Gastrointestinal Cancers: Exploring the Range of Digestive Tract Malignancies

Oct 02, 2024

Table of Contents

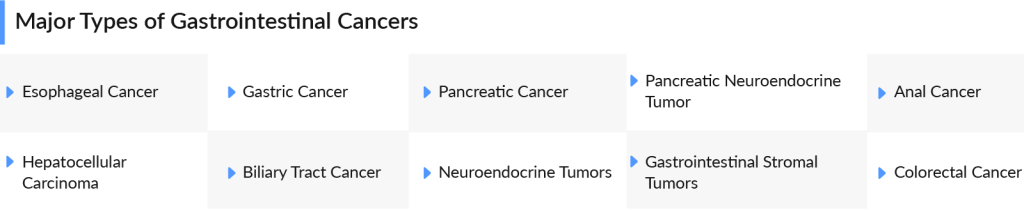

With millions of cases diagnosed globally each year, gastrointestinal cancers represent a significant health challenge but also an opportunity for breakthroughs in targeted therapies and personalized medicine. Gastrointestinal cancers refer to a group of cancers that affect the digestive system, including the esophagus, stomach, liver, pancreas, small intestine, colon, and rectum. These cancers are often silent in their early stages, making them harder to detect but highly treatable if caught early.

Types of GI cancers vary, with each affecting a different part of the digestive system. Each type requires a specialized approach, from early detection strategies to advanced treatment protocols, to improve survival rates and enhance the quality of life for patients. Let’s delve into each type of GI cancer in detail.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Eylea HD Injection 8 Mg Approved By FDA; Veopoz Receives FDA Approval for CHAPLE Disease Treatmen...

- Lion TCR Secures Triple FDA Milestones with IND Clearance for Chronic Hepatitis B; Corstasis Ther...

- Antibody–Drug Conjugates: An Emerging Concept in Cancer Therapy

- From Science Fiction to Reality: Investigating the Market Dynamics and Growing Demand for the Sma...

- Agios’ cancer pipeline auction; uniQure’s gene therapy on hold; Ultragenyx, Mereo Deal; aTy...

Upper Digestive GI Cancers

Upper digestive GI cancers are some of the most challenging yet critical areas of oncology today. These cancers often develop silently, with symptoms appearing only in later stages, making early detection crucial. With advancements in targeted therapies and immunotherapy, the fight against upper digestive GI cancers is gaining momentum, giving patients renewed hope and a chance for better outcomes. Some of the types of upper digestive GI cancers are

Esophageal Cancer

Esophageal Cancer is the eighth most common cancer worldwide – the seventh most common cancer in men and the thirteenth most common cancer in women. It is classified into adenocarcinoma, originating from mucus-producing gland cells, and squamous cell carcinoma, arising from the flat cells lining the esophagus, along with rare forms like small cell carcinoma, sarcoma, and others. Esophageal Cancer typically does not show symptoms until the tumor has enlarged, nearly 40% of the cases are diagnosed when the tumor becomes metastatic.

The 7MM accounted for approximately 77K diagnosed incident cases of esophageal cancer in 2023. The highest number of diagnosed incident cases of esophageal cancer were observed in Japan and the second highest number of diagnosed incident cases of esophageal cancer were observed in the US. TP53 point mutations represent the most frequent gene mutations occurring in about 50% of cases.

Esophageal cancer treatment often involves surgery to remove the cancer. Fluoropyrimidine- and platinum-containing chemotherapy is the cornerstone treatment. Other esophageal cancer therapies such as Eli Lilly’s CYRAMZA, Merck’s KEYTRUDA, Bristol-Myers Squibb/Ono Pharmaceutical’s OPDIVO and YERVOY are also recommended either alone or in combination with the standard chemotherapeutic regimen.

According to DelveInsight’s analysis, the current developmental pipeline for esophageal cancer is promising; several companies have initiated clinical trials investigating new treatment options or studying how to use existing treatment options better.

