Exploring the Metastatic Castration-Sensitive Prostate Cancer Market Landscape

Mar 18, 2022

Table of Contents

Prostate cancer is the third most frequent cancer in the United States and the fourth most common worldwide. 1 in every 9 males in the United States will be diagnosed with Prostate Cancer at some time in their life. According to the American Cancer Society, Prostate Cancer is the second largest cause of cancer mortality among males in the United States, after only lung cancer.

As per DelveInsight Metastatic Castration-Sensitive Prostate Cancer Epidemiology Report, there were more than 7 million prevalent cases of Prostate Cancer in the 7MM in 2021.

Downloads

Article in PDF

Recent Articles

- With early-stage data, Chimeric antigen receptor T cell (CART) finding its way towards entering P...

- Byondis’s HER2-targeting ADC trastuzumab duocarmazine; AbbVie Migraine Drug Atogepant; Grünenthal...

- PARP inhibitors in Urothelial carcinoma (UC): Hit or miss?

- ASCO GU 2022: Renal Cell Carcinoma Highlights

- 12 Breakthrough Prostate Cancer Drugs in Late-Stage Development

The symptoms of Prostate Cancer vary from person to person. But the most common Prostate Cancer symptoms include the weak or interrupted flow of urine, frequent urination, burning during urination, blood in the urine, pain in the back, hips and pelvis.

Prostate Cancer treatment options mostly include hormonal treatments (also known as androgen-deprivation therapy or ADT), chemotherapy, immunotherapy, radiation therapy, and surgery. Active surveillance, surgery, and radiation therapy are among the three main therapeutic options for localized or locally progressed Prostate Cancer. Patients who have never received ADT are referred to as Hormone-Sensitive Prostate Cancer (HSPC) or Castrate-Sensitive Prostate Cancer (CSPC).

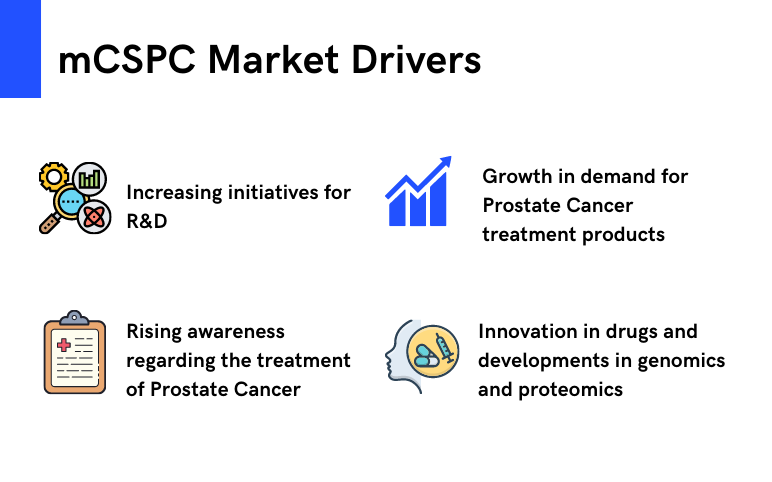

But the Metastatic Castration-Sensitive Prostate Cancer market is predicted to develop at a quick pace because of the rising Prostate Cancer prevalence due to an older population and increased public awareness, market penetration in mCSPC due to label expansion, and the introduction of novel treatments.

Metastatic Castration-Sensitive Prostate Cancer Market Scenario

Metastatic Castration-Sensitive Prostate Cancer (mCSPC), also referred to as Metastatic Hormone-Sensitive Prostate Cancer (mHSPC) in literature, refers to Prostate Cancer that still responds to testosterone suppression therapy. Moreover, patients with newly diagnosed metastatic disease and high-risk disease characteristics tend to have a poorer Prostate Cancer prognosis.

