The Journey of PD-(L)1 Inhibitors: Milestones and Breakthroughs

May 31, 2024

Table of Contents

The advent of PD-(L)1 inhibitors marks a monumental shift in the landscape of cancer treatment. These agents have redefined the therapeutic approach to several malignancies, offering hope where traditional therapies often fell short. PD-(L)1 inhibitors are a class of drugs that block the interaction between the programmed death-1 (PD-1) receptor on T cells and its ligand, PD-L1, on tumor cells. This interaction typically acts as a brake on the immune system, preventing T cells from attacking cancer cells. By inhibiting this pathway, PD-(L)1 inhibitors unleash the immune system to recognize and destroy cancer cells.

PD-1 inhibitors are expected to be the leading drug class in terms of sales in the future. Immuno-oncology agents, especially the PD-(L)1 class, have transformed cancer treatment across various tumor types and stages, from metastatic to early stage. The adoption of PD-(L)1 therapies has been driven by their proven versatility. They can be used as monotherapy or in combination with targeted agents like tyrosine kinase inhibitors, chemotherapy, or other immunotherapy agents. This versatility has led to durable tumor responses and improved survival benefits, all while maintaining acceptable toxicity profiles. The improved safety profile of PD-(L)1 therapies compared to chemotherapy allows them to be used as a backbone therapy in a wide range of combination regimens.

Downloads

Article in PDF

Recent Articles

- T-cell Immunoglobulin and ITIM domain (TIGIT) Inhibitor: An Insight into the Pipeline Development...

- Rapid Global Expansion of Chinese PD-1/PD-L1 Key Players

- Reblozyl under FDA review; Audentes buyout & Tecentriq’s new approval

- Kalydeco got approved; Opdivo for SCLC; FDA approved for pain relief; GC4419 obviates

- PD-1 and PD-L1 inhibitors – Competitive Landscape, Pipeline and Market Analysis, 2015

Approved PD-(L)1 Inhibitors Available in the US Market

Chemotherapy is the only option for cancer patients before checkpoint inhibitors, but chemotherapy has many side effects. The most explored and successful checkpoint inhibitor is PD-(L)1. As of now seven PD-1 and three PD-L1 approved in the United States.

These inhibitors have revolutionized the treatment landscape for various malignancies, including melanoma, non-small cell lung cancer, renal cell carcinoma, and urothelial carcinoma. Their approval has marked significant progress in immunotherapy, offering new hope to patients with advanced or metastatic cancers by improving survival rates and, in some cases, providing durable responses.

As per DelveInsight analysis, the market size of PD-(L)1 inhibitors in the US was nearly USD 26 billion in 2023. The leader of the PD-(L)1 market has been KEYTRUDA for a long time, and it is expected to dominate in the future. The major sales share of KEYTRUDA is coming from NSCLC, TNBC, and melanoma.

The in-depth assessment of FDA-approved PD-(L)1 inhibitors along with their detailed approval timeline is given below:

