The Dynamic Landscape of Myelofibrosis Treatment: A 2024 Perspective

Jun 10, 2024

Table of Contents

Myelofibrosis is a rare disease with a high unmet need, with no disease-modifying treatments. Before 2011, treatment options for myelofibrosis were limited to either allogeneic transplant or palliation. Currently, Janus kinase (JAK) inhibitors have become the mainstay of pharmacologic therapy for myelofibrosis patients. As seen by two recent large acquisitions for billions of dollars with late-stage myelofibrosis companies, myelofibrosis is a financially lucrative market. This implies that promising results from newly developed medicines might potentially pave the way for licensing prospects as well.

JAKAFI’s dominance in the myelofibrosis treatment

The oral JAK1/JAK2 inhibitor JAKAFI (ruxolitinib) was initially approved by the FDA in 2011 for myelofibrosis, based on Phase III COMFORT trials. Over a decade later, JAKAFI continues to be the standard of care in higher-risk myelofibrosis.

Downloads

Article in PDF

Recent Articles

- JAK Inhibitors: New Lifeline for Hair Loss Treatment

- GSK Acquires Sierra Oncology; BriaCell’s Targeted Breast Cancer Immunotherapy; Merck’s Tepmetko; ...

- Polycythemia Vera: Growing Competition and the Changing Treatment Landscape in 2025

- JAK Inhibitors Market

- Myelofibrosis Treatment Market Heats Up with GSK’s Momelotinib Entry

The second JAK inhibitor approved for the treatment of myelofibrosis was INREBIC (fedratinib), approved in 2019. The JAKARTA study served as the basis for approval for INREBIC and was contemporary to the COMFORT studies that led to the approval of JAKAFI. Research indicates that INREBIC and JAKAFI have similar efficacy in myelofibrosis patients. However, their toxicity profiles differ, with INREBIC having a risk of encephalopathy, leading to a black box warning on the label.

The third approved JAK inhibitor for myelofibrosis was VONJO (pacritinib). The approval was based largely on the PERSIST-2 trial, where patients who were previously treated with JAK inhibitors, who were thrombocytopenic (platelet counts less than 100,000), were randomized between VONJO and the best available therapy.

The fourth and most recently approved JAK inhibitor was OJJAARA (momelotinib) by GSK. In September 2023, the US FDA approved OJJAARA for the treatment of intermediate or high-risk myelofibrosis, including primary or secondary myelofibrosis, in adults with anemia. It was supported by data from the pivotal MOMENTUM study and a subpopulation of adult patients with anemia from the SIMPLIFY-1 Phase III trial.

