NMIBC Treatment Paradigm Evolution: A Look At The Clinical Development Shift From High-Risk Bcg Unresponsive To Untapped High-Risk Bcg Naïve And Intermediate-Risk NMIBC

Aug 30, 2024

Table of Contents

A high cure rate characterizes Non-muscle Invasive Bladder Cancer (NMIBC), yet there is a notable risk of recurrence and progression to muscle-invasive disease. Effective NMIBC management involves precise local resection, staging, and a risk-based approach with intravesical agents. The conventional gold standard for intermediate or high-risk NMIBC has long been Transurethral Resection of the Bladder (TURB), followed by intravesical BCG instillations. Unfortunately, BCG treatment fails in approximately half of high-risk patients, leading to persistent or early recurrent NMIBC.

Intense clinical development and back-to-back approval: Which therapy will dominate the high-risk NMIBC BCG unresponsive segment?

The treatment landscape for urothelial cancer has many approved therapies, whereas therapies are limited for NMIBC treatment. This scarcity, especially in BCG-unresponsive NMIBC, has shifted the focus of many companies toward this market segment. The limited efficacy of VALSTAR chemotherapy, which has shown only a 21% Complete Response Rate (CRR) with a median duration of 1 year, prompted the US Food and Drug Administration (FDA) to issue guidance encouraging the development of new treatments for BCG-unresponsive NMIBC. As a result, KEYTRUDA was approved in January 2020, ADSTILADRIN (the first adenovirus gene therapy) in December 2022, and ANKTIVA + BCG in April 2024, all within a short timeframe. This rapid succession of approvals has attracted key players to develop new therapies for BCG-unresponsive NMIBC, leading to significant pipeline activity in this area.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- OPDIVO Approved for Resectable NSCLC; Palvella Gets $2.6M FDA Grant; First Patient Dosed in UGN-1...

- CG Oncology Teams Up With Merck & BMS; Parse Biosciences Partners With Molecular Diagnostics...

- Imbalance Between BCG Supply and Increased Demand: The Crisis Impacting Bladder Cancer Treatment

- Market Drivers and Barriers That Will Shape The NMIBC Market In The Next Ten Years

- Advances in Non-Muscle Invasive Bladder Cancer Treatment: Exploring Emerging Therapies

Meanwhile, other segments of NMIBC, including BCG-naïve, BCG-recurrent, intermediate-risk, and low-risk, currently lack approved treatments. Companies are now turning their attention to these segments, advancing clinical trials to higher phases. The field of treatments for BCG-unresponsive high-risk NMIBC is extremely competitive. New therapies must excel in efficacy, safety, ease of administration, cost, and production capacity to meet the demand to succeed. Competitors are exploring strategies like combination therapies, unique mechanisms of action, and improved delivery methods.

In early 2020, the FDA approved intravenous KEYTRUDA for the treatment of BCG-unresponsive NMIBC with CIS (with or without papillary tumors) for patients who are unfit or unwilling to undergo radical cystectomy. The approval was based on one of the two arms of a multicenter Phase II study (KEYNOTE-057), which assessed the role of pembrolizumab in BCG-unresponsive NMIBC with CIS. The trial showed 41% CR at the first evaluable efficacy assessment at 3 months, defined as the absence of high-risk or progressive disease. KEYTRUDA offers better convenience to patients with the IV infusion route of administration compared to other available treatment options. However, it is associated with high costs and the potential for significant side effects.

Meanwhile, multiple novel drugs with alternative mechanisms of action have proven to be safe and effective in NMIBC treatment, and others are under investigation. One important point to note is that KEYTRUDA is targeting a smaller subset, i.e., patients must have PD-L1 expression to generate a good response. Data indicate that biomarker testing is not routinely done for individuals with NMIBC. According to a worldwide survey, half of doctors said they did not routinely check for biomarkers in patients with NMIBC. According to a country-specific study, Spain and Japan had disproportionately high rates of lack of regular testing among NMIBC patients. More than half of doctors in China and Germany tested for PD-1/PD-L1; around one-third tested in France, Italy, the UK, and the US; and less than one-fifth tested in Spain and Japan (Broughton et al., 2022).

