Cervical Cancer Market Has A Lot Going On Under The Hood

Nov 07, 2024

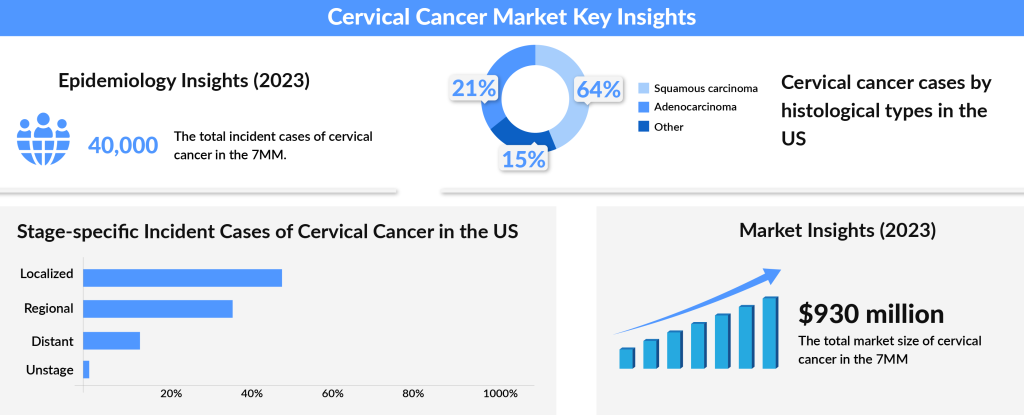

Cervical cancer is the fourth most common type of cancer and the fourth leading cause of death in women. According to the WHO, HPV infections contribute to an estimated 530,000 cases of cervical cancer and 264,000 related deaths annually, with over 85% of these fatalities occurring in low- and middle-income countries. HPV vaccination can significantly lower the incidence of cervical cancers caused by the virus. In 2022, there were approximately 660,000 new cases of cervical cancer and 350,000 related deaths worldwide.

The rising incidence of cervical cancer is closely linked to a surge in HIV infections among women, which significantly increases the risk of developing pre-invasive cervical lesions. Improved screening technologies and greater awareness in developed countries have also contributed to higher diagnosis rates.

Downloads

Article in PDF

Recent Articles

- Merck, Gilead teams up for HIV treatment; Bright Future for Sanofi/Regeneron’s Libtayo; Roche acq...

- Cervical cancer

- Boehringer Ingelheim’s Diabetic Macular Ischemia Study; Novartis’ Mariana Oncology Acquisition; A...

- Top 5 Cancers Creating Major Challenge To The Global Healthcare System

- Sanofi’s Rare Disease Drug Xenpozyme’ Approval; FDA Approves Novartis’ Pluvicto; AstraZenec...

Despite progress in research, with advanced screening sensitivity and HPV vaccines that help prevent the virus, cervical cancer remains a substantial global healthcare challenge. In many cases, inadequate disease awareness and subtle symptoms delay diagnosis, enabling the cancer to spread further.

In about 10–15% of cervical cancer cases, doctors detect the disease in advanced stages, significantly complicating treatment outcomes. While localized cervical cancer boasts a promising five-year survival rate of over 90%, the outlook for patients with metastatic cervical cancer is far less hopeful, with survival rates dropping below 20%. This disparity underscores the urgent need for improved awareness, early detection, and innovative therapies in the fight against cervical cancer.

Doctors individualize cervical cancer treatment based on the cancer’s stage, the patient’s overall health, and their personal preferences. Physicians often take a multidisciplinary approach, combining surgery, radiation, chemotherapy, targeted therapy, or even immunotherapy to achieve the best possible outcomes.

For early-stage cases (stage IA-IB1), radical hysterectomy remains the gold standard, effectively removing cancerous tissue through surgery. As the cancer progresses to more advanced stages (IIB2-IVA), chemoradiation or concurrent chemoradiotherapy (CCRT) becomes the preferred approach, targeting the tumor with intense precision. When the cancer has spread further, palliative care takes priority, with systemic treatments designed to manage symptoms and improve quality of life.

Emerging treatments, like immunotherapy, offer hope for advanced cases by leveraging the body’s immune system to target cancer cells more effectively. With a variety of evolving treatment strategies, the cervical cancer treatment landscape continues to advance, bringing a broader set of therapeutic options to patients at every stage of the disease.

However, recently, these approaches have come under scrutiny. Most patients put under the regimen experience recurrence. The inability to combat the recurrence of cancer adds to the cost of the treatment, leaving patients as well as caretakers in a state of quandary. Further, the treatments have a long-term relationship with adverse toxicities such as radiocystitis, radiation enterocolitis, vaginal stenosis, and pelvic adhesion.

Therefore, several pharma companies are proactively exploring novel treatment options to treat cervical cancer. Key companies such as ADC therapeutics, Agenus, Akeso Biopharma, AstraZeneca, Betta Pharmaceuticals, Biocad, Bristol Myers Squibb, Exelixis, Genentech (Roche), Genmab, and many others are actively engaged in accelerating the cervical cancer market size. The firms are evaluating their contenders at different stages of clinical development.

Besides, some of the companies exploiting their candidates at earlier stages of development include Daiichi Sankyo/ AstraZeneca, Xencor, Iovance Biotherapeutics, Verastem, and Akeso. Companies are investing in novel therapeutic agents and exploring existing treatment modalities to add their own charm.

What The Future Hold For Cervical Cancer Market?

Before digging into the cervical cancer drug pipeline, here, the addition of AVASTIN (bevacizumab) – targeted therapy – to the armamentarium is worth reckoning. Regarded as one of the most significant advancements in the cervical cancer treatment market for recurrent and metastatic cases, Roche’s recombinant humanized monoclonal IgG1 antibody, AVASTIN, is approved for several cancers, including recurrent or late-stage (metastatic) cervical cancer.

The drug has enjoyed a monopoly in the cervical cancer market for years. However, as AVASTIN’s period of market exclusivity ended in 2019 in the US, the market witnessed a heavy pouring of biosimilars. Pfizer’s ZIRABEV, Amgen’s MVASI, and Samsung’s AYBINTIO are among the copy versions of AVASTIN that have been approved for cervical cancer. The companies are also eyeing the European cervical cancer market, however, AVASTIN still has a few years to spare.

On April 29, 2024, the FDA granted full approval to TIVDAK (tisotumab vedotin-tftv), developed by Seagen (now part of Pfizer), for recurrent or metastatic cervical cancer in patients with disease progression after chemotherapy. TIVDAK initially received accelerated approval for this use in 2021. This antibody-drug conjugate (ADC) targets tissue factor (TF) using Genmab’s human monoclonal antibody combined with Pfizer’s ADC technology, which attaches the cell-killing agent monomethyl auristatin E (MMAE) through a cleavable linker. In early 2024, the European Medicines Agency validated its marketing authorization application, bringing TIVDAK closer to availability for patients in Europe.

Another advancement shaping the recurrent/metastatic cervical cancer market in the foreseeable future is Immunotherapy. Merck has also approved KEYTRUDA (Pembrolizumab) for advanced cervical cancer in PD-L1-positive patients. KEYTRUDA is a leading man of the company, taking leaps and bounds in the field of cancer. Merck secured seven approvals for KEYTRUDA in several other cancers last year, with many more likely on the horizon. However, the journey for the therapy will not be free of obstacles, as it will soon be wrestling with Regeneron’s Libtayo (Cemiplimab) for the cervical cancer market share. Libtayo is in the Phase III trial of development in the drug pipeline for cervical cancer.

Emerging Therapies in the Cervical Cancer Treatment Pipeline

Several players are actively evaluating their candidates for the treatment of cervical cancer, following these approved drugs. AstraZeneca is one of those in this race with its drug IMFINZI (durvalumab). The therapy is in the Phase III trial under evaluation in concurrence with chemoradiation therapy (SOC CCRT) and brachytherapy.

Another player worth a mention here is Iovance Biotherapeutics. The company is investigating its tumor-infiltrating lymphocyte (TIL) therapy, LN-145, in cervical cancer patients. Although the trial is in early Phase II, the results look very promising, and if everything down the track goes smoothly, it can be a great addition to the cervical cancer market.

AstraZeneca’s Volrustomig is an investigational therapy in the cervical cancer treatment pipeline. This bispecific monoclonal antibody, administered intravenously, targets both programmed cell death protein 1 (PD-1) and cytotoxic T lymphocyte protein 4 (CTLA4). AstraZeneca is currently evaluating Volrustomig in its Phase III eVOLVE-Cervical study (NCT06079671), focusing on women with high-risk, locally advanced cervical cancer (FIGO 2018 stage IIIC to IVA with lymph node involvement) who remain stable after platinum-basedchemoradiotherapy(CCRT). The company anticipates accepting its first regulatory filing after 2025.

While several companies are putting their faith in targeted therapies and immunotherapies, TECENTRIQ (atezolizumab) is emerging as a strong candidate in cervical cancer treatment. In a Phase III trial, combining TECENTRIQ with Avastin and chemotherapy significantly improved median overall survival (32.1 vs. 22.8 months) and progression-free survival (13.7 vs. 10.4 months) compared to standard care. Although associated with a high rate of serious adverse events (79%), this promising combination could soon redefine frontline treatment options.

Inovio Pharmaceuticals is advancing VGX-3100, a therapeutic cancer vaccine for cervical dysplasia. The REVEAL1 Phase III trial met its endpoints, showing that the HPV-16/18 clearance achieved at week 36 was sustained through week 88. However, the REVEAL2 trial, focused on a biomarker-based subgroup, showed no significant benefit over a placebo, leading the FDA to dismiss it as pivotal. Despite this, VGX-3100 still demonstrated efficacy in lesion regression and viral clearance in the broader patient population, suggesting further potential in cervical cancer treatment.

The cervical cancer market is rapidly evolving, with new advancements reshaping the treatment landscape. As the cervical cancer pipeline expands, innovative therapies are offering new hope to patients worldwide. While challenges like late-stage diagnosis and resistance to current treatments persist, the ongoing research and development of cervical cancer drugs promise to unlock more effective solutions.

As the market continues to grow, these advancements hold the potential to significantly improve survival rates and quality of life for those affected by this global healthcare challenge, marking a pivotal moment in the fight against cervical cancer.