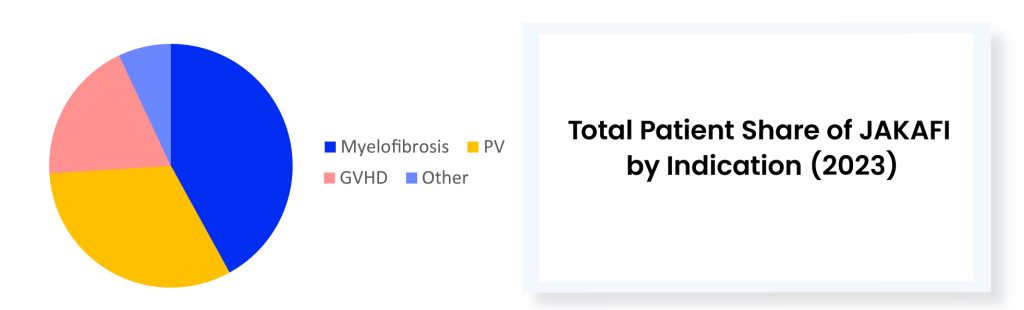

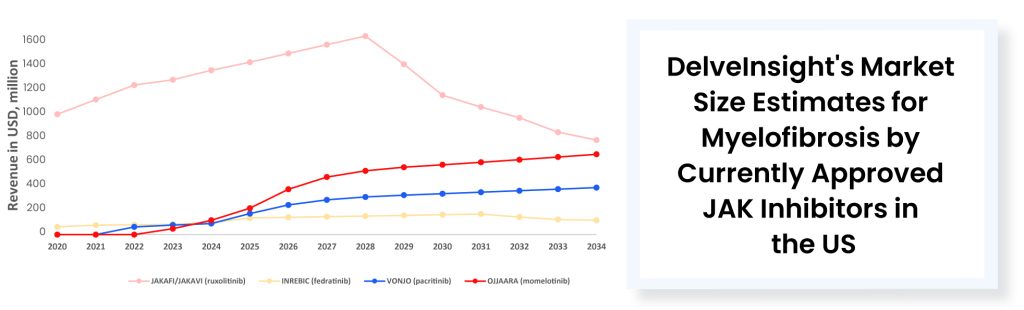

The approval of VONJO and INREBIC has not notably affected JAKAFI. However, the latest approval of a JAK inhibitor could potentially have some impact. Last year (in 2023) JAKAFI generated ~USD 1.08 billion in US net product revenues. It is worth mentioning that while JAKAFI has garnered approvals across various indications over the years, polycythemia vera and myelofibrosis stand out as the primary revenue-generating indications for this drug. No other approved myelofibrosis treatment therapies come close to matching the annual sales of JAKAFI. In 2023, VONJO’s revenue was around USD 67 million, whereas OJJAARA’s revenue was approximately USD 41 million. INREBIC generated a total of USD 110 million in product revenues by the end of 2023.

JAKAFI stands as the undisputed champion in the realm of myelofibrosis therapeutics, reigning supreme amidst its recently approved competitors. While playing defense against new rivals in myelofibrosis, Incyte believes the rare blood disorder polycythemia vera will serve as JAKAFI’s main growth driver in the future. Meanwhile, there is a concern regarding JAKAFI’s upcoming loss of exclusivity in 2028. Novel combinations represent another strategy Incyte is banking on.

With a broader-than-expected label, OJJAARA’S poses a threat to JAKAFI

The market leader, JAKAFI has been a dominant force for 12 years. However, the market authorization of OJJAARA presents potential competition. With just USD 3 million in upfront cash, up to USD 195 million in milestones, and tiered royalties, Sierra purchases momelotinib from Gilead after the failures of Simplify-1 and 2 trials. Following its success in the phase III Momentum trial for post-JAKAFI myelofibrosis, GSK pays USD 1.9 billion in cash to acquire Sierra. Unlike other approved myelofibrosis treatment therapies, OJJAARA’s FDA label lacks highlighted toxicity warnings and has a broad label including primary and secondary myelofibrosis in adults with anemia. The FDA approved this therapy for patients with myelofibrosis regardless of their treatment history. About half of the first-line myelofibrosis population is anemic at diagnosis. Given OJJAARA’S label, anemic patients might go directly to the GSK drug as their initial myelofibrosis treatment option. OJJAARA also targets patients who are ineligible for JAKAFI treatment, as JAKAFI could potentially worsen anemia during myelofibrosis therapy. Data suggests that there is around a 50% risk that JAK inhibitors may worsen anemia. Approximately 70% to 80% of myelofibrosis patients are anemic by the end of frontline therapy with JAK inhibitors, and nearly half of those patients need transfusions. Sierra’s focus on addressing anemia has effectively differentiated OJJAARA from JAKAFI.

Current unmet needs in myelofibrosis treatment despite approved therapies

- For some patients, dose-dependent anemia and thrombocytopenia related to ruxolitinib may lead to discontinuation of treatment. While dosing adjustments can alleviate anemia and thrombocytopenia, this may compromise clinical outcomes.

- After 2–3 years of myelofibrosis treatment, some patients who initially responded to ruxolitinib develop drug resistance, likely due to its limited impact on driver mutations burden.

- JAK inhibitors have minimal effects on achieving complete hematological remission and normalizing blood counts without strong evidence of disease-modifying effects. These obstacles underscore the necessity for alternative therapies for myelofibrosis beyond JAK inhibitors.

- Allogeneic-hematopoietic stem cell transplantation remains the only curative option for patients with myelofibrosis but is limited to a subset of high-risk and fit patients.

- Currently approved therapies are associated with significant adverse effects. Before the approval, a clinical hold was also put on the development of pacritinib over concern of increased risk of bleeding and cardiac events. Major adverse cardiac events are a class effect. They have been observed in ruxolitinib, fedratinib, and other JAK inhibitors as well, and even in JAK inhibitors used to treat other indications. So, certainly, something to keep in mind when using JAK inhibitors in the clinic.

Promising emerging therapies for myelofibrosis treatment beyond JAK inhibitors

Although existing JAK inhibitors prescribed for myelofibrosis treatment have demonstrated considerable clinical advantages by reducing symptoms and reducing spleen enlargement, they have not exhibited definitive disease-modifying effects, leading to most patients discontinuing the medication within one to two years. Owing to these reasons, the MPN community is keen on exploring potential alternative myelofibrosis treatments beyond JAK inhibitors that could offer additional benefits.

Different mechanisms other than JAK inhibