Bispecific and Trispecific Antibodies: Are They Better Than CAR-Ts?

May 13, 2024

Table of Contents

CAR-T therapy has been given the green light for treating blood cancers, but it hasn’t demonstrated sustained effectiveness against solid tumors thus far. The focus of ongoing CAR-T development leans heavily toward blood cancers rather than solid ones. On the other hand, bispecific antibodies have gained approval for both blood cancers and solid tumors, showing encouraging and enduring outcomes in the latter. Current efforts in bispecific antibody development prioritize solid tumors over blood cancers. The advantage of “off-the-shelf” drugs with straightforward manufacturing processes favors bispecific antibodies over CAR-T therapies.

Target Patient Pool for Bispecific and Trispecific Antibodies

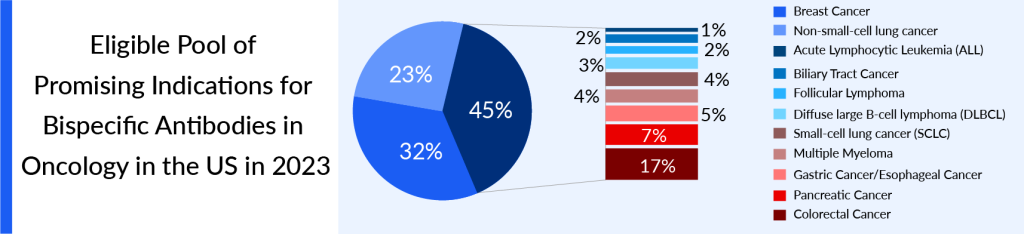

In the 7MM, the highest eligible pool of promising indications for bispecific antibodies in oncology was seen in the United States, followed by EU4 and the UK in 2023. The treatment-eligible pool of potential indications for bispecific antibodies in oncology in the United States was around 895K in 2023

Downloads

Article in PDF

Recent Articles

- 6 Upcoming Bispecific Antibodies Beyond Oncology

- Novartis’ Canakinumab for NSCLC; Novartis’s Zolgensma Updates; Trodelvy Prospects in New Breast C...

- A New Era for Multiple Myeloma Treatment: Bispecific Antibodies Enter the Fray

- CAR-T Phase I trials; ContraVir Announces; Merck acquired; Excision BioTherapeutics bags $10M

- Roche’s Phase 2 data; Celgene and Bluebird’s CAR-T therapy; Regeneron/Sanofi gets results; Allerg...

As per the estimates, of the selected hematological indications in the 7MM in 2023, the patient pool for DLBCL and Multiple Myeloma is high. For example, the patient pool for Acute Lymphocytic Leukemia, a less prevalent type of leukemia that primarily affects children, is smaller. In 2023, among the solid cancers, NSCLC and Breast cancer have significantly larger patient pools due to their higher incidence, in the United States.

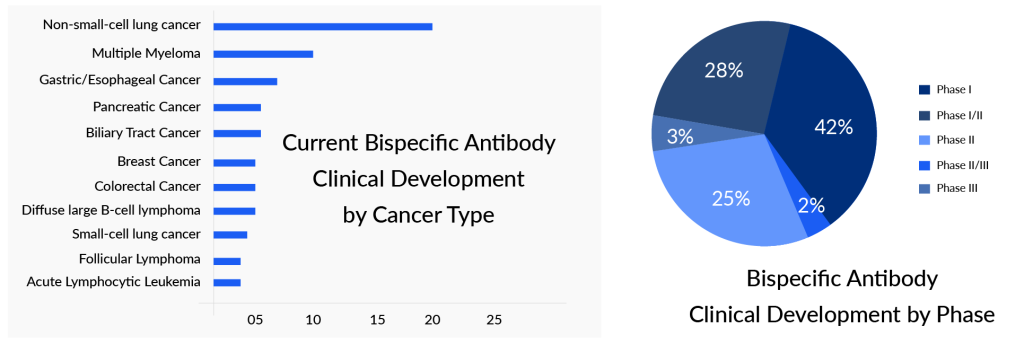

Numerous bispecific antibodies have received FDA approval, and over 500 bispecific antibodies are undergoing clinical trials for both solid tumors and blood cancers. Yet, there hasn’t been any trispecific antibody that has been approved or advanced to late-stage development.

Bispecific Antibodies: Bridging the Gap

Bispecific antibodies are designed to address complex diseases by targeting two disease factors simultaneously within a single molecule. While most are approved for cancer treatment, specifically for conditions like multiple myeloma and DLBCL, a select few, including HEMLIBRA and VABYSMO, have been sanctioned for non-cancer uses such as hemophilia A, wet age-related macular degeneration, and diabetic macular edema. Additionally, KIMMTRAK, another bispecific agent, has gained approval for treating uveal melanoma.

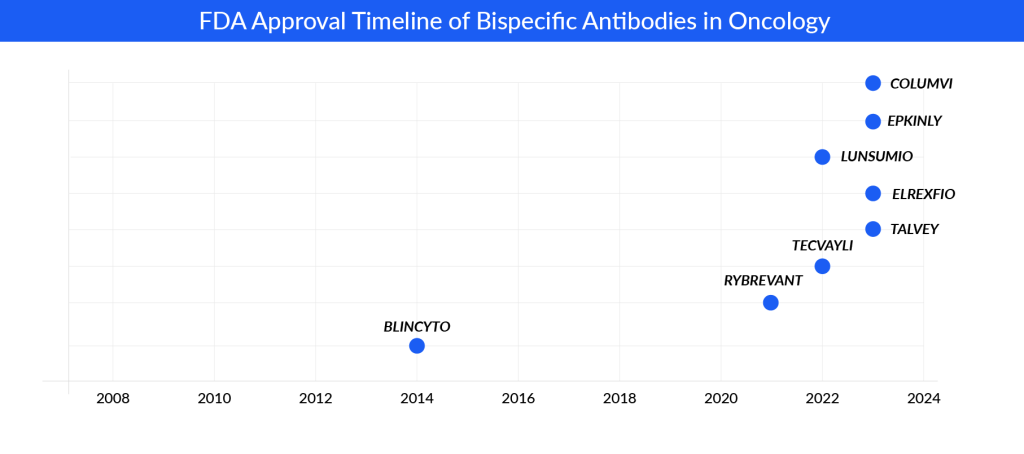

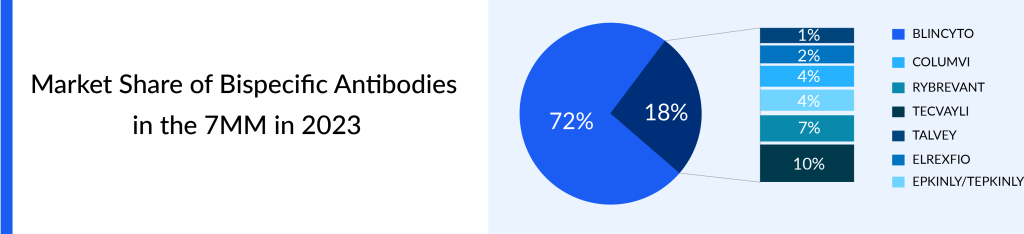

In addition, in the past few years, there have been significant breakthroughs in cancer therapy within the pharmaceutical field, particularly with the emergence of bispecific antibodies as a leading edge of progress. A significant achievement in this regard was the approval by the FDA of BLINCYTO, the pioneering bispecific antibody aimed at treating relapsed or refractory B-cell acute lymphoblastic leukemia, which targets CD19 X CD3.

The approval of BLINCYTO marked a pivotal moment in the research and development landscape of bispecific antibodies. With this therapy, Amgen has fortified its position in treating acute lymphoblastic leukemia. Looking ahead, Amgen aims to broaden its reach by venturing into first-line consolidation treatment and addressing patients who can benefit from chemotherapy reduction. Furthermore, the company is actively working on a subcutaneous formulation of BLINCYTO to ensure its sustained presence in the market.

RYBREVANT boasts superior safety profiles compared to the now-withdrawn EXKIVITY, particularly in patients with EGFR mutations involving exon20 insertion. J&J is progressing with a Phase III trial of RYBREVANT in combination with chemotherapy for exon20 insertion NSCLC in the first-line setting, with plans for regulatory filings in the US and EU by 2023. Additionally, there are plans to broaden its application to target EGFR NSCLC, potentially positioning it as a competitor to TAGRISSO in the future.

The field of cancer treatment is currently filled with optimism as a wave of bispecific antibodies, also referred to as T-cell-redirecting bispecific antibodies (TRBAs), are making their way into clinical trials. A notable trend involves the utilization of immunoglobulin G (IgG)-based structures, which prolong drug exposure for increased effectiveness. This structural design enables prolonged interactions between immune cells and target cells, effectively regulating crucial signaling pathways. The selection of target antigens has emerged as a crucial element, providing competitive edges in the evolving landscape of bispecific antibody development. In trials focusing on hematological cancers, attention is directed towards various targets such as CD19, CD20, BCMA, CD123, and CD33, redirecting T cells via CD3 to combat cancerous cells.

Clinical studies involving solid tumors offer a broader spectrum of targets and modes of action. Bispecific antibodies demonstrate their versatility by targeting various antigen pairs, from singular targets like HER2/HER2 to combinations like VEGF/Ang-2, IGF-1/IGF-2, PD-1/CTLA4, PD-1/PD-L1, or PD-L1/CTLA4, illustrating their adaptability in addressing the intricate nature of solid tumors.

