Unlocking New Avenues in KRAS-Driven Cancer Research Beyond G12C

Jan 08, 2024

Table of Contents

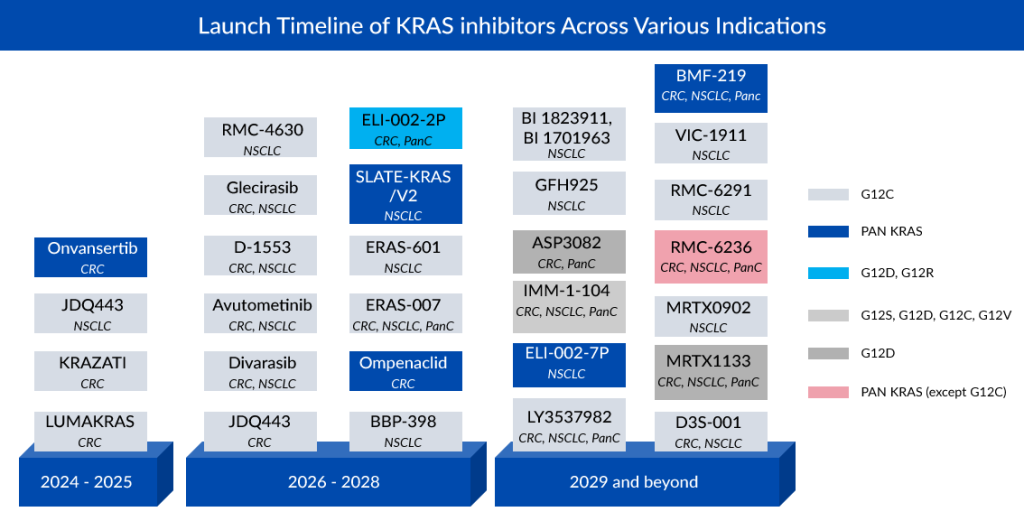

The KRAS G12C mutation obstructs the binding of GAP to KRAS, preventing GTP hydrolysis and keeping G12C-mutant KRAS continuously active. This sustained activation triggers the MAPK and PI3K signaling pathways, fueling the formation of tumors. Drugs like sotorasib and adagrasib directly target KRAS G12C by forming a bond with cysteine 12 in the KRAS-G12C protein’s switch-II pocket. This action locks KRAS in an inactive state, halting cell proliferation. While inhibiting KRAS G12C proves effective against certain lung cancers, it doesn’t impact PI3K signaling. This suggests that alternative pathways unrelated to KRAS-G12C might activate PI3K, contributing to resistance against G12C inhibitors and prompting the development of new therapies. G12C stands as the primary focus in KRAS targeting, yet newer studies reveal emerging targets like G12D, although their treatment paths are less established. Some companies are exploring PAN-KRAS inhibition as a novel treatment method. For instance, Onvansertib, currently in a Phase II trial for metastatic colorectal cancer treatment, aims to address all KRAS mutations by activating PLK1, which triggers RAS downstream pathways.