But the advanced Prostate Cancer treatment market has rapidly evolved. In recent years, there has been significant progress in the treatment for Metastatic Castration-Sensitive Prostate Cancer (mCSPC) patients, including chemotherapy and new hormonal treatments (NHT). Each of these has been shown to improve survival when compared to the traditional regimen of androgen deprivation treatment alone.

At ESMO 2021, prominent players disclosed updated and final findings from current studies in Metastatic Castration-Sensitive Prostate Cancer (mCSPC). Among the findings given the first was the PEACE-1 study, which demonstrated that adding prednisone and abiraterone acetate (Zytiga) to androgen-deprivation treatment (ADT) with docetaxel improved radiographic PFS and OS in patients with mCSPC. The other study was the STAMPEDE trial, which found that adding abiraterone acetate and prednisolone with or without enzalutamide (Xtandi) to ADT improved survival outcomes in individuals with high-risk non-metastatic prostate cancer.

Moreover, at ASCO GU 2022, several companies presented the latest findings of their PARP inhibitors and CAR-T candidates for Prostate Cancer treatment. Among the PARP Inhibitors were Johnson & Johnson’s Zejula (Niraparib) and AstraZeneca and Merck’s Lynparza (Olaparib). J&J announced the findings of its pivotal Phase III MAGNITUDE study for Niraparib in patients with homologous recombination repair (HRR) gene-altered mCRPC. After a median follow-up of 18.6 months, niraparib plus Abiraterone resulted in a 47% improvement in rPFS (Radiographic Progression-Free Survival) in patients with BRCA 1/2 alterations and a 27% improvement in all HRR biomarker positive patients. The median rPFS with niraparib plus Abirateronein in the BRCA 1/2 population was 16.6 months, while it was 16.5 months in patients with HRR gene alterations. The combination improves rPFS and other endpoints in patients with HRR-related genes, but there is no evidence of benefit in people without HRR biomarkers.

In addition, the PROpel Phase III study found that AstraZeneca and Merck’s Lynparza were both highly effective as first-line treatments in men with mCRPC. According to the data, the median investigator-assessed rPFS was 24.8 months, which is both statistically significant and clinically meaningful. The study also found a trend toward better overall survival (OS), though the difference was not statistically significant at the time of the data cut-off (analysis at 29% data maturity). The study will continue to assess OS as a critical secondary endpoint.

On the other hand, P-PSMA-101, a CAR-T product candidate for the treatment of mCRPC, is currently being tested in Phase I clinical trial by Poseida Therapeutics. This study’s findings were also presented at the ASCO GU meeting this year, with 71% (10/14) of patients demonstrating measurable decreases in Prostate-specific antigen (PSA) levels, and 36% (5/14) patients demonstrating a 50% or greater decrease in PSA levels. In addition, one patient showed signs of complete tumour eradication.

Metastatic Castration-Sensitive Prostate Cancer Marketed Drugs

Currently, there are 4 FDA approved drugs available in the Metastatic Castration-Sensitive Prostate Cancer drug market, namely, Xtandi (Astellas Pharma/Pfizer), Erleada (Janssen Pharmaceuticals), Zytiga (Janssen Biotech) and Orgovyx (Myovant Sciences/Takeda). Among all, Xtandi is a blockbuster Prostate Cancer therapy.

The FDA approved Xtandi for patients with mCSPC in December 2019. Prior to this, the FDA approved Xtandi for patients with CRPC. With this approval, Xtandi became the first and only oral treatment approved by the FDA for three advanced prostate cancer types: non-metastatic, CRPC, and mCSPC. The ARCHES trial looked into the efficacy of Xtandi. All of the patients in the study had either received a GnRH analogue or had had a prior bilateral orchiectomy. The primary efficacy endpoint in this trial was rPFS. However, the median rPFS in the Xtandi arm was not reached compared to 19.4 months in the placebo arm. However, a significant improvement in time to initiation of a new antineoplastic therapy was reported in the Xtandi arm compared to the placebo arm. When compared to placebo plus ADT, the use of Xtandi plus ADT significantly reduced the risk of radiographic progression or death by 61%. OS data for this drug was not available at the time of the rPFS analysis. This approval had put Zytiga and Xtandi in direct competition.