The next major drug to be approved for this NMIBC was Ferring’s ADSTILADRIN, which has exhibited robust clinical efficacy in patients with high-risk, BCG-unresponsive NMIBC with carcinoma in situ, with or without papillary tumors (±Ta/T1). Notably, it demonstrated impressive results with a CRR of 51%, surpassing KEYTRUDA’s CR of 41%. While KEYTRUDA boasts a more favorable route of administration, ADSTILADRIN stands out for its convenient dosing schedule, excellent tolerability, and unique selling points, such as a new ready-to-use formulation allowing direct administration by physicians. In terms of safety, KEYTRUDA was discontinued due to adverse reactions in 11% of patients, whereas the permanent discontinuation of ADSTILADRIN due to an adverse reaction occurred in ~2% of patients. Since ADSTILADRIN is gene therapy, the long-term benefits remain elusive, and a cumbersome mechanism and use of an adenovirus vector raise questions about its viability. Potential problems extend beyond the complexity of manufacturing a gene therapy and include Adstiladrin’s use of a non-replicating adenovirus serotype 5 (Ad5) vector.

The most recent NMIBC therapy approved by the FDA is ANKTIVA + BCG developed by ImmunityBio. Notably, in NMIBC patients, the CRR reached 62%. In terms of safety, permanent discontinuation of ANKTIVA with BCG due to adverse reactions occurred in 7% of patients. The efficacy of ANKTIVA is better than other approved drugs, but in terms of safety, it is not better than ADSTILADRIN. ANKTIVA does not require any special freezers or equipment; it can be stored in standard refrigerators and freezers. Since ANKTIVA is administered as a mixture with BCG, it does not necessitate any different equipment or processing from BCG administration. This means urology practices do not need to make any changes to order, store, or implement ANKTIVA. This ease of integration could lead to a rapid adoption of ANKTIVA in clinical settings.

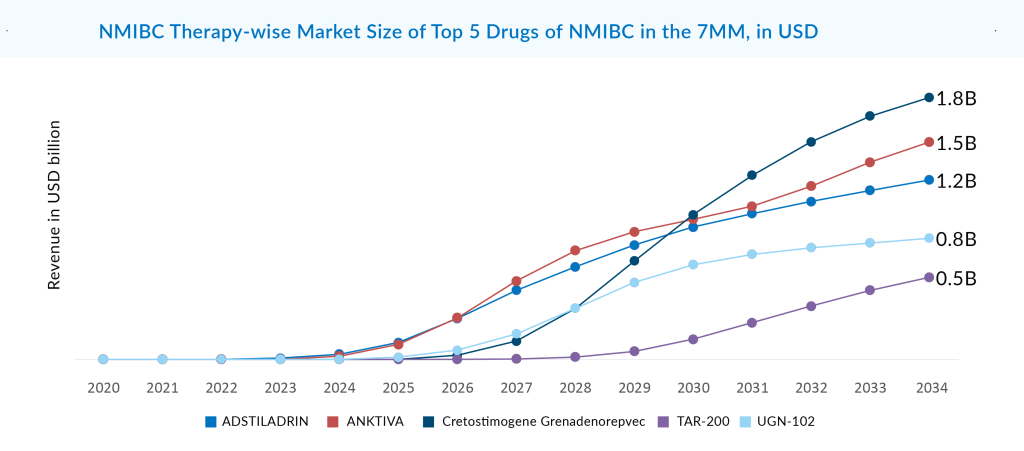

Among the emerging and marketed NMIBC drugs, CG0070, also known as Cretostimogene Grenadenorepvec, an oncolytic vaccine utilizing adenovirus serotype 5, is best in terms of safety and efficacy. Given its unique mechanism, there is speculation about the potential synergistic action of CG0070 with PD-1 inhibitors. As monotherapy in the BOND-003 trial, 75.2% of patients evaluated for CG0070 efficacy achieved a complete response at any time. Repeat induction converted to a complete response was seen in 53.8% of patients with no treatment discontinuations due to AEs, and no deaths were reported. The company was evaluating CG0070 in combination with pembrolizumab in Phase II (CORE-001). CRR in the intention to treat the population at 24 months was 54%, and 95% of patients maintained a CRR for another 12 months with a median DoR that has not been reached but exceeds 21 months. This data is better than CG0070 as monotherapy for BCG-unresponsive patients. Now, the company is planning to do another Phase II CORE-008 trial in 2H of 2024 as a mono/combination for high-risk NMIBC. After approval, CG0070 is going to compete with ADSTILADRIN and EG-70. CG0070 is expected to generate risk-adjusted revenue of roughly USD 1.8 billion in the 7MM by 2034.