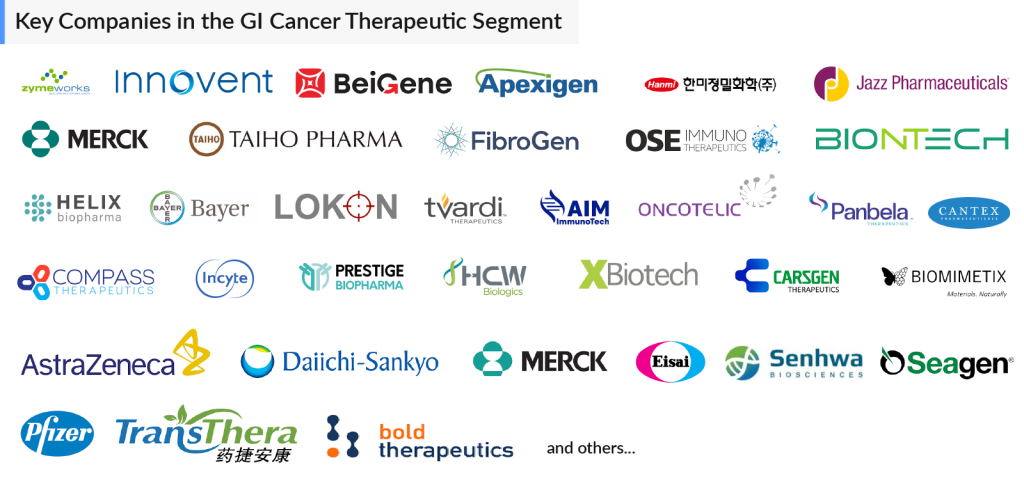

Potential drugs that can significantly change the esophageal cancer market during the forecast period include TEVIMBRA (tislelizumab) (BeiGene), zanidatamab (Jazz Pharmaceuticals/Zymeworks), LENVIMA (Merck/Eisai), telisotuzumab adizutecan (AbbVie), and others. These drugs are in the late stages of clinical development which are expected to bring a positive shift to the market.

Currently, the esophageal cancer market size was USD 1 billion in 2023 in the 7MM and the United States held the largest market share (40%). The dynamics of the esophageal cancer market are also anticipated to change in the coming years, owing to the rise in healthcare spending in the 7MM.

Want to know more about esophageal cancer? Get detailed insights at the Esophageal Cancer Market Report

Gastric Cancer

Gastric cancer ranks as the sixth most common cancer globally and is the third leading cause of cancer-related deaths. More than one-half of all new gastric cancers worldwide occur in China and Japan. Japan stands out with a five-year survival rate of 90%, significantly higher than other countries. In 2022, Japan reported the highest number of new gastric cancer cases among the 7MM, totaling 126K. While the incidence of gastric cancer is declining in Western nations like the US, cases of gastroesophageal junction (GEJ) cancer are on the rise.

The management of gastric cancer typically requires a combination of approaches, customized according to the cancer’s stage and location. Some of the approved medications for treating gastric cancer include ENHERTU (AstraZeneca/Daiichi Sankyo), CYRAMZA (Eli Lilly), OPDIVO (Bristol-Myers Squibb), KEYTRUDA (Merck), AYVAKIT (Blueprint Medicines), HERCEPTIN (Genentech), and others.

The gastric cancer pipeline is very robust, with many emerging drugs such as Bemarituzumab (Amgen), TEVIMBRA + Chemo (Beigene), AZD0901 (AstraZeneca), ONO-4538 + Ipilimumab + Chemotherapy (Ono Pharmaceutical), Evorpacept (ALX Oncology), Lenvatinib + Pembrolizumab ± FLOT (Eisai Pharma/Merck), CT041 (CARsgen Therapeutics), CHM-2101 (Chimeric Therapeutics), and others.

Apart from these, several oncolytic virus therapies are also in the pipeline. The anticipated launch of these gastric cancer oncolytic virus therapies will give a boost to the overall market growth in the future.

Discover the potential of oncolytic virus therapies for gastric cancer treatment

Pancreatic Cancer

Pancreatic cancer is among the deadliest cancers worldwide, with a higher prevalence in men than in women. There are two main categories of pancreatic cancer: exocrine pancreatic cancer, which encompasses adenocarcinoma, and neuroendocrine pancreatic cancer. According to analysis from DelveInsight, in 2023, the majority of stage-specific incident cases of pancreatic cancer in the US were classified as distant, accounting for nearly 50% of cases, followed by regional and localized instances.

For pancreatic cancer patients showing BRCA mutations, LYNPARZA (olaparib) was approved by the US FDA in 2019. VITRAKVI (larotrectinib) and ROZLYTREK (entrectinib) are approved for solid tumor patients having NTRK gene expression. Other than these, KEYTRUDA (pembrolizumab) is approved for solid tumor patients having microsatellite instability-high expression.

