Travere’s FILSPARI Approval Sparks Rivalry in the IgA Nephropathy Space

Sep 16, 2024

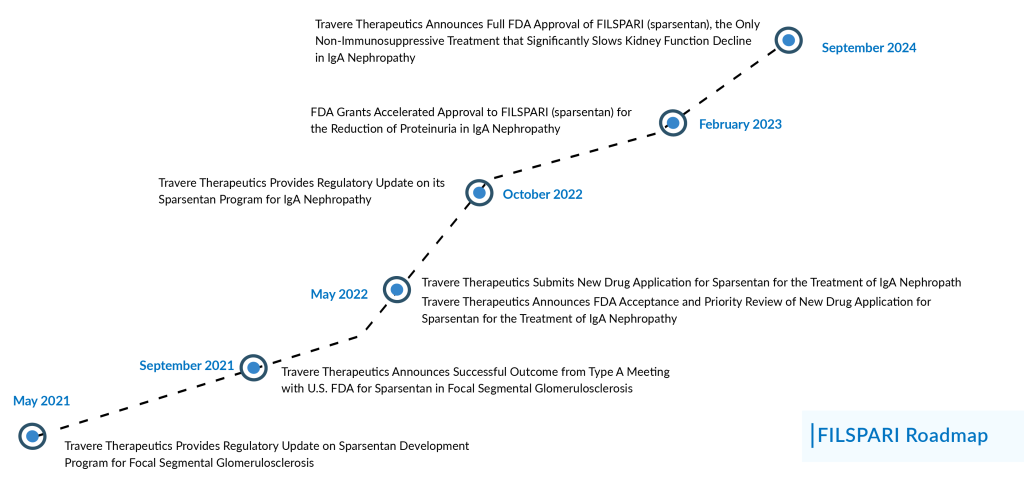

A year after failing to meet a trial endpoint, Travere Therapeutics can now relax. On 05 September 2024, the FDA upgraded FILSPARI’s conditional approval for the kidney disease IgA nephropathy to full approval.

FILSPARI’s complete approval broadens its use, permitting the small molecule blocker to help slow kidney function decline in adults at risk of disease progression. This also eliminates the prior necessity of having a specific urinary protein level.

FILSPARI is a first-in-class, orally active single-molecule that acts as a high-affinity dual-acting antagonist of the ETA and AT1 receptors, which are linked to the development of kidney disease. It is the first non-immunosuppressive drug launched in the IgAN treatment space through an accelerated approval pathway in February 2023.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- IgA Nephropathy – Navigating the Emerging Therapies and Key Companies in the Therapeutics D...

- 4 Late-Stage IgA Nephropathy Treatment Drugs to Look Out

- Advancements in IgA Nephropathy (IgAN) Treatment: From Standard-of-care (SoC) to Emerging Therapies

- AbbVie Presents Phase III CANOVA Study Results; Novartis’ Iptacopan Shows Promise in Phase III St...

- Novo Nordisk Seeks FDA Approval for Higher-Dose 7.2 mg WEGOVY Injection; Ascendis Pharma Granted ...

In February 2023, the FDA granted accelerated approval to FILSPARI based on proteinuria data from the Phase III PROTECT study. At that point, Travere had demonstrated that FILSPARI could reduce urine protein levels more than three times more effectively than Avapro (irbesartan), the active control.

Travere had intended for PROTECT to act as the confirmatory trial for FILSPARI. However, in September 2023, the company revealed that the trial had “narrowly” missed its efficacy target concerning the total slope of the estimated glomerular filtration rate (eGFR).

Despite showing a consistent treatment effect across different measurements and in patients with varying levels of proteinuria, Travere proceeded to seek full approval after receiving positive feedback from the FDA.

In March 2024, the company announced the submission of a sNDA to the US FDA for conversion of its accelerated approval of FILSPARI to full approval. In addition to this, recently in April 2024, the European Commission granted CMA for FILSPARI for the treatment of adults with primary IgAN.

The complete approval is now contingent on a revised analysis involving 404 randomized patients. In the final analysis of the 404 randomized patients, FILSPARI notably slowed the decline in kidney function from baseline to Week 110 compared to irbesartan. The ITT analysis indicated that the average eGFR slope from baseline to Week 110 was -3.0 mL/min/1.73 m²/year with FILSPARI and -4.2 mL/min/1.73 m²/year with irbesartan, reflecting a significant treatment difference of 1.2 mL/min/1.73 m²/year (p=0.0168). The beneficial effects of FILSPARI on proteinuria observed at Week 36 persisted through the two-year follow-up. Additionally, the PROTECT Study results showed that by Week 110, FILSPARI resulted in a 3.8 mL/min/1.73 m² difference in the mean change from baseline in eGFR compared to irbesartan.