In the competitive landscape of NMIBC unresponsive to BCG, another player is Johnson & Johnson’s TAR-200 ± cetrelimab, which is a drug-device combination using chemotherapy gemcitabine. In terms of efficacy, CG Oncology and Johnson & Johnson’s drugs are similar, and it is believed that both will produce a data package that satisfies FDA requirements for approval. Apart from this, it is expected that other emerging treatments like TAR-002, RUVIDAR, and ONCOFID P-B may also join the NMIBC market. ONCOFID P-B is also a chemotherapy-based product. Fidia Farmaceutici is developing this paclitaxel-hyaluronic acid-based conjugate in a Phase III trial. A non-viral plasmid-based therapy EG-70 developed by enGene will compete in the market with viral therapies and offer an advantage in terms of safety by posing a lower risk of triggering an immune response over viral therapies developed by Ferring Pharmaceuticals, CG Oncology, Istari Oncology, Vaxiion Therapeutics, and others. The design of EG-70, characterized by its ease of use and non-viral nature, positions it well to integrate smoothly into the standard of care. The goal is for it to become a practice-changing product without necessitating any changes in practice for urologists.

Amid BCG scarcity, what advancements are being made in the high-risk, BCG-naïve NMIBC segment?

The BCG-naïve segment has long been challenging to penetrate, given the dominance of BCG as the sole market holder in NMIBC. However, any drug that surpasses BCG’s CRR could gain a significant advantage in this patient segment. For BCG naïve high-risk disease, ongoing shortage indicates the need for non-BCG-based alternative therapies and additional BCG strains.

The current scarcity of BCG has given NMIBC key players a chance to enter this BCG-dominated market. Major companies, including Merck (KEYTRUDA + BCG), ImmunityBio (ANKTIVA + BCG), Roche (TECENTRIQ + BCG), Pfizer (Sasanlimab + BCG), and AstraZeneca (IMFINZI + BCG), are focusing on combination therapies with BCG to enhance the efficacy of drug rather than replacing BCG.

ImmunityBio has been conducting trials in BCG-naïve patients with ANKTIVA + BCG, but success has been elusive. In Phase I/II data presented last year, all nine subjects achieved complete remission, and the treatment was well tolerated. Meanwhile, TARA-002, developed by Protara Therapeutics, reported data from two patients with CIS-only, showing a 100% CRR, and from seven patients with CIS + Ta/T1, showing a 14% CRR—significantly lower than BCG’s CRR of approximately 70%. These developments indicate that while new therapies show promise, they have yet to match the efficacy of BCG, highlighting the ongoing challenges in this market.

Urogen’s first-mover advantage with UGN-102 is set to transform the intermediate-risk segment

With no approved drugs for low- and Intermediate-Risk NMIBC (IR-NMIBC), chemotherapy, TURBT, and BCG remain the only treatment options. The ongoing BCG shortage has led physicians to reserve this therapy for high-risk patients, which in turn has contributed to an increase in disease progression, with more patients advancing to higher-risk stages. The risk of progression to higher-stage disease in NMIBC stands at approximately 15%, prompting pharmaceutical companies to prioritize the development of treatments for early-stage disease, particularly in the intermediate-risk category.

Numerous promising treatments are being developed for IR-NMIBC. A few companies, such as Urogen, CG Oncology, Johnson & Johnson, and Ferring Pharmaceuticals, are focusing on developing treatments for intermediate-risk NMIBC. DelveInsight expects that owing to the first-mover advantage, Urogen’s treatments (UGN-102 and UGN-103) should already be well-known by the time CG0070 and ADSTILADRIN join the IR-NMIBC segment.

A strong body of evidence supports UGN-102’s attractive clinical profile. The ATLAS and ENVISION trials both achieved their primary endpoint. If authorized, it can be expected that UGN-102 would change the standard of therapy for low-grade, intermediate-risk NMIBC from recurrent surgery to a minimally invasive, routine, nonsurgical alternative. The forthcoming ENVISION data will support the New Drug Application (NDA) filing, as per URogen’s announcement earlier this year. On August 14, 2024. UroGen announced the successful completion of its NDA submission for UGN-102 as the first FDA-approved treatment for low-grade IR-NMIBC. Assuming priority review, UG-102 now has the advantage over all other emerging therapies in the IR-NMIBC segment. The company may launch as early as Q1 of 2025. Since there is not much competition in the IR-NMIBC segment, there is a substantial commercial potential for this asset. UGN-102 is expected to capture the largest market size in the 7MM, with a revenue of ~USD 850 million by 2034.