The chemotherapy drugs used for the treatment of pancreatic cancer include XELODA (capecitabine), 5-FU (fluorouracil), GEMZAR (gemcitabine), CAMPTOSAR (irinotecan), and others. Targeted therapies such as TARCEVA (erlotinib) were approved by the FDA for people with advanced pancreatic cancer in combination with the chemotherapy drug gemcitabine.

Quantitatively pancreatic cancer pipeline seems to be quite strong, however, pancreatic cancer clinical trials face difficulties in patient recruitment due to the disease’s aggressive nature and late-stage diagnosis. Additionally, identifying appropriate endpoints and assessing treatment efficacy pose challenges in trial design.

Key players include FibroGen (pamrevlumab), OSE Immunotherapeutics (OSE2101), Lokon Pharma (LOAd703), Oncotelic Inc. (OT-101), Helix Biopharma Corporation/Theradex (L-DOS47 + Doxorubicin), Tvardi Therapeutics (TTI-101), AIM ImmunoTech (Rintatolimod), BioNTech (BNT122), Prestige Biopharma (PBP1510), HCW Biologics (HCW9218), Cantex Pharmaceuticals (Azeliragon), XBiotech (XB2001), Lumicell (LUM015), CARsgen Therapeutics (CT041), and others are investigating their drugs in different settings.

With the expected launch of these pancreatic cancer therapies, the market will witness an upsurge in growth in the coming years.

Learn how the oncolytic virus therapies for pancreatic cancer can revolutionize the therapeutic space

Lower Digestive GI Cancers

Lower digestive GI cancers pose significant health challenges, yet they also represent a realm of hope and innovation in medical science. These cancers often arise from the intricate interplay of genetic factors, lifestyle choices, and environmental influences, making early detection and prevention crucial. Advances in screening techniques and targeted therapies are revolutionizing patient outcomes, transforming what was once a daunting diagnosis into a manageable condition. Some of the types of lower digestive GI cancers are

Colorectal Cancer

Colorectal cancer is the second most frequent type of cancer and represents approximately 12–14% of all cancer cases in men and women. Out of these, approximately 25% of patients present with metastases at initial diagnosis, and almost 50% may eventually develop metastases, contributing to the high mortality rates reported for CRC. DelveInsight reports that in 2023, there were around 550K new colorectal cancer cases in the 7MM, a number that is expected to rise by 2034.

The most common treatment for early-stage colorectal cancer is surgery. Some patients with early-stage disease may also receive chemotherapy after surgery. The treatment plan for metastatic CRC may include a combination of surgery, radiation therapy, immunotherapy, and chemotherapy, which are used to slow the spread of the disease and often temporarily shrink a cancerous tumor.

Anti-angiogenesis therapy aims to inhibit angiogenesis, the formation of new blood vessels. This type of treatment includes medications such as AVASTIN (bevacizumab), STIVARGA (regorafenib), ZALTRAP (ziv-aflibercept), and CYRAMZA (ramucirumab). These drugs can be used in conjunction with FOLFIRI chemotherapy as a second-line option for metastatic colorectal cancer.

In the second and third-line settings, OPDIVO (nivolumab) with or without YERVOY (ipilimumab), as well as BRAFTOVI (encorafenib) in combination with ERBITUX (cetuximab), have been approved as effective treatment regimens for mCRC patients. On the other hand, KEYTRUDA (pembrolizumab) is approved specifically as a first-line therapy for mCRC.

Additionally, medications that inhibit EGFR may also be effective in halting or slowing the progression of colorectal cancer. The most commonly used EGFR inhibitors for mCRC patients are ERBITUX (cetuximab) and VECTIBIX (panitumumab). However, various secondary sources indicate that cetuximab and panitumumab may be less effective for tumors with specific mutations in the RAS gene.

The colorectal cancer pipeline is very robust; many potential therapies are being investigated for the treatment of colorectal cancer. The emering therapies for colorectal cancer include Adagrasib (Bristol Myers Squibb/Mirati Therapeutics), ENHERTU (Daiichi Sankyo/AstraZeneca), ELI-002 (Elicio Therapeutics), MK-4280A + pembrolizumab (Merck), RRx-001 (EpicentRx), Onvansertib (Cardiff Oncology), and others.

