Is it the Dawn of Biologics in the Eosinophilic Esophagitis Treatment Landscape?

Jan 09, 2023

Table of Contents

Eosinophilic Esophagitis (EoE) is a chronic inflammatory ailment that is immune-mediated. It is characterized by an increased number of eosinophils infiltrating the esophagus, thus, impacting one’s fundamental eating ability. It affects both adults and children and is caused by allergens; food antigens are considered the main precursors of EoE, although other genetic and environmental factors are also known. The incident and prevalent cases of EoE have been on an upsurge at an outpaced rate not just because of increased awareness or better diagnosis but also due to the understanding of the pathophysiology along with an increase in the number of other potential risk factors like food and air allergens, early-life exposures to proton pumps or antibiotics, acid suppressants, and preterm birth, etc.

As per Delveinsight analysis, this increase in eosinophilic esophagitis prevalence is expected to reach 1 billion by 2032 among the seven major markets.

Downloads

Article in PDF

Recent Articles

- Merck’s KEYTRUDA as Adjuvant Therapy for RCC Patients; BMS Receives Positive CHMP Opinion for CAR...

- Precigen’s PRGN-3006; Yescarta Approved as a First CAR T-cell Therapy for R/R LBCL; Biogen ...

- InnoCare’s Trial In China; Sanofi/GSK COVID-19 Vaccine; Apellis’s Empaveli for PNH; LianBio...

- PTC Therapeutics’ Gene Therapy Upstaza; Sanofi and Regeneron’s Dupixent; Bayer CAR-T Collaboratio...

- DUPIXENT Receives First-Ever Biologic Approval for COPD: Adds Another Jewel in its Crown

Until 2022, the eosinophilic esophagitis treatment was managed by dietary eliminations and medical treatments like proton pump inhibitors and swallowed topical steroids (budesonide and fluticasone), which helped relieve symptoms and inflammation. However, in the first half of 2022, the US FDA approved the usage of DUPIXENT (dupilumab) — the first and the only biologic to show meaningful clinical data for eosinophilic esophagitis treatment in adults and pediatric patients 12 years and older. Further, by investigating the potential use of DUPIXENT in children with EoE aged 1–11, Sanofi/Regeneron could be the first pharma giant to mark its presence with a therapeutic asset catering to this age group.

Rising Prevalence and Promising Eosinophilic Esophagitis Pipeline – the Perfect Catalyst for a Market With High Growth Potential

As per Delveinsight’s analysis, the eosinophilic esophagitis treatment market is estimated to increase at a CAGR of 26% during the study period 2019–2032.

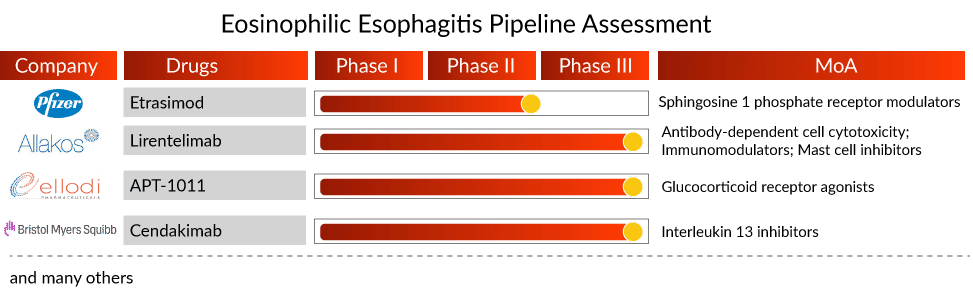

Besides a significant expected rise in prevalence, the emerging eosinophilic esophagitis treatment space shows potential with a couple of mAbs, apart from dupilumab, waiting in line for their approval in EoE. FASENRA (benralizumab; AstraZeneca/Kyowa Hakko Kirin) and cendakimab (Bristol Myers Squibb) are the two mAbs in late-stage clinical development. Further, a reformulation of fluticasone propionate—APT-1011 (Ellodi Pharmaceuticals) is also being investigated in Phase III eosinophilic esophagitis clinical trials. It has also received Fast Track Designation from the US FDA.

However, Takeda’s decision to discontinue launching Eohilia for EoE has been a game-changer for other eosinophilic esophagitis therapies. Takeda was the first to file for FDA approval, but the regulatory body issued a complete response letter mentioning that the drug could not be approved and recommended additional studies. This led to Takeda ceasing launch-related activities for Eoholia.

While Eohilia’s exit shifts the focus on other potential assets, APT-1011, being a similar asset (i.e., reformulation of fluticasone), is under the spotlight. Whether Ellodi’s APT-1011 will face a similar consequence or prove its safety and efficacy remains doubtful. If approved, APT-1011 will generate approximately USD 220 million by 2032, as per DelveInsight’s estimates.

What’s Cooking in the Eosinophilic Esophagitis Treatment Space?

- In December 2022, Regeneron Pharmaceuticals, Inc. and Sanofi announced that the New England Journal of Medicine published results from a positive Phase III trial in which adults and adolescents treated with Dupixent® (dupilumab) 300 mg weekly experienced significant improvements in signs and symptoms of eosinophilic esophagitis (EoE) that lasted up to a year.