Epidemiological Insights into Geographic Distribution of KRAS Mutations

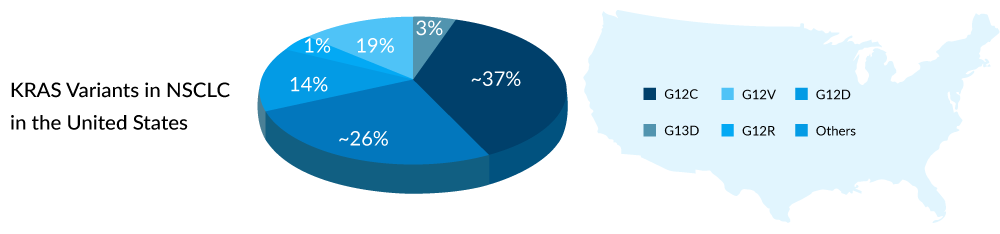

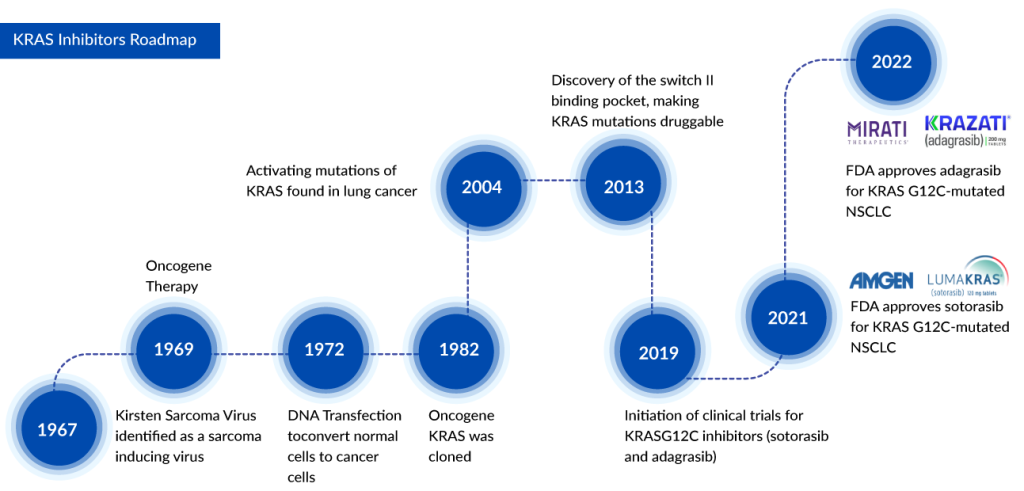

The identification of KRAS mutation dates back to the 1980s, and it has since been recognized as a prevalent mutation in various cancers such as lung cancer, colorectal cancer, and pancreatic cancer. Among these, the G12C variant is the most widespread in non-small cell lung cancer (NSCLC) across the United States, Europe, and Japan, occurring in approximately 25–30% of KRAS-mutated NSCLC patients, as per DelveInsight analysis. Immunotherapy stands as the standard of care for individuals with KRAS-mutant NSCLC, especially those with G12C variations, as there are currently no authorized treatments specifically targeting this variant.

Downloads

Article in PDF

Recent Articles

- Snippet

- Applications of AI in Healthcare: COVID-19 and Beyond

- CDK 4/6 Inhibitors- The Changing Paradigm for Breast Cancer Treatment

- Merck sells biosimilars; AbbVie’s PARP; Pharma heads; Biogen looks to M&A

- Digital Twin Technology – Assessing the Growing Role and Its Evolving Applications in Healt...

In colorectal cancers, around 45% exhibit KRAS mutations, with G12D being the predominant variant found in about 25–35% of individuals with KRAS mutations. Despite G12D being the most common variant, the majority of KRAS therapies for colorectal cancer focus on G12C, despite its lower prevalence in this cancer type. Ongoing developments include limited treatments for G12D and PAN-KRAS variants.

Pancreatic cancer, where KRAS mutations are present in 60–90% of patients, sees G12D as the most frequent KRAS variant, occurring in approximately 40–50% of KRAS-mutated patients. However, the development of effective “systemic” and “biomarker-specific” therapies for pancreatic cancer patients remains a substantial unmet need. Recognizing this, several key players in the pharmaceutical and biotech industries are increasingly exploring the potential of targeting KRAS mutations in pancreatic cancer, seeing this relatively unexplored segment as a promising market opportunity for cancer treatment.

The Therapeutic Landscape of KRAS Inhibitors: Progress and Promise

LUMAKRAS, the first approved targeted treatment for NSCLC patients with the KRAS G12C mutation, has been joined by Mirati’s KRAZATI as the second approved therapy in this category. The primary distinctions between these two KRASG12C inhibitors lie in their CNS-specific activity and Duration of Response (DoR). KRAZATI demonstrates the ability to penetrate the central nervous system, hindering the proliferation of cancer cells within the brain, whereas there is currently insufficient evidence to suggest a similar outcome for LUMAKRAS. In terms of DoR, LUMAKRAS has exhibited superior outcomes.

Moreover, LUMAKRAS appears to have a more favorable safety profile compared to KRAZATI. Notably, KRAZATI is associated with QTc interval prolongation, a notable side effect that may elevate the risk of ventricular tachyarrhythmias. Despite LUMAKRAS showing potential advantages, drawing definitive conclusions remains challenging due to the overall similarity in the efficacy of both drugs. KRAZATI may offer increased utility, particularly for individuals with brain metastases, given that the lifetime incidence of brain metastases is approximately 40% in patients with KRASG12C-mutant NSCLC.

In the United States, Mirati’s drug KRAZATI is priced at USD 19,750 for a 30-day supply, whereas LUMAKRAS has a lower list price of USD 17,900 per month. Sotorasib, with an estimated list price of GBP 6,907.35 for a 30-day supply of 240 tablets (each containing 120 mg, excluding VAT and business submission), has a commercial arrangement in place (including a managed access agreement and a commercial access agreement). KRAZATI has not yet received licensing in Europe. LUMAKRAS 120 mg tablets are priced at approximately YEN 4,204.3 per tablet. Comparatively, current pricing indicates that in Japan and the UK, the prices are approximately 60% and 50% lower than those in the US.

Over 40% of individuals with metastatic colorectal cancer exhibit a KRAS mutation, rendering them unresponsive to current targeted therapies such as EGFR inhibitors. Onvansertib holds substantial promise for this patient group due to its role as a PLK1 inhibitor, influencing downstream RAS pathways. This positions Onvansertib to potentially address the treatment requirements of all colorectal cancer patients with KRAS mutations.

Notably, alongside Amgen and Mirati Therapeutics, who are focused on the KRASG12C CRC subset, various other companies, including Novartis, Roche, InventisBio, Jacobio, Eli Lilly, and more, are exploring investigational drugs both as monotherapy and in combination with other targeted inhibitors. It is crucial to recognize that KRASG12C mutations represent only a small fraction of metastatic colorectal cancer cases, and fierce competition may limit commercial prospects. To capitalize on a substantial market share, it is essential to broaden the patient pool. Cardiff Oncology’s Onvansertib is poised to exploit this opportunity, backed by robust clinical data in KRAS-mutant metastatic colorectal cancer. Additionally, Mirati Therapeutics is extending its focus beyond G12C with MRTX1133, specifically targeting G12D CRC patients.

Advancing Therapies: Clinical Trials for KRAS Inhibitors

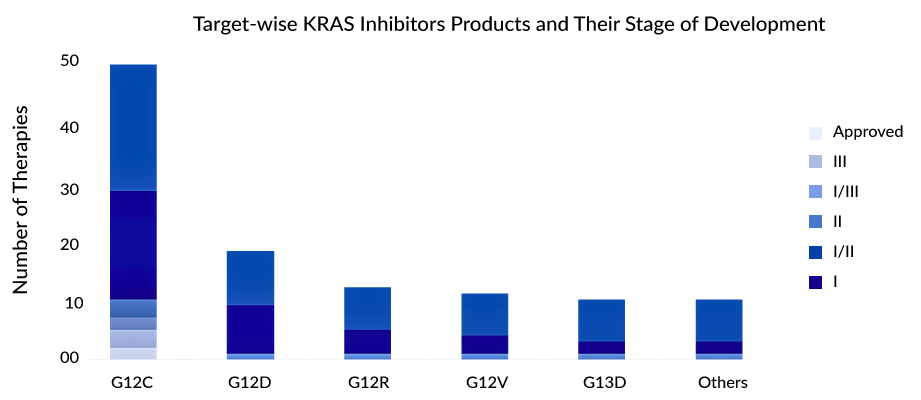

The G12C variant stands out as the most prevalent KRAS mutation in NSCLC. As a considerable number of drugs currently in the developmental pipeline are designed to target the G12C variant in NSCLC, the landscape is expected to become increasingly competitive. With the successful translation of KRASG12C discovery into clinical applications, attention has shifted towards the KRASG12D target, with Astellas emerging as a new player in this domain. Research efforts are now primarily concentrated on developing combination therapies aimed at preventing or overcoming resistance to KRASG12C inhibitors. Companies are also exploring pan-KRAS strategies to introduce tailored approaches for other KRAS mutation types.

Preclinical and clinical evidence indicates that relying solely on a KRASG12C inhibitor as monotherapy may not be enough to achieve a sustained positive response. Therefore, combining KRASG12C inhibitors in therapy holds greater potential for demonstrating improved anti-tumor effectiveness and may also address adaptive resistance mechanisms. The majority of treatments are currently in the early stages of evaluation, with only a limited number progressing beyond Phase II.

