgery. The choice of Graves’ disease treatment often depends on the patient’s age, severity of the disease, and specific symptoms. Management focuses on quickly alleviating symptoms and reducing thyroid hormone levels.

Antithyroid medications (ATDs) inhibit the production of thyroid hormones by preventing iodide, a salted or reduced form of iodine, from interacting with thyroglobulin, thereby reducing hormone synthesis. Methimazole is the most commonly used ATD due to its long half-life and low incidence of side effects. Another ATD, carbimazole, is approved in European countries but not in the United States. It is an inactive drug that converts to the active form, methimazole, in the bloodstream, making it less potent.

Propylthiouracil, the least potent ATD, is approved in both the United States and Europe. It is the preferred treatment during the first trimester of pregnancy because it has minimal placental transfer. Historically, propylthiouracil was the first-choice ATD in the USA and South America. However, the American Thyroid Association (ATA) now recommends methimazole over propylthiouracil. Methimazole is widely used across Europe and Japan, while carbimazole is predominantly used in the UK.

For symptomatic patients, particularly those with a heart rate exceeding 90 beats per minute, a history of cardiovascular disease, or older adults, a beta-adrenergic blocker is recommended. Atenolol (25–50 mg taken orally once daily) is often preferred due to its cardioselectivity (beta-1 selective) and convenient dosing. Alternatively, propranolol (10–40 mg taken orally every 6–8 hours) may be used because it can also inhibit the peripheral conversion of T4 to T3. If beta blockers are unsuitable, calcium channel blockers like diltiazem or verapamil may help manage heart rate.

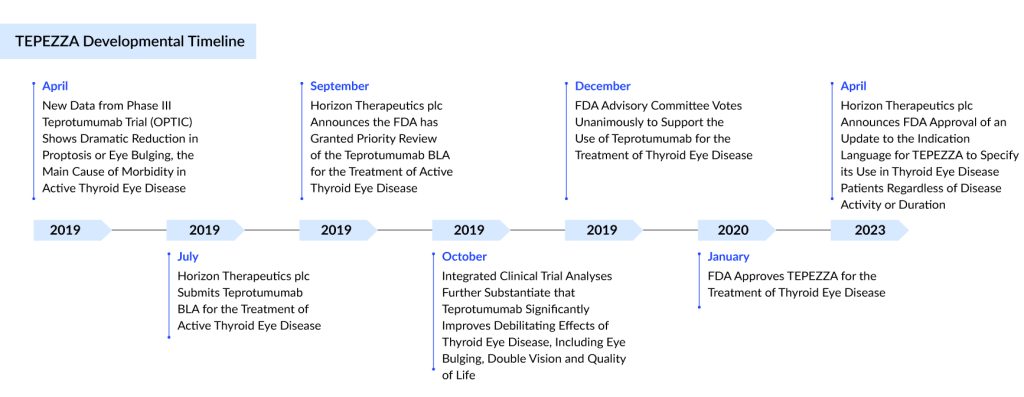

In January 2020, the US FDA approved TEPEZZA for treating thyroid eye disease following an accelerated Priority Review. TEPEZZA is the first and only FDA-approved treatment for TED, marking a significant advancement in addressing eye-related complications associated with Graves’ disease.

