What Factors are Shaping the Trends in the ARDS Market?

Nov 20, 2024

Table of Contents

Despite decades of research, treatment options are limited in the ARDS market. There are only a few treatments available in the ARDS market. The mainstay of management remains supportive care with mechanical ventilation. Other ARDS treatment options for patients include supplemental oxygen, prone positioning, the use of paralytics, fluid management, and a technique known as positive end-expiratory pressure (PEEP) to help push fluid out of air sacs. These are used in addition to ongoing ARDS treatment for the original disease or injury.

However, the dynamics of the ARDS market are expected to change in the coming years. Several leading pharma companies in the ARDS market are currently involved in developing novel therapies with distinct MoA to improve the treatment landscape.

Downloads

Article in PDF

Recent Articles

- In the fight against COVID-19 – Lilly with Olumiant, Gilead with remdesivir, Rutgers with testing...

- Alnylam’s lumasiran results; AZ’s oncology drug; Astellas Roxadustat; Evotec’s partnership with ABL

- Supply shortage: Why ventilators are in demand amid the Coronavirus crisis

- Rising Acute Respiratory Distress Syndrome (ARDS) Prevalence Posing a Major Public Health Concern

- Watch Out for the Most Promising Therapies in the Pipeline in ARDS Market

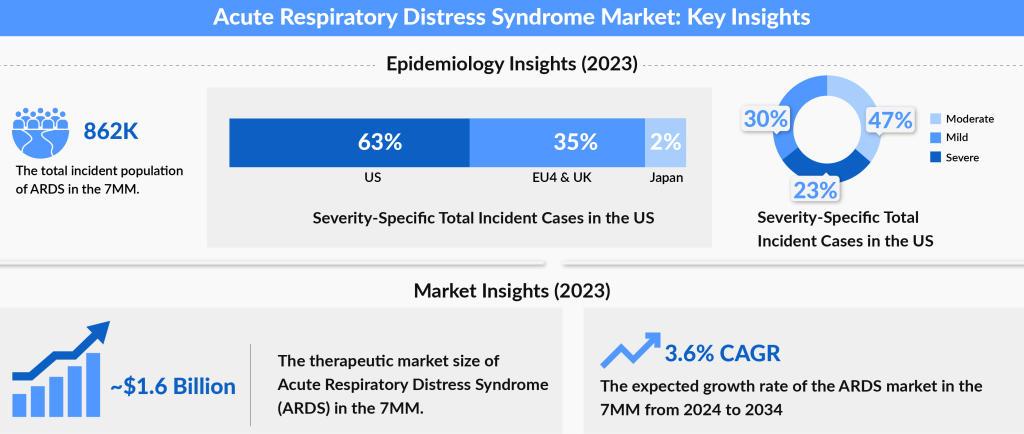

As per the recently published Acute Respiratory Distress Syndrome (ARDS) Market Report by DelveInsight, the ARDS market size shall grow during the forecast period (2024-2034) owing to the launch of upcoming therapies and is expected to increase at a significant rate during the study period.

As per our estimates, the ARDS market size in seven major markets was approximately USD 1,643 million in 2023, which is further expected to increase by 2034 at a Compound Annual Growth Rate (CAGR) of 3.6% for the study period (2024-2034).

DelveInsight estimates show that the United States accounts for the largest ARDS market size compared to EU5 (the United Kingdom, Germany, Italy, France, and Spain) and Japan. The US contributed approximately 74% to the total ARDS market size of ARDS in the 7MM in 2023.

Among the EU5 countries, Germany had the highest market size, with approximately USD 206 million, followed by France in 2023. Moreover, the ARDS market size in Japan was valued at ~USD 46 million in 2023. The ARDS market is expected to grow, mainly due to the increasing incident cases and the launch of upcoming therapy during the forecast period.

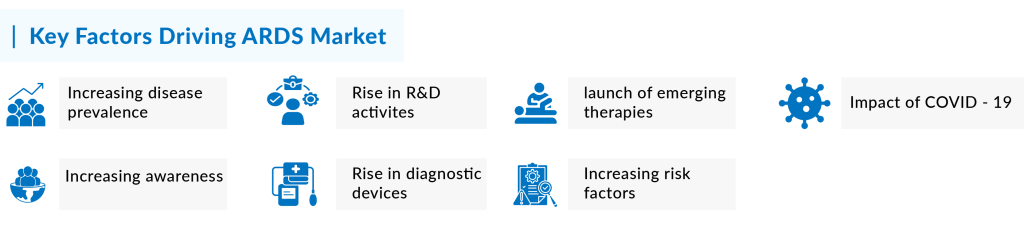

Key factors fueling the ARDS market growth

Several factors are driving the growth of the ARDS market. Among the prominent factors include rising ARDS prevalence, increasing R&D activities, the opportunistic market for emerging drugs, and others. Moreover, the increased ARDS market size is a direct result of the anticipated approval of new therapies and the growing patient population with acute respiratory distress syndrome in the 7MM. A detailed assessment of these factors is given below

Increasing ARDS prevalence and awareness

The rise in prevalence is a major factor contributing to the growth of the ARDS market. As per our analysis, the total incident cases of Acute Respiratory Distress Syndrome in the United States were approximately 591 thousand in 2023. The United States accounted for the largest share of the incident ARDS population, representing around 62% of the total 7MM population in 2023. In comparison, the EU4 and the UK together contributed about 34%, while Japan accounted for roughly 4% of the total ARDS incident cases in 2023. This growing patient population, particularly in the United States, is expected to drive demand for novel treatment options, creating significant opportunities for market leaders to address the increasing needs of ARDS patients, thereby boosting market growth in the coming years.

Additionally, the government is taking several measures and initiatives to make people aware of ARDS so that the number of undiagnosed and unreported cases will decrease and people will opt for medical treatment. Thus, the rising disease awareness is bolstering the ARDS marker size.

Rising cases of key indications

The major risk factors driving the ARDS prevalence are pneumonia, sepsis, aspiration, trauma, pancreatitis, COVID-19, and others. According to DelveInsight analysts, among the key indications, the highest cases were recorded for pneumonia (210K cases), followed by sepsis and trauma in the US in 2023. The increase in the cases of these indications will boost the ARDS market size. The trend of ARDS epidemiology is anticipated to be the same in the coming years.

COVID and its impact

As of 2024, COVID-19 cases have significantly declined, and it is no longer a major factor influencing the prevalence of ARDS. While the pandemic initially led to a surge in COVID-19-associated ARDS cases, this impact has diminished as COVID-19 cases have virtually disappeared. The primary drivers of ARDS prevalence today are the longstanding risk factors, such as trauma, pneumonia, sepsis, and other underlying pulmonary conditions, rather than COVID-19-related complications.

With the pandemic no longer contributing to the increase in ARDS cases, the focus has shifted back to traditional causes of acute respiratory distress syndrome. The growing patient population, combined with rising cases of acute lung injury and other risk factors, continues to fuel the demand for new treatments. As a result, market leaders are focusing on developing innovative therapies for ARDS, with a focus on these traditional risk factors, which will drive the growth of the ARDS market in the coming years.

Impact of emerging therapies in the ARDS market

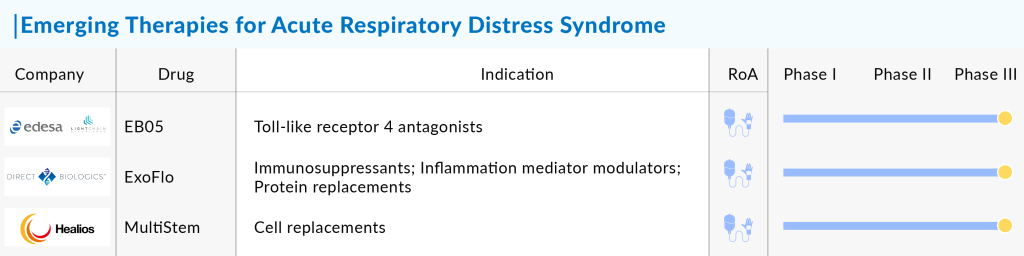

The uptake of potential emerging ARDS therapies with a better clinical profile is expected to be high since no drug has been approved. Several molecules are being evaluated and investigated by leading pharmaceutical goliaths such as Staidson (Beijing) Biopharmaceuticals Co., Ltd, Cartesian Therapeutics, GEn1E Lifesciences, Aqualung Therapeutics Corp., Theratome Bio, Meridigen Biotech Co., Ltd., Dompé Farmaceutici S.p.A, Veru Healthcare, Windtree Therapeutics, MiNK Therapeutics, Avalo Therapeutics, Inc, Cynata Therapeutics Limited, Thiogenesis Therapeutics, Inc., Arch Biopartners, Ibudilast, and others to strengthen the pipeline, thereby raising the hope for an efficacious therapy soon.

Currently, several assets in the ARDS pipeline are in the late and middle stages of development. The expected launch of emerging therapies, such as EB05 (paridiprubart) by Edesa Biotech and Light Chain Bio, ExoFlo (DB-001) by Direct Biologics, MultiStem (HLCM051) by Healios and Nobel Pharma, GEn 1124 by GEn1E Lifesciences, ALT-100 by Aqualung Therapeutics Corp., STSA 1002 by Staidson (Beijing) Biopharmaceuticals Co., Ltd., TP508 by Chrysalis BioTherapeutics, etc. shall further create a positive impact on the ARDS market.

