Novo Nordisk vs. Eli Lilly: The Battle for Anti-Obesity Drug Market Dominance

Mar 17, 2025

Table of Contents

The global obesity crisis has sparked a multibillion-dollar showdown in the pharmaceutical world, with Novo Nordisk and Eli Lilly locked in an intense battle for supremacy. These industry titans are redefining the weight loss drug market with groundbreaking GLP-1 therapies. Novo Nordisk’s WEGOVY (semaglutide) and Eli Lilly’s ZEPBOUND (tirzepatide) are reshaping the anti-obesity drug market—but which powerhouse will claim the top spot in this high-stakes race?

Obesity Drug Market Overview and Growth Potential

The US obesity drug market is on a meteoric rise, projected to soar past USD 73 billion by 2034. This explosive growth is driven by surging obesity rates, a paradigm shift in medical perception—from lifestyle choice to chronic disease—and groundbreaking pharmaceutical advancements.

Downloads

Article in PDF

Recent Articles

- Booming Healthcare sector in MENA: Lucrative opportunity for Global pharma players

- Cytokinetics Announces Results From SEQUOIA-HCM Clinical Trial of Aficamten; FDA Approves Chiesi’...

- OZEMPIC’s New Approval Cements Novo’s Lead in GLP-1 Market

- Future Avenues for Prediabetes Treatment: The Road Ahead

- Mobile Health Apps for Obesity Treatment: A Modern Solution to a Growing Problem

Obesity drug market leaders Novo Nordisk and Eli Lilly are in an intense race, ramping up investments in manufacturing, obesity drug clinical trials, and regulatory approvals to dominate this booming sector. With over 138 million people in the US affected by obesity and increasing demand for effective treatments, the market is witnessing unprecedented expansion.

Beyond Novo and Eli Lilly, companies such as Boehringer Ingelhium, Pfizer, Roche, AstraZeneca, Regor therapeutics, Viking Therapeutics, Amgen, BioAge Labs, Gan & Lee Pharmaceuticals, Sun Pharma, Innovent Biologics, Aphaia Pharma, Vertex Pharmaceuticals, and others are entering the space, fueling new innovations in GLP-1 therapies, combination therapies, and next-gen metabolic treatments. As governments and insurers recognize the economic and healthcare burden of obesity, coverage and accessibility are set to improve, further accelerating market adoption.

With no signs of slowing down, the anti-obesity drug market is emerging as one of the most lucrative frontiers in modern medicine—a multi-billion-dollar revolution reshaping the future of healthcare.

Wondering which is the best weight loss drug? Find out at “Obesity: A Worldwide Pandemic with Advancing Management Options.”

Novo Nordisk: The Pioneer in GLP-1 Therapy

Novo Nordisk, the pharmaceutical giant, revolutionized weight loss treatment by pioneering GLP-1 receptor agonists. With decades of expertise in diabetes and metabolic disorders, the company turned its innovation engine toward tackling obesity. Its blockbuster drug, OZEMPIC (semaglutide), transformed diabetes care, while its higher-dose counterpart, WEGOVY, became a game-changer in weight management. As demand for these treatments skyrockets, Novo continues to push the boundaries, investing in new weight loss medications and reshaping the future of metabolic health. Apart from WEGOVY, SAXENDA, another Novo Nordisk weight loss drug, is also approved in the US for obesity.

SAXENDA—Key Asset in Novo Nordisk Obesity Market

Novo Nordisk weight loss drug, SAXENDA (liraglutide), is a GLP-1 receptor agonist designed to support long-term weight loss when combined with a reduced-calorie diet and increased physical activity. It’s prescribed for adults with obesity (BMI ≥30 kg/m²) or those who are overweight (BMI ≥27 kg/m²) with at least one weight-related condition, such as hypertension, type 2 diabetes, or dyslipidemia. It’s also approved for pediatric patients (12+ years, ≥60 kg) with severe obesity, based on international standards.

The recommended SAXENDA daily dose is 3 mg, with a gradual dose escalation starting at 0.6 mg per day and increasing weekly to minimize side effects. Pediatric patients may require up to eight weeks to reach the full dose, with the option to adjust if needed. In 2024, SAXENDA generated sales of USD 345 million in the US.

While SAXENDA has been a trusted option for weight management, WEGOVY—another Novo Nordisk weight loss drug—has entered the market with a higher efficacy profile and a once-weekly injection (compared to SAXENDA’s daily dose). Clinical studies suggest that WEGOVY leads to greater weight loss, making it a strong competitor. However, SAXENDA remains a well-established choice with a longer history of use and a flexible dosing regimen that may suit certain patients better.

Read our blog “The Race to Redefine Obesity Treatment” and discover why WEGOVY is winning in the WEGOVY versus SAXENDA battle

WEGOVY—Star Performer in Novo Nordisk Obesity Market

As obesity continues to be a growing global health concern, WEGOVY has emerged as a game-changer in weight management. Developed by Novo Nordisk, WEGOVY (semaglutide) is a GLP-1 receptor agonist designed to support sustainable weight loss when paired with a balanced diet and regular physical activity. At an annual cost of ~17K, this once-weekly injection offers a convenient option for adults with obesity (BMI ≥30) or those who are overweight (BMI ≥27) with related health conditions, helping them achieve and maintain weight loss.

By mimicking the body’s natural GLP-1 hormone, WEGOVY influences appetite regulation, promoting a feeling of fullness and reducing caloric intake. Its dosing regimen starts gradually, increasing over time to the full 2.4 mg maintenance dose. Administered subcutaneously, it fits seamlessly into daily routines, requiring just a single injection per week.

Common adverse reactions (adults and pediatric patients ≥12 years) and WEGOVY side effects include nausea, diarrhea, vomiting, constipation, abdominal pain, headache, fatigue, dyspepsia, dizziness, abdominal distension, eructation, hypoglycemia in patients with type 2 diabetes, flatulence, gastroenteritis, gastroesophageal reflux disease, and nasopharyngitis.

Since its US FDA approval in June 2021 and subsequent EU and Japan approval in 2022 and 2023, respectively, for chronic weight management, WEGOVY has rapidly gained traction. In March 2024, it became the first obesity medication to receive FDA approval for reducing the risk of cardiovascular events, reinforcing its role beyond weight loss. Now available in over 15 markets worldwide, WEGOVY has driven remarkable growth, generating USD 5.7 billion in US sales in 2024 alone.

With its expanding reach and growing recognition, WEGOVY is redefining the future of obesity treatments.

Dive deep to explore the WEGOVY effectiveness in treating obesity

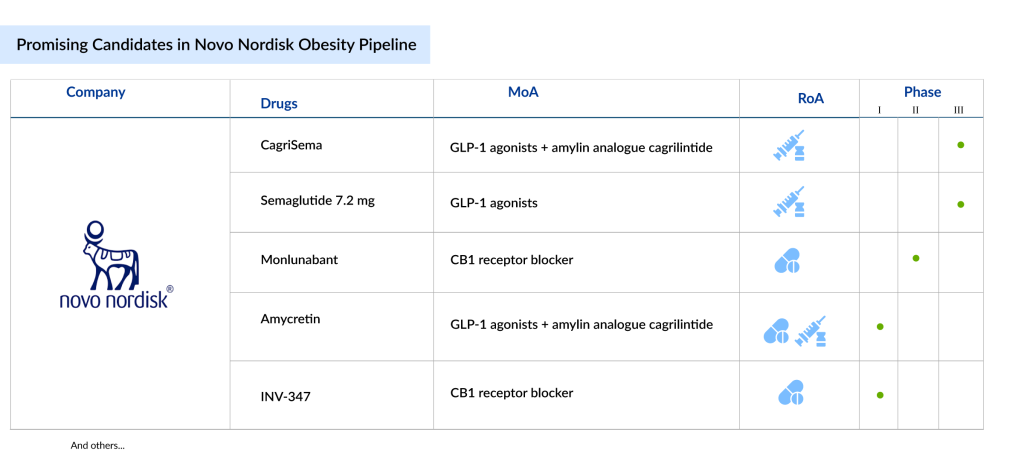

What’s Next in Novo Nordisk Obesity Pipeline?

Following the massive success of WEGOVY (semaglutide 2.4 mg), the company is evaluating semaglutide 7.2 mg in phase III obesity drug clinical trials. In January 2025, Novo Nordisk disclosed key findings from the STEP UP study, a Phase IIIb trial within the global STEP program. This 72-week study compared the efficacy and safety of subcutaneous semaglutide 7.2 mg against semaglutide 2.4 mg and a placebo, all administered weekly, in 1,407 adults with obesity who also participated in lifestyle interventions. The trial met its primary endpoint, demonstrating that semaglutide 7.2 mg led to significantly greater weight loss at week 72 compared to placebo.

Another most anticipated candidate in Novo Nordisk obesity pipeline is CagriSema, a powerful combination of semaglutide and cagrilintide, designed to enhance appetite suppression and improve metabolic control.

Beyond CagriSema, Novo Nordisk is advancing amycretin-based therapies, targeting dual gut hormones to amplify weight loss effects. These novel treatments aim to not only help patients shed excess weight but also improve metabolic health, reducing the risk of obesity-related conditions like diabetes and cardiovascular disease. As competition in the obesity drug market heats up, Novo Nordisk’s obesity pipeline positions it as a frontrunner in delivering life-changing solutions for millions worldwide.