So far, FILSPARI’s launch has been successful. The drug generated $27.1 million in sales during the second quarter, which is 37% higher than the previous quarter. Travere is looking into possible combinations for FILSPARI, including with SGLT-2 inhibitors, for treating IgAN.

In addition, Travere remains committed to FILSPARI’s potential in treating focal segmental glomerulosclerosis (FSGS), despite the drug not meeting the primary endpoint related to eGFR slope in a phase III trial.

A global collaborative project named PARASOL is studying the link between proteinuria and kidney failure in FSGS, which could help establish proteinuria as a surrogate endpoint for regulatory approvals. Inrig mentioned that once Travere gains more clarity on this pathway, expected later this year, it plans to resume discussions with the FDA regarding a potential filing.

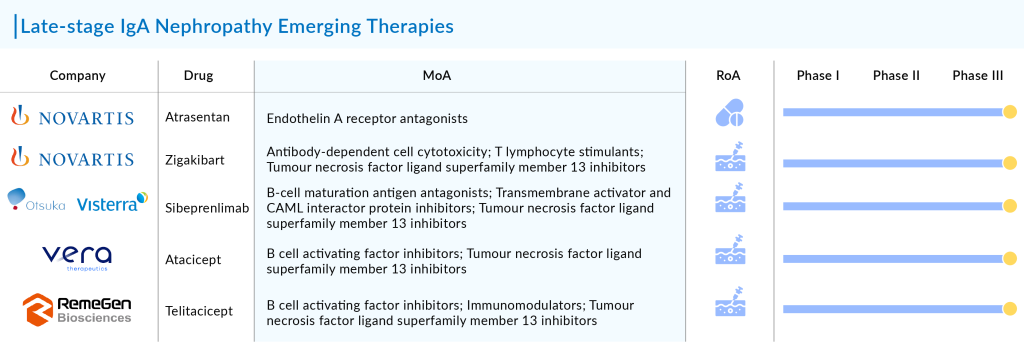

With this approval for IgA nephropathy, FILSPARI faces competition from Novartis’ FABHALTA, which received accelerated approval last month, and Calliditas’ TARPEYO, which received full approval in December 2023 after an initial accelerated approval in December 2021. Additionally, Novartis’ atrasentan, a selective ETA receptor inhibitor, is currently being reviewed by the FDA.

The reductions in proteinuria observed with FABHALTA, atrasentan, and FILSPARI in their respective Phase III trials were largely comparable, despite variations in trial designs and patient demographics. Travere’s study directly compared FILSPARI with the angiotensin II receptor blocker (ARB) irbesartan, while Novartis’s trials assessed its new IgAN drugs against a placebo in patients receiving supportive care, including ARBs and ACE inhibitors.

FILSPARI can be seen as a single-tablet combination due to its dual mechanism of action, whereas atrasentan is used as an additional treatment alongside existing medications. However, one setback for Travere is that despite receiving full approval from the FDA, FILSPARI’s boxed warning still includes a requirement for liver monitoring.

Due to the potential risk of liver toxicity, patients on FILSPARI must undergo monthly liver function tests during the first year of treatment and then every three months thereafter. In contrast, Novartis’ FABHALTA does not carry this warning. Travere is gathering additional data on FILSPARI, including real-world usage, to potentially request a change in the FDA’s requirements in the future.

Apart from these IgAN therapies, FILSPARI will also get tough competition from the upcoming drugs. Key players in the development of IgAN therapies include Visterra (sibeprenlimab), Vera Therapeutics (Atacicept), and RemeGen (telitacicept).

The anticipated introduction of these IgAN therapies is set to revolutionize treatment approaches in the coming years. To date, there has been a significant gap in specific treatments for IgAN, underscoring the urgent need for therapies that can halt progression to end-stage kidney disease (ESKD), a key unmet need. Significant progress in this area is expected to greatly influence the IgAN treatment market during the forecast period.

Downloads

Article in PDF

Recent Articles

- 4 Late-Stage IgA Nephropathy Treatment Drugs to Look Out

- Amgen’s UPLIZNA Wins First FDA Nod for IgG4-Related Disease; Aldeyra Gets FDA CRL for Reproxalap ...

- Merck’s WINREVAIR™ EU Approval; BALVERSA for Urothelial Carcinoma; Novartis and Versant’s Boreali...

- Sanofi to Acquire Provention Bio; USFDA Committee Votes in Favor Roche’s Polivy; FDA to Rev...

- AbbVie Presents Phase III CANOVA Study Results; Novartis’ Iptacopan Shows Promise in Phase III St...