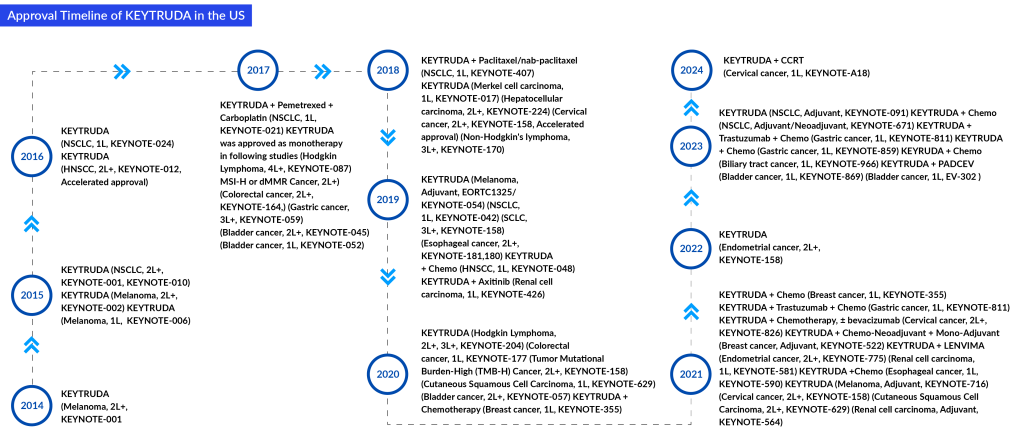

KEYTRUDA: Merck

KEYTRUDA is a PD-1-blocking antibody. It is a humanized monoclonal antibody that blocks the interaction between PD-1 and its ligands, PD-(L)1 and PD-(L)2, thereby activating T lymphocytes, which may affect both tumor cells and healthy cells. In some cancers, it is only given to patients whose tumors produce high protein levels known as PD-(L)1. It is approved for multiple types of cancer. It was first approved by the FDA in September 2014 for advanced melanoma. Since then, it has received multiple approvals, and the latest FDA approval was in January 2024 as a treatment for patients with FIGO 2014 Stage III-IVA cervical cancer. In February 2024, Merck announced that the FDA has accepted for priority review a new sBLA seeking approval for KEYTRUDA in combination with standard-of-care chemotherapy (carboplatin and paclitaxel), followed by KEYTRUDA as a single agent for the treatment of patients with primary advanced or recurrent endometrial carcinoma. The FDA has set a Prescription Drug User Fee Act (PDUFA), or target action, date of June 21, 2024.

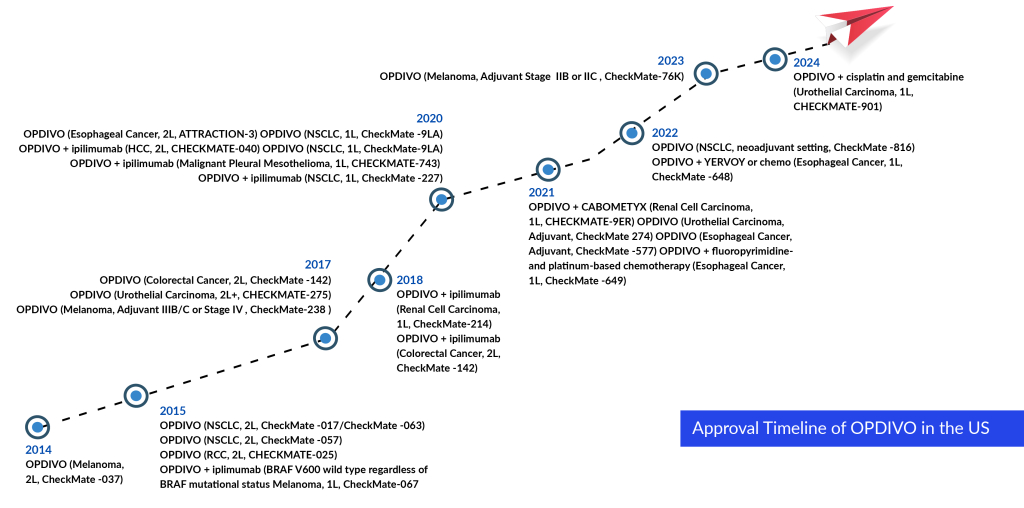

OPDIVO: Bristol-Myers Squibb/Ono Pharmaceutical

OPDIVO (nivolumab) is a PD-1 inhibitor. It first received the US FDA accelerated approval in December 2014 for unresectable or metastatic melanoma. Currently, OPDIVO as monotherapy is undergoing Phase III investigation for adjuvant hepatocellular carcinoma, peri-adjuvant muscle-invasive urothelial carcinoma, and adjuvant NSCLC Stages IB-IIIA. In addition, the drug is currently in the registrational phase for peri-adjuvant NSCLC (in the US and EU).

