Vertex’s JOURNAVX: A Historic Milestone in Pain Treatment After a Long Dry Spell

Feb 17, 2025

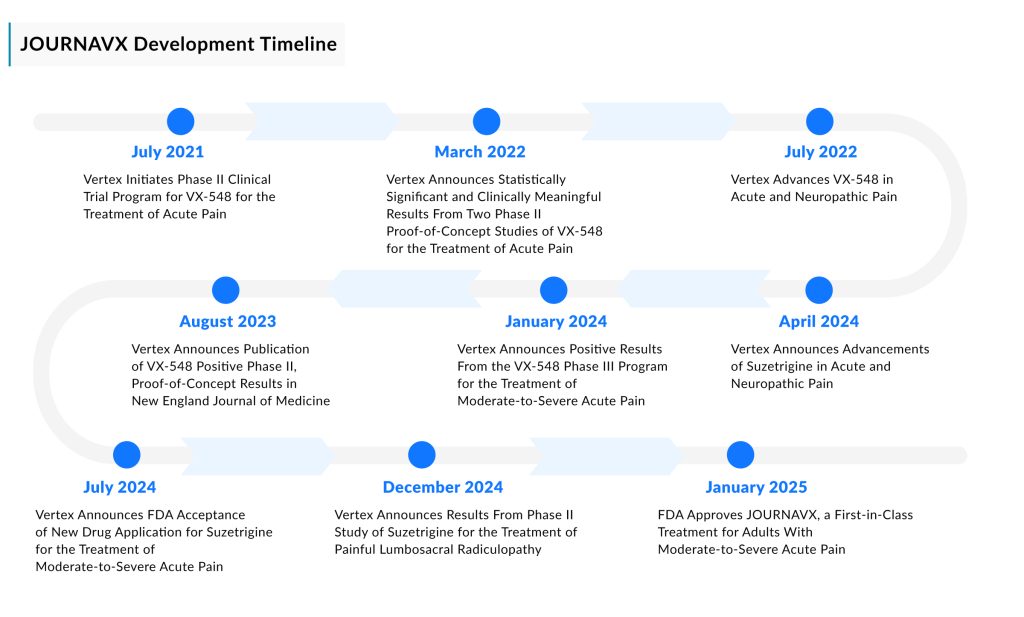

A week after Purdue Pharma and the Sackler family agreed to a $7.4 billion settlement over lawsuits related to the opioid painkiller OxyContin, the FDA approved Vertex’s suzetrigine, marking the first novel mechanism for acute pain relief in over 20 years—potentially reshaping the treatment landscape.

Marketed as JOURNAVX, suzetrigine is a groundbreaking non-opioid pain reliever designed to manage moderate to severe acute pain in adults. As an oral voltage-gated sodium channel (NaV) inhibitor, it blocks pain signals in the peripheral nervous system before they reach the brain. This approval represents the most significant pain management advancement in over two decades.

JOURNAVX is intended for adults experiencing moderate to severe acute pain, typically caused by surgery or injury. While opioids and other painkillers are commonly used for such conditions, their potential for addiction has been a major concern.

Downloads

Article in PDF

Recent Articles

- Non-opioid Analgesics Chronic Pain Treatment: Savior of Underserved Patients

- Edwards’s Pascal Precision System; Abbott’s New Spinal Cord Stimulation Device; Imagin to A...

- AstraZeneca Scraps £450M UK Vaccine Factory; FDA Approves First Non-Opioid Pain Reliever JOURNAVX...

- Novo Nordisk to Acquire Ocedurenone; FDA Awards Orphan Drug Designation to SLS009 in AML; FDA App...

- Emerging Therapies in the Chronic Pain Pipeline Transforming the Chronic Pain Market Landscape

Each year, over 80 million people in the U.S. are prescribed medication for moderate to severe acute pain, with about half receiving opioids. Among them, approximately 85,000 develop opioid use disorder. As per DelveInsight’s estimates, postoperative and trauma pain were found to contribute the most cases in the total diagnosed acute pain cases in the United States with approximately 80% of cases put together.

In the United States, severity-specific acute pain cases were mostly mild and moderate, with severe cases accounting for only ~15% of the diagnosed acute pain incident cases in 2023.

Unlike opioids, JOURNAVX works by blocking pain signals in the peripheral nervous system rather than the brain, reducing its potential for addiction. In clinical trials, its side effects have generally been mild, including itching, rash, muscle spasms, and elevated levels of creatine phosphokinase in the blood.

The approval marks the culmination of a lengthy and meticulous development journey, with Vertex achieving success where several other companies had abandoned efforts to develop a treatment using a similar mechanism of action.

The industry’s pursuit of a breakthrough drug began over two decades ago when researchers in Asia identified two genetic mutations that provided deeper insights into how pain signals travel through the body. These discoveries highlighted the NaV1.7 channel as a crucial transmitter of pain signals. Blocking pain-signaling ions from passing through this channel would prevent them from reaching the brain. However, the target proved difficult to pin down due to the high similarity among NaV channels, making it challenging to selectively inhibit NaV1.7.

