Celiac Disease: The Hidden Epidemic of Gluten Sensitivity

Aug 14, 2020

The contribution of key pharma companies, such as 9 Meters Biopharma, ImmunogenX, Provention Bio, Cour Pharmaceuticals/Takeda, Precigen ActoBio, Falk Pharma, and Zedira is significant in driving Celiac disease market size.

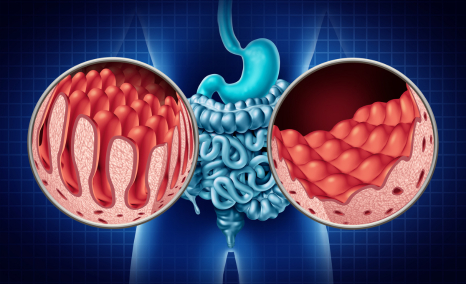

Who would have thought that consumption of gluten can trigger an autoimmune disorder? Although it may sound unbelievable, not aware to many, gluten sensitivity is a commonly occurring disease, also known as celiac sprue, nontropical sprue, or gluten-sensitive enteropathy. Gluten is a protein in wheat, barley, rye, and other grains and is what makes dough elastic and gives bread its chewy texture. Celiac Disease (CD) is one of the most underdiagnosed or misdiagnosed diseases, and the interesting part is that there are regional differences when it comes to the diagnosis and screening of this disease. The disease was once thought to be rare, but after years or a decade of serological testing, it has been found to be much more prevalent than estimated previously. Also, women are more susceptible to CD than men due to the different biological roles of the two genders.

The gold standard for CD diagnosis is represented by the combination of mucosal changes detected by duodenal biopsy and the positivity of serological tests.Despite the progress made in serology, no antibody test available currently results in sensitivity and specificity of 100%; thus, requiring intestinal biopsy as a key adjunct for establishing a correct diagnosis.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Takeda acquisition on Shire raises its share by 25 percent

- Sygnis AG and ECACC Collaboration; BioNTech and Genentech Partnership; Partnership between Zydus ...

- Merck, Eisai in renal cancer market; G1 Therapeutics on Cosela’s approval; Takeda’s Maribav...

- Takeda scores; PhRMA launches; Valeant’s Obagi; Ex-Novo executive signs

- Takeda’s ADZYNMA Approved by FDA; AskBio Presents Preliminary Data from Phase I Trial of Gene The...

Earlier, the condition was found to be more prevalent in Europe than in the United States; however, as per recent studies, the numbers are found to be similar in both regions. As per DelveInsight, there were 687,959 Celiac disease diagnosed cases in 2019 in the United States. Furthermore, among EU5 countries, Italy is leading with the maximum diagnosed cases nowadays, the diagnostic rate of CD in Italy is much higher than in the past, mainly because of the case-finding policy adopted by doctors and greater disease awareness. As per the Italian Health Ministry, a significant increase in celiac diagnosis during the first decade has been witnessed with an average increase of around 10,000 patients/year; yet, there is still a long way to go. According to DelveInsight, there were 226,843 diagnosed cases in Italy in the year 2019 and the number is expected to show a high jump in the coming 10 years.

Additionally, the United Kingdom has witnessed a four-fold increase in the rate of celiac diagnoses over the past two decades.

Specialists refer to the celiac ‘iceberg’ when considering this vast number of undiagnosed cases.

In France, the condition seems to occur in a very less number of patients. Reasons for such low prevalence are unclear because the French population does consume plenty of gluten in the form of bread and other bakery products. The low prevalence can also be attributed to low awareness and even less screening in the country. Nonetheless, as per the latest news, people living in France who suspect they may be intolerant to gluten can now take an at-home test that is said to be 98.8% reliable.

To date, celiac disease is considered to be a rare indication in Japan, which may be attributed to extremely low screening and diagnosis rates of the indication in the Japanese population. Another major factor that needs to be considered is that Japanese cuisine possesses quite low amounts of gluten in it; however, this scenario is expected to change over the years due to an increase in gluten intake among the Japanese population.

Now, the question arises, If not gluten, what are these people consuming? The answer shines in the form of a Gluten-free Diet (GFD), which is the only option to alleviate the complication associated with the condition. The only preventive measure to get rid of CD is to permanently remove gluten from the diet, which allows the intestinal villi to heal and to begin absorbing nutrients properly. In some cases, steroid-based medications, i.e., corticosteroids, including prednisolone, can also be prescribed as supportive therapies in the case of celiac crisis and RCD II patients. However, there is another set of patients known as non-responsive patients (NRCD), who report of continuation of symptoms and/or signs of celiac disease (CD) despite being on a gluten-free diet (GFD).

