8 Emerging Bispecific Antibodies Transforming NSCLC Treatment

Mar 28, 2025

Non-small cell lung cancer (NSCLC) remains one of the toughest cancers to treat, but bispecific antibodies (BsAbs) are changing the game. Unlike traditional therapies, BsAbs are engineered to target two different antigens simultaneously, enhancing precision and boosting immune response. This dual-targeting approach allows BsAbs to not only block cancer growth signals but also engage immune cells more effectively, leading to higher tumor-killing efficiency and reduced resistance.

The potential of bispecific antibodies in NSCLC lies in their ability to combine the best of immunotherapy and targeted therapy. By bridging tumor cells with immune cells like T cells, BsAbs create a direct path for immune attack, even in cases where immune checkpoint inhibitors have failed.

Currently, two bispecific antibodies are approved for NSCLC treatment: Merus and Partner Therapeutics’ BIZENGRI (approved in the US in 2024), a bispecific antibody that binds to the extracellular domains of HER2 and HER3 expressed on the surface of cells, including tumor cells, inhibiting HER2:HER3 dimerization and preventing NRG1 binding to HER3, and Janssen’s RYBREVANT (approved in the US in 2021), a bispecific EGF receptor-directed and MET receptor-directed antibody indicated for the treatment of adult patients with locally advanced or metastatic NSCLC with EGFR exon 20 insertion mutations, as detected by an FDA-approved test, whose disease has progressed on or after platinum-based chemotherapy.

Downloads

Article in PDF

Recent Articles

- Revolutionary Advances and Bright New Horizons in Multiple Myeloma Treatment

- Gilead’s Livdelzi FDA Approval for Primary Biliary Cholangitis; Incyte and Syndax’s Niktimv...

- AstraZeneca’s Imfinzi for Biliary Tract Cancer; FDA Clears Boehringer’s Spesolimab; Novo Nordisk ...

- AstraZeneca’s IMFINZI Archives Another Milestone — Becomes the First Immunotherapy for Limited-St...

- Bristol Myers’ Opdivo combo Opdualag for Melanoma; Biogen’s Aduhelm; Marinus’ Ztalmy for CDKL-5 D...