Zytiga (abiraterone acetate) was approved in 2018 for the treatment of metastatic high-risk CSPC in combination with prednisone. The Phase III LATITUDE trial results were used to determine approval in this category. Prior to this, Zytiga was approved in 2011 for patients with mCRPC who had previously received chemotherapy, and the indication was expanded in 2012 to include all patients with mCRPC. Furthermore, both drugs are expected to have a significant Metastatic Castration-Sensitive Prostate Cancer market share in the coming years.

Moreover, Erleada (Janssen Pharmaceuticals) was approved by the FDA in September 2019 for patients with mHSPC. In the TITAN Trial, the efficacy of Erleada was assessed. This trial’s findings revealed statistically significant improvements in both OS and rPFS. The hazard ratio for overall survival was 0.67 at the time of a predetermined interim analysis, and neither arm achieved median overall survival. The hazard ratio for improving rPFS was 0.48. The median rPFS with apalutamide plus ADT was not reached, but it was 22.1 months with placebo plus ADT. Janssen’s position in the Prostate Cancer drug market has been strengthened as a result of this approval. Drugs like Zytiga, on the other hand, have been subjected to generic competition in recent years. The approval of Erleada for mCSPC treatment has stifled the growth of Zytiga’s sales, which are already under pressure.

Furthermore, Orgovyx, a small molecule GnRH receptor antagonist developed by Myovant Sciences in collaboration with Takeda, was approved for advanced Prostate Cancer treatment in December 2020. The FDA granted approval based on the results of a Phase III HERO clinical trial in which relugolix was used as monotherapy in men with advanced Prostate Cancer. The company announced in November 2019 that the Phase III HERO study of once-daily oral relugolix met its primary efficacy endpoint and all six key secondary endpoints in men with advanced prostate cancer. In addition, the company anticipates future regulatory submissions in Europe and Japan.

Moreover, Prostate cancer treatments are more effective when used early due to advancements in the field over the last few years. However, combination therapy has yet to be proven effective. To do so, it is necessary to have a thorough understanding of the market and the associated unmet needs. Reflecting on these issues, the importance of allocating resources to R&D is also critical. Furthermore, policies must be considered to achieve significant success in mHSPC pricing, as this will aid in the launch of a truly appealing product and appropriate to the market in which it is launched. All these factors contribute to a strong product-market fit.

Furthermore, the dynamics of the Metastatic Castration-Sensitive Prostate Cancer treatment market are expected to change in the future due to an increase in the number of companies interested in developing specific drugs for mCSPC and increased awareness and penetration of drugs for patients with mCSPC.

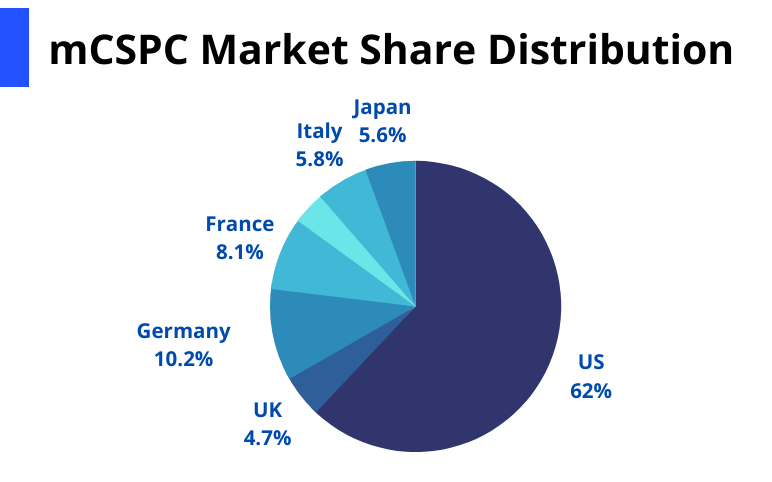

As per DelveInsight Metastatic Castration-Sensitive Prostate Cancer Market Report, the Metastatic Castration-Sensitive Prostate Cancer market size was USD 679.1 million in the 7MM in 2021, which is further anticipated to increase by 2032. Among the 7MM, the United States is expected to hold the maximum Metastatic Castration-Sensitive Prostate Cancer market share.

