Could Hidradenitis Suppurativa Be Another Psoriasis?

Sep 06, 2024

Hidradenitis suppurativa is a chronic inflammatory skin disease that affects the hair follicles and apocrine sweat glands. Hidradenitis suppurativa affects approximately 1% of the population, with women being more commonly affected than men. It often begins after puberty, usually in the 20s or 30s.

In 2023, the total prevalent cases of hidradenitis suppurativa in the 7MM were nearly 6.2 million. These cases are anticipated to increase by 2034, as per DelveInsight. As per estimates, in the US, EU4 and the UK, hidradenitis suppurativa was seen to be slightly more common in females (~75%) than males (~25%). Conversely, in Japan, males represent nearly 70% of the total cases, while females account for around 30%.

As the hidradenitis suppurativa cases are on the rise, several key companies have increased their focus on research and development to improve early diagnosis and management of the disease.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Psoriasis Therapy Market Size

- Amgen Announced the Result of its CodeBreak-200 Trial; FDA Clears Bristol-Myers Squibb’s Deucrava...

- Prolong’s PP-007 Fast-Tracked for Stroke; FDA Expands JYLAMVO Pediatric Approval; Corcept’s Cushi...

- Biogen-Eisai’s Aduhelm; Quidel acquires Ortho Clinical Diagnostics; Accutar Biotechnology’s...

- Could Amgen’s Biosimilar Wezlana Pose a Challenge to Johnson & Johnson’s Stelara

What do we have today as hidradenitis suppurativa treatment options?

The primary treatment for mild hidradenitis suppurativa typically includes antibacterial washes and topical antibiotics. Acute flare-ups can be addressed with intralesional corticosteroids or minor surgical interventions. For mild-to-moderate cases, oral treatments may involve prolonged use of broad-spectrum antibiotics and systemic retinoids.

Off-label hidradenitis suppurativa treatments often feature antibiotics like clindamycin, rifampicin, and tetracycline, which have demonstrated efficacy in studies and are particularly useful for more severe or widespread lesions. Corticosteroids, such as triamcinolone acetonide, are employed to quickly reduce inflammation during acute flare-ups and to treat persistent nodules and sinus tracts. Prednisone and other corticosteroids are also used to alleviate pain and swelling.

Currently, the hidradenitis suppurativa treatment market is primarily driven by off-label therapies and AbbVie/Eisai’s HUMIRA, which holds a dominant position in the US hidradenitis suppurativa treatment market. HUMIRA (adalimumab) is a recombinant human IgG1 monoclonal antibody that targets human tumor necrosis factor (TNF). In September 2015, the FDA approved HUMIRA for treating moderate-to-severe hidradenitis suppurativa in adults.

However, HUMIRA’s effectiveness in treating hidradenitis suppurativa patients is only moderate. The situation differs in Europe, where HUMIRA biosimilars such as AMGEVITA, IMRALDI, HYRIMOZ, and HULIO entered the market in October 2018. These HUMIRA biosimilars have significantly reduced HUMIRA’s market share in Europe, leading to a continued decline in its market presence since the expiration of its patent exclusivity in 2018, according to the company.

Other approved therapies include COSENTYX and BIMZELX to treat moderate-to-severe hidradenitis suppurativa in adults. Novartis’ COSENTYX (secukinumab), is a monoclonal antibody targeting IL-17A. By selectively binding to and inhibiting Interleukin-17A, it reduces neutrophil activity. This medication is approved for treating multiple conditions, including plaque psoriasis, ankylosing spondylitis, and psoriatic arthritis, and is administered via the subcutaneous route. In October 2023, Novartis announced that the FDA approved COSENTYX for the treatment of moderate to severe hidradenitis suppurativa in adults.

UCB Biopharma’s BIMZELX (bimekizumab) is a humanized IgG1 monoclonal antibody that specifically targets IL-17A, IL-17F, and IL-17AF cytokines, preventing them from interacting with the IL-17RA/IL-17RC receptor complex. In April 2024, the FDA accepted the supplemental Biologics License Application (sBLA) for BIMZELX for the treatment of adults with moderate-to-severe hidradenitis suppurativa. Additionally, in April 2024, the European Medicines Agency (EMA) granted approval for BIMZELX to treat active moderate-to-severe hidradenitis suppurativa.