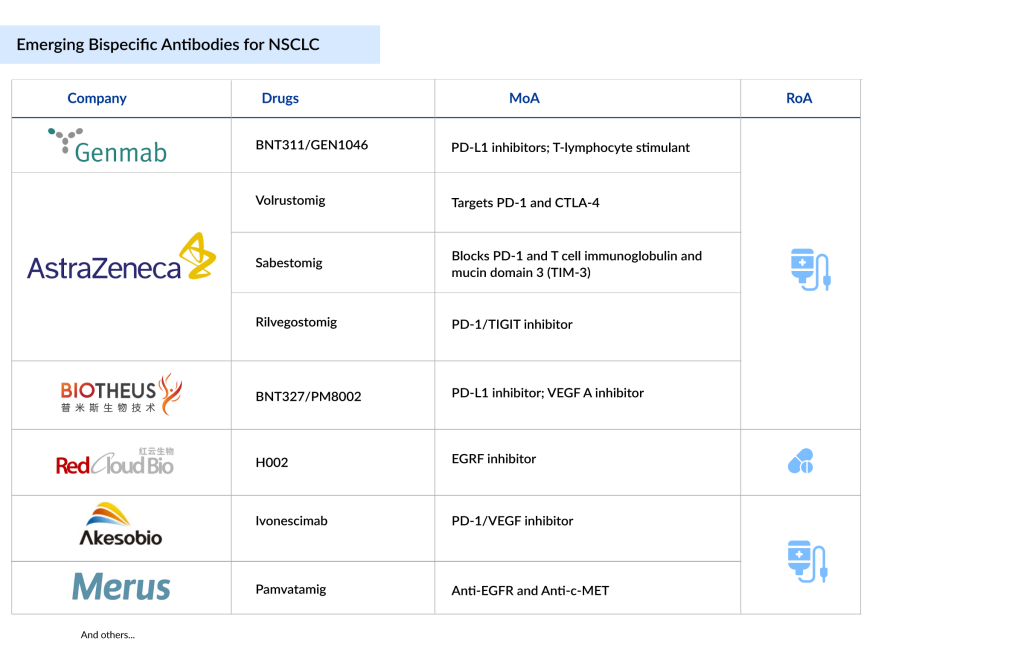

Following the success of BIZENGRI and RYBREVANT in the NSCLC bispecific space, many companies also want to enter this segment. Companies such as Genmab (BNT311/GEN1046), AstraZeneca (Volrustomig, Rilvegostomig, Sabestomig), Akeso Biopharma/Summit Therapeutics (Ivonescimab), Biotheus/BioNTech (BNT327/PM8002), RedCloud Bio (H002), and Merus (Pamvatamig), among others, are currently working with their lead assets.

Here are 8 of the most exciting candidates in development, each bringing hope for better outcomes and improved quality of life.

Genmab’s BNT311/GEN1046

Phase III

Acasunlimab (BNT311/GEN1046) is an experimental PD-L1x4-1BB bispecific antibody that combines Genmab’s DuoBody technology with BioNTech’s immunomodulatory antibodies. It is designed to trigger an antitumor response by conditionally activating 4-1BB on T cells and natural killer cells, which requires the PD-L1 arm to bind simultaneously.

Acasunlimab is being evaluated in ongoing clinical trials, including a phase III study for patients with metastatic non-small cell lung cancer who are PD-L1 positive and have experienced disease progression after treatment with a checkpoint inhibitor.

In August 2024, Genmab announced that it would take full responsibility for acasunlimab’s development and potential commercialization, as BioNTech decided not to continue involvement under their existing agreement. However, BioNTech will receive certain milestone payments and a tiered single-digit royalty on Genmab’s net sales of the drug.

AstraZeneca’s Volrustomig

Phase III

Volrustomig (MEDI5752) is a monovalent, bispecific humanized IgG1 monoclonal antibody targeting PD-1 and CTLA-4. It is designed to inhibit PD-1 while providing stronger CTLA-4 blockade on PD-1+ activated T cells compared to resting peripheral T cells lacking PD-1 expression. This mechanism could enable more effective CTLA-4 inhibition at tolerable doses than current PD-1/CTLA-4 combinations. Volrustomig is one of the first molecules of this kind.

A Phase III, two-arm, parallel-group, randomized, multicenter, open-label study (eVOLVE-Lung02, NCT05984277) is currently underway to assess the efficacy of first-line volrustomig plus chemotherapy versus pembrolizumab plus chemotherapy in mNSCLC patients with PD-L1 TC < 50%. AstraZeneca’s Q3 2024 report indicates that data from the Phase III eVOLVE-Lung02 trial is expected by 2025, while results from the Phase II eVOLVE-01 trial (NCT06448754) are anticipated in the second half of 2025.

Akeso Biopharma/Summit Therapeutics’ Ivonescimab

Phase III

Ivonescimab (AK112, SMT112) is a first-in-class PD-1/VEGF bispecific antibody, independently developed by Akeso, and the first to reach Phase III clinical trials. It is engineered using Akeso’s proprietary Tetrabody technology to block PD-1 from binding to PD-L1 and PD-L2 while also preventing VEGF from binding to its receptors. Combining PD-1 inhibition with VEGF blockade has demonstrated strong efficacy in various cancers, including renal cell carcinoma, NSCLC, and hepatocellular carcinoma. Ivonescimab’s dual-targeting mechanism may enhance antitumor activity more effectively than combining separate PD-1 and VEGF inhibitors.