G12C is the most prominently targeted variant, although some treatments are exploring effectiveness against G12D, G12V, and G13D. Considerable attention is focused on the development of various allele-specific inhibitors, including those targeting G12V and G12R. Ongoing investigations involve combining KRAS inhibitors with immune checkpoint inhibitors, SHP2, SOS1, MEK inhibitors, and other agents to explore their effectiveness in addressing both initial and acquired resistance.

Some of the most promising therapies in the pipeline targeting KRASG12C mutations include JDQ443 (Novartis), Divarasib/GDC-6036 (Roche), LY353798 (Eli Lilly), and others. JDQ443 is an experimental compound that selectively targets and covalently binds to KRASG12C, and it is administered orally. Preliminary findings from the KontRASt-01 study (NCT04699188), specifically from the Phase Ib stage, indicate a confirmed overall response rate (ORR) of 57% at the recommended dosage of 200 mg administered twice daily in patients with advanced NSCLC. Currently, the drug is undergoing Phase III trials, where it is being assessed as a monotherapy against docetaxel. This trial is focused on individuals with advanced NSCLC who carry a KRASG12C mutation and have previously undergone treatment with platinum-based chemotherapy and immune checkpoint inhibitor therapy, either sequentially or in combination. Novartis has plans to submit a New Drug Application (NDA) for JDQ443 by 2024 for the treatment of NSCLC and colorectal cancer following the year 2026.

Divarasib, also known as GDC-6036, is an orally administered small molecule. In preclinical models, it exhibited strong and specific inhibition of the KRAS G12C protein. GDC-6036 is specifically designed to bind selectively to the switch II pocket of the KRASG12C protein by interacting with the cysteine residue at position 12. This interaction leads to the irreversible locking of the protein in the inactive GDP-bound state. Results from the Phase Ib study of GDC-6036 in combination with cetuximab for colorectal cancer were presented at AACR 2023. The combined treatment of GDC-6036 and cetuximab demonstrated noteworthy clinical efficacy and a manageable safety profile in the treatment of CRC.

LY353798 is an exclusive covalent inhibitor designed for KRASG12C, displaying efficacy both as a standalone treatment and in conjunction with other anticancer therapies in preclinical models. Its competitive pharmacokinetic characteristics endorse its progression into clinical trials. In vitro studies have demonstrated its ability to target the KRAS G12C mutation, effectively hindering mutant KRAS-dependent signaling. LY353798 is currently undergoing investigation in a Phase I clinical trial involving patients with non-small cell lung cancer, colorectal cancer, or other advanced solid tumors.

What Lies in the Future Beyond G12C?

The future of cancer therapies and treatment extends beyond the scope of KRASG12C mutations, marking a pivotal moment in the relentless pursuit of effective and personalized approaches to combat this formidable disease. While KRASG12C mutations have been a focal point in cancer research, ongoing advancements suggest a broader understanding of the intricate molecular landscape that underlies tumorigenesis.

| A Brief Overview of KRAS Inhibition Beyond G12C | ||||

| KRAS Target | Company | Product | Indication | Phase |

| PAN-KRAS | Cardiff Oncology | Onvansertip | CRC | Phase II |

| Gritstone Bio | SLATE-KRAS/v2 | NSCLC | Phase II | |

| PAN-KRAS (except G12C) | Revolution Medicines | RMC-6236 | NSCLC, CRC, PanC | Phase I |

| G12S, G12D, G12V | Immuneering | IMM–1-104 | NSCLC, CRC, PanC | Phase II |

| G12D, G12R | Elicio Therapeutics | ELI-002-2P | CRC, PanC | Phase II |

| G12D | Astellas | ASP3082 | CRC, PanC | Phase I |

| Mirati | MRTX1133 | NSCLC, CRC, PanC | Phase II | |

In recent years, the identification of additional genetic alterations and signaling pathways has opened new avenues for targeted therapies. Researchers are exploring novel targets beyond KRASG12C, seeking to decipher the complex interplay of genetic mutations that drive cancer progression. This multi-faceted approach acknowledges the heterogeneity of cancer and emphasizes the importance of tailored treatments based on individual molecular profiles.

