The Expanding Market of Complement Inhibitors

Dec 18, 2023

Table of Contents

The development of complement inhibitors has been growing rapidly over the years, and it has proved to be one of the breakthroughs in various therapeutic areas. These inhibitors act on the dysregulated complement system, a group of proteins that forms an essential part of innate immunity. This system comes into effect only when it is activated by three different types of pathways, i.e., classical, alternative, and lectin pathways.

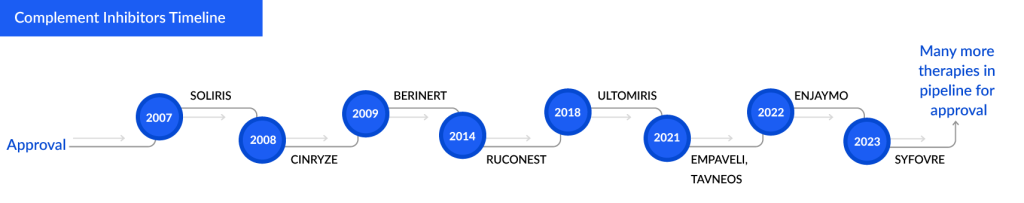

The scientists’ interest in the complement system started in the 19th century, but the successful approval of a complement inhibitor was not until 2007. SOLIRIS (Eculizumab) became the first complement inhibitor approved by the US FDA. This launch brought a ray of hope to the patients suffering from fatal diseases such as paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), generalized Myasthenia Gravis (gMG), and many more.

Downloads

Click Here To Get the Article in PDF

Recent Articles

With the extensive rise in R&D and increased healthcare spending, companies are trying their best to develop their products and grab this lucrative opportunity. Till now, approximately nine complement inhibitor’s have been approved across various geographies. SOLIRIS, CINRYZE, and BERINERT are some of the older approved complement inhibitors, while AVACOPAN, ENJAYMO, and EMPAVELI are listed in recent developments.

To date, complement inhibitors are seen to be potential targets in rare indications, but with the increase in research and development, these inhibitors are also being investigated in Oncology. If successful, these therapies could significantly contribute to the treatment landscape and improve the patient’s quality of life.

Current Therapeutic Landscape of Complement Inhibitors in Some Major Indications

The first approval of complement inhibitors came across Paroxysmal nocturnal hemoglobinuria (PNH), a rare disorder in which red blood cells break apart prematurely, which leads to the premature death of patients suffering from it (National Organization for Rare Disorders (NORD). SOLIRIS of Alexion Pharmaceuticals became the first-generation C5 inhibitor approved for PNH in 2007. However, the drug was not there to treat the condition but rather to halt the breakdown of RBC and reduce the risk of thrombosis. Since its approval, the drug has improved overall survival and transformed the lives of patients, but despite the good results, one of the biggest disadvantages with this drug was the cost burden as it is one of the most expensive drugs in the world, which limits patient access in many countries.

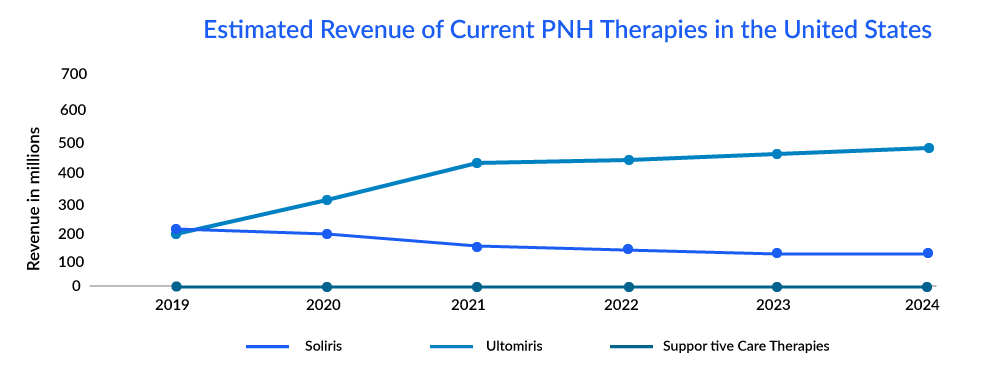

To address the major challenges in SOLIRIS, i.e., cost burden and frequent administration schedule, ULTOMIRIS of Alexion Pharmaceuticals was approved for the treatment of adults with PNH in the United States in 2018. It offers weight-based dosing and is infused every 8 weeks rather than every 2 weeks. After the successful performance of the drug, many patients of PNH shifted to ULTOMIRIS due to low cost with a longer schedule of treatment.