Eli Lilly: The Challenger with a Dual-Action Advantage

Pharma giant Eli Lilly has shaken up the anti-obesity drug market with tirzepatide—branded as MOUNJARO for diabetes and ZEPBOUND for obesity. Unlike traditional GLP-1 drugs, tirzepatide targets both GLP-1 and GIP receptors, unlocking superior weight-loss results compared to semaglutide (OZEMPIC, WEGOVY). With game-changing clinical outcomes and skyrocketing demand, Eli Lilly is challenging Novo’s dominance in the booming obesity drug market.

ZEPBOUND—Eli Lilly’s Weight Loss Medication Contender

Originally developed for type 2 diabetes, ZEPBOUND (tirzepatide), Eli Lilly weight loss medication, is now making waves in obesity treatment. With a sharp focus on metabolic diseases, the company is poised to lead the booming obesity market. DelveInsight projects that ZEPBOUND will claim a massive 35% market share by 2034.

ZEPBOUND injection has received FDA approval for treating adults with moderate-to-severe obstructive sleep apnea and obesity. It is also authorized for use alongside a reduced-calorie diet and increased physical activity to aid in weight loss and long-term weight management for adults with obesity or those who are overweight with at least one weight-related health condition.

As the first and only dual-activating GIP and GLP-1 obesity treatment, ZEPBOUND, Eli Lilly weight loss medication, addresses a key factor contributing to excess weight by curbing appetite and reducing food intake. Common ZEPBOUND side effects include nausea, diarrhea, vomiting, constipation, abdominal pain, indigestion, injection site reactions, fatigue, allergic responses, belching, hair loss, and heartburn, though this is not an exhaustive list of potential ZEPBOUND side effects. In Q4 2024, US ZEPBOUND revenue reached USD 1.91 billion, a significant increase from USD 175.8 million in Q4 2023.

Eli Lilly Obesity Pipeline: Key Candidates to Watch

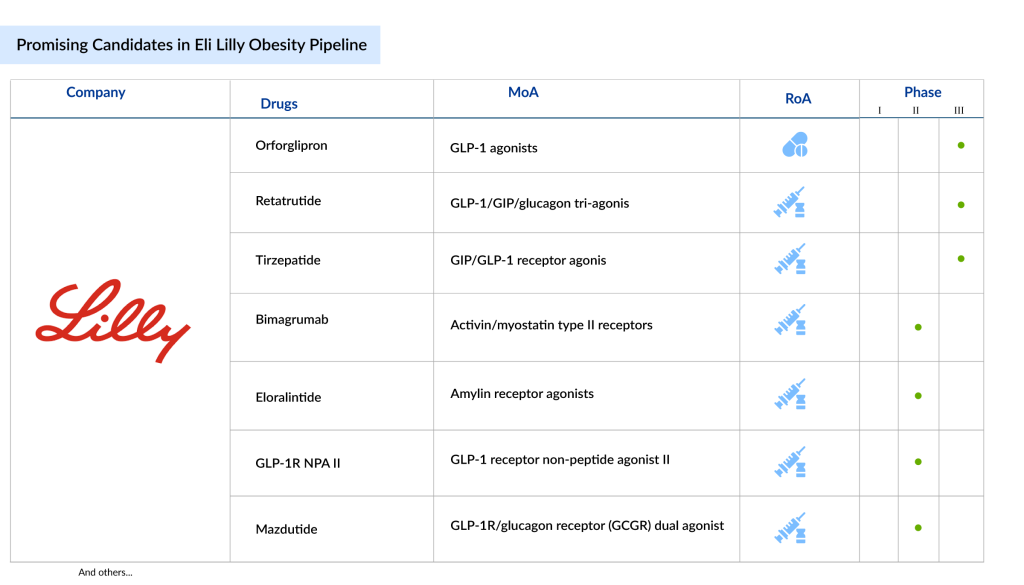

Eli Lilly is at the forefront of developing innovative therapies to combat obesity, with several promising GLP-1 therapies in its pipeline. Since the majority of therapies in Eli Lilly obesity pipeline are GLP-1 based, their launch will substantially expand GLP-1 market share in the weight loss injection treatments. Eli Lilly is evaluating its lead asset, tirzepatide, in phase III obesity drug clinical trials for the reduction of morbidity and mortality in obesity.

Another notable candidate in Eli Lilly obesity pipeline is retatrutide, a triple-hormone receptor agonist targeting GLP-1, GIP, and glucagon receptors. In a Phase II trial, retatrutide demonstrated a mean weight reduction of over 17.5% in adults without diabetes but with obesity or pre-obesity, marking a significant advancement in weight management therapies.