Emerging Options for Graves’ Disease Treatment

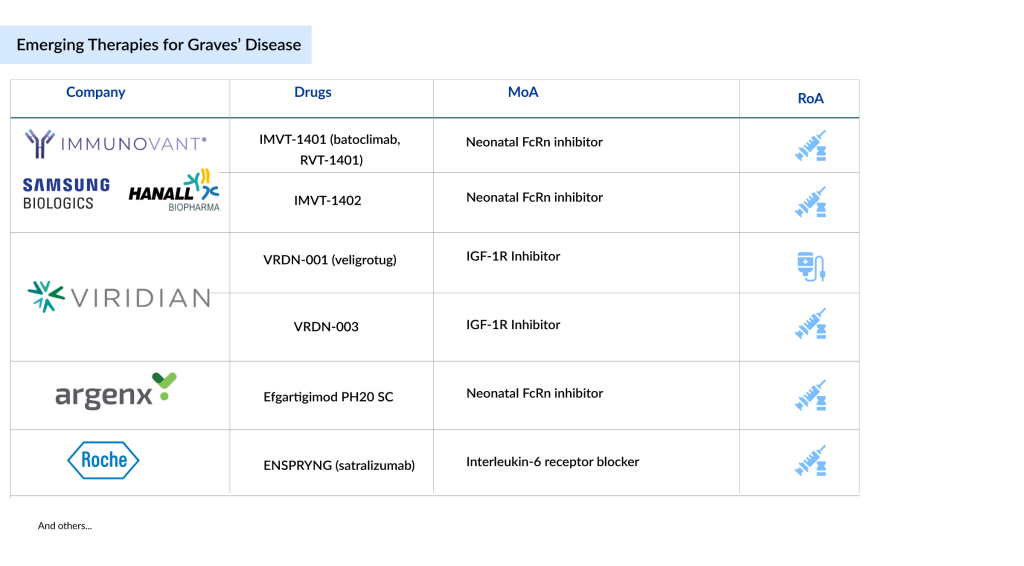

The pipeline for Graves’ disease is expanding, with leading companies like Immunovant, Viridian Therapeutics, Argenx, Tourmaline Bio, Hoffmann-La Roche, and Sling Therapeutics driving the development of targeted therapies for thyroid disorders. Notably, Viridian Therapeutics is unique in advancing treatments for both moderate to severe active TED and chronic TED. Additionally, Kriya Therapeutics, Septerna, and Crinetics Pharmaceuticals are making progress with earlier-stage products in this field.

Promising emerging candidates for Graves’ disease treatment include veligrotug (VRDN-001), VRDN-003, batoclimab, Efgartigimod PH20 SC, ENSPRYNG (satralizumab, RG6168), LASN01, linsitinib, AP-PA02, and Lonigutamab (anti-IGF-1R), among others.

These emerging Graves’ disease treatments, while targeting different mechanisms or molecular pathways, provide promising alternatives to current therapies by offering novel approaches to managing autoimmune diseases like thyroid eye disease. Their development reflects a growing focus on more precise, targeted treatments for these complex conditions.

In this setting, currently, only two MoAs — IGF-1R inhibitors and neonatal FcRn inhibitors are dominating. IGF-1R inhibitors like teprotumumab and linsitinib represent a cutting-edge therapeutic approach for managing Graves’ disease and its related ocular complications. By selectively targeting and modulating critical signaling pathways involved in disease progression, these inhibitors not only alleviate symptoms but also address the underlying mechanisms driving tissue damage in the eyes and orbit. This dual-action strategy holds great promise for improving disease management, potentially reducing both clinical symptoms and long-term complications associated with Graves’ disease.

Similarly, neonatal FcRn inhibitors, such as batoclimab, offer an innovative treatment approach for Graves’ disease by focusing on the autoimmune processes underlying the condition. These inhibitors block the neonatal Fc receptor, which is crucial for extending the lifespan of harmful antibodies, including thyroid-stimulating immunoglobulins (TRAb). By inhibiting this receptor, batoclimab rapidly normalizes thyroid hormone levels and lowers TRAb concentrations, delivering significant therapeutic advantages. This makes it a particularly promising option for patients unresponsive to standard treatments, opening new possibilities for managing this complex autoimmune disorder.

Graves’ Disease Treatment Market: What’s Ahead?

Currently, TEPEZZA is the only approved treatment specifically indicated for active Graves’ orbitopathy, emphasizing a significant unmet need in the market. Although off-label use of drugs like glucocorticoids, rituximab, and tocilizumab is common, their effectiveness is inconsistent, and none have received regulatory approval for this condition. The limited options point to a crucial gap in targeted, effective, and approved therapies for managing the disease, particularly in severe or resistant cases.

This shortage contributes to a lack of clarity about the current treatment landscape. Nonetheless, certain studies provide insights, revealing that teprotumumab and glucocorticoids remain the primary treatments.

Despite this, the market for Graves’ disease treatments is anticipated to increase, driven by increasing disease awareness, better diagnostic tools, and the expansion of targeted biologic therapies. As per DelveInsight analysis, the Graves’ disease market size in the 7MM was around USD 4.4 billion in 2023 and is expected to increase with a significant CAGR during the forecast period. Among the 7MM, the United States accounted for the largest market size, i.e., approximately 72% of the overall market in 2023.

Additionally, as many potential therapies are being investigated for the treatment of Graves’ disease, it is safe to predict that the treatment space will significantly impact the Graves’ disease market in the coming years.

Furthermore, the growing awareness of Graves’ disease and improved diagnostic techniques are likely to drive market expansion. The shift towards personalized medicine, aiming for targeted and more effective treatments with fewer side effects, is anticipated to further fuel the market’s development.

Moreover, the increasing prevalence of autoimmune diseases, along with the aging population, will contribute to rising demand for advanced therapies in this space. These trends indicate a promising future for the Graves’ disease treatment market, with continued innovation and new therapeutic options on the horizon.

Downloads

Article in PDF

Recent Articles

- Tepezza receives approval; a new way to treat Alzheimer’s

- Ipsen to Acquire Albireo; Chiesi Farmaceutici to Buy Amryt Pharma; Takeda Presents Phase III Resu...

- Graves’ Ophthalmopathy Treatment Market: A Billion-Dollar Opportunity For Pharma Companies

- Thyroid Eye Disease: The Hidden Impact of Thyroid Dysfunction on Eye Health

- Thyroid awareness month