The field of hidradenitis suppurativa treatment is close to experiencing a surge of new drug development. To put the market opportunity for hidradenitis suppurativa into perspective for a condition that affects roughly 1% of the population, it is clear that, with the right strategy, it has the potential to be very profitable.

What is on the horizon as hidradenitis suppurativa treatment options?

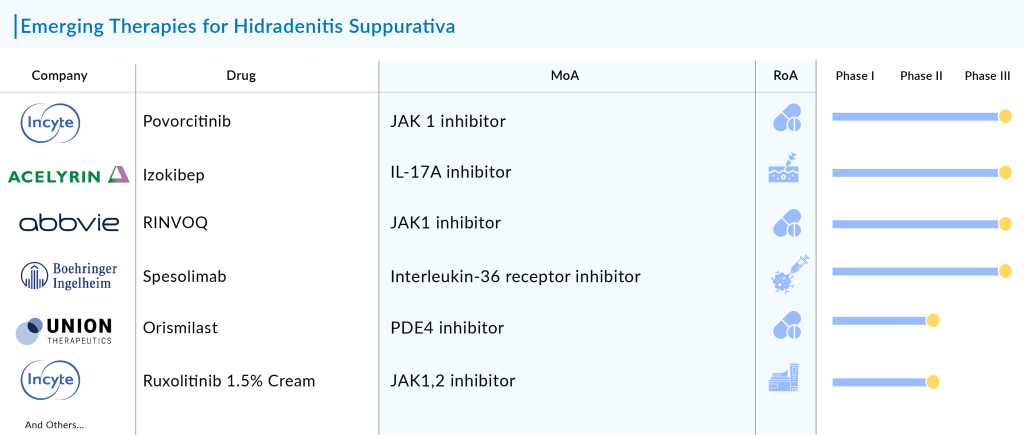

The hidradenitis suppurativa market treatment is entering an unprecedented era of rapid growth. Moreover, the hidradenitis suppurativa market has a diverse pipeline targeting Interleukins (i.e., IL-17, IL-36), anti-TNF, JAKi, and anti-complement factors.

Some of the drugs in the hidradenitis suppurativa pipeline include Povorcitinib (Incyte Corporation), Izokibep (ACELYRIN), RINVOQ (AbbVie), Lutikizumab (AbbVie), Sonelokimab (MoonLake Immunotherapeutics), Spesolimab (Boehringer Ingelheim), Brepocitinib (Priovant Therapeutics), Eltrekibart (Eli Lilly), Ruxolitinib 1.5% Cream (Incyte Corporation), SAR-444656/KT-474 (Sanofi/Kymera Therapeutics), Orismilast (UNION Therapeutics), and others.

The anticipated launch of these hidradenitis suppurativa therapies will significantly boost the therapeutic segment. In addition, the potential emerging hidradenitis suppurativa treatment option may open new doors for patients who may not respond to currently available therapeutics.

These emerging therapies, which specifically address the underlying inflammatory pathways of HS, have the potential to significantly improve clinical outcomes, reduce disease severity, and enhance the overall quality of life for those affected.

Moreover, the advent of these new hidradenitis suppurativa treatments underscores a shift toward a more personalized approach in hidradenitis suppurativa management. With advancements in understanding the pathophysiology of the disease, these therapies are tailored to individual patient profiles, potentially leading to more effective and sustained remission.

As a result, the treatment paradigm for hidradenitis suppurativa is evolving from a one-size-fits-all approach to one that is more nuanced and patient-centered. This progress not only promises better management of hidradenitis suppurativa but also highlights the growing impact of precision medicine in addressing complex chronic conditions.

The future hidradenitis suppurativa treatment space looks promising

The hidradenitis suppurativa treatment landscape is picking up the pace, due to a lack of opportunities in rheumatoid arthritis, and other overcrowded autoimmune indications. What we experienced 15 to 20 years ago in psoriasis is now happening in hidradenitis suppurativa. This is just the starting point.

While hidradenitis suppurativa has posed a particular challenge to dermatologists and drug developers given the scientific community’s incomplete understanding of the disease drivers, physicians are hopeful about the wave of new targets and candidates that could address patients currently underserved by adalimumab and secukinumab.

The hidradenitis suppurativa field is on the brink of significant advancements in drug development. Novartis’ COSENTYX currently enjoys some breathing room following its approval, but it may soon face stiff competition from UCB’s BIMZELX. Unlike COSENTYX, which targets IL-17A, BIMZELX inhibits both IL-17A and IL-17F, potentially contributing to its superior efficacy. In pivotal Phase III trials, BE HEARD I and II, BIMZELX demonstrated a significantly higher likelihood of patients achieving a 50% Hidradenitis Suppurativa Clinical Response (HiSCR50) compared to placebo at 48 weeks.

As per DelveInsight analysis, in 2023, the total market size of hidradenitis suppurativa in the 7MM was USD 1.4 billion, and HUMIRA and its biosimilars captured a major share. Since 2018, biosimilars of HUMIRA have been approved in the EU market, and HUMIRA’s revenue has started to decline. The patient share of overall adalimumab is also expected to decline due to the entry of more efficacious approved products, COSENTYX and BIMZELX.

While BIMZELX offers greater effectiveness, COSENTYX benefits from being the first to market and is currently seeing strong launch momentum. It’s important to note that BIMZELX’s effectiveness stands out in comparison to both HUMIRA and COSENTYX. Although COSENTYX has gained some flexibility in treating hidradenitis suppurativa due to Novartis’ clearance, BIMZELX from UCB, which has shown “incrementally better” results than COSENTYX, could become a significant competitor in the near future.

HUMIRA remains the standard first-line option, followed by anti-IL-17 therapies, but a growing number of candidates and new targets are coming up the pipeline. Novartis Pharmaceuticals was testing three new treatments for hidradenitis suppurativa, including Remibrutinib. At AAD’24, they shared promising Phase IIb results for this oral BTK inhibitor in patients with moderate-to-severe disease.

Remibrutinib was one of six treatments assessed in a 16-week Phase IIb study for patients with mild-to-severe hidradenitis suppurativa. This positive data presents a new market opportunity for Remibrutinib, which is nearing a regulatory filing this year for chronic spontaneous urticaria. At AAD, we also saw detailed Phase II results for AbbVie’s IL-1α/1β antagonist lutikizumab, showing strong responses in patients who had not benefited from anti-TNF therapy, and updated Phase II data on Moonlake’s anti-IL-17 nanobody sonelokimab.

Some of the key data presented on hidradenitis suppurativa at the American Academy of Dermatology 2024 conference include Incyte Corporation’s Phase II trial of ruxolitinib 1.5% cream and the 24-week topline results from the Phase II MIRA trial of sonelokimab. There is significant excitement surrounding nanobodies, given their ability to target multiple pathways and penetrate tissues effectively, which makes them promising candidates for treating hidradenitis suppurativa.

Sonelokimab has the potential to replace Novartis’ COSENTYX if Moonlake’s Phase II results are confirmed in Phase III. Despite the significant impact on patients’ well-being, the mild segment remains untapped, with no approved hidradenitis suppurativa therapies and only two emerging options: orismilast and ruxolitinib cream.

In summary, the future of hidradenitis suppurativa treatment appears promising, with advancements in targeted therapies and personalized medicine offering new hope for more effective and less invasive options. Innovations in biologics and immune modulators are poised to significantly improve patient outcomes and quality of life.

Downloads

Article in PDF

Recent Articles

- Virus, the Cancer Therapy of the Future

- FDA rejects BioMarin’s Valoctocogene Roxaparvovec; J&J inks $6.5B deal; Alzheon bags $...

- Merck’s Remicade; Sanofi, Regeneron set Kevzara; Novartis to sever; Teva puts women’s...

- What Does the Future of Plaque Psoriasis Treatment Market Look Like?

- AstraZeneca’s Imfinzi for Biliary Tract Cancer; FDA Clears Boehringer’s Spesolimab; Novo Nordisk ...