Glioblastoma Multiforme Market: Emerging Pipeline Therapies To Keep A Keen Eye On

Oct 10, 2024

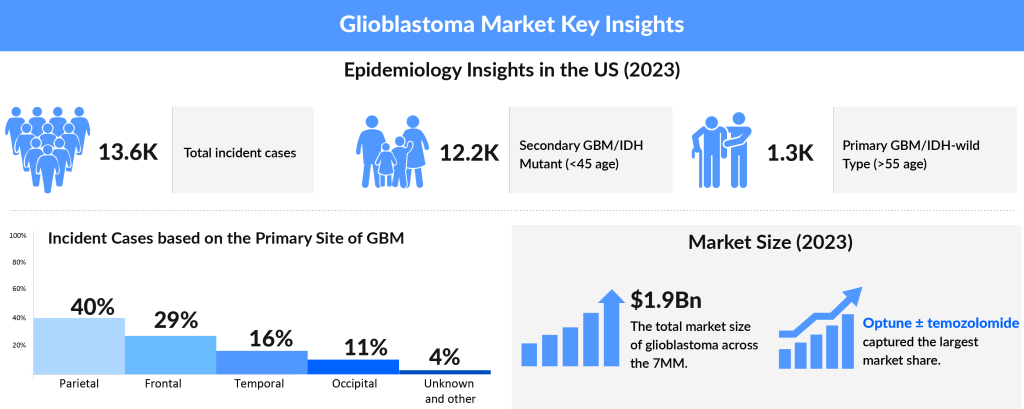

The present Glioblastoma multiforme (GBM) market has several unmet needs. Poor prognosis, 10-15 months median survival rate, no curative treatment to the patients, limited treatment options, drug resistance, incapability of therapies to cross BBB (blood-brain-barrier), intratumor heterogeneity, and a high mortality rate are among them.

The cardinal approach is always surgery followed by radiation therapy with chemotherapy BiCNU (carmustine), Avastin (bevacizumab), and Temodar (temozolomide) as an adjunct. Further, no standard of care is available in the market for recurrent GBM market.

However, over the turn of the decade, with advances in medical science, efforts into clinical and basic research, the GBM market has witnessed several therapies showing promising results in the clinical trials. The Glioblastoma multiforme market constitutes a robust and diverse pipeline backing up its growth in the coming years. Advanced medical technology has further helped in receiving a clearer picture of the disease as well as in making a prompt diagnosis.

Downloads

Article in PDF

Recent Articles

- Merck’s Gefapixant; Pfizer’s Somatrogon; Gilead’s Viklury; AbbVie’s Skyrizi; Gilead’s...

- 13 of the most commonly asked questions about Glioblastoma multiforme, Answered

- KEY CLINICAL OUTCOMES

- Idera’s Phase I Data; DelMar Initiates Trial; Novartis’ study; Humira gets EC approval

- Glioma vs. Glioblastoma Therapeutics Space: Unveiling the Battlefront

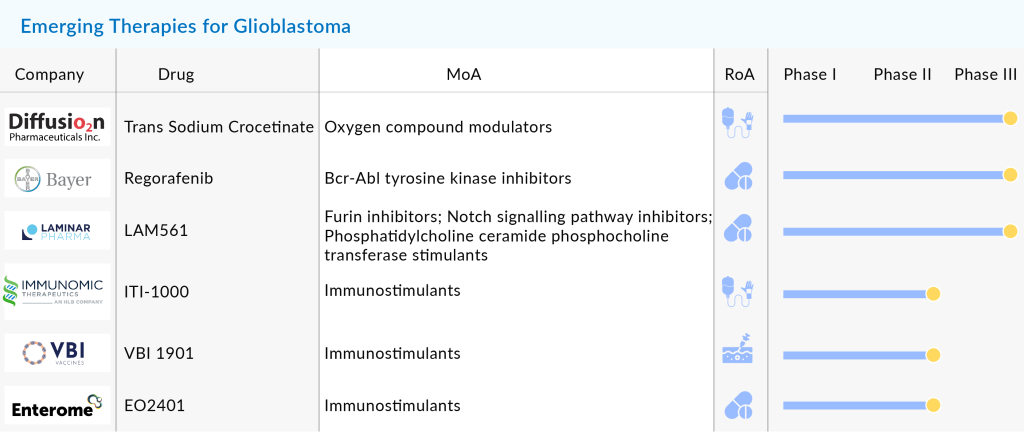

Several companies are clinically testing the efficacy and safety of a wide range of therapeutic products differing in the mechanism of actions and routes of administration. DelveInsight’s Glioblastoma multiforme market forecast analysis demonstrates notable companies, including Bayer, Chimerix, Aivita Biomedical, Denovo Biopharma, Northwest Therapeutics, VBL Therapeutics, Laminar Pharmaceuticals, MedImmune, DNAtrix, Immunomic Therapeutics, Imvax, MimiVax, CNS Pharmaceuticals, Epitopoietic Research Corporation (ERC), Istari Oncology, SonALAsense, Kintara Therapeutics, and Bristol Myers Squibb, among others, are investing their funds, time, and efforts in accelerating the Glioblastoma multiforme market.