Furthermore, in April 2022, the FDA awarded ExoFlo a Regenerative Medicine Advanced Therapy (RMAT) designation. In July 2022, the company initiated the evaluation of the drug in phase III for COVID-19 moderate-to-severe ARDS. Another ARDS drug, MultiStem, is under development by Athersys and is currently in phase II/III stage for the treatment of COVID-19-induced ARDS. The FDA granted Fast Track designation to Athersys for its clinical program evaluating MultiStem cell therapy for the treatment of ARDS. Also, in September 2020, the FDA granted RMAT Designation to MultiStem Cell Therapy for the treatment of ARDS.

In April 2023, the US FDA approved the expansion of the pivotal Phase III EXTINGUISH ARDS trial to assess the safety and efficacy of ExoFlo for treating moderate-to-severe acute respiratory distress syndrome (ARDS) from any cause. The drug demonstrated positive safety data and significant efficacy results in its Phase II trial involving hospitalized adult COVID-19 patients with moderate-to-severe ARDS. Additionally, ExoFlo showed promising outcomes in its expanded access program for hospitalized COVID-19 patients with moderate-to-severe ARDS.

Hence, the ARDS pipeline is robust, with therapies in advanced stages of development with several designations. The availability of these therapies in the ARDS market will bring a ray of hope for the patients.

A rise in the MedTech segment

The global ARDS treatment market has expanded significantly in recent years and is predicted to proliferate in the future. Pharmaceutical and healthcare companies are rapidly evolving due to technological advancements, increased healthcare spending, and improved healthcare facilities and processes. Many hospitals, ambulatory surgical care facilities, and clinics throughout the world are implementing cutting-edge technology and equipment.

Furthermore, the increasing focus on drug discovery, rising demand for precision medicine, widespread use of home care settings and point-of-care diagnostics, and increased expenditures in R&D activities are likely to fuel global ARDS market growth during the forecast period.

Diagnostic devices such as capnography devices, spirometers, pulse oximeters, and blood gas analyzers aid in the early detection of acute respiratory distress, allowing proper therapy and treatment to be administered to patients, hence functioning as a significant driving factor in the ARDS market.

Currently, the leading MedTech companies working in the acute respiratory distress syndrome diagnostic segment include Medtronic, F. Hoffmann-La Roche Ltd, Hamilton Medical, Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare Limited., LivaNova PLC, Gilead Sciences, Inc., Fresenius SE & Co. KGaA, Besmed Health Business Corp., Armstrong Medical, Smiths Medical, and others along with some domestic players.

Way ahead

One of the primary causes of acute respiratory distress syndrome is air pollution. Vehicles are frequently responsible for harmful gas emissions. With more people utilizing personal mobility, air pollution is increasing the number of ARDS patients. Furthermore, the ARDS market is expected to rise due to lifestyle-related issues, growing healthcare infrastructure in developed countries, and increased knowledge about respiratory disorders.

Several risk factors, including alcohol abuse, chemotherapy, obesity, and low blood-protein levels, are contributing to the surge of ARDH cases. Furthermore, technological advances are projected to boost the acute respiratory distress syndrome market. One of the primary driving forces in the global ARDS market is the availability of suitable therapy and diagnostics for acute respiratory distress syndrome.

As COVID-19 was one primary factor for the rise in ARDS cases, there are other ongoing threats that continue to contribute to the increasing prevalence of this life-threatening condition. These include severe infections like pneumonia, aspiration, and sepsis, as well as non-pulmonary factors such as trauma and pancreatitis. These conditions lead to intense lung inflammation, hypoxemia, and non-hydrostatic pulmonary edema, making it difficult for the lungs to function properly.

Treatment for ARDS primarily remains supportive, with mechanical ventilation being the foundation of care. Other interventions include supplemental oxygen, prone positioning, fluid management, and Positive End-Expiratory Pressure (PEEP). Neuromuscular blocking agents (NMBAs) and corticosteroids are also used to help manage oxygenation and reduce inflammation.

Although experimental treatments like β2 agonists and Keratinocyte Growth Factor (KGF) have shown promise in early studies, they have not yet been proven effective in large-scale trials. Statins, despite their anti-inflammatory effects, have had mixed results and are not recommended for routine ARDS treatment.

With rising cases of pneumonia, sepsis, trauma, and other severe conditions driving the incidence of ARDS, the demand for more effective therapies continues to grow. However, despite decades of research, treatment options beyond supportive care remain limited, highlighting the need for continued innovation in ARDS management.

Downloads

Article in PDF

Recent Articles

- Supply shortage: Why ventilators are in demand amid the Coronavirus crisis

- Watch Out for the Most Promising Therapies in the Pipeline in ARDS Market

- Unmet Needs and Emerging Trends in the Acute Respiratory Distress Syndrome Market Landscape

- In the fight against COVID-19 – Lilly with Olumiant, Gilead with remdesivir, Rutgers with testing...

- Rising Acute Respiratory Distress Syndrome (ARDS) Prevalence Posing a Major Public Health Concern