Despite the approval of these drugs, some patients still suffered a significant disease burden, including frequent transfusions and debilitating fatigue, which reinforces the urgent need for new treatments. EMPAVELI, a targeted C3 therapy that came into the market in 2021, demonstrated substantial and clinically meaningful improvements across a range of important hematologic measures compared to C5 inhibition. C3 inhibition can block all three possible ways of complement activation, i.e., classical, lectin, and alternative, with the potency to control both intravascular and extravascular hemolysis. One potential advantage of C3 inhibition is the reduction in extravascular hemolysis.

The second approval of the same drug, “SOLIRIS,” came for Atypical Hemolytic Uremic Syndrome (aHUS), a very rare disease that causes tiny blood clots in the blood vessels. Historically, plasma exchange was the standard of care, but the results were unsatisfactory because most patients did not achieve satisfactory results. The treatment landscape of aHUS changed with the entry of the drug into the market; the drug was able to manage thrombotic microangiopathy and reduce mortality and morbidity. Despite the promising performance, the usage of this drug seems to be never-ending, with almost no idea of how long the drug should be used. Secondly, the drug seems to have side effects, and infections with encapsulated bacteria are one of them. Patients need vaccination against serotypes A, C, W, Y, and recently B and receive prophylactic antibiotics. High cost and reimbursement challenges come hand in hand with this drug.

Another indication with most complement inhibitors being used is Myasthenia gravis, a chronic autoimmune neuromuscular disease that causes weakness in the skeletal muscles. Steroids and steroids-sparring agents usually do management of this condition, and these agents seem to affect the immune system adversely. Treating those side effects can sometimes be challenging; there are also many refractive patients, and many have significant exacerbation; these patients have to go through the TDS follow-up process.

Management of myasthenia gravis is often done by pyridostigmine in case of mild symptoms, and prednisone and pyridostigmine are often used in case of moderate symptoms. In the case of exacerbations, intravenous immunoglobulin, plasma exchange, and steroids are used. In case of refractory condition, medications like rituximab, SOLIRIS, or even IVIG are used in case the patient has not responded to steroids.

SOLIRIS seems to be used in refractory AChR+ gMG cases. Regulatory agencies in Europe and Japan have restricted the use of complement inhibition in patients with refractory AChR+ gMG. While the FDA did not place such a restriction for its use in the US, the insurance industry has followed the parameters of the Phase III REGAIN trial, limiting, for the most part, its use in a similar patient population. If the drug is used outside the prescribed patient pool, it may not be covered. There is also a critical need to identify possible biomarkers predictive of therapeutic response, a field not yet sufficiently explored in myasthenia gravis.

Alexion Pharmaceuticals’ Monopoly and Cost Play

Despite showing breakthrough results in various indications, the drug faces a backlash because of the cost and insurance coverage. Alexion Pharmaceuticals came up with ULTOMIRIS, a substitute for SOLIRIS, because the drug’s every 8 weeks dosage was non-inferior to SOLIRIS’s every 2 weeks dosage schedule, making it a cost-effective option. Therefore, ULTOMIRIS has recently been used in almost all indications where SOLIRIS was approved, and patients are switching to it because of its convenience. More complement inhibitors are coming up in the future and targeting the oral route of administration so that compliance can be increased and the cost burden can be reduced. The company has developed the OneSource Copay Program to help patients cope with the out-of-pocket cost of such expensive drugs.

Some Complement Inhibitors and Approval Years:

Hereditary angioedema (HAE), Cold Agglutinin Disease (CAD), and ANCA-associated Vasculitis are conditions where complement inhibitors play a vital role.

The Potential of Alexion’s Products in the Current Market:

Note: The market estimation and prevalence are specific to the United States and 2022. These numbers are subject to change as per the recent DelveInsight report updation.

Currently, four complement inhibitors are approved for treating type 1 and 2 hereditary angioedema in two different settings. CINRYZE and HAEGRADA are approved for the prophylactic prevention of hereditary angioedema attacks, and BERINERT and RUCONEST are approved for the treatment of acute attacks of HAE. Although RUCONEST is not as effective at treating facial and laryngeal (around the larynx) attacks compared to abdominal or limb attacks, it is mostly administered by a healthcare professional, unlike BERINERT, which can be self-administered. Along with being the first subcutaneous formulation in the hereditary angioedema market, CSL Behring launched HAEGRADA into the hereditary angioedema market as a direct competitor to Shire’s CINRYZE, being listed at a price that was 18% less than that of CINRYZE. This would allow it to gain formulary access quickly, capturing a sizeable patient pool relatively faster.

ENJAYMO (sutimlimab) became the first approved monoclonal IgG4 antibody directed against human complement factor C1s in 2022 in the US for Cold Agglutinin Disease (CAD). The benefits of this drug, including rapid symptom improvement and low toxicity, make it a favorable treatment option for CAD. But the use of sutimlimab also comes with its drawbacks—namely, an indefinite treatment schedule and its cost, which is higher than rituximab-based regimens, which have been the standard of care. However, the ORRs of sutimlimab are likely similar if not better than that of the standard of care.