While many companies relied on patch-clamp electrophysiology—a method for measuring ion channel currents developed in the 1970s—Vertex took a more advanced approach. The company utilized an electrical stimulation voltage ion probe reader, enabling it to screen a larger number of potential compounds with greater efficiency.

Another key differentiator for Vertex was its decision to explore the Nav1.8 channel, which plays a closely related role to Nav1.7. Despite setbacks in three clinical trials, the first of which began a decade ago, Vertex remained persistent. Its Nav1.8 inhibitors failed to show success, but two years ago, the company finally made a breakthrough with JOURNAVX, which was then advanced to late-stage trials.

In two Phase III studies, JOURNAVX demonstrated significantly better pain relief than a placebo in the first 48 hours following tummy tuck and bunion removal procedures. However, the trials did not meet their secondary endpoints, as JOURNAVX proved no more effective than the commonly used opioid painkiller Vicodin.

Vertex is positioning JOURNAVX for potential approval in chronic pain, which could significantly expand its patient base. However, clinical performance in this area has been inconsistent. In December, the company released phase II trial results for lumbosacral radiculopathy. Although the study met its primary endpoint, the news caused a decline in Vertex’s stock price.

While safety is the primary factor that sets JOURNAVX apart from the opioids it will compete against, pricing is another key distinction. Vertex plans to charge $15.50 for a 50-mg dose of JOURNAVX, totaling $420 for a two-week treatment course. Additionally, Vertex is studying suzetrigine for peripheral neuropathic pain (PNP). A Phase III pivotal trial for suzetrigine in patients with painful diabetic peripheral neuropathy is underway.

The approval of JOURNAVX has driven momentum in the non-opioid pain market, which includes companies such as Tris Pharma, Latigo Biotherapeutics, Algiax Pharmaceuticals, Collegium Pharmaceuticals, Protega Pharmaceuticals, Cara Therapeutics, and SiteOne Therapeutics, among others.

Just days after regulators approved Vertex Pharmaceuticals’ JOURNAVX, Germany’s Algiax Pharmaceuticals released Phase IIa data for a potential rival. On February 4, 2025, the company announced that its lead candidate, AP-325—a non-opioid pain drug—demonstrated a rapid onset of action and sustained pain relief in patients with chronic neuropathic pain.

AP-325 is a small molecule that modulates GABAA receptors, aiming to restore balance between excitatory and inhibitory neuronal signals. By consistently preventing excessive neuronal activation, it holds promise for transforming neuropathic pain treatment.

Algiax’s randomized Phase IIa trial involved 99 patients, assessing AP-325 as a monotherapy for peripheral post-surgical neuropathic pain. The drug showed a “clinically meaningful” reduction in pain within two weeks of treatment. Over 25% of patients treated with AP-325 experienced a pain reduction of ≥50%, compared to just 11% in the placebo group.

Furthermore, more than half of those receiving AP-325 did not require rescue medication, compared to 21% in the placebo group. Algiax noted that the drug’s efficacy, as measured by the “number needed to treat,” aligns with opioid-based treatments, but without the associated safety risks. Safety data for AP-325 indicated side effects similar to those of the placebo, with no central nervous system effects such as sedation, drowsiness, or dizziness.

On the same day, SiteOne Therapeutics reported that interim results from the Phase I trial of STC-004 indicate the lead NaV1.8 inhibitor is well-tolerated and has a half-life suitable for once-daily oral administration. Furthermore, pharmacodynamic assessments confirm that the candidate is effectively interacting with its target. The company, which secured $100 million in a Series C round last December, intends to advance STC-004 into Phase II trials in the second half of the year.

In January 2025, Tris announced positive Phase III results for its non-opioid pain medication, cebranopadol, demonstrating strong efficacy and a favorable safety profile in patients recovering from abdominoplasty. Meanwhile, Latigo launched in February 2024, securing $135 million in a Series A funding round for its NaV1.8 inhibitor, LTG-001.

Additionally, Collegium Pharmaceuticals utilizes its proprietary DETERx platform to enable extended-release drug delivery while preventing abuse and tampering. Cara Therapeutics is developing novel chemical compounds that target peripheral kappa opioid receptors to treat pruritus. Meanwhile, Protega Pharmaceuticals recently received approval for an opioid formulation designed to deter abuse.

The evolving dynamics of pain management are certainly intriguing, especially with multiple players working on developing new treatments. This suggests a promising future for pain management options.

Downloads

Article in PDF

Recent Articles

- Revolutionizing Pain Management: The Growth in Innovative Devices and Rise of Market

- AstraZeneca Scraps £450M UK Vaccine Factory; FDA Approves First Non-Opioid Pain Reliever JOURNAVX...

- GE HealthCare Launched CardioVisio; J&J’s Elita Laser Correction Platform; ICU Medical’s Plum...

- How are Neurostimulation Devices Playing a Vital Role in the Treatment of Chronic Pain?

- Merck sells biosimilars; AbbVie’s PARP; Pharma heads; Biogen looks to M&A