Dry AMD Market: Pegcetacoplan or Zimura, Which Therapy Will Dominate the Market?

May 27, 2022

The Dry AMD market is a billion-dollar business opportunity today as around 80–90% of individuals are affected by it. As per DelveInsight analysis, there were approximately 34.9 million cases of Dry AMD in 2021. Moreover, in 10–15% of patients with Dry AMD, the deterioration is more rapid and extensive, and they suffer significant vision loss due to Geographic Atrophy (GA)—an aggressive form of Dry AMD.

Geographic Atrophy is less prevalent, accounting for 10–20% of all cases of legal blindness caused by Age-related Macular Degeneration. In 10-15% of patients with Dry AMD, the deterioration is more rapid and extensive, and they suffer significant vision loss due to Geographic Atrophy. Most companies are currently developing therapies for Geographic Atrophy treatment, pertaining to this. Due to the lack of approved therapies, the first drug to receive regulatory approval can have a first-mover advantage compared to other Dry AMD pipeline therapies.

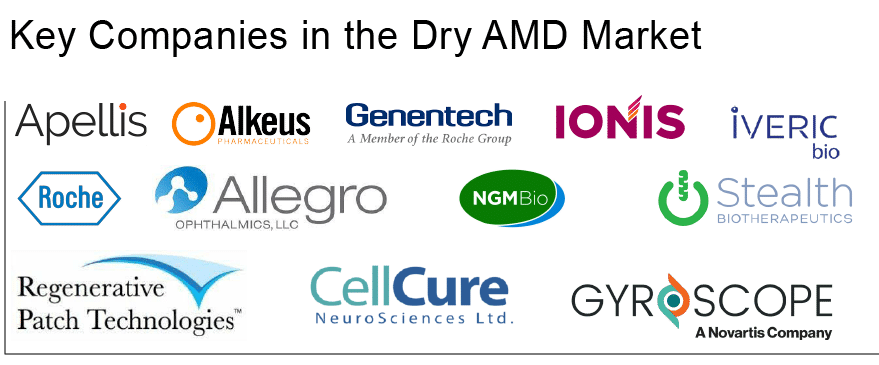

Key Dry AMD companies with their lead products such as Apellis Pharmaceuticals (Pegcetacoplan), Alkeus Pharmaceuticals (ALK-001), Iveric bio (Zimura), Genentech (Roche; RO7171009; RG6147), Ionis Pharmaceuticals/Roche (IONIS-FB-LRx), Allegro Ophthalmics (Luminate), NGM Biopharmaceuticals (NGM621), Stealth BioTherapeutics (Elamipretide), Regenerative Patch Technologies (CPCB-RPE1), CellCure Neurosciences (OpRegen), Gyroscope Therapeutics (GT005), and others are working on developing a new treatment for Dry AMD.

Downloads

Article in PDF

Recent Articles

- Notizia

- Novartis on AMD drug; Hospira recall of vials; Takeda wraps up; FDA bans imports

- Retinal Degeneration : The Current Pipeline Scenario

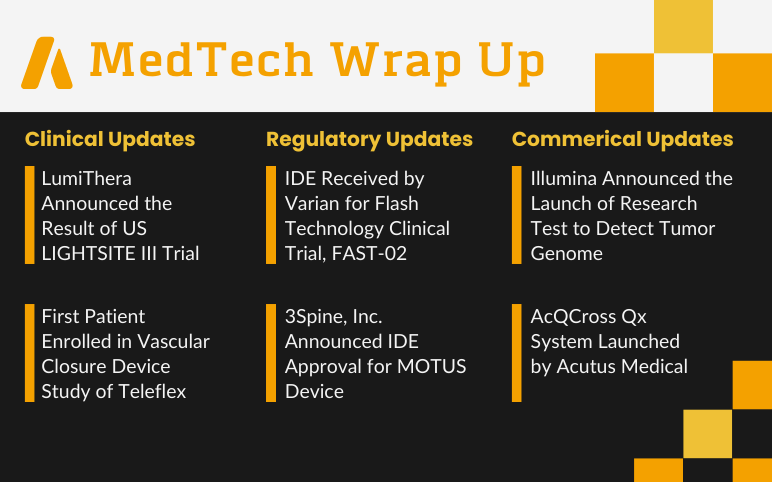

- LumiThera’s US LIGHTSITE III Trial; First Patient Enrolled in Vascular Closure Device Study of Te...

- Dry AMD Treatment- An Underserved Market With Billion-Dollar Potential

The closest rivals and most potential candidates in the Dry AMD market race are pegcetacoplan, developed by Apellis Pharmaceutical, and zimura, developed by Iveric bio. Both these drugs can be seen as a potential treatment to reduce the progression of Geographic Atrophy and will be available soon in the Dry AMD market.

Apellis Pegcetacoplan (formerly known as APL-2) is a synthetic cyclic peptide conjugated to a PEG polymer that binds specifically to C3, effectively blocking all three pathways of complement activation (classical, lectin, and alternative). Besides Geographic Atrophy, pegcetacoplan is also in Phase III for Cold Agglutinin Disease (CAD), Complement 3 Glomerulopathy (C3G), and Immune-complex Membranoproliferative Glomerulonephritis (IC-MPGN). A subcutaneous drug formulation is already approved for Paroxysmal Nocturnal Hemoglobinuria (PNH) treatment. According to Phase III results at 12 months, the OAKS study met its primary endpoint, while the DERBY study failed to meet its primary endpoint. However, Apellis’ chances of getting intravitreal pegcetacoplan approved for Geographic Atrophy improved following an 18-month study in the pivotal DERBY and OAKS trials in March 2022, indicating a favorable safety profile for Geographic Atrophy secondary to Age-related Macular Degeneration. The reduction in Geographic Atrophy lesion growth improved with monthly pegcetacoplan treatment from 13% to 21% from 0–6 to 12–18 months. Apart from these two Geographic Atrophy trials, the company is also conducting another Phase III trial, an extension study evaluating the long-term safety and efficacy in patients who participated in Study APL2-103 or completed the Dry AMD treatment at Month 24 of either DERBY or OAKS study.

|

|

|||||

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apellis plans to submit an NDA, to the US FDA, in the second quarter of 2022 to approve intravitreal pegcetacoplan for Dry AMD treatment; the submission would be supported by the completed Phase II and Phase III Dry AMD clinical trials. The company is also planning to begin pre-submission disclosures to the European medicines agency (EMA) in the first quarter of 2022 and submit a marketing authorization application (MAA) to the EMA in the second half of 2022.

On the other hand, Iveric zimura (avacincaptad pegol) showed a reduction in the mean rate of Geographic Atrophy growth by 28.11% for the zimura 2 mg group as compared to the corresponding sham control group and 29.97% for the zimura 4 mg group as compared to the corresponding sham control group over 18 months in Phase II/III (GATHER1/ OPH2003) study. Data from additional post hoc analyses were consistent with the primary analysis results. The company has received a written agreement from the US FDA, under a special protocol assessment (SPA), for the overall design of the Phase III (GATHER2) trial. The company is planning to submit a new drug application (NDA) to the FDA for marketing approval of zimura for Geographic Atrophy treatment if the GATHER2 data are positive. The company is also planning to initiate a Phase III clinical trial evaluating zimura for patients with intermediate Age-related Macular Degeneration. However, there can be no guarantee that Iveric’s second pivotal trial could be a letdown, as Apellis’ was. In Iveric’s defense, C5 is arguably a more popular and proven target than C3. Iveric is in pole position to confirm that the C5 complement pathway inhibition approach to treating Geographic Atrophy and, more broadly, Age-related Macular Degeneration works. If it succeeds in doing that next year, it will be in pole position for commercialization. Apart from Geographic Atrophy, zimura is also in Phase II clinical trials for Stargardt Disease – a market opportunity worth a few hundred million but a potentially significant opportunity to establish further proof-of-concept for zimura and the company’s gene therapy pipeline. As already mentioned, the addressable markets for Geographic Atrophy and Age-related Macular Degeneration are huge – zimura, if approved, looks like a guaranteed blockbuster. Moreover, Pegcetacoplan is anticipated to generate over 900 million dollars in revenue in the Dry AMD market by 2032, while zimura could generate over a billion dollars in the United States Dry AMD market.

As per our estimate, even though pegcetacoplan is expected to launch first in the Dry AMD market, zimura will have the edge over pegcetacoplan. Owning to its compelling efficacy in slowing the growth of Geographic Atrophy lesions with an immaculate safety/tolerability profile to date. Approval of therapies for Dry AMD is expected to pave the way for exciting novel therapeutic opportunities in the Dry AMD market. The expected entry of these novel Dry AMD therapies with different mechanisms of action may change the treatment regimen of Dry AMD.

FAQs

Dry AMD is a progressive degeneration of the macula cells that occurs over many years as retinal cells die and are not replaced. The term 'dry' does not imply that the individual has dry eyes.

Dry AMD symptoms appear gradually and are usually painless. They include visual distortions, reduced central vision in one or both eyes, decreased intensity or brightness of colors, increased blurriness of printed words, and others.

There is currently no Dry AMD treatment available. However, numerous clinical trials are currently underway by several companies to improve the Dry AMD treatment landscape.

As per DelveInsight analysis, there were approximately 34.9 million cases of Dry AMD in 2021. These numbers are further expected to increase by 2032.

Key therapies in the Dry AMD pipeline include Pegcetacoplan, ALK-001, Zimura, RO7171009, RG6147, IONIS-FB-LRx, Luminate, NGM621, Elamipretide, CPCB-RPE1, OpRegen, GT005, and others.

Leading pharma companies such as Apellis Pharmaceuticals, Alkeus Pharmaceuticals, Iveric bio, Genentech, Ionis Pharmaceuticals, Roche, Allegro Ophthalmics, NGM Biopharmaceuticals, Stealth BioTherapeutics, Regenerative Patch Technologies, CellCure Neurosciences, Gyroscope Therapeutics, and others are working on developing a novel approach to treating Dry AMD.

Downloads

Article in PDF

Recent Articles

- LumiThera’s US LIGHTSITE III Trial; First Patient Enrolled in Vascular Closure Device Study of Te...

- Global Top Players in Intraocular Lens (IOL) Market

- Vir’s drug shows results; Abbott launches coronavirus antibody lab test; Reprogrammed skin ...

- Dry AMD Treatment- An Underserved Market With Billion-Dollar Potential

- Novartis on AMD drug; Hospira recall of vials; Takeda wraps up; FDA bans imports