What does NMIBC’s future market landscape look like?

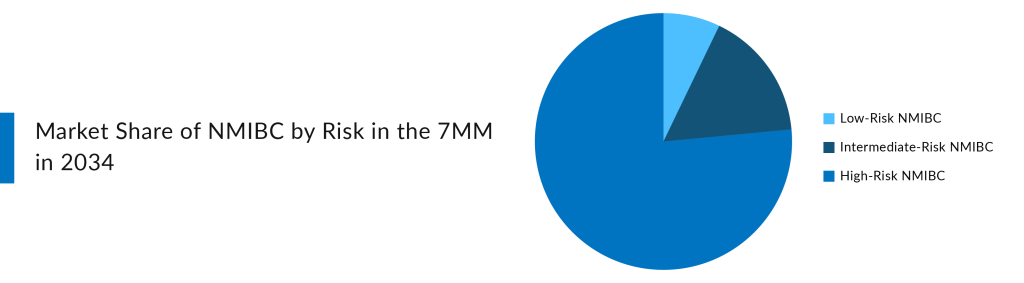

The NMIBC market is gaining traction, with several therapies expected to enter the major markets by 2034. With three essential drugs capturing billion-dollar markets in the 7MM by 2034 (DelveInsight’s estimates), the market opportunity in the NMIBC space seems substantial. The need for novel therapies drives this, the high cost of treatment, the targeting of multiple patient segments, and the rising prevalence of NMIBC.

In addition to Merck, Ferring Pharmaceuticals, ImmunityBio, CG Oncology, Johnson & Johnson, UroGen Pharma, enGene, Roche, AstraZeneca, Fidia farmaceutici, Protara Therapeutics, and Theralase Technologies, other significant players in the field are developing early-stage treatments for NMIBC, including Emtora Biosciences, NanOlogy, SURGE Therapeutics, Lipac Oncology, Tyra Biosciences, Istari Oncology, Astellas Pharma, Vaxiion Therapeutics, Aura Biosciences, Archivel Farma, Prokarium, Pfizer, and others.

Looking at the NMIBC pipeline, none of the companies is currently focusing on the Low-Risk NMIBC segment. At present, Chemotherapy, BCG, and TURBT dominate the low-risk NMIBC market. The high-risk segment dominates the total NMIBC market. While the goal is to start with BCG-unresponsive high-risk NMIBC patients, there is an opportunity to expand growth into other market segments, such as IR-NMIBC and BCG-naïve high-risk NMBIC. Few companies are eyeing IR-NMIBC and BCG-naïve high-risk NMBIC owing to the broader market potential. Among those, UGN-102 stands out as the only drug specifically targeting the IR-NMIBC segment, positioning it uniquely within this lucrative market.

Conclusion

The growing array of novel therapeutic agents for individuals with NMIBC presents challenges in determining the optimal treatment and sequence, given the diverse mechanisms of action and varying levels of efficacy. Personalized treatment strategies are recommended, relying on a comprehensive understanding of disease characteristics, available treatments, and patient attributes and identifying and validating prognostic and predictive biomarkers. Several NMIBC clinical trials are underway to create a bladder-preserving strategy for extremely high-risk cases of BCG-naïve NMIBC and BCG-unresponsive NMIBC in the future. Emerging treatments like Immunotherapy and viral vector gene therapies show promise in meeting approval standards. Yet, clinicians need to assess their safety and cost-effectiveness meticulously. Enhancing patient care quality hinges on persistent efforts to overcome the practical challenges in bedside management.

Downloads

Article in PDF

Recent Articles

- Market Drivers and Barriers That Will Shape The NMIBC Market In The Next Ten Years

- Fourth FDA Approval for AbbVie’s Vraylar; FDA Approves Ferring’s Adstiladrin for NMIBC; Merck and...

- OPDIVO Approved for Resectable NSCLC; Palvella Gets $2.6M FDA Grant; First Patient Dosed in UGN-1...

- Imbalance Between BCG Supply and Increased Demand: The Crisis Impacting Bladder Cancer Treatment

- Advances in Non-Muscle Invasive Bladder Cancer Treatment: Exploring Emerging Therapies