Akeso is currently conducting a Phase III trial comparing AK112 monotherapy with pembrolizumab as a first-line treatment for NSCLC patients with positive PD-L1 expression. Another Phase III trial is evaluating AK112 plus chemotherapy versus chemotherapy alone in EGFR-mutated, advanced nonsquamous NSCLC patients who have progressed after EGFR-TKI therapy. Additionally, multiple clinical trials are underway to explore AK112 across different treatment stages for NSCLC.

The US FDA has granted Fast Track Designation (FTD) for ivonescimab in combination with platinum-based chemotherapy for treating locally advanced or metastatic NSCLC with EGFR mutations after progression on EGFR-TKI therapy. In August 2023, China’s National Medical Products Administration (NMPA) Center for Drug Evaluation (CDE) granted priority review for ivonescimab’s New Drug Application (NDA). In November 2022, Akeso announced that the China NMPA’s CDE had awarded Breakthrough Therapy Designation (BTD) for ivonescimab combined with docetaxel for treating locally advanced or metastatic NSCLC in patients who had not responded to prior PD-(L)1 inhibitor and platinum-based doublet chemotherapy.

Summit Therapeutics’ September 2024 quarterly report noted that topline data from the global Phase III HARMONi trial in second-line or later EGFR-mutated advanced NSCLC is anticipated in mid-2025. In September 2024, Summit also announced plans to amend the HARMONi-3 study protocol to include both squamous and nonsquamous NSCLC patients without actionable genomic alterations, modify the primary endpoint to include progression-free survival (PFS) along with overall survival (OS), and increase the sample size to approximately 1,080 patients.

AstraZeneca’s Rilvegostomig

Phase III

Rilvegostomig is a bispecific antibody designed to target two key immune checkpoint proteins: PD-1 (programmed cell death protein 1) and TIGIT (T-cell immunoreceptor with Ig and ITIM domains). It has potential to enhance immune responses and fight cancer. When administered, rilvegostomig binds to both PD-1 and TIGIT, blocking their signaling pathways. Inhibiting PD-1 restores immune function by activating T cells and boosting T-cell-mediated responses. Blocking TIGIT, which is found on various immune cells, particularly tumor-infiltrating lymphocytes (TILs), prevents it from interacting with its ligands CD112 and CD155. This allows CD112 and CD155 to engage more effectively with the costimulatory receptor CD226 (DNAM-1) on immune cells like NK cells and CD8+ T cells, triggering CD226 signaling and enhancing immune responses against cancer cells. PD-1 normally acts as a brake on T-cell activation when bound to its ligands PD-L1 or PD-L2, helping tumors evade immune attacks. TIGIT also suppresses T-cell activity and contributes to immune evasion by tumor cells.

In September 2024, AstraZeneca shared efficacy and safety data from the ARTEMIDE-01 Phase I trial of rilvegostomig in patients with metastatic NSCLC at WCLC 2024.

Biotheus/BioNTech’s BNT327

Phase II/III

PM8002 is an advanced PD-(L)1-based bispecific antibody designed to inhibit both the PD-L1 and VEGF pathways. Its PD-L1-targeting arm enhances PD-L1-based enrichment, directing VEGF neutralization to the PD-L1+ tumor microenvironment (TME). This localized action aims to boost efficacy while minimizing off-target toxicity from VEGF inhibition. By addressing these two synergistic, clinically validated targets, PM8002 has the potential to serve as a foundational component for future combination therapies.

In November 2023, Biotheus and BioNTech signed an exclusive global licensing and collaboration agreement, granting BioNTech the rights to develop, manufacture, and commercialize PM8002 worldwide, excluding Greater China, where Biotheus retained commercialization rights.

In November 2024, BioNTech SE and Biotheus announced that BioNTech would acquire Biotheus, a clinical-stage biotech company focused on developing innovative antibodies for cancer and inflammatory diseases. Under the terms, BioNTech will pay Biotheus an upfront amount of $800 million, primarily in cash with a small portion in American Depositary Shares, to acquire 100% of Biotheus’ issued share capital, subject to standard adjustments. Additional milestone-based payments of up to $150 million are also included. The acquisition is expected to close in Q1 2025, pending regulatory approvals and other customary conditions.