The anticipated launch of these therapies will boost the colorectal cancer market growth and give a ray of hope to thousands of people suffering from this condition.

Discover which therapies are expected to grab the major colorectal cancer market share in the coming years

Anal Cancer

Anal cancer is relatively rare, accounting for about 2.7% of all reported gastrointestinal cancers in the United States. Anal cancer is more prevalent among women than men and is most frequently diagnosed between the ages of 45 and 75 years. Anal squamous cell cancer (ASCC) occurs most frequently, accounting for approximately 80–85% of all anal canal cancers; other rare types include adenocarcinomas, melanoma, and basal cell carcinoma. The total incident cases of anal cancer in the 7MM were around ~20K cases in 2023 out of which the highest incident cases of this disease were seen in the United States.

Currently, there are no approved therapies specifically designed for the treatment of anal cancer. Treatment options for locoregional anal cancer typically include surgery, radiation therapy, and chemotherapy.

First-line chemoradiotherapy (CRT) commonly involves a combination of mitomycin with either infusional 5-fluorouracil (5-FU) or capecitabine, accompanied by intensity-modulated radiotherapy (IMRT) as the preferred radiation approach. In cases of locally recurrent disease, surgical management is usually pursued. Nivolumab and pembrolizumab are considered second-line immunotherapy options for patients who do not respond to initial treatments.

The pipeline for anal cancer treatments is continuously evolving with ongoing research and clinical trials focusing on innovative approaches to improve outcomes and reduce side effects. Current areas of interest in the pipeline include targeted therapies and immunotherapies such as Retifanlimab (Incyte Corporation), BMX-001 (BioMimetix), and others.

Thus the pipeline for anal cancer looks promising, with a range of novel therapies and approaches under investigation that have the potential to redefine treatment standards and improve patient outcomes in the future.

DelveInsight estimates that the market size for anal cancer is expected to grow from USD 7 million in 2023 in the US with a significant CAGR by 2034. This growth can be attributed to the introduction of upcoming therapies and the rising incidence of the disease. The anticipated launch of these therapies is also expected to attract new entrants to the anal cancer market, resulting in increased competition and innovation.

Discover more about anal cancer drugs in development

Hepatocellular and Biliary Liver Cancer

Hepatocellular and biliary liver cancers represent a formidable challenge in oncology, emerging as significant health threats worldwide. Both cancers highlight the critical need for early detection and innovative treatments, as they often go unnoticed until advanced stages. The intricate interplay between lifestyle factors, viral infections, and genetic predispositions makes understanding these cancers essential for developing targeted therapies and improving patient outcomes.

Hepatocellular Carcinoma

Hepatocellular carcinoma accounts for about 85%-90% of all primary liver cancer cases. The organization also reports that there are approximately six new cases of HCC per every 100,000 people in the general population of the US. The number of people who develop HCC in the US has risen in the last four decades. As per DelveInsight’s analysis, approximately 41K incident cases of HCC were observed in 2023 in the US.

Current treatments primarily focus on targeting angiogenesis through multikinase inhibitors, VEGF, TKIs, and addressing the tumor microenvironment using immune checkpoint inhibitors. While many healthcare providers view TECENTRIQ (atezolizumab) combined with AVASTIN (bevacizumab) as the first-line standard, patient-specific factors may lead to alternative choices such as NEXAVAR (sorafenib), LENVIMA (lenvatinib), or IMFINZI (durvalumab) with IMJUDO (tremelimumab). With multiple options available for both first- and second-line therapies, including TKIs and immunotherapies, the optimal treatment sequence remains unclear.

A major gap in the development of systemic therapies is the lack of single-targeted treatments or antibody-drug conjugates. This is because somatic genetic changes in HCC are varied and occur infrequently, without a clear dominant driver. As a result, future strategies with the most potential will likely concentrate on the immune microenvironment of HCC and its interactions with the tumor microenvironment and genomics.

The dynamics of the HCC market are anticipated to change in the coming years owing to the improvement in the rise in number of healthcare spending across the world. Some of the emerging HCC therapies include Tiragolumab/RG6058 (Roche), Nofazinlimab/CS1003 (CStone Pharmaceuticals), ADI-PEG20 (Polaris), AK104 (Akeso Biopharma), Rivoceranib plus Camrelizumab (Elevar Therapeutics), TTI-101 (Tvardi Therapeutics), AZD5851 (AstraZeneca), and others.