The Potential Upcoming Therapeutic Landscape of Complement Inhibitors

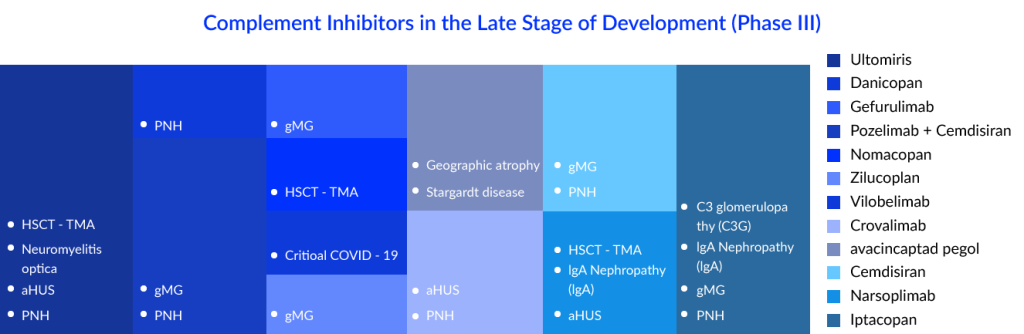

The development of complement inhibitors seems to have gotten a great push in recent years as more and more companies are investigating their products. Companies such as Regeneron, UCB, Roche, Iveric Bio, Achillion, and Novartis are some big players trying to target lucrative opportunities in the complement inhibitors market.

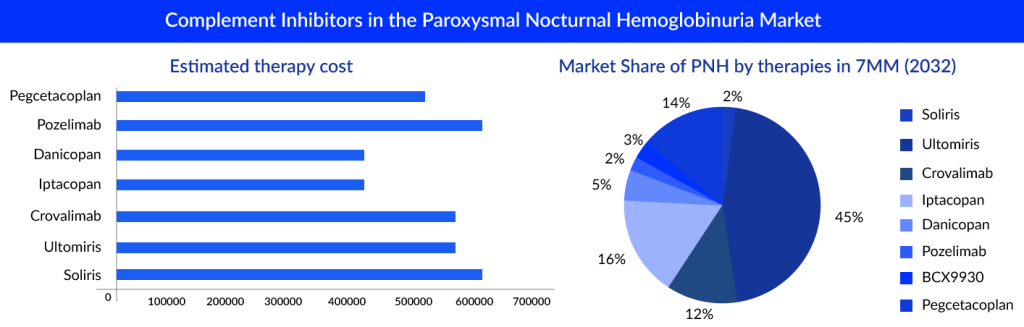

With complement inhibitors being investigated in so many indications, PNH seems to have most of them. As discussed above, SOLIRIS was the first drug approved for paroxysmal nocturnal hemoglobinuria treatment, but the market has evolved a lot over the years due to the emergence of various therapeutic targets in the complement cascade and different treatment modalities. The current standard of care (SoC) consists of drugs such as SOLIRIS, ULTOMIRIS, and EMPAVELI. ULTOMIRIS was known to be an improved version of SOLIRIS, while C5 inhibitors have dominated the paroxysmal nocturnal hemoglobinuria market over the years, but the emergence of EMPAVELI, which is a C3 inhibitor, has transformed the complement inhibitors market dynamics. C3 inhibitors have been ranked higher than C5 inhibitors as extravascular hemolysis (EVH) is not addressed by C5 inhibitors. C5 inhibitors can only reduce IVH (intravascular hemolysis), whereas C3 inhibitors reduce IVH and EVH. Iptacopa, Crovalimab, Danicopan, and Pozelimab are some of them. Crovalimab and danicopan are coming up as add-on therapies to the current approved C5 inhibitors, while Iptatopan is an upcoming Factor B inhibitor; as per the latest results, hemolysis, fatigue, and anemia were found to be improved from what we have in the current treatment.

“There are other drugs out there like a factor D inhibitor, is being developed. That’s even more effective than danicopan, which is another one out there. There were data presented on both of those. . The advantage of factor D and factor B is that it takes less drug to inhibit them. And they aren’t amplified as much as say C3 is during that process. Hopefully, there is not as much breakthrough hemolysis, at least theoretically, that is the hope with these new drugs”.

– Duke University School of Medicine, US

KOL views:

“In the emerging pipeline, there are novel terminal complement inhibitors that target C5, as well as proximal complement inhibitors that interfere with C3 or even further upstream (factor B and D). Long-term safety data for these novel complement inhibitors, however, are still required.”