Beyond tirzepatide and retatrutide, Eli Lilly is also investing in oral GLP-1 therapies (orforglipron), aiming to provide convenient, effective alternatives to injections. In June 2023, Lilly reported that Orforglipron led to an average weight loss of up to 14.7% over 36 weeks in adults with obesity or overweight based on Phase II trial results.

With obesity now recognized as a chronic disease requiring long-term management, these innovative drugs could transform weight loss from a struggle to a science, giving patients powerful, sustainable solutions.

Curious about the best GLP-1 drugs for weight loss? Explore our expert insights on GLP-1 Agonists for Obesity

ZEPBOUND vs. WEGOVY: Which Weight Loss Drug Reigns Supreme?

Novo initially held an advantage over Lilly, as WEGOVY entered the market before Lilly’s competing drug, ZEPBOUND, and secured broader insurance coverage early on. However, this early lead appears to be fading. ZEPBOUND has demonstrated greater weight loss than WEGOVY, giving it a commercial edge in GLP-1 weight loss research. Both companies have also made consistent progress in improving their drug supply.

Novo has pinned its hopes on CagriSema to counter Lilly’s competitive threat. CagriSema combines semaglutide, the active ingredient in WEGOVY, with cagrilintide, a second drug. The company believed this combination could drive greater weight loss than ZEPBOUND, which functions differently.

Early weight loss trial results suggest CagriSema performs better than Wegovy alone, but it has fallen short of investor and executive expectations. In a Phase III trial targeting people with obesity but not diabetes, Novo aimed for 25% weight loss — a goal it missed in December. A smaller Phase II trial in diabetics showed 16% weight loss after 32 weeks, fueling hopes for stronger results in a longer Phase III study.

Commercializing CagriSema, if approved, could be challenging. Unlike Zepbound, which contains a single ingredient, CagriSema’s two components can’t be mixed together, requiring separate manufacturing and delivery via a dual-chambered pen.

Keen to know why Novo is leading? Read “WEGOVY vs. ZEPBOUND” and find out

Conclusion

Novo Nordisk is strengthening its dominance in the weight loss market with its well-established GLP-1 therapies, including WEGOVY and SAXENDA, while also developing next-generation treatments like CagriSema. Clinical trials have shown that WEGOVY leads to greater weight loss compared to other treatments, including Eli Lilly’s ZEPBOUND, reinforcing its position as a top obesity treatment.

Novo’s strong market presence and deep expertise in diabetes and obesity treatments have earned the trust of both healthcare providers and patients. As obesity rates continue to climb, Novo’s innovative solutions give it a competitive edge over emerging rivals like Eli Lilly. Additionally, Novo’s strategic management of supply chain challenges has helped maintain the consistent availability of WEGOVY and SAXENDA, boosting patient satisfaction and prescribing confidence. In contrast, Eli Lilly has faced supply issues that have affected the availability of ZEPBOUND.

Novo’s acquisition of Catalent facilities to meet growing demand reflects a strategic move to strengthen production capacity. The company’s increased R&D investment—up 48%—underscores its commitment to clinical innovation and expanding product indications.

Novo’s pricing strategy also contributes to its market leadership. Despite premium pricing, Novo has been more effective in negotiating with insurers to improve coverage, making WEGOVY and SAXENDA more accessible to a wider patient base and increasing market share.

Novo holds a commanding position in the GLP-1 market, with nearly two-thirds of patients using its treatments, supported by robust sales growth and a positive market outlook. Sales of its obesity care products, including WEGOVY and SAXENDA, increased by 56% in Danish kroner and 57% at constant exchange rates (CER). Meanwhile, ZEPBOUND generated USD 1.91 billion in U.S. revenue in Q4 2024, a sharp rise from USD 175.8 million in Q4 2023.

As demand for effective and reliable weight-loss solutions grows, Novo’s ability to deliver strong efficacy, consistent availability, and improved affordability positions it ahead of Eli Lilly in the obesity treatment market.

It will be interesting to see which company, Novo Nordisk or Eli Lilly, will reach the trillion-dollar mark first. Both have seen remarkable growth driven by the success of their diabetes and obesity treatments. With strong pipelines and expanding market opportunities, the race to a trillion-dollar valuation could reflect broader trends in the healthcare and pharmaceutical sectors.

Downloads

Article in PDF

Recent Articles

- Neurotech’s ENCELTO Becomes First FDA-Approved Treatment for MacTel Type 2; Plus Therapeutics’ Rh...

- Chemists may help solve the air-pollution health crisis

- 7 Promising Obesity Drugs Set to Launch by 2027

- WEGOVY: A Leader in the Obesity and Weight Loss Treatment

- Digestive Health Products: Exploring the Market Dynamics and Key Factors Driving the Demand