The anticipated launch of these emerging therapies for HCC are poised to transform the market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the HCC market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

Get all the latest updates and breakthroughs on HCC at Hepatocellular Carcinoma Market Report

Biliary Tract Cancer

Biliary tract cancer, often overlooked, is a silent but aggressive form of cancer that affects the bile ducts, gallbladder, and liver. Biliary tract cancers constitute epithelial malignancies of the biliary tree and include the following: gallbladder cancer (GBC) and cholangiocarcinoma (CCA). CCA is further divided into intrahepatic CCA, perihilar CCA (Klatskin’s tumor), and distal CCA.

In 7MM, the United States accounted for the highest number of total incident cases of BTC, which is around 30% of the total incident cases of BTC in the 7MM, in 2023. In the US, among the mutation-specific cases of BTC, TP53 cases were highest, followed by KRAS cases in 2023.

Early-stage disease treatment typically involves surgery followed by adjuvant chemotherapy. For patients with locally advanced disease, loco-regional therapies such as trans-arterial chemoembolization (TACE) and external beam radiation therapy (EBRT) may be considered. In cases of locally advanced or metastatic disease, combining gemcitabine with cisplatin has shown survival benefits. Chemotherapy remains a dominant approach in current treatments.

PEMAZYRE (pemigatinib) and LYTGOBI (futibatinib) are two FGFR2 inhibitors that have received FDA approval. Another target being explored in Biliary Tract Cancer research is the PD-1 immune checkpoint molecule. In October 2023, the FDA granted expanded approval for KEYTRUDA (pembrolizumab), an immunotherapy targeting PD-1, to be used with gemcitabine and cisplatin for treating locally advanced unresectable or metastatic BTC.

Researchers are also investigating other genetic mutations in Biliary Tract Cancer tumors to develop more treatment options. TAFINLAR (dabrafenib) + MEKINIST (trametinib) have been approved in the U.S. for treating BRAFV600E-positive solid tumors, while VITRAKVI (larotrectinib) and ROZLYTREK (entrectinib) are being used to treat NTRK fusion-positive solid tumors.

The BTC pipeline is looking promising. Some of the drugs in the pipeline include CTX-009 (Compass Therapeutics), Zanidatamab (Jazz Pharmaceuticals/Zymeworks), CX-4945 (Senhwa Biosciences) and others. Other pharma companies working on their lead candidates include Zymeworks, AstraZeneca, Daiichi Sankyo, Merck Sharp & Dohme, Eisai, Seagen, Pfizer, TransThera Sciences, Compugen, Bold Therapeutics, and others.

Some of these therapies have recently advanced to the later stages of development, and DelveInsight’s analysts predict their potential launch in the US market for BTC treatment.

In summary, several promising treatments are being explored for BTC. While it’s too early to definitively say whether the highlighted candidates will enter the market during the forecast period (2024–2034), it is reasonable to expect a positive outlook for this market’s future. If approved, these drugs are likely to bring substantial changes to the BTC landscape in the coming years. The BTC treatment space is projected to see significant growth and will grow from USD 1 billion in 2023 at a significant CAGR, driven by increased global healthcare investment.

Explore more about the evolving landscape of the biliary tract cancer market

Miscellaneous

Apart from the above-mentioned GI cancers, there are several other types of GI cancers which are impacting the quality of life of patients. From neuroendocrine tumors to GIST, these cancers defy the common types like colorectal or pancreatic, making early detection and treatment a challenge. Despite their rarity, they demand urgent attention, innovative therapies, and specialized care to improve patient outcomes.

Neuroendocrine Tumors

Neuroendocrine tumors (NETs) develop most commonly in the gastrointestinal tract, specifically in the large intestine (20%), small intestine (19%), and appendix (4%). Approximately 21% of well-differentiated NETs, 30% of moderately differentiated NETs, and 50% of poorly differentiated or undifferentiated NETs are diagnosed in the metastatic stage.

Neuroendocrine tumors have been described in many organs, but are most common in the gastroenteropancreatic (GEP-NET) and pulmonary tract (PNET). In comparison, thymic neuroendocrine tumors (TNETs) are rare, accounting for less than 5% of mediastinal and thymic neoplasms, and 0.4% of all neuroendocrine tumors overall.

The total number of incident cases of NETs in the US was nearly 29K cases in 2023 and is projected to increase by 2034 as per DelveInsight. Non-functional/Asymptomatic/Unknown NETs hold the largest contributors to the overall NETs by functional status.