OPDIVO also approved in NSCLC, generated around USD 1.2 billion sales in the US which is less than KEYTRUDA. But in Melanoma, OPDIVO is the leader in the US. KEYTRUDA and OPDIVO captured around 80% of PD-(L)1 market in 2023. KEYTRUDA is a leader in the US and EU markets, whereas OPDIVO is leading in Japan market.

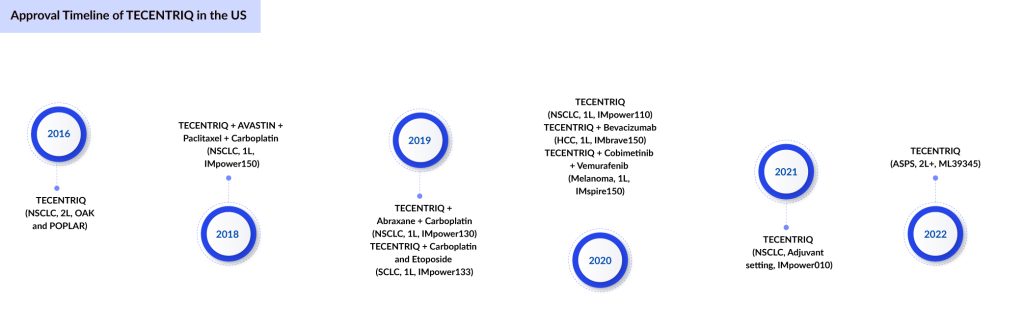

TECENTRIQ: Genentech/Hoffmann-La Roche

TECENTRIQ is a cancer immune checkpoint inhibitor targeting PD-L1, which is a protein expressed on tumor and tumor-infiltrating immune cells. It is an Fc-engineered, humanized, non-glycosylated IgG1 kappa immunoglobulin with a calculated molecular mass of 145 kDa. PD-L1 blocks T-cell activity by binding with PD-1 and B7.1 receptors on T-cell surface. By inhibiting PD-L1, TECENTRIQ may enable the activation of T cells and boost the immune response against cancer cells. TECENTRIQ holds the leading position in small-cell lung cancer.

In March 2024, Chugai Pharmaceutical filed a regulatory application with the MHLW for TECENTRIQ IV infusion 1,200 mg for an additional indication of alveolar soft part sarcoma. The company is expecting Phase III (SKYSCRAPER-01) tiragolumab + TECENTRIQ in 1L PD-L1+ NSCLC final OS results in the second half of 2024.

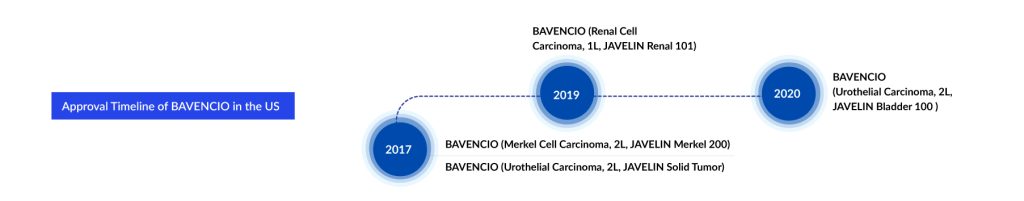

BAVENCIO: Merck

BAVENCIO (avelumab) is a human anti-programmed death ligand-1 (PD-L1) antibody. BAVENCIO has been shown in preclinical models to engage both the adaptive and innate immune functions. By blocking the interaction of PD-L1 with PD-1 receptors, BAVENCIO has been shown to suppress the T-cell-mediated antitumor immune response in preclinical models. It has also been shown to induce NK cell-mediated direct tumor cell lysis via antibody-dependent cell-mediated cytotoxicity (ADCC) in vitro. In November 2014, Merck and Pfizer announced a strategic alliance to codevelop and co-commercialize BAVENCIO.