Promising Bispecific and Trispecific Antibodies in the Pipeline

Bispecific antibodies have gained significant attention, whereas trispecific antibodies remain largely unexplored. Most companies are still in the initial phases of research and development. Sanofi, Johnson & Johnson, and Harpoon Therapeutics stand out for their ambitious efforts in this area, with several projects underway. In contrast, many other companies have only one trispecific antibody in their developmental pipeline. The majority of the upcoming key players are focusing on oncology indications; only a few, for example, Provention Bio, Yabao Pharmaceutical, AbbVie, and AstraZeneca, are active in the non-oncology space.

The promising bispecific antibodies in the pipeline include Ivonescimab (Akeso/Summit Therapeutics), Zanidatamab ((Zymeworks/BeiGene/Jazz Pharmaceuticals)), Zenocutuzumab (Merus), and Cevostamab (Roche), among others.

Ivonescimab, also referred to as SMT112 in the US, Canada, Europe, and Japan, and AK112 in China and Australia, is a new investigational bispecific antibody that merges the benefits of immunotherapy by blocking PD-1 with the anti-angiogenic effects of VEGF inhibition in a single molecule. Discovered by Akeso, Ivonescimab is currently undergoing multiple Phase III clinical trials. Summit and Akeso joined forces in December 2022 through a collaboration and licensing agreement for Ivonescimab. Summit initiated clinical development of Ivonescimab in NSCLC, with enrollment starting in 2023 in two Phase III trials within its licensed regions. To date, over 950 patients have received treatment with Ivonescimab in clinical trials conducted in China and Australia, with recent enrollment also underway in Summit’s licensed areas.

Zanidatamab, a HER2-targeted bispecific antibody crafted through Zymework’s Azymetric platform, is presently undergoing extensive assessment in Phase I, Phase II, and pivotal clinical trials worldwide. It aims to be a leading therapy for patients with HER2-expressing cancers, spanning biliary tract, gastroesophageal adenocarcinomas, breast, and other tumor types. Notably, Zanidatamab has received Breakthrough Therapy Designation (BTD) for biliary tract cancer from both the FDA and China’s CDE, along with two Fast Track designations. One Fast Track designation is for HER2-positive biliary tract cancers that have been previously treated or recurred, while the other is for first-line gastroesophageal adenocarcinoma when combined with standard chemotherapy. Furthermore, Orphan Drug designation has been granted in the US for biliary tract and gastric cancers, and in the EU for gastric cancer. Zymeworks has forged separate agreements with BeiGene and Jazz Pharmaceuticals, conferring exclusive development and commercialization rights for zanidatamab in various countries globally.

In addition to these bispecific antibodies, the promising trispecific antibodies in the pipeline include GTB-3550 (GT Biopharma), GB263T (Genor Biopharma), NM21-1480 (Numab Therapeutics), and SAR442257 (Sanofi), among others. The anticipated launch of bispecific and trispecific antibodies is poised to revolutionize targeted therapy in biomedicine. These innovative antibodies hold the promise of enhanced efficacy and precision by simultaneously targeting multiple disease-associated molecules, potentially leading to improved treatment outcomes and expanded therapeutic options for patients across various medical conditions.

Bispecific and Trispecific Antibodies: Future Directions

Bispecific and trispecific antibodies represent a paradigm shift in targeted therapy, offering unprecedented precision and versatility in disease treatment. As per DelveInsight analysis, the total market size of bispecific antibodies in oncology in the 7MM was ~USD 690 million in 2023, which is expected to grow during the forecast period 2024–2035.

Although hematologic cancers now dominate the market, treatments targeting solid tumors, such as NSCLC, are projected to have a substantial market presence in the future. RYBREVANT is predicted to be a key bispecific antibodies market driver, with a market opportunity of roughly USD 2 billion.

By 2035, DLBCL will dominate the bispecific antibodies in the oncology market, i.e., ~USD 4.5 billion followed by NSCLC and multiple myeloma. ELREXFIO will be going to capture the highest market share of the multiple myeloma bispecific antibodies market by 2035, i.e., USD ~1 billion in the 7MM.

Looking ahead, ongoing research efforts aim to address existing challenges and further expand the therapeutic applications of bispecific and trispecific antibodies. Advances in antibody engineering, computational modeling, and high-throughput screening techniques are driving innovation in this field, paving the way for the development of next-generation biologics with enhanced potency, specificity, and safety profiles.

Downloads

Article in PDF

Recent Articles

- Pfizer to acquire Arena Pharma; Takeda’s ‘Wave 2’ multiple myeloma med data; No...

- PTC Therapeutics’ Gene Therapy Upstaza; Sanofi and Regeneron’s Dupixent; Bayer CAR-T Collaboratio...

- Cellectis successfully bags USD 164 million for Gene-editing and CAR-T programs

- Roche’s HEMLIBRA: A Game Changer in Hemophilia A Treatment Landscape

- Abbvie-Genmab’s EPKINLY Approval for DLBCL Treatment: The First CD20XCD3 Bispecific Antibody