Through this acquisition, BioNTech will secure full global rights to BNT327/PM8002. Clinical trials will assess BNT327/PM8002 in combination with chemotherapy for treating SCLC, NSCLC, TNBC, and other cancers.

RedCloud Bio’s H002

Phase I/II

H002 is a fourth-generation EGFR inhibitor developed by RedCloud Bio. In preclinical studies, it has demonstrated strong, broad-spectrum effectiveness and high selectivity against various EGFR mutations, including single mutations (Del19 and L858R), double mutations (Del19/C797S, L858R/C797S, Del19/T790M, and L858R/T790M), and triple mutations (Del19/T790M/C797S and L858R/T790M/C797S). These studies also showed that H002 provides sustained antitumor activity and has a favorable safety profile. Additionally, H002 exhibited potent antitumor effects in an EGFR-positive brain metastases model.

Phase I/IIa clinical trials for H002 in advanced NSCLC have begun in both the US and China. RedCloud Bio aims to develop H002 globally as a next-generation EGFR kinase inhibitor to address the significant unmet clinical needs of patients with EGFR TKI-resistant NSCLC.

AstraZeneca’s Sabestomig

Phase I/II

AZD7789 is a monovalent, bispecific, humanized IgG1 antibody that targets PD-1 and TIM-3, receptors involved in regulating antitumor activity and myeloid cell activation. Blocking both PD-1 and TIM-3 simultaneously may help overcome or delay resistance to anti-PD-(L)1 therapies. AstraZeneca shared Phase I safety and early efficacy results for AZD7789 at ESMO 2023. In November 2024, AstraZeneca announced that it expects Phase I clinical trial data for sabestomig in 2025.

Merus’ Pamvatamig

Phase I/II

Pamvatamig (MCLA-129) is an ADCC-enhanced human IgG1 Biclonics antibody that targets both EGFR and c-MET. In preclinical studies, MCLA-129 inhibits cancer cell growth and survival pathways while activating immune effector responses to destroy cancer cells. It has been shown to overcome tyrosine kinase inhibitor resistance in NSCLC cell lines and suppress tumor growth in NSCLC xenograft models. In January 2019, Merus announced an exclusive licensing agreement with Betta Pharmaceuticals, allowing Betta to develop and market MCLA-129 in China, while Merus retains rights to the drug outside of China.

The anticipated launch of these bispecific antibodies for NSCLC is poised to redefine the oncology treatment landscape. Additionally, this advancement is set to shake up the market dynamics, driving heightened competition among pharmaceutical giants and accelerating investments in next-generation immuno-oncology solutions.

With improved patient outcomes, reduced side effects, and broader applicability in diverse NSCLC subtypes, bispecific antibodies are anticipated to command significant market share. DelveInsight estimates that the market size for NSCLC in the 7MM is expected to grow from USD 30 billion in 2024, with a significant CAGR by 2034. The introduction of bispecific antibodies could fuel strategic partnerships, fast-track clinical trials, and create new revenue streams, reshaping the competitive landscape in lung cancer treatment.

Downloads

Article in PDF

Recent Articles

- Edwards’ Sapien 3 with Alterra Prestent; Koios Medical’s breast, thyroid cancer-spotting AI; Line...

- Bristol Myers’ Opdivo combo Opdualag for Melanoma; Biogen’s Aduhelm; Marinus’ Ztalmy for CDKL-5 D...

- IMFINZI’s AEGEAN Phase III Trial Data for Treating Resectable NSCLC; Ipsen and Day One’s Exclusiv...

- KEY CLINICAL OUTCOMES

- Evolving Landscape for Rare Biomarkers in Non-Small Cell Lung Cancer