Surgery is generally considered a first-line treatment for localized NETs. The frontline treatment for metastatic disease is somatostatin analogs, and currently, two agents are FDA-approved: SANDOSTATIN (octreotide acetate) and SOMATULINE DEPOT (lanreotide). Both somatostatin analogs provide symptomatic relief in 50% to 70% of patients and biochemical responses in 40% to 60% of patients.

Traditionally, mTOR inhibitor – everolimus or sunitinib – was acknowledged second-line agent, but with the recent approval of PRRT (peptide receptor radionuclide therapy), the choice of second-line therapy is debatable.

While GEP-NETs in children and adolescents are rare, the impact can be devastating. Advanced Accelerator Applications (AAA)/Novartis’s LUTATHERA is now the very first therapy approved specifically for use in pediatric patients with GEP-NETs. offering new hope to young patients living with this rare cancer.

All available therapies for NETs, whether monotherapy or combination, are currently leveraged to treat this complex, diverse population of patients, yet no treatment has maintained progression-free survival (PFS) indefinitely.

Several key companies are working with their lead assets to improve the treatment landscape. Some of the drugs in the NETs pipeline include ITM-11 (ITM Isotope Technologies Munich), CAM2029 (Camurus), Cabozantinib (Exelixis), RYZ101 (RayzeBio), Lurbinectedin (PharmaMar), and others. In addition to these, a few key players are active in PCPG, including Chimerix (ONC201), Enterome (EO2401), Merck (MK-6482), Perspective Therapeutics ([212Pb]VMT-α-NET), and others.

To summarize, as several new medicines will enter, the NETs market size is expected to rise from USD 1.5 billion in 2023 in the US. Demand for emerging therapies would be driven by physician enthusiasm, which a significant unmet need, frequent switching, and the usage of multi-drug regimens would fuel.

Keen to know more about the latest developments in NETs? Get detailed insights at the Neuroendocrine Tumors Market Outlook

Gastrointestinal Stromal Tumors

Gastrointestinal stromal tumor (GIST) is a rare cancer affecting the digestive tract or adjacent structures within the abdomen, typically arising from interstitial cells of Cajal (ICCs) or less differentiated precursor cells. Mutations in KIT or PDGFRA genes, or other rare gene alterations, drive GIST progression, with the majority of tumors exhibiting mutations in the KIT gene.

In the assessment done by DelveInsight, the estimated total incident cases of GIST in the 7MM were nearly 16K in 2023. The highest incident cases of GIST were accounted by the US in 2023, which are expected to show a steep rise soon due to the improvement in diagnostic testing and advancements in genetic testing and account for 43% of the total cases in the 7MM.

Our assessments indicate that KIT and PDGFRA mutations are the most common events in GIST pathogenesis, with BRAF mutations also affecting a portion of the population. In 2023, the US had around 80% cases of KIT mutation, 8% cases of PDGFRA mutation, 1% cases of BRAF mutation, and 11% cases of other mutations.

Currently, seven therapies are approved for GIST, including five TKIs and two NTRK inhibitors. These therapies include GLEEVEC (Imatinib Mesylate), STIVARGA (Regorafenib), SUTENT (Sunitinib Malate), AYVAKIT (Avapritinib), QINLOCK (Ripretinib), ROZLYTREK (Entrectinib), and VITRAKVI (Larotrectinib), each approved for different treatment stages. Additionally, certain off-label therapies are used for patients resistant to these approved treatments.

Imatinib, a selective tyrosine-kinase inhibitor targeting KIT, PDGFRA, and ABL, was first approved for advanced GIST in 2002. It received approval for adjuvant treatment in high-risk patients in 2008 and for use in adult patients after surgical removal of CD117-positive GIST in 2012. The FDA approved it in 2001, followed by the EMA and PMDA in 2003, transforming GIST treatment.

The GIST pipeline landscape is robust with several companies working on their products. Emerging therapies such as Pimitespib (only in Japan), Bezuclastinib (CGT9486/PLX9486), MEK162 + Imatinib Mesylate, Cabometyx (cabozantinib), and others have the potential to overcome the unmet needs of the market.

