Entry of late-phase potential drugs like Pemrevlumab (FibroGen), PLN–74809 (Pliant Therapeutics), KD025 (Kadmon Corporation, LLC), PRM151 (Promedior, Inc.), Tipelukast (MediciNova), CC 90001 (Celgene), PBI-4050 (Prometic BioSciences), BG00011 (STX-100) (Biogen), GLPG 1690 (Galapagos NV), BMS 986020 (Bristol-Myers Squibb), VAY 736 (Morphosys, Novartis Pharmaceuticals) and MK-7264 (Afferent Pharmaceuticals, Inc., Merck), TD139 (Galecto Biotech AB) covering all the severity segments of IPF may bring revolution in the treatment of IPF by 2028.

Moreover, five potential therapies, namely Tipelukast, TAS-115, Thrombomodulin Alfa, LT-1001 and LT1002, expected to hit the Japan market by 2020, and improve the IPF therapeutic landscape in Japan.

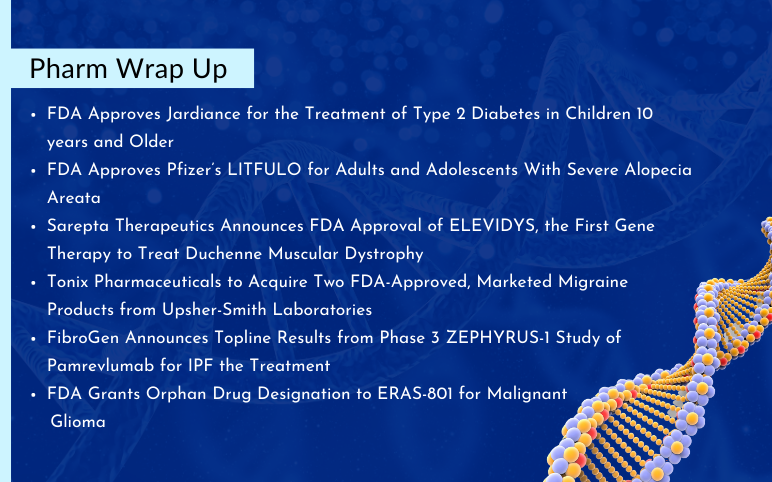

Not long ago, PLN-74809, a lead candidate of Pliant Therapeutics, received orphan drug designation from the U.S. FDA for the treatment of Idiopathic Pulmonary Fibrosis. Recently, Pharmaceutical company, FibroGen, which is running the clinical trials for its candidate Pemrevlumab, revealed promising results in the Idiopathic Pulmonary Fibrosis treatment. The drug significantly lowered down the IPF progression and improved lung functioning drastically. The company announced the beginning of the ZEPHYRUS Phase 3 study of Pemrevlumab. FibroGen further assured the IPF patient pool of an improved life by addressing the underlying unmet needs in the field of Idiopathic Pulmonary Fibrosis, through its innovative therapeutic approach in the form of Pemrevlumab.

As per DelveInsight’s analysts, the Idiopathic Pulmonary Fibrosis market size in the 7MM was found to be USD 1,700 million in 2017 and is expected to grow in the future years owing to the anticipated launch of IPF emerging therapies during the forecasted period 2019-2028.

United States is expected to grab the highest Idiopathic Pulmonary Fibrosis market share of 2028 with USD 1100 million. Among EU5 countries, Germany has the potential to dominate the IPF market size with USD 182 million in 2017, while United Kingdom to settle with the least Idiopathic Pulmonary Fibrosis market share of USD 50 million in 2017.