In addition, avelumab is under clinical investigation for the treatment of NSCLC, solid tumors, metastatic urothelial cancer, metastatic urothelial cancer, and other indications. In March 2023, Merck strengthened its oncology franchise by regaining exclusive worldwide rights to develop, manufacture, and commercialize BAVENCIO following the termination of their Alliance agreement with Pfizer.

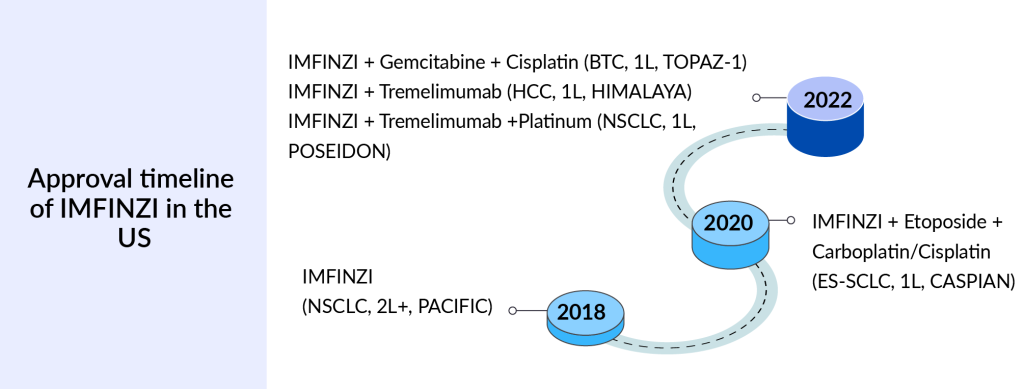

IMFINZI: AstraZeneca

IMFINZI is a human monoclonal antibody that binds to PD-(L)1 and blocks the interaction of PD-L1 with PD 1 and CD80, countering the tumor’s immune-evading tactics and releasing the inhibition of immune responses. It is approved in four indications, NSCLC, ES-SCLC, BTC, and HCC. The first FDA approval of IMFINZI was in February 2018 for patients with Stage III NSCLC.

IMFINZI + IMJUDO combination was approved remarkably after 11 and a half years in the US approvals of the first CLTA4 for NSCLC, liver cancer, and BTC that gives another option to patients from OPDIVO + YERVOY. In 2023, IMFINZI’s overall sales reached approximately USD 4 billion worldwide, with the majority of revenue generated from the NSCLC indication.

The company is expecting an FDA decision for IMFINZI as neoadjuvant therapy in the AEGEAN trial in the first half of 2024 for small-cell lung cancer, and the company is anticipating Phase III data readout of the NILE trial in first-line bladder cancer in the second half of 2024.

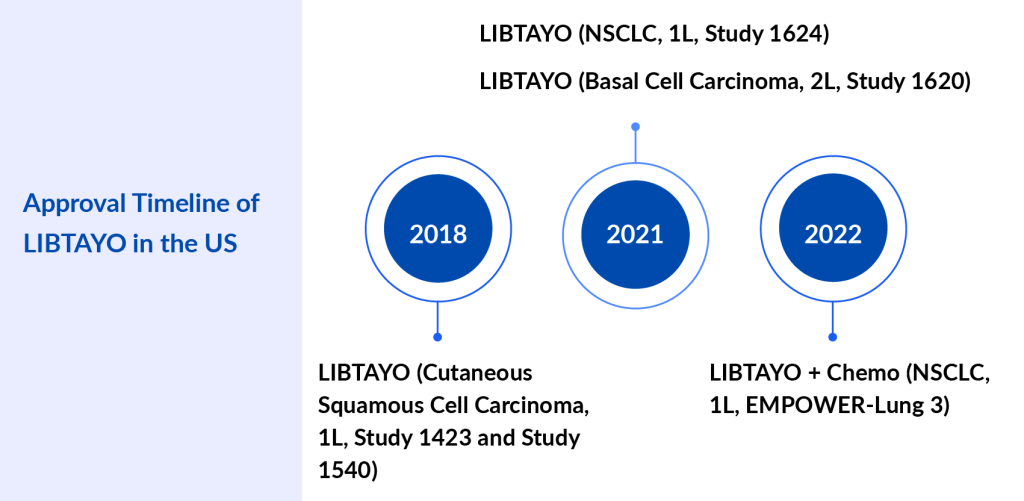

LIBTAYO: Regeneron/Sanofi

LIBTAYO binds to PD-1 to help immune cells kill cancer cells better and is used to treat different types of cancer. LIBTAYO is used to treat certain types of basal cell carcinoma and cutaneous squamous cell carcinoma that are locally advanced or have spread to other parts of the body. It is also used alone or with other drugs to treat adults with non-small cell lung cancer that is locally advanced or has spread to other parts of the body and may have the PD-L1 protein but does not have a mutation in the EGFR, ALK, or ROS1 gene. It is also being studied in the treatment of other types of cancer. LIBTAYO blocks PD-1 and helps the immune system kill cancer cells. It is a type of monoclonal antibody and a type of immune checkpoint inhibitor.

The company is planning to conduct a pivotal interim analysis from the Phase III study in adjuvant CSCC in the second half of 2024. The company is planning to report potentially pivotal initial results from the Phase II/III study of fianlimab (LAG-3 antibody) in combination with LIBTAYO in first-line metastatic melanoma and initial combination data in first-line advanced NSCLC in the second half of 2024.

LIBTAYO is the market leader for non-melanoma skin cancers, such as cutaneous squamous cell carcinoma and basal cell carcinoma, and is expected to maintain its dominance in the coming years.

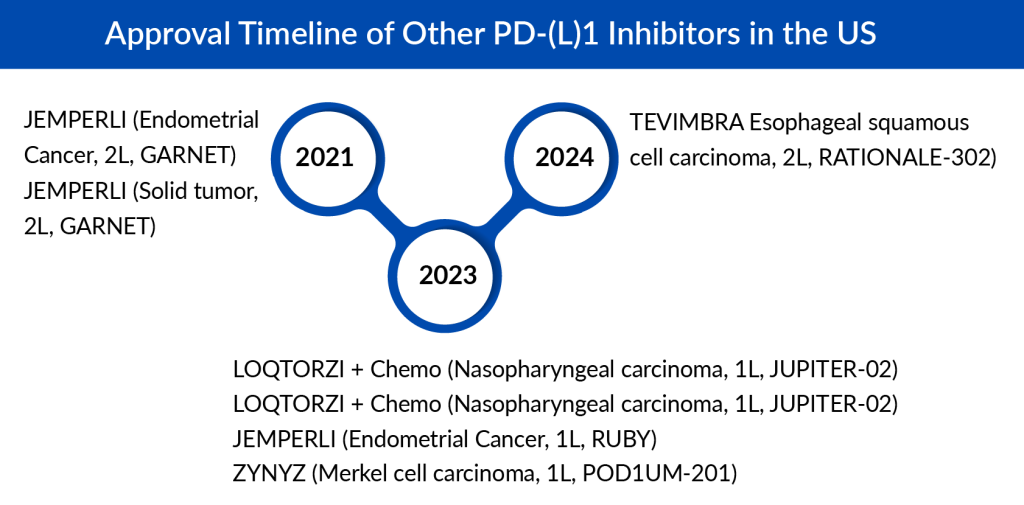

Other PD-(L)1 Inhibitors in the US

Following the approvals of BAVENCIO and KEYTRUDA for Merkel cell carcinoma, ZYNYZ also received approval for this indication. With a Merkel cell carcinoma patient population of approximately 3,000 cases in the US, ZYNYZ is expected to encounter strong competition from these established drugs, and it is projected that ZYNYZ could achieve near to USD 50 million in sales by 2034.

The PD-(L)1 segment in China has been growing rapidly, and several businesses are attempting to market their products in developed nations and other foreign markets. TEVIMBRA and LOQTORZI are both approved in the US and developed by Chinese companies. TEVIMBRA was first approved in Europe based on trial data from China and later received US approval for esophageal cancer. Recently, TEVIMBRA also gained approval in Europe for NSCLC.

After a 2-year delay, LOQTORZI, approved in the US for nasopharyngeal carcinoma, is the first PD-1 inhibitor approved in this sub-segment. It is the first PD-1 inhibitor to be approved by the FDA based on data from trials conducted in China.

Future Landscape of PD-(L)1 Inhibitors

KEYTRUDA, developed by Merck, has indeed emerged as a dominant force in the field of oncology drugs, particularly in the realm of immunotherapy. Its success can be attributed to various factors, including Merck’s effective commercial tactics, extensive clinical research, and strategic collaborations. Merck’s commercial strategy for KEYTRUDA has been multifaceted. In terms of R&D, Merck has demonstrated a commitment to exploring KEYTRUDA’s potential in combination with other drugs to enhance its effectiveness and expand its utility across different cancer types. Vibostolimab, quavonlimab, and faveselimab—are examples of agents being evaluated in combination with KEYTRUDA in clinical trials.

These combination therapies aim to leverage synergistic effects, targeting multiple pathways involved in cancer progression and immune evasion. By evaluating KEYTRUDA in combination with other novel agents, Merck’s R&D department seeks to improve treatment outcomes for cancer patients further and maintain the drug’s competitive edge in the rapidly evolving oncology landscape.

KEYTRUDA’s and OPDIVO (IV) patent is set to expire in the US in 2028. This expiration is expected to significantly affect the PD-(L)1 market, as KEYTRUDA and OPDIVO currently hold substantial market shares. The loss of two leading medications’ patent exclusivity will have a significant effect on the PD-(L)1 market. While several novel PD-1/PD-L1 inhibitors are being studied for various cancer types, such as spartalizumab, sasanlimab, zimberelimab, sugemalimab, HLX10, INCB99280, and balstilimab, they are not expected to significantly reduce the impact of KEYTRUDA and OPDIVO on the PD-(L)-1 market. To tackle the biosimilar impact, Bristol Myers Squibb has already developed the subcutaneous formulation of OPDIVO, and the patent expires for SC formulation in 2030.

Success in the competitive field of PD-1/PD-L1 hinges on standing out from the crowd. Companies must make an effort to be creative and target areas where current treatments are not ideal. Coming out on top in novel measures or addressing a gap can also differentiate businesses in this cutthroat climate.

GSK’s decision to focus on head and neck cancer for JEMPERLI’S next major opportunity in a front-line setting shows courage. PD-(L)1 drugs have faced difficulty in treating this cancer. OPDIVO, IMFINZI, and BAVENCIO did not succeed in eight important Phase III trials for head and neck cancer, but examining Jade’s design gives some hope.

Chinese companies are increasingly targeting the US market, buoyed by the recent approvals of TEVIMBRA and LOQTORZI. Companies such as Alphamab Oncology, Shanghai Henlius Biotech, and CStone Pharmaceuticals are developing drugs for the US market to capture significant revenue and provide patients with lower-cost options. For instance, Coherus has priced LOQTORZI 20% lower than KEYTRUDA. These developments are likely to be closely watched by the medical community, patients, and insurance providers, given the substantial medical demand.

Downloads

Article in PDF

Recent Articles

- Immutep’ First-Line Treatment Positive Outcomes; Pfizer’s Once-Daily Oral GLP-1 Agonist Danuglipr...

- Imfinzi combo gets ODD; Mayzent gets EU nod; Positive results of VP-102

- A Quick Review of Antibody-Drug Conjugates (ADCs) in Lung Cancer: HER2, TROP-2, HER3, MET, and CE...

- Evotec, Takeda Deal; AZ COVID Vaccine US Trials; Promega’s Recognition; Roche’s Tecentriq R...

- Merck’s Keytruda sales; Valeant on name change; Pfizer – BMS; Amgen puts Repatha outcomes for deal