Chemotherapy Induced Febrile Neutropenia Market: High time to end the monopoly

Apr 27, 2020

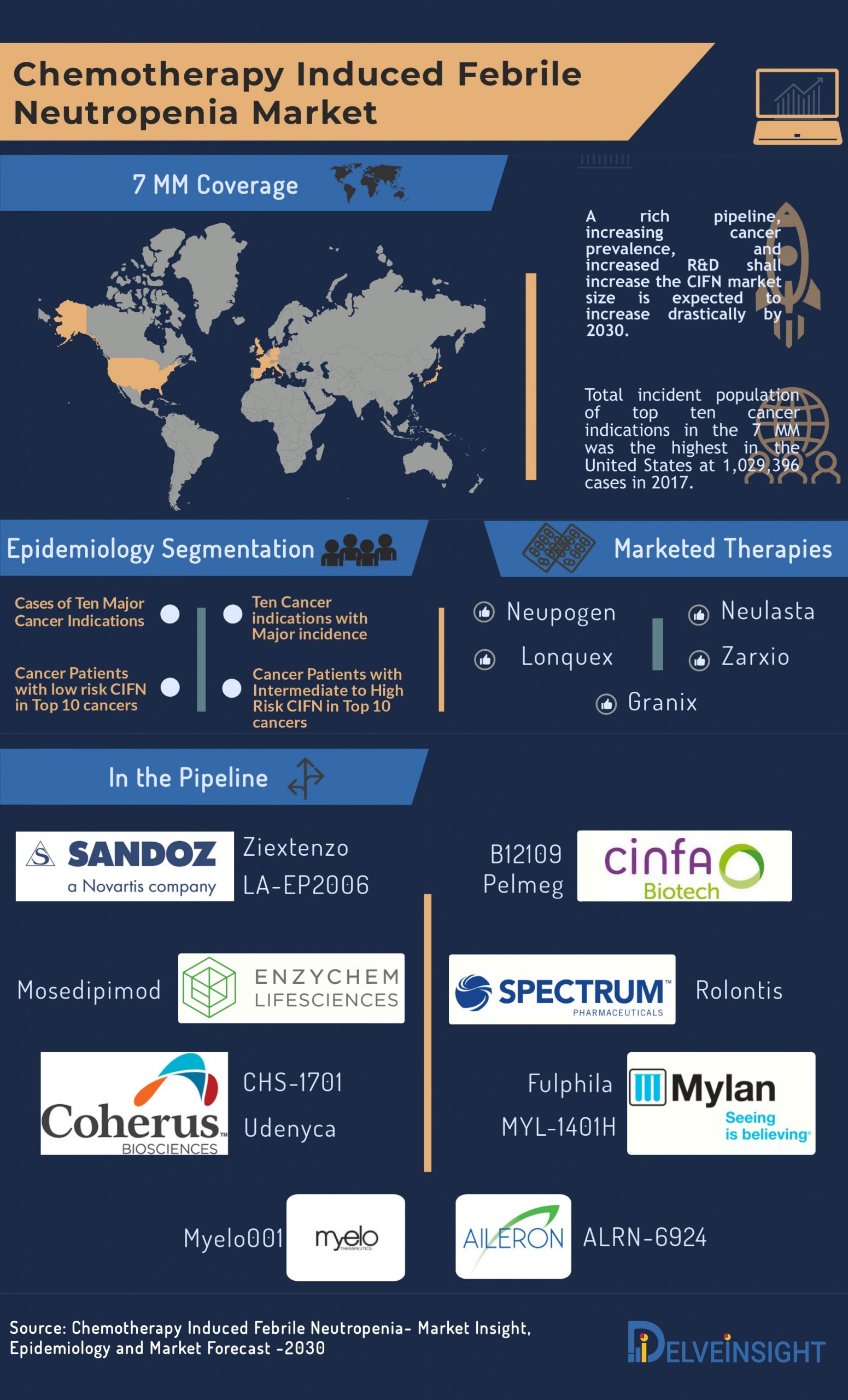

A rich pipeline in the Chemotherapy Induced Febrile Neutropenia market with promising clinical pieces of evidence, CIFN market size is expected to increase drastically by 2030

A range of breakthroughs and series of medical advancements have significantly helped in dampening down the global burden of cancer, which as per a report by WHO was estimated to be 18.1 million new cases and 9.6 million deaths in 2018. Improved diagnosis, testing and awareness have facilitated early detection of cancer and targeting cancer through surgery, radiation therapy, chemotherapy and immunotherapy have overall increased survival rate, and life expectancy of the cancer patients.

However, with the inclination towards cytotoxic approaches to target and kill cancer, several complications arise such as killing or destroying neutrophils or white blood cells. Neutropenia is one of the most severe hematologic toxicities of cancer chemotherapy and often limits the doses of chemotherapy tolerated by the patients. It is a condition that results in a low neutrophil count in the blood, thus rendering the patient susceptible to infections from pathogens, ultimately leading to fever – in the case known as Chemotherapy Induced Febrile Neutropenia (CIFN).

Downloads

Article in PDF

Recent Articles

- LEQEMBI Intravenous Infusion Approval; Novartis’ Presented Updates on Lutathera; FDA Accept...

- Phase III RUBY Trial of Jemperli Plus Chemotherapy Updates; FDA Approves Roche’s Vabysmo for RVO;...

- Analyzing the Growth of the Biosimilar Market Through Years

- Meeting the Unmet Need for Oral Mucositis

- Celecoxib first Generic Approval to Teva and Mylan from FDA

Febrile neutropenia is one of the most common and adverse complications of chemotherapy, which in addition to reduced immunity, also delays the course of treatments, leads to early termination of the doses, and compromises with the potential of curing the patient. It is often associated with increased treatment cost, morbidity and mortality.

Chemotherapy Induced Febrile Neutropenia Market: Marketed therapies

A result of chemotherapy – often myelosuppressive – the condition calls for urgent evaluation, and monitoring. The current standard of care in Chemotherapy Induced Febrile Neutropenia market is granulocytic colony-stimulating factor (G-CSF). In the U.S. and Europe, G-CSF is being used prophylactically only in high-risk patients and as a therapeutic once neutropenia is detected.

The first and only approved human G-CSF – Neupogen (Filgrastim) – an Amgen’s product – is a leukocyte growth factor indicated to decrease the occurrence of infection‚ reduce the time to neutrophil recovery and the duration of fever, following induction or consolidation chemotherapy treatment of patients with acute myeloid leukemia (AML). When Neupogen first entered the market in 1991, it proved to be a blockbuster and managed to dominate Chemotherapy Induced Febrile Neutropenia market even with high prices and a few limitations. The patent expiry of Neupogen paved the way for biosimilars to have their fair share of CIFN market.

Zarxio by Sandoz became the first approved biosimilar in 2009 in E.U. and in 2015 in the U.S. The biosimilar is a leukocyte growth factor indicated to decrease the incidence of infection and reduce the time to neutrophil recovery and the duration of fever. Since its launch, Zarxio has posed to be a fierce competition to Neupogen. However, the launch of Neulasta by Amgen again turned the tables, owing to its administration once-during the chemotherapy cycle. Other marketed therapies in the Chemotherapy Induced Febrile Neutropenia market are Teva’s Granix in U.S. and Lonquex in other parts of the world.

However, G-CSF treatments did not prove to be 100% effective with associated side effects such as splenic rupture, severe bone pain, chest pain, nausea, hypoxemia, and they were not pocket friendly either. Moreover, they are administered after 1-3 days of chemotherapy; if administered the same day, it may worsen neutropenia.

Chemotherapy Induced Febrile Neutropenia Market: Unmet needs and R&D in the space

The current limitations of the treatments and therapies have led doctors and physicians to hunt for the alternatives to existing therapies with the help of extensive R&D in the domain. The therapeutics in the Chemotherapy Induced Febrile Neutropenia pipeline is mostly biosimilars of G-CSF or antibiotics that differ in their mechanisms and approaches to treat CIFN in several aspects, hence have the edge over the marketed ones.

Rolontis (Spectrum Pharmaceuticals), Fulphila (Mylan Pharmaceuticals), Udenyca (Coherus Biosciences), Mosedipimod (Enzychem), Pelmeg (Cinfa Biotech S.L.), Ziextenzo (Sandoz Pharmaceuticals), Myelo001 (Myelo Therapeutics), ALRN-6924 (Aileron Therapeutics) along with Neulasta biosimilars including MYL-1401H (Mylan Pharmaceuticals), CHS-1701 (Coherus Biosciences), B12109 (Cinfa Biotech S.L.) and LA-EP2006 (Sandoz Pharmaceuticals) are anticipated to impact Chemotherapy Induced Febrile Neutropenia market positively.

In addition to Spectrum Pharmaceuticals, Mylan Pharmaceuticals, Coherus Biosciences, Enzychem, Cinfa Biotech, Sandoz Pharmaceuticals, Myelo Therapeutics, Aileron Therapeutics, Mylan Pharmaceuticals, other pharma companies such as Generon Corporation, and USV Biologics are also investing their funds and time in developing an effective cure to address the unmet needs in the Chemotherapy Induced Febrile Neutropenia market.

A rich pipeline in the Chemotherapy Induced Febrile Neutropenia market with promising clinical pieces of evidence, CIFN market size is expected to increase drastically by 2030. The emerging drugs are going to grab the share, thus ending the monopoly of Neulasta in the CIFN market. As per DelveInsight, CIFN market will witness the entry of several potential drugs that will cut down the share of Neulasta and deteriorate its earnings.

Overall, a robust pipeline filled with novel therapies along with the rising prevalence of the disease will lead to a significant boost to the Chemotherapy Induced Febrile Neutropenia market revenue generated during the forecast period [2020-2030].

Febrile neutropenia is one of the most common and adverse complications of chemotherapy that results in reduced immunity, delayed course of treatment, early termination of the doses, increased treatment cost, morbidity and mortality.

Rolontis, Fulphila, Udenyca, Mosedipimod, Pelmeg, Ziextenzo, Myelo001, ALRN-6924, MYL-1401H, CHS-1701, B12109 and LA-EP2006 are anticipated to impact Chemotherapy Induced Febrile Neutropenia market positively.

Spectrum Pharmaceuticals, Mylan Pharmaceuticals, Coherus Biosciences, Enzychem, Cinfa Biotech, Sandoz Pharmaceuticals, Myelo Therapeutics, Aileron Therapeutics, Mylan Pharmaceuticals, Generon Corporation, and USV Biologics are the key companies in the CIFN market.

The current limitations of the treatments including not 100% effective, associated side effects such as splenic rupture, severe bone pain, chest pain, nausea, hypoxemia, affordability, and administration duration are the major unmet needs in the CIFN market.

Downloads

Article in PDF

Recent Articles

- Meeting the Unmet Need for Oral Mucositis

- Celecoxib first Generic Approval to Teva and Mylan from FDA

- LEQEMBI Intravenous Infusion Approval; Novartis’ Presented Updates on Lutathera; FDA Accept...

- Analyzing the Growth of the Biosimilar Market Through Years

- Phase III RUBY Trial of Jemperli Plus Chemotherapy Updates; FDA Approves Roche’s Vabysmo for RVO;...