FcRn Inhibitors Being The Fastest Growing Class, Plans To Get Explored In 20+ Indications

Jul 15, 2024

Table of Contents

Vyvgart enjoying strong commercial uptake whereas RYSTIGGO is preferred for MuSK+ Myasthenia gravis. What do the physicians believe?

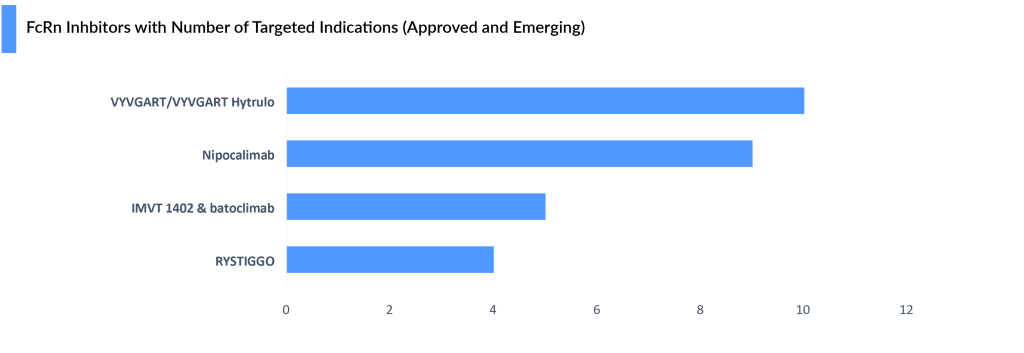

The neonatal Fc receptor (FcRn) inhibitor market is heating up, with a growing cast of leading contenders such as Argenx, JnJ, and UCB pharma, along with a few early-stage players such as ACT-101 (Alpha Cancer Technologies). The drugs with substantial evidence hold immense promise for revolutionizing the treatment of autoimmune diseases. Let’s delve into the current competitive landscape, exploring both approved and emerging players. Currently, FcRn inhibitors are approved in three indications including Myasthenia gravis, primary immune thrombocytopenia (ITP), and chronic inflammatory demyelinating polyneuropathy (CIDP), spanning multiple therapy areas including, Neurology, Rheumatology, Endocrinology, Dermatology, Hematology, Renal and others.

Downloads

Article in PDF

Recent Articles

- Biogen’s Aduhelm; FDA Approves Sanofi’s Enjaymo; NHS & Orchard Signs a Deal; Bri...

- Business Cocktail

- Agios’ PYRUKYND SNDA Accepted by FDA for Thalassemia; BridgeBio’s BBO-8520 Gets FDA Fast Track fo...

- Evaluating the Upcoming Drugs in Pipeline for Major Autoimmune Diseases

- Myasthenia Gravis Awareness Month

Argenx’s VYVGART, the first mover takes the stage

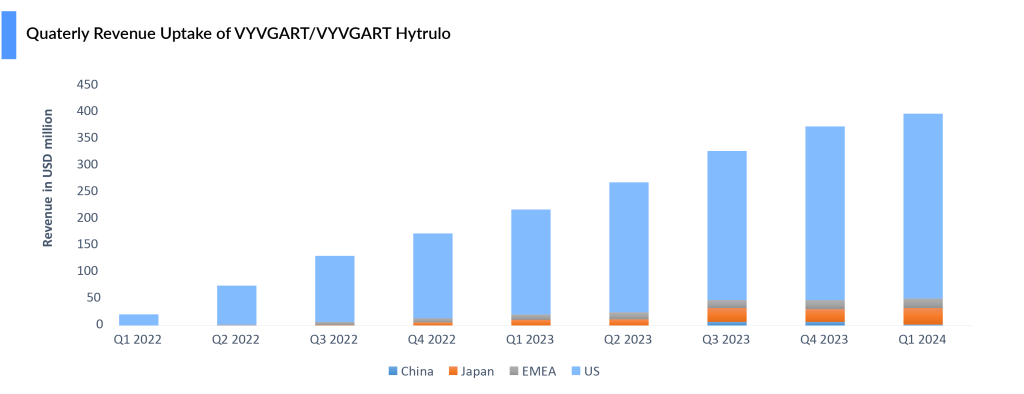

In recent years, FcRn inhibitors have emerged as a promising treatment option for patients with generalized myasthenia gravis (gMG), which accounts for 80–85% of myasthenia gravis cases. Argenx’s VYVGART (Efgartigimod alfa), as the first FDA-approved FcRn inhibitor, has achieved significant commercial success, reaching blockbuster status within the first 2 years of launch, posting sales of USD 400 million in 2022 and USD 1.2 billion in 2023, with growth driven by new patient starts and penetration into earlier lines.