Metastatic Castration-Sensitive Prostate Cancer Emerging Drugs

The Metastatic Castration-Sensitive Prostate Cancer pipeline possesses drugs in the late-stage development. The leading mCSPC companies such as Bayer, Merck Sharp & Dohme, Pfizer, Janssen, Clovis Oncology, Bristol-Myers Squibb, AstraZeneca, Novartis, and others are evaluating their lead assets to improve the Metastatic Castration-Sensitive Prostate Cancer treatment market. Some of the mCSPC drugs in the pipeline, such as Nubeqa, hold the potential to become blockbuster therapy.

Nubeqa (darolutamide) (Bayer) is an oral ARi with a unique chemical structure that binds to the receptor with high affinity and exhibits strong antagonistic activity, inhibiting receptor function and prostate cancer cell growth. Nubeqa was approved in the US in 2019 for the treatment of patients with nmCRPC. The approval was based on the findings from the Phase III ARAMIS trial.

To date, the company reports that strong launch performance has been observed in men with high-risk nmCRPC. Nubeqa has made significant progress as a result of increased volumes in the United States. In Europe, the company is also seeing promising early signs. So far, Germany’s pricing and reimbursement environment have been favourable. It is the only second-generation ARi in Germany to benefit significantly from IQWIG and GB-A. Finally, a significant increase in nmCRPC market share and a sustained increase in new prescribers and favourable consumer opinion will encourage continued acceptance of this candidate in the United States and other countries. A Phase III ARASENS study in males with mHSPC recently met the primary endpoint of OS for Nubeqa + docetaxel + ADT.

ARASENS is part of a larger Nubeqa development package that includes ARANOTE, an ongoing Phase III study in mHSPC that is evaluating Nubeqa + ADT. Bayer plans to present these significant findings at an upcoming scientific conference and discuss them with health officials. Given the encouraging results of Phase III mCSPC trial and Nubeqa’s strong performance in nmCRPC thus far, it is reasonable to expect that Nubeqa’s potential in men with metastatic HSPC will provide a new therapeutic option. The drug is expected to hit the Metastatic Castration-Sensitive Prostate Cancer market in the United States in 2022, followed by the European Union and Japan in 2023.

Furthermore, the other mCSPC products in the development include Keytruda (Merck Sharp & Dohme), Talazoparib (Pfizer), Niraparib (Janssen), Rubraca (Clovis Oncology), Opdivo (Bristol-Myers Squibb), Capivasertib (AstraZeneca), 177Lu-PSMA-617 (Novartis), Firmagon (Ferring Pharmaceuticals), Tecentriq (Genentech), Cabometyx (Exelixis/ Bristol-Myers Squibb), and others. All these mCSPC drugs are expected to be get launched by 2032.

Future of the Metastatic Castration-Sensitive Prostate Cancer Market

The majority of attention in the advanced Prostate Cancer market has been focused on the research and development of drugs for patients with CRPC, despite the fact that CSPC has a poor prognosis and a reduced quality of life. However, in recent years, there has been an expansion in the field of mCSPC, which has resulted in the approval of a few drugs for this patient population. Because there are only a few drugs approved in this domain, the market presents an opportunity for new drugs. Because of the less competitive environment, any therapy, if approved, may capture a significant Metastatic Castration-Sensitive Prostate Cancer market share.

Many drugs can be used in the mCSPC treatment, but androgen deprivation therapy with docetaxel, enzalutamide (Xtandi), apalutamide (Erleada), or abiraterone acetate (Zytiga) remains the standard of care. Darolutamide (Nubeqa) may also be added to this treatment. The established markets for already approved drugs may provide fair competition for upcoming therapies.