- In December 2022, Sanofi and partner Regeneron announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) had recommended approval of Dupixent (dupilumab) for the treatment of adults and adolescents with eosinophilic esophagitis, a chronic inflammatory disease.

- In November 2022, Revolo Biotherapeutics, a company developing therapies that reset the immune system to achieve superior long-term remission for patients with autoimmune and allergic diseases, announced that the last patient had completed a Phase IIa proof of concept clinical study investigating its immune-resetting molecule, ‘1104, for the treatment of eosinophilic esophagitis (EoE).

- In October 2022, Eupraxia Pharmaceuticals Inc., a Phase II clinical-stage biotechnology company with an innovative drug delivery technology platform, announced the start of a Phase II trial of EP-104IAR in adult patients with eosinophilic esophagitis (EoE), a rare disease that impairs swallowing and has a significant impact on quality of life.

- In October 2022, Regeneron Pharmaceuticals, Inc. and Sanofi announced late-breaking positive results from a Phase III trial of Dupixent® (dupilumab) in children aged 1 to 11 years with active eosinophilic esophagitis (EoE).

- In May 2022, Sanofi and its partner Regeneron announced that the FDA had approved Dupixent (dupilumab) for a new indication, eosinophilic esophagitis (EoE).

- In March 2022, Pfizer Inc. announced the completion of its acquisition of Arena Pharmaceuticals, a clinical stage company developing innovative potential therapies for the treatment of several immuno-inflammatory diseases. Arena Pharmaceuticals brings to Pfizer a portfolio of diverse and promising development-stage therapeutic candidates in gastroenterology, dermatology, and cardiology, including etrasimod, an oral, selective sphingosine 1-phosphate (S1P) receptor modulator currently in development for a range of immuno-inflammatory diseases including ulcerative colitis, Crohn’s Disease, atopic dermatitis, eosinophilic esophagitis, and alopecia areata.

What’s Ahead in the Eosinophilic Esophagitis Treatment Market?

While there is no approved eosinophilic esophagitis treatment in the US, Europe had JORVEZA by Dr. Falk Pharma, which was approved in 2018. JORVEZA is indicated for eosinophilic esophagitis treatment in adults aged 18 and above, and it is an orodispersible tablet — a more convenient and reliable way of delivering budesonide.

Despite the favorable therapeutic effects of biologics, the approval of DUPIXENT, coupled with the promising biologics in the eosinophilic esophagitis pipeline, invites questions about their high costs. Understanding cost-effectiveness becomes paramount, along with providing proper patient access. Cost-effectiveness evaluations will help payers, providers, and policymakers in decision-making. Although biologics are expensive eosinophilic esophagitis treatments, they are likely to be more cost-effective when used as a part of precision medicine. Moreover, a better understanding of the pathophysiology and mechanism of DNA instability and the impact of current eosinophilic esophagitis treatments on disease progression will help shape future clinical practice.

FAQs

Eosinophilic Esophagitis (EoE) is a chronic inflammatory ailment that is immune-mediated. It is characterized by an increased number of eosinophils infiltrating the esophagus, thus, impacting one’s fundamental eating ability.

Dysphagia, food impaction, and choking/gagging with meals, particularly when eating coarse textures, are the most common eosinophilic esophagitis symptoms in school-aged children and adolescents, whereas dysphagia is more common in adults. Other eosinophilic esophagitis symptoms include abdominal/chest pain, vomiting, and regurgitation.

The clinical manifestations of EoE, as well as endoscopic and histological findings in esophageal mucosa biopsies, are used to make the eosinophilic esophagitis diagnosis. Biopsy findings demonstrating increased intra-epithelial esophageal eosinophil counts without concomitant eosinophilic infiltration in the stomach or duodenum remain the gold standard for eosinophilic esophagitis diagnosis.

Eosinophilic esophagitis treatment currently consists of dietary, pharmacological, and endoscopic interventions. PPIs and corticosteroids are the mainstays of treatment in pharmacologic therapy. PPIs and corticosteroids, unfortunately, are associated with a high rate of remission.

Leading companies, including Bristol Myers Squibb (BMS), Ellodi Pharmaceuticals, AstraZeneca, Kyowa Hakko Kirin, Dr. Falk Pharma GmbH, Regeneron Pharmaceuticals, Sanofi, Allakos, Pfizer, Revolo Biotherapeutics, EsoCap AG, and others are currently evaluating their lead assets in various clinical stages.

Downloads

Article in PDF

Recent Articles

- PTC Therapeutics’ Gene Therapy Upstaza; Sanofi and Regeneron’s Dupixent; Bayer CAR-T Collaboratio...

- Merck’s KEYTRUDA as Adjuvant Therapy for RCC Patients; BMS Receives Positive CHMP Opinion for CAR...

- Precigen’s PRGN-3006; Yescarta Approved as a First CAR T-cell Therapy for R/R LBCL; Biogen ...

- Dupixent Breaks Ground: First and Only Eosinophilic Esophagitis Treatment for Pediatric Patients

- InnoCare’s Trial In China; Sanofi/GSK COVID-19 Vaccine; Apellis’s Empaveli for PNH; LianBio...