The contribution of key pharma companies, such as 9 Meters Biopharma, ImmunogenX, Provention Bio, Cour Pharmaceuticals/Takeda, Precigen ActoBio, Falk Pharma, and Zedira is significant in accelerating the Celiac disease market size. As per DelveInsight the Celiac Disease current market size (2020) is 833 USD million in the United States. Except for Provention Bio’s monoclonal antibody, all the companies in the Celiac disease market have successfully met their primary endpoints in their Phase II results and have received Fast Track Designations for early approval. The leading player with the earliest launch date is expected for 9 Meters Biopharma, which is developing Larazotide—an oral peptide that acts by normalizing the disrupted tight junctions between the gut cells seen in CD patients. Currently, it is the only late-stage (Phase III) drug, which is being investigated for the relief of persistent symptoms in adult CD patients. 9 Meters Biopharma is targeting the launch of its drug as early as possible owing to the current unmet need for unavailability of promising symptomatic as well as curable treatment options. The company expects to release the interim results of this trial in the second half of 2021 and is also seeking commercialization partners to reach out to patients directly, using consumer advertising and branding in the US, which will help them to expand their market at a larger scale as the patients will have a direct reach to the medicine.

Another potential player, ImmunogenX is investigating Latiglutenase (IMGX003) in the Phase II gluten-challenge study to evaluate both mucosal and symptomatic protection in a general population of CD patients. It is another symptomatic treatment for CD patients, and the study is to be followed shortly by a phase II/III real-world trial that will focus on symptom improvement in seropositive patients as a prelude to a phase III trial.

Furthermore, PRV-015 (formerly known as AMG 714) is a fully human IL-15 monoclonal antibody that is being developed by another major company in the market, Provention Bio for the treatment of GFD non-responsive CD (NRCD). The drug has already completed a Phase II clinical developmental trial for patients suffering from Refractory CD II and another phase II trial for CD patients, which was conducted only in Finland, with quite an unsatisfactory results in both the trials. However, the company has planned another Phase II trial, in August 2020 for treating GFD non-responsive CD patients, to re-establish their safety and efficacy before applying for marketing approval.

Takeda is finally developing TAK-101, a disease-modifying agent, and an extremely novel immune modifying biodegradable nanoparticle encapsulating gliadin proteins for the treatment of CD. Takeda acquired an exclusive global license for CNP-101 from Cour Pharmaceuticals’in October 2019. The company is expected to have a perfect deal with the regulatory bodies based on its novel mechanism of action as well as its disease-modifying nature. Cour Pharma used their nanoparticle platform to trick the body into believing that gliadin, the gluten component that triggers the autoimmune response, is a natural bodily antigen: friend, not foe. They encased gliadin in a biodegradable polymer smaller than a micron and sent it whirling Alice in Wonderland style through the body – ushered by monocyte “sentinels” down into the spleen and livers, where antigen-presenting T-cells encoded it as non-harmful. Based on this optimistic approach and promising Phase II results, the company is expected to boost the treatment market in a positive way. Moreover, the best disease reversing therapy is being developed by an early-stage company in celiac disease market, ActoBio, which is developing antigen-specific investigational immunotherapy candidates with the potential to reverse gluten sensitivity.

Although the current major unmet need is reversal or prevention of the disease from further progression, most of the late-stage players target symptoms associated with the celiac disease (CD); hence there is still time for the cure to be available, wherein the underlying disease is eradicated from scratch. In recent time, the market is going to be dominated by GFDs mainly, as they are being used as an adjunct to any of the celiac disease pipeline therapy. Nonetheless, the increasing diagnosed prevalence of the disease, increasing awareness among physicians and patients, upcoming promising emerging therapies, and active R&D is anticipated to fuel the market size during the coming decade.

Downloads

Article in PDF

Recent Articles

- HUTCHMED’s NDA Submission to FDA for Fruquintinib; Cytokinetics to Discontinue ALS Drug Candidate...

- Top 6 Celiac Disease Therapies Progressing in Mid-Stage Trials

- Takeda’s ADZYNMA Approved by FDA; AskBio Presents Preliminary Data from Phase I Trial of Gene The...

- ALCMI, ALCF and Scancell partner; Sun unloads Ohm Labs plants; Takeda and Ovid join; Guardant and...

- Oncology Therapeutics Making Big in Coming Years