Emerging Pipeline Therapies to watch out for in the GBM Market

The companies are weaving in a wide range of novel therapeutic agents as well as agents for adjunct therapies to supplement the existing therapies, in the GBM pipeline to facilitate better patient outcomes. One such approach under scrutiny is Gene therapy. Realizing the lack of potential of surgery and chemos in recurrent Glioblastoma multiforme, VBL Therapeutics, led the clinical trials exploiting its gene therapy VB-111 (Ofranergene obadenovec) against Glioblastoma multiforme. Despite falls and frustrations that came in the way of evaluation of its gene therapy, which feasts on the blood vessels that cancerous cells flourish on, in GLOBE trial (NCT02511405), the company is running a randomized, controlled, clinical trial with rGBM undergoing a second surgery (NCT04406272).

To harness the might of immune response, Ziopharma designed its therapy Veledimex to regulate the immune system to attack cancerous cells. The company is running a Phase II trial of its drug Veledimex to switch on and off Ad-RTS-hIL-12 (Controlled IL-12) as a monotherapy in two studies and in combination with a PD-1 inhibitor (Libtayo) in a third one (NCT04006119). So far, the company seems to be very optimistic about its drug Veledimex, which can cross the BBB. The company is also investigating Controlled IL-12 in combination with Opdivo in the Phase I trial.

Another class of treatment option proliferating as an antineoplastic regimen in the Glioblastoma market landscape is Therapeutic Vaccines. It is not news that GBMs are notorious for their immunosuppression. However, Vaccines offer a personalized therapeutic approach unique to individual GBM patients to achieve an immune response stimulated against tumors. In the present GBM market, several vaccines or immunotherapy candidates undergo rigorous testing to assess their safety and efficacy in GBMs. VBI Vaccines recently dosed the first patient in the second study arm in the ongoing Phase IIa clinical study of VBI-1901 in combination with either GlaxoSmithKline’s GM-CSF or AS01B as immunomodulatory adjuvants (NCT03382977). Recently, in June 2021, the company was granted Fast track designation by the FDA for VBI-1901 for the treatment of recurrent Glioblastoma.

In the race is also Aivita Biomedical with its immunotherapeutic vaccine AV-GBM-1, which has managed to improve the overall survival rate at 15 months by 76% as compared to 48% in the control arm in an ongoing Phase II clinical trial in patients with newly diagnosed glioblastoma (NCT03400917). TVAX Biomedical is another contender in the Glioblastoma multiforme market that has received the US FDA Fast Track Designation for the use of its vaccine-enhanced adoptive T cell therapy (VACT), TVI-Brain-1 for the treatment of glioblastoma multiforme, based on the impressive results of Phase I and Phase II studies. Immunomic Therapeutics (ITI-1000) and DNAtrix (DNX-2401) also proactively run clinical trials evaluating their immunotherapies in the Glioblastoma multiforme space. On November 22, 2021, DNAtrix, announced the presentation of data from its Phase I study of DNX-2401 in diffuse intrinsic pontine glioma (DIPG) at the 26th Annual Meeting of the Society for Neuro-Oncology (SNO) in Boston. DNX-2401, an adenovirus-based immunotherapy, is designed to selectively target and kill tumor cells while triggering a strong anti-tumor immune response. The therapy has already received FDA Fast Track and Rare Pediatric Disease designations for DIPG, underscoring its potential to address this challenging pediatric cancer.

Besides gene therapies and immunotherapies, the Glioblastoma multiforme market space is also experiencing several other therapeutic agents such as multi-kinase inhibitors PD-1/PD-L1 inhibitor, monoclonal antibodies, a selective antagonist of dopamine receptor D2 (DRD2), and ClpP agonists undergoing trials. For instance, DelMar Pharmaceuticals is developing VAL-083, and announced positive interim data from its two Phase 2 trials showcasing improved outcomes over the current standard of care as both a first-line treatment and for recurrent GBM (NCT02717962). Kintara Therapeutics has encountered setbacks with its drug VAL-083. Despite showcasing promising patient case studies at the 2023 European Association for Neuro-Oncology Annual Meeting in September, the company announced on October 31, 2023, that VAL-083 failed to outperform existing standards of care in the GBM AGILE trial. As a result, Kintara has halted its development of VAL-083 and shifted its focus to its second program, REM-001. Meanwhile, Kazia’s paxalisib continues to show promise in newly diagnosed glioblastoma patients, raising hopes for it as a more viable therapeutic option in the fight against this aggressive cancer.

A novel proteasome inhibitor, marizomib, is under Phase III clinical supervision by Celgene combined with standard temozolomide-based radiochemotherapy vs. standard temozolomide-based radiochemotherapy alone in patients with newly diagnosed Glioblastoma (NCT03345095). Celgene’s pipeline therapies won the weightage hereafter BMS acquired it in a blockbuster deal, which was no less than horse-trading. This implies the amount of faith BMS has put into Celgene and its pipeline therapies.

In the Phase III trial, there is Diffusion Pharmaceuticals with its contender Trans Sodium Crocetinate for primary Glioblastoma multiforme, with the ability to increase survival in inoperable glioblastoma multiforme (GBM) patients in open-label, dose-escalation study (NCT03393000). Intending to bring in a vetted PI3K inhibitor class of drugs, Kazia Therapeutics introduced its paxalisib in the GBM market space, which has recently bagged the USFDA fast track designation. Just like Kazia, Denovo Biopharma is also among those to have received Fast Track designation for DB102 (enzastaurin) for newly-diagnosed glioblastoma. On the other hand, WPD Pharmaceuticals has struck gold as it received hefty funds from the Polish National Center for Research and Development (NCRD) to develop WPD101, a recombinant fusion protein helping in the treatment of GBM.

In April 2024, TME Pharma (France/Germany) announced that the FDA has granted Fast Track designation for NOX-A12 (olaptesed pegol), a CXCL12 inhibitor, used with radiotherapy and bevacizumab to treat aggressive glioblastoma.

On October 17, 2023, Diakonos Oncology Corporation announced that the FDA awarded Fast Track designation for its dendritic cell vaccine, DOC1021, based on positive preliminary Phase I trial results in patients with glioblastoma multiforme (GBM). Also in October 2023, MimiVax received Fast Track designation for its SurVaxM vaccine targeting newly diagnosed glioblastoma (nGBM).

Earlier, in July 2022, Alpheus Medical announced that the FDA granted both Orphan Drug and Fast Track designations for CV-01, a novel sonodynamic therapy for recurrent glioblastoma. In a recent collaboration, Cellipont Bioservices and Diakonos Oncology partnered for the process development and cGMP manufacturing of DOC1021 for GBM and other cancer indications.

Way ahead

Even so, there are several candidates in the Glioblastoma multiforme pipeline, and the early results look promising enough; however, it is not wise to celebrate early. It is yet to see which candidate reaches the finish line keeping in mind the disappointing results of the Rindopepimut, a therapeutic vaccine of Celldex Therapeutics, in Phase III trials (NCT01480479), in EGFRvIII-positive recurrent glioblastoma multiforme. Similarly, AbbVie’s decision to halt the Phase 3 INTELLANCE-1 evaluating its novel antibody-drug conjugate (ADC) depatuxizumab mafodotin (Depatux-M) for the treatment of newly diagnosed glioblastoma (GBM) owing to lack of survival benefit. Not to forget the hard-crash of BMS’s Opdivo had in patients with MGMT methylation GBM.

On a brighter side, the results so far of the GBM pipeline therapies look promising and shall sure-shot expedite the present Glioblastoma multiforme market size. Increasing incidence and interest of pharma companies, as well as a particular focus in addressing the needs prevalent in the rare diseases, shall further provide a much-needed momentum to treat such immune-cold tumors.

Downloads

Article in PDF

Recent Articles

- Glioma vs. Glioblastoma Therapeutics Space: Unveiling the Battlefront

- Incyte’s Clinical Trial for Myelofibrosis; Eisai and Bioge’s Leqembi; FDA Approves Reata Pharmace...

- Leo Pharma’s Hand Eczema Clinical Trial Updates; GSK’s PD-1 inhibitor Jemperli Approval; Ro...

- Glioblastoma Multiforme: Advancements in the Treatment Paradigm of the Malignant Condition

- 13 of the most commonly asked questions about Glioblastoma multiforme, Answered