VYVGART achieved a milestone in December 2021, securing the first FDA approval as a FcRn inhibitor, targeting generalized myasthenia gravis in adults with an anti-acetylcholine receptor (AChR) antibody. Based on multiple physicians’ perspectives, ~50% of gMG patients are currently on a novel agent, with the split being 60% on FcRn, and 40% on complement inhibitors, which we believe could be vice-versa in varied scenarios.

In June 2023, Argenx gained FDA approval for the subcutaneous formulation, VYVGART Hytrulo, offering a 1,008 mg fixed dose via a single injection over 30–90 seconds in weekly cycles for 4 weeks. VYVGART is approved across the US, Japan, Europe, the UK, Israel, Mainland China, and Canada for gMG, while VYVGART SC is approved in the US, Europe, the UK, and Japan. As of May 2024, over 10,000 patients have been treated globally with both formulations.

VYVGART Hytrulo is poised to be a significant revenue driver for Argenx in the near term. In March 2024, the MHLW also approved VYVGART IV for primary immune thrombocytopenia (ITP). In June 2024, the FDA approved VYVGART HYTRULO for CIDP, widening its window to another important segment of patients. While the failure of UCB’s rozanolixizumab has eliminated the threat to VYVGART in the competitive landscape of CIDP it will be up against Takeda’s already-approved subcutaneous immune globulin treatment HYQVIA.

The added dosing convenience should help protect VYVGART’s competitive positioning against other FcRn blockers and other approved treatment modalities for gMG, including C5 inhibitors: ULTOMIRIS and ZILUCOPLAN. Due to its compelling clinical profile, broad label, and added dosing flexibility with the approval of HYTRULO.

Despite setbacks in trials for pemphigus vulgaris and ITP and discontinuation in ANCA-associated vasculitis, VYVGART posted a 6% quarter-over-quarter increase, reaching USD 398 million in Q1 2024. With approvals in three indications—gMG, CIDP, and ITP—Argenx continues to work to further expand Vyvgart’s reach in gMG by broadening its addressable myasthenia gravis population to include seronegative patients, with registrational studies planned for 2024. The company is also advancing the development of a pre-filled syringe, which would enable patients to self-administer the drug.

Physicians prefer RYSTIGGO (2nd FcRn) for MuSK+ gMG

UCB’s RSYTIGGO (rozanolixizumab) emerged victorious in June 2023, securing the second FDA approval as a FcRn inhibitor for gMG. RYSTIGGO is the first approved therapy to treat the two main subsets of gMG—those positive for the anti-acetylcholine receptor (AChR) or anti-muscle-specific tyrosine kinase (MuSK) antibodies. This dual mechanism may be a threat to argenx’s VYVGART, which only targets AChR gMG.

“No two people living with gMG experience the disease in the same way, so we can’t take a ‘one size fits all’ approach to disease management,” said Iris Loew-Friedrich, Executive Vice-President and Chief Medical Officer at UCB.

UCB launched RYSTIGGO in the US in July 2023 and at the end of 2023 in Japan. UCB kept the price at USD 6,050 per vial with varying dosages based on the patient’s weight and the severity of symptoms. Whereas the WAC price of VYVGART HYTRULO fixed dose is ~USD 15,700 USD per vial. RYSTIGGO is advised to be administered as a subcutaneous infusion with an infusion pump at a maximum rate of 20 mL per hour, once a week for 6 weeks. On the other hand, VYVGART Hytrulo is given as a subcutaneous injection over about 30 to 90 seconds, following a cycle of once-weekly injections for 4 weeks, offering greater convenience.

Immunovant has announced the development in around 23 indications, only 5 indications are in the pipeline others are in preclinical or planned.

Multiple target indications, increasing the highly potential addressable market for FcRn inhibitors

While the approved frontrunners dominate the gMG market, the pipeline brims with contenders for various autoimmune and neurological indications.