– Université Paris Diderot, France

“Biosimilar to eculizumab are soon to enter the market, but there still remains a question whether the patients would like to go back on every-2-week treatments if every-8-week treatments available in the market.”

-Duke University School of Medicine, US

The Potential of Complement Inhibitors in the Paroxysmal Nocturnal Hemoglobinuria Market

The market of PNH is derived by the complement inhibitors; it is estimated that ultomiris is expected to capture a market of approximately 600 million by 2024 with an estimated per-patient cost of approximately USD 570,000.

“The pipeline of PNH seems to have quite promising upcoming therapies, but ULTOMIRIS seems to dominate the market with high revenue even after 10 years.”

Upcoming PNH Therapies Estimated 2028 Sales in the United States:

Generalized myasthenia gravis is the second most potential indication with maximum complement inhibitors in the pipeline. SOLIRIS was the first to be approved here, also. Many generalized myasthenia gravis drugs are emerging in the same class, including the recently approved ULTOMIRIS and the upcoming Zilucoplan. The drugs have shown statistically significant improvement in the quality of life of the refractory AChR-Ab+ gMG patients. However, they also represent a safety concern for infections. Headache and nasopharyngitis were common side effects observed in various studies of complement inhibitors. Meningococcal infection, including meningitis, was also found to be an additional risk for the patients using these therapies. All populations to be treated must be mandatorily vaccinated at least 2 weeks before starting treatment. Gefurulimab, pozelimab, zilucoplan, and cimdisiran are some of the complement inhibitors being investigated in the late phase. Gefurulimab is an investigational C5 inhibitor optimized for subcutaneous administration, while pozelimab, a monoclonal antibody, blocks the activity of complement factor C5 and prevents diseases mediated by the complement pathway. The drug showed better efficacy results than eculizumab and ravulizumab. The drugs also addressed the issue of CHAPLE, an ultra-rare hereditary immune disease that causes over-activation of the complement system. Zilucoplan also seems to be a potential candidate, as it is a self-administrable, subcutaneous formulation; this may give an advantage over the current available therapies to increase adherence.

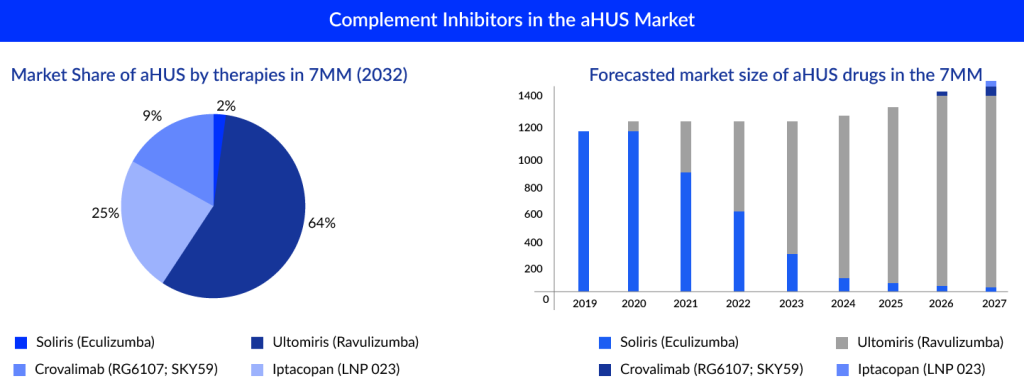

In gMG, apart from complement inhibitors, Neonatal Fc receptor (FcRn) antagonists are also the most promising and novel emerging class. Atypical Hemolytic Uremic Syndrome also comes up with many complement inhibitors. We have different key players such as Novartis (Iptacopan), Roche (Crovalimab), and others investigating their candidates to manage aHUS in the 7MM. Apart from complement inhibitors, new first-in-class molecules such as Iptacopan, a selective factor B (FB) inhibitor, are also a potential upcoming aHUS treatment option.

Upcoming aHUS Therapies Estimated 2028 Sales in the United States:

SOLIRIS and ULTOMIRIS majorly derive the current market of complement inhibitors. Many upcoming therapies have various mechanisms of action and targets set to launch in the upcoming year. It would be interesting to see these therapies’ uptake in the future.

Downloads

Article in PDF

Recent Articles

- New biomarkers for screening in Pancreatic Cancer

- Gene Therapy’s Emergence: The “New” approach for Huntington’s disease

- FDA Approves PENBRAYA for Most Common Serogroups Causing Meningococcal Disease; BIMZELX Approved ...

- KaliVir, Astellas licensing deal; AbCellera’s IPO; Bayer CAR-T Cell therapy collab with Ata...

- Major Highlights and Insights from the AAAAI Annual Meeting, 2024