One promising avenue involves the development of combination therapies that target multiple signaling pathways simultaneously. By addressing the intricate network of genetic abnormalities, these combination strategies aim to enhance treatment efficacy and overcome potential resistance mechanisms. As our understanding of the genetic and molecular intricacies of cancer deepens, the prospect of more comprehensive and personalized therapeutic interventions becomes increasingly realistic.

Furthermore, the integration of cutting-edge technologies, such as artificial intelligence and genomic sequencing, further propels the field towards precision medicine. Predictive modeling and analysis of vast datasets enable clinicians to identify optimal treatment strategies tailored to an individual’s unique genetic makeup. This shift towards personalized medicine holds great promise for improving treatment outcomes and minimizing adverse effects.

Therefore, the future beyond the KRASG12C mutation holds exciting prospects in the realm of cancer therapeutics. From expanding the scope of targeted therapies to exploring combinatorial approaches and harnessing the power of immunotherapy, researchers are at the forefront of a dynamic and evolving field. The ongoing efforts to unravel the intricacies of KRAS-mutant cancers pave the way for innovative treatments that may transform the outlook for patients facing these challenging diagnoses.

Untapped Potential in the KRAS Inhibitors Market

The treatment landscape for KRAS-mutant cancers has rapidly evolved, with several promising advancements in recent years. The KRAS inhibitor market is expected to grow significantly in the coming years, driven by the increasing incidence of cancer and the growing demand for personalized cancer treatments; ongoing research and clinical trials have identified potential treatment strategies.

According to DelveInsight’s analysis, the market size for KRAS inhibitors reached USD 240 million in 2022 across the 7MM and is expected to grow with a significant CAGR to reach USD 10 billion by 2032. As per the estimates, the US is set to be the largest market for KRAS inhibitors, with ~70% of the market share among the seven major markets.

NSCLC is anticipated to emerge as the predominant market for therapies targeting KRAS, driven by heightened interest from major pharmaceutical and biotech companies in exploring untapped KRAS biomarkers, particularly G12C variants. Mirati Therapeutics and Amgen, with their G12C inhibitors KRAZATI and LUMAKRAS, respectively, are poised to achieve blockbuster status in the coming years as key players in the KRAS inhibitors market.

Subsequent to NSCLC, colorectal cancer exhibits notable pipeline activity, featuring companies such as Novartis (JDQ443), Roche (Divarasib), InventisBio (D-1553), Jacobio (Glecirasib), and Eli Lilly (LY3537982). Cardiff Oncology is positioned as a market leader in colorectal cancer treatment with its PLK1-inhibiting drug Onvansertib for KRAS-mutated CRC. Despite KRAS being more prevalent in pancreatic cancer than in colorectal cancer and NSCLC, there is limited pipeline activity in this area. Anticipated growth in the KRAS pancreatic cancer category over the next decade is restrained, primarily due to the majority of experimental medicines being in the early stages of research.

Conclusion: A Glimpse into the Future

The emergence of KRAS inhibitors marks a pivotal moment in cancer therapeutics, offering a ray of hope for patients battling KRAS-mutant cancers. The progress made in decoding the complexities of KRAS and the development of targeted inhibitors underscores the resilience of scientific innovation in confronting challenging diseases.

As research in this field advances, the future holds the promise of more refined therapies, improved patient outcomes, and potentially transforming the landscape of cancer treatment. The pursuit of effective KRAS inhibitors stands as a testament to the relentless efforts of the scientific community in combating cancer and bringing forth a new era of precision medicine.

In the dynamic landscape of cancer research, the quest for more potent KRAS inhibitors remains a beacon of hope, illuminating the path toward more effective and personalized cancer treatments.

Downloads

Article in PDF

Recent Articles

- Bayer Phase III NSCLC Trial; D&D Pharmatech Gets FDA Nod for GLP-1R Agonist in Multiple Sclet...

- T-cell Immunoglobulin and ITIM domain (TIGIT) Inhibitor: An Insight into the Pipeline Development...

- Most Promising Oncological Drugs Expected to Launch in 2022

- How Will Artificial Intelligence Change The Future Of Healthcare?

- DNA Sequencing Market: Unveiling Innovations and Key Trends Shaping the Market Growth