The GIST market is currently driven by approved therapies across multiple lines of treatment. With a rising incidence of cases and the anticipated launch of emerging therapies such as crenolanib, bezuclastinib, and others, the overall market size of GIST is expected to surge from USD 450 million in 2023 in the 7MM at a significant CAGR by 2034.

Get more information about GIST at Gastrointestinal Stromal Tumors Treatment Landscape

Pancreatic Neuroendocrine Tumor

Pancreatic neuroendocrine tumors are a rare type of cancer that starts as a growth of cells in the pancreas. Pancreatic neuroendocrine tumors start from the hormone-producing cells in the pancreas called islet cells. Multiple endocrine neoplasia type 1 (MEN1) syndrome is a risk factor for Pancreatic Neuroendocrine Tumors.

In stage-wise incident cases, metastatic pancreatic neuroendocrine tumors and regionally advanced pancreatic neuroendocrine tumors are high in number in comparison to localized or unstaged. The old age population is more susceptible to suffering from Pancreatic Neuroendocrine Tumors, as per DelveInsight.

The treatment strategy has 4 components: surgery, locoregional therapy, systemic therapy, and complication control. Surgical removal of primary, non-metastatic PNET is the only clinical cure, and surgical debulking of liver PNET metastases reduces the hormone secretion from functioning PNETs and the tumor mass effects of all PNETs.

SUTENT was the first treatment approved by the FDA in 2011 for patients with progressive, well-differentiated pancreatic neuroendocrine tumors (PNET). It is a small molecule receptor tyrosine kinase (RTK) inhibitor that targets multiple RTKs, such as vascular endothelial growth factor receptor (VEGFR), platelet-derived growth factor receptor (PDGFR), Kit, and Flt-3.

LUTATHERA, developed by Advanced Accelerator Applications, is a somatostatin analog approved by the FDA in 2018 as the first peptide receptor radionuclide therapy (PRRT). AFINITOR (everolimus), a kinase inhibitor, is used to treat adult patients with progressive pancreatic neuroendocrine tumors and progressive, well-differentiated, nonfunctional NET of the gastrointestinal tract or lung that are unresectable, locally advanced, or metastatic.

Despite all these available treatment options, the clinical pipeline for PNET seems weak at present, researchers, as well as key players such as Aadi Bioscience, Inc., Ipsen, Merck Sharp & Dohme LLC, and others, are actively focused on the development of novel therapies for the treatment of PNET.

With the increasing incidence of PNET and their apparent heterogeneity from benign incidental lesions to malignant carcinoma the management of patients with PNET is complex. This heterogeneity and the multiple effective treatment options have led to the development of a patient-centered, personalized approach to treatment.

Dive deep into the in-depth assessment of pancreatic neuroendocrine tumor emerging therapies

What Lies Ahead for Gastrointestinal Cancers?

The future of gastrointestinal cancer treatment is brighter than ever, thanks to groundbreaking advancements in precision medicine, immunotherapy, and early detection technologies. Researchers are increasingly focusing on personalized therapies that target specific genetic mutations and molecular pathways, offering more effective, tailored treatments with fewer side effects. Liquid biopsies, for example, allow for the detection of cancerous cells at their earliest stages, improving the chances of survival with timely intervention. Immunotherapies, such as immune checkpoint inhibitors, are also revolutionizing treatment, helping the body’s own immune system fight cancer more effectively.

Additionally, innovative surgical techniques, robotic surgeries, and minimally invasive procedures are making it possible for patients to recover faster and with fewer complications. Combining these advancements with novel drug developments and a deeper understanding of cancer biology, the fight against gastrointestinal cancers is poised for major victories. Researchers are optimistic that these innovative approaches will not only improve patient outcomes but also move us closer to the ultimate goal—turning gastrointestinal cancers into manageable, chronic conditions, or even curing them altogether.

Downloads

Article in PDF

Recent Articles

- Adagio Raises $336 M; Lyndra’s Schizo Trial; BMS Opdivo for Gastric Cancer; Anixa Ovarian C...

- Unveiling the Future: Global Neuroendocrine Tumor Market Trends & Innovations

- Eisai Submits Marketing Authorization Application for Tasurgratinib; CHMP Issues Positive Opinion...

- Lassen’s anti-IL-11 antibody; PTC’s COVID-19 trial; Lenzilumab’s result; Orca raises $192M

- Bristol-Myers Squibb’s Opdivo Approval; Mirati’s KRAS-inhibitor Adagrasib; J&J and Legend Bi...