JnJ’s Nipocalimab: Next market entrant

Momenta Pharmaceuticals’ nipocalimab, acquired by JnJ (in 2020 for USD 6.5 billion), is a rising star being evaluated in a multitude of rare diseases, including gMG. In the Phase III VIVACITY study, nipocalimab significantly reduced Myasthenia Gravis-Activities of Daily Living Scale (MG-ADL) scores in adults with gMG. Additionally, in the Phase II DAHLIAS study, nipolacimab showed significant improvement in clinESSDAI scores for Sjogren’s Disease.

Nipocalimab is the only anti-FcRn studied across three segments: rare autoantibody diseases (such as gMG and chronic inflammatory demyelinating polyneuropathy), maternal-fetal diseases (like hemolytic disease of the fetus and newborn), and prevalent rheumatology conditions (including rheumatoid arthritis and SjD). It has received Fast Track designation from the FDA for hemolytic disease of the fetus and newborn (HDFN), wAIHA, and gMG, and holds orphan drug status for multiple conditions. With potential regulatory approvals in various indications, JnJ envisions nipocalimab achieving blockbuster status.

Vyvgart’s reign secure as Immunovant shifts focus

Immunovant’s IMVT-1402 has attracted interest due to its initial safety findings, surpassing batoclimab-Immunovant’s primary anti-FcRn in specific important criteria. Its limited impact on LDL cholesterol and serum albumin levels when taken at a 300 mg subcutaneous dose is particularly interesting. This customized decrease in IgG levels could be very important for the effectiveness of treatment in Rheumatology and Hematology, as consistent IgG reduction is crucial.

From a commercial perspective, the introduction of IMVT-1402 could reshape the dynamics of the market. Despite VYGART’s established presence in various indications, IMVT-1402’s different approach may give it an edge, increasing rivalry in the market.

Immunovant is prioritizing IMVT-1402, over batoclimab, keeping VYVGART’s lead secure for now. While continuing the batoclimab MG trial, Immunovant plans a potentially registrational program for IMVT-1402 in MG. A final decision will be made based on the results of the current batoclimab trial. Immunovant expects these topline results and the related decision to be by the end of this fiscal year (Q1, 2025). A clinical update for batoclimab in Graves’ disease is expected by the end of 2024. IMVT-1402 may also replace batoclimab in a CIDP study. Immunovant aims to launch IMVT-1402 trials in 4–5 indications by March 2025, expanding to 10 by the following year.

What do the physicians believe and practice?

- The Uptake of FcRn inhibitors as a class would be higher if they were self-administered, which both Argenx and Immunovant are working towards. However, some patients prefer supervision by a healthcare provider.

- While several biologics are already approved for gMG, existing treatment options are somewhat limited by their black box/REMS, high treatment burden (IV, in-office SC, or daily SC administration), and/or cyclical dosing regimen.

- Vyvgart subcutaneous version has led to an increased willingness to prescribe

- Despite the success, a downside to FcRn inhibitors is the requirement for a more than 50-day drug holiday due to transient IgG decline & infection risk, potentially leading to the rebound of autoantibodies, complement activation, & symptom worsening. In an extremely optimistic view, the FcRn class could begin to resemble the TNF class for autoimmune diseases.

- There is no preference from Insurance companies when it comes to choosing Complement Inhibitors vs. FcRn inhibitors in patients who have already tried the standard of care

- Very few patients switch from complement inhibitors to an FcRn inhibitor

- In addition to FcRn antagonists and complement inhibitors, several investigational gMG drugs have garnered physician and investor interest due to their novel mechanisms of action, such as Enspryng (satralizumab) and Uplizna (inebilizumab).

Downloads

Article in PDF

Recent Articles

- Eisai Announces Solo Development of Farletuzumab Ecteribulin (FZEC); Johnson & Johnson’s Nipo...

- Assessment of Key Products that Got FDA Approval in Second Half (H2) of 2021

- FDA Approves LEQEMBI IV Dosing for Early Alzheimer’s; Vanda Accepts FDA Hearing on Tradipitant fo...

- Biogen’s Aduhelm; FDA Approves Sanofi’s Enjaymo; NHS & Orchard Signs a Deal; Bri...

- The Expanding Market of Complement Inhibitors