According to the DelveInsight analysis, Prostate Cancers with HRR gene mutations are more aggressive. These changes are exacerbated in patients with metastatic disease and respond extremely well to PARP inhibitors. Although the efficacy of PARP inhibitors has been demonstrated in previous studies in patients with metastatic castration-resistant prostate cancer, the use of these agents earlier in the disease process has yet to be evaluated. This knowledge gap could be addressed by trials like the Phase III AMPLITUDE trial, which is assessing the use of standard ADT plus Zytiga and prednisone with or without the PARP inhibitor Zejula in patients with HRR gene–mutated mCSPC. As per the estimates, we believe that these agents may be clinically beneficial in this patient population.

Furthermore, Orgovyx (Relugolix) has the potential to address the mCSPC unmet needs. Given the scarcity of approved therapy for mCSPC patients, the drug could become a blockbuster if it demonstrates promising efficacy and safety data in the ongoing trial. Other therapies, including Nubeqa (darolutamide) + ADT docetaxel and Capivasertib + Abiraterone: PTEN deficient, have the potential to shift Metastatic Castration-Sensitive Prostate Cancer market dynamics.

Although the pipeline landscape is not robust at the moment, the entry of pharmaceutical firms exploring novel drugs for mCSPC/mHSPC in the future label extension of currently approved therapies may contribute to the overall Metastatic Castration-Sensitive Prostate Cancer market size. Moreover, we can expect that the Prostate Cancer therapeutic market will change in the upcoming years.

FAQs

Metastatic Castration-Sensitive Prostate Cancer (mCSPC), also referred to as Metastatic Hormone-Sensitive Prostate Cancer (mHSPC) in literature, refers to Prostate Cancer that still responds to testosterone suppression therapy.

Prostate Cancer treatment options mostly include hormonal treatments (also known as androgen-deprivation therapy or ADT), chemotherapy, immunotherapy, radiation therapy, and surgery. Active surveillance, surgery, and radiation therapy are among the three main therapeutic options for localized or locally progressed Prostate Cancer.

Currently, there are 4 FDA approved drugs available in the Prostate Cancer drug market, namely, Xtandi (Astellas Pharma/Pfizer), Erleada (Janssen Pharmaceuticals), Zytiga (Janssen Biotech) and Orgovyx (Myovant Sciences/Takeda).

The leading companies involved in the mCSPC market are Astellas Pharma, Pfizer, Janssen Pharmaceutical, Myovant Sciences, Takeda, Bayer, Merck Sharp & Dohme, Clovis Oncology, Bristol-Myers Squibb, Novartis Pharmaceuticals, Ferring Pharmaceuticals, Genentech, Exelixis, and others.

The mCSPC products in the development include Nubeqa (Bayer), Keytruda (Merck Sharp & Dohme), Talazoparib (Pfizer), Niraparib (Janssen), Rubraca (Clovis Oncology), Opdivo (Bristol-Myers Squibb), Capivasertib (AstraZeneca), 177Lu-PSMA-617 (Novartis), Firmagon (Ferring Pharmaceuticals), Tecentriq (Genentech), Cabometyx (Exelixis/ Bristol-Myers Squibb), and others.

Downloads

Article in PDF

Recent Articles

- Seagen/Astellas plans to expand their Antibody Drug Conjugate (ADC), Padcev in additional bladder...

- 12 Breakthrough Prostate Cancer Drugs in Late-Stage Development

- Another Feather in the Cap for Xtandi and Keytruda — The Two Main Cancer Drugs

- Byondis’s HER2-targeting ADC trastuzumab duocarmazine; AbbVie Migraine Drug Atogepant; Grünenthal...

- FDA Approves AstraZeneca’s Enhertu; Bayer Wins FDA Approval for Prostate Cancer Therapy, Nubeqa; ...