Interleukin-2-targeting Therapies: Journey from Bench to Bedside

Jan 31, 2025

Expected data readouts in 2025, filling the unmet need, and estimated market opportunity in Oncology, Immunological and Neurodegenerative Diseases

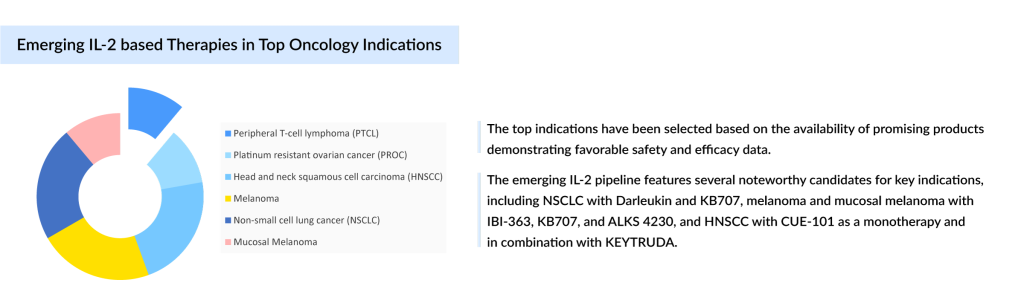

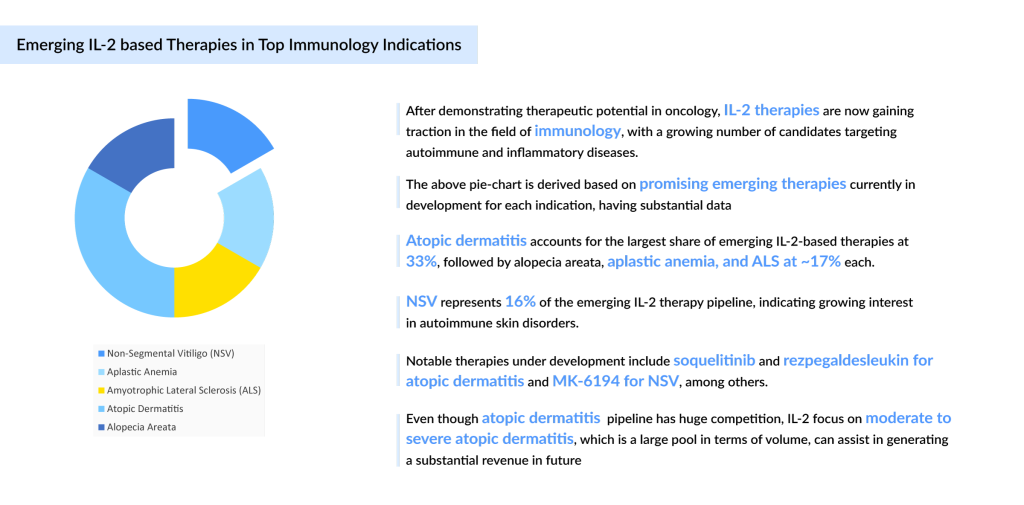

In the evolving landscape of immunotherapy, Interleukin-2 (IL-2) therapies have carved a niche, particularly in the treatment of metastatic melanoma, metastatic renal cell carcinoma (mRCC), relapsed or refractory Peripheral T-cell Lymphoma (R/R PTCL) and relapsed or refractory Cutaneous T-cell Lymphoma (R/R CTCL). In addition to it, IL-2 therapies are now being vigorously explored across a wide range of disease areas, spanning oncology, autoimmune disorders, and beyond. Ongoing investigations include indications such as non-segmental vitiligo (NSV), aplastic anemia, amyotrophic lateral sclerosis (ALS), PTCL, CTCL, platinum-resistant ovarian cancer (PROC), head and neck squamous cell carcinoma (HNSCC), melanoma, atopic dermatitis, alopecia areata, non-small cell lung cancer (NSCLC), mucosal melanoma, and others.

The global IL-2 therapy market is experiencing robust growth, fueled by biotechnological advancements and the increasing recognition of IL-2’s versatility across multiple therapeutic areas. With the emergence of novel therapies and expanded indications, the United States IL-2 market is projected to reach USD 3.2 billion by 2034. Key players driving this expansion include Iovance Biotherapeutics, Eisai, Citius Pharmaceuticals, Nektar Therapeutics, Mural Oncology, Corvus Pharmaceuticals, and Krystal Biotech, among others. These companies are investing heavily in R&D to develop next-generation IL-2-based therapies with enhanced efficacy and safety profiles.

Downloads

Click Here To Get the Article in PDF

The first chapter in the IL-2 era was written in 1992 when PROLEUKIN, the first recombinant human IL-2, was approved for the treatment of mRCC, and a few years later, in 1998, the therapy gained approval for metastatic melanoma treatment.

The commercial success of PROLEUKIN has been turbulent, with flat sales since 2021 as reported by Clinigen Group. However, in 2023, PROLEUKIN’s rights were transferred to Iovance Biotherapeutics, which has rejuvenated interest in the therapy by integrating it with AMTAGVI (Lifileucel), a tumor-derived autologous T-cell therapy, with an anticipated commercial opportunity of USD 300 million in the 7MM by 2034 in metastatic melanoma, offering hope for patients with tumors resistant to other therapies.

A new dawn: From PROLEUKIN to LYMPHIR

In a remarkable twist of fate, LYMPHIR (denileukin diftitox-cxdl) emerged as the next evolution of IL-2 therapy. Approved by the FDA in August 2024, LYMPHIR represents a significant leap forward. In 2021, it received regulatory approval in Japan for the treatment of relapsed or refractory PTCL and CTCL under the brand name REMITORO. Unlike its predecessor, PROLEUKIN, LYMPHIR’s unique targeted mechanism focuses on selectively depleting IL-2 receptors on malignant T cells and regulatory T cells (Tregs). This selective targeting allows LYMPHIR to treat CTCL with greater precision, fewer side effects, and more efficacy. LYMPHIR’s approval not only opened a new chapter for adult patients with relapsed or refractory Stage I–III CTCL but also set the stage for further exploration in solid tumors.

From autoimmunity to immuno-oncology

While IL-2’s legacy in cancer treatment had been well established, its potential in autoimmune diseases was still relatively untapped. In recent years, however, this landscape has been changing rapidly, with new IL-2-based therapies showing promise in managing chronic conditions like atopic dermatitis, alopecia areata, and neurodegenerative diseases like amyotrophic lateral sclerosis.

The emergence of Rezpegaldesleukin (NKTR-358), a recombinant protein developed by Nektar Therapeutics, marked a new frontier in autoimmunity treatment. This novel therapy selectively stimulates T-regulatory cells (Tregs) via the IL-2 pathway, investigated for moderate-to-severe atopic dermatitis (Phase II) and severe alopecia areata (Phase II), Nektar expects topline data in H1 2025 and H2 2025, respectively for both indications. Rezpegaldesleukin offers a more precise and less toxic approach to controlling inflammation. The ability to self-administer the drug through subcutaneous injections further enhances its appeal and is expected to reach a market of around USD 930 million by 2034.

Simultaneously, Soquelitinib (CPI-818), developed by Corvus Pharmaceuticals, takes a distinct approach by inhibiting ITK (IL-2-inducible T-cell kinase), a protein critical for T-cell activation. This novel therapy is under investigation for moderate-to-severe atopic dermatitis (Phase I) and relapsed/refractory peripheral T-cell lymphoma (PTCL) (Phase III). In August 2024, the US FDA granted Fast Track Designation (FTD) for R/R PTCL after two prior systemic therapies, while in February 2024, Orphan Drug Designation (ODD) was granted for T-cell lymphoma. Early-stage data from December 2024 for atopic dermatitis were promising, with final results expected in H1 2025, whereas its first launch is expected in PTCL by 2027 in the US. Combining both PTCL and atopic dermatitis, it is expected to reach a market of approximately USD 360 million by 2034.

Meanwhile, in the field of neurodegenerative diseases, ILTOO pharma’s ILT-101, an IL-2 replacement therapy, which is already available under an expanded access program in Europe for ALS, is expected to launch post-regulatory approval in European countries first. Within the ALS market landscape, there remains a high trial failure rate of even late-stage pipeline therapies, with limited approved therapies such as Riluzole and Radicava, which are the basis of the standard of care in ALS.

