Insights into Cancer Cachexia Treatment: Unraveling the Mystery

May 03, 2024

Cancer cachexia, a debilitating condition characterized by severe weight loss and muscle wasting, complicates the battle against cancer. Approximately half of all patients with cancer experience cachexia. This rate of occurrence rises to as high as 86% in the last 1–2 weeks of life, with 45% of patients losing more than 10% of their original body weight over disease progression.

Cancer cachexia impacts approximately 60% of the 1.4 million patients diagnosed with cancer in the United States each year. Additionally, the occurrence of cachexia varies across cancer types and ranges from 60% among lung cancer patients to about 80% among gastrointestinal cancer (pancreas, stomach, colorectal, and esophagus) patients. It is estimated that more than 30% of cancer patients die due to cachexia, and more than 50% of patients die with cachexia being present. Among late-stage patients, cachexia affects 50–80% of cancer patients.

DelveInsight estimated that there has been an increasing trend observed among cancer cachexia patients during the forecast year (2024–2034). Although the prevalence of cancer cachexia has been found to occur from the localized stage of cancer to the advanced or metastatic stage, the ratio is quite high in the case of advanced stages of cancer.

Downloads

Click Here To Get the Article in PDF

The present strategies for cancer cachexia treatment in the United States encompass a range of methods, including pharmaceutical treatments such as corticosteroids and progesterone medications, along with the utilization of an anamorelin.

Progestational drugs like megestrol (Megace) and medroxyprogesterone can cause increased appetite and weight gain in individuals suffering from anorexia and cachexia. A randomized, prospective clinical study comparing megestrol (800 mg/d) to dexamethasone (0.75 mg qid) showed that both medications had similar effects on patients’ appetites. However, megestrol was linked to a higher occurrence of blood clot-related events, whereas dexamethasone was associated with more instances of muscle weakness, changes in body appearance resembling Cushing’s syndrome, and peptic ulcers.

Although corticosteroids and progestational agents have shown effectiveness in treating cancer-related anorexia and cachexia, they typically don’t provide significant long-term benefits for most patients. As a result, alternative treatments like enteral or parenteral nutrition have been thoroughly investigated.

On January 22, 2021, Ono Pharmaceutical and Helsinn Group jointly announced that ONO had obtained approval for manufacturing and marketing ADLUMIZ (anamorelin), a ghrelin receptor agonist, for the treatment of cancer cachexia associated with non-small cell lung cancer, gastric cancer, pancreatic cancer, or colorectal cancer in Japan. ADLUMIZ is a selective, innovative ghrelin receptor agonist designed for oral administration. Ghrelin, a natural peptide predominantly produced by the stomach, triggers various pathways upon binding to its receptor, positively influencing body weight, muscle mass, appetite, and metabolism. Clinical studies have demonstrated that ADLUMIZ effectively increases body weight and muscle mass, while also enhancing appetite in cancer cachexia patients.

Another approach to address cancer cachexia involves promoting protein synthesis as a means to counteract and suppress the significant degradation of proteins in skeletal muscle wasting and cachexia. Emerging evidence suggests that heightened production of myostatin and its counterpart activin A contributes to the advancement of atrophy and cachexia.

Although there’s a shortage of extensive clinical trial data to direct the care of individuals with cachexia, several hospitals have established specialized programs for cancer cachexia. The teams managing these programs depend on findings from published research on handling cancer cachexia and adopt best practices devised within their institutions and beyond.

Over the last two decades, the study of cancer cachexia has provided new insights that allowed a better understanding of the multiple mechanisms regulating the onset and progression of this metabolic disorder and paved the way for the development of novel therapeutic strategies for cancer cachexia treatment.

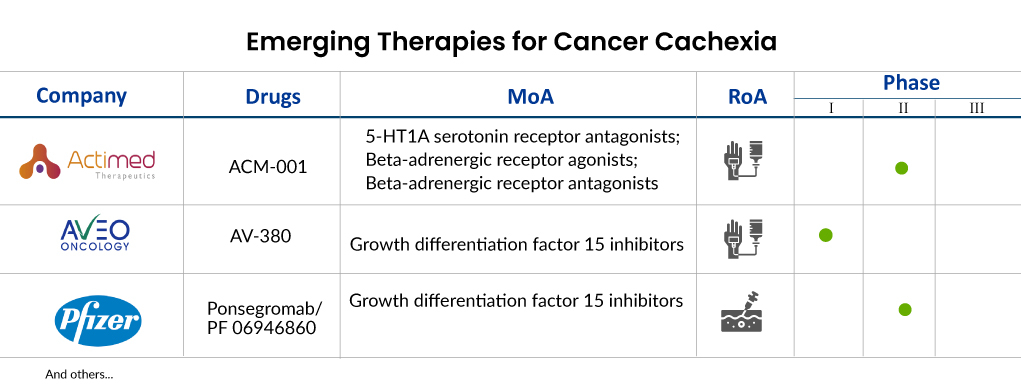

Some of the drugs in the cancer cachexia pipeline include ACM-001 (Actimed Therapeutics), AV-380 (Aveo Oncology), Ponsegromab/PF 06946860 (Pfizer), EXT418 (Extend Biosciences), and others.

Actimed Therapeutics is presently in the process of advancing ACM-001.1 (S-pindolol), previously referred to as MT-102. This compound has finished a Phase II trial (ACT-ONE) involving patients afflicted with cachexia associated with stage III and IV non-small cell lung cancer (NSCLC) as well as colorectal cancer (CRC). On December 14, 2021, the company disclosed the initiation of a clinical investigation in healthy individuals after receiving regulatory clearance from the UK Regulatory Agency. This study aims to assess the pharmacokinetics (PK) and pharmacodynamics (PD) of ACM-001.1, which is being developed as a therapy for cancer cachexia.

MT-102 (S-pindolol) functions as an agent capable of transforming anabolic/catabolic processes, focusing on β-1 receptor antagonism to impede cancer cell catabolism, enhance anabolism and muscle development, and induce partial β2 receptor agonism and central 5-HT1A antagonism to stimulate appetite, ultimately enhancing overall patient well-being and alleviating fatigue. This distinctive blend of anti-catabolic and pro-anabolic pharmacology positions MT-102 as a promising candidate for cancer cachexia treatment. In August 2023, Actimed received approval from the FDA for its Investigational New Drug (IND) application for the IMPACT program. The company intends to commence patient dosing in 2024.

AV-380 represents AVEO Oncology’s groundbreaking antibody, designed to effectively inhibit growth differentiation factor 15 (GDF15), a cytokine associated with inflammation. Elevated GDF15 levels are often linked to cachexia in cancer patients and various animal models. By targeting GDF15, AV-380 aims to shift the body’s metabolism from breakdown to growth, potentially offering relief from cachexia’s effects. AVEO is currently exploring AV-380’s potential in treating and preventing cancer cachexia through a Phase I study, combining it with standard chemotherapy in metastatic cancer patients exhibiting cachexia and elevated GDF-15 levels.

PF 06946860, developed by Pfizer, is a monoclonal antibody that inhibits growth factor 15 (GDF 15), administered subcutaneously. It’s aimed at treating cachexia and is currently undergoing Phase II clinical trials in patients with NSCLC, pancreatic cancer, CRC, and cachexia. Initial phase 1 findings indicate that suppressing GDF-15 could potentially alleviate symptoms associated with cachexia. Ponsegromab, another term for PF 06946860, is a highly potent and selective humanized monoclonal antibody targeting GDF-15-mediated signaling. The main goal of the Phase II trial is to evaluate how ponsegromab impacts body weight in patients with cancer, cachexia, and high levels of circulating GDF-15.

The anticipated launch of cancer cachexia therapies heralds a promising shift in the treatment landscape, offering newfound hope to patients grappling with this debilitating condition. As these therapies make their way to the cancer cachexia treatment market, we anticipate a transformative impact on treatment dynamics. Traditionally, cancer cachexia has been a challenging aspect of cancer care, often overshadowed by efforts to combat the primary tumor. However, with these new treatments, healthcare providers will have a targeted approach to address cachexia symptoms, improving patients’ quality of life and potentially extending survival rates.

![Market Size of Cancer Cachexia by Therapies in the US [2020-2034]](https://assets.delveinsight.com/blog/wp-content/uploads/2024/05/03162907/Market-Size-of-Cancer-Cachexia-by-Therapies-in-the-US-2020-2034.jpg)

In terms of cancer cachexia market size, the introduction of cancer cachexia therapies is poised to carve out a significant niche within the broader oncology sector. With an estimated prevalence of up to 80% among advanced cancer patients, the market potential for effective cachexia treatments is substantial. As these therapies gain regulatory approval and widespread adoption, we anticipate a notable expansion in the overall cancer cachexia market size, driven by increased demand from both patients and healthcare providers seeking more comprehensive cancer care solutions.

In the competitive landscape, the emergence of cancer cachexia therapies will inevitably pose a challenge to existing treatments. Marketed therapies, while addressing certain aspects of cancer care, may fall short in effectively managing cachexia-related symptoms. As such, the new entrants stand to compete favorably by offering a specialized focus on alleviating cachexia’s debilitating effects. Success in capturing cancer cachexia market share will hinge not only on the efficacy of these therapies but also on factors such as pricing, accessibility, and physician adoption. Nonetheless, with the pressing need for improved cachexia management, the anticipated launch of these cancer cachexia therapies represents a significant step forward in advancing cancer care.

Downloads

Article in PDF