Anticipated data readouts in 2025 – Whether IL-2s can meet the safety and efficacy benchmark in respective indications?

As the field of IL-2-targeting therapies continues to mature, the next generation of treatments is already on the horizon, promising to further refine and expand the reach of immunotherapy.

One such promising therapy is ALKS 4230 (nemvaleukin alfa), developed by Mural Oncology. This recombinant fusion protein is an IL-2 receptor agonist with platinum-resistant ovarian cancer (PROC) as its leading indication followed by mucosal melanoma. According to the latest presentation in November 2024, Mural Oncology anticipates the interim overall survival readout for the PROC cohort (ARTISTRY-7) to be available by late 1Q/early 2Q 2025, with top-line data for mucosal melanoma (ARTISTRY-6, Cohort 2) expected in 2Q 2025. ALKS 4230 has also garnered key regulatory designations that underscore its potential and expedite its path toward commercialization and reach a market of nearly USD 140 million by 2034.

Another exciting innovation is KB707, developed by Krystal Biotech, which delivers IL-2 and IL-12 directly to the tumor site through gene therapy. Krystal Biotech is the same company that received approval for the first topical gene therapy, VYJUVEK, for dystrophic epidermolysis bullosa in May 2023. The company is now developing two different routes of administration of intratumoral injection for metastatic melanoma and inhalation for advanced NSCLC. The product has already received FTD in both indications. Early-stage clinical trials have shown particularly promising results for NSCLC, preliminary clinical data in post-anti-PD-1 NSCLC patients demonstrated a 27% ORR and 73% DCR in monotherapy trials, reinforcing KB707’s potential to reshape cancer treatment. KB707 exemplifies how targeted gene therapies could reshape the treatment of cancer, offering a more localized, potent immune response with fewer adverse effects.

Additionally, CUE-101 from Cue Biopharma represents a significant advancement in IL-2-based therapies, specifically targeting the HPV16 antigen in HNSCC. The US FDA granted FTD to CUE-101 in October 2022, recognizing its potential to treat HPV16+ refractory/metastatic HNSCC both as a monotherapy and in combination with KEYTRUDA. By integrating IL-2 replacement with targeted antigen presentation, CUE-101 seeks to improve tumor targeting while simultaneously enhancing the anti-cancer immune response. Currently undergoing clinical trials, this innovative therapy is already showing promising results, particularly when used in combination with immune checkpoint inhibitors such as KEYTRUDA, and is expected to reach a market value of approximately USD 370 million by 2034.

Looking ahead, the IL-2 market is poised for a period of rapid transformation. Therapies like PROLEUKIN and LYMPHIR are already making significant impacts in oncology, while newer agents like ALKS 4230, Rezpegaldesleukin, and Soquelitinib are broadening the landscape for autoimmune diseases and immuno-oncology. By 2034, the market for IL-2-based/targeting therapies is expected to reach an estimated USD 4 billion, reflecting the expanding role of IL-2 in treating both cancer and autoimmune diseases.

In addition to the aforementioned companies, several other organizations are actively evaluating their IL-2-based and targeting therapies across early and mid-stage phases of development.

Several companies are engaged in the development of IL-2-based or targeting therapies, currently in the very early stages of development, specifically in the preclinical phase. These include Medicenna Therapeutics (MDNA223, MDNA209, MDNA113), a collaboration between Medicenna Therapeutics and Merck (MDNA223), Xilio Therapeutics (XTX501), Shanghai Junshi Biosciences (JS206), Egle Therapeutics (EGL001, EGL002, EGL003), Cue Biopharma (CUE-401), Iovance Biotherapeutics (IOV3001), among others.

As the pipeline of IL-2-based therapies grows, the future holds immense promise. Next-generation therapies are designed not only to extend survival in cancer patients but also to address the unmet medical needs of those suffering from autoimmune disorders. The ability to precisely modulate the immune system, enhancing its ability to fight disease without causing undue harm, is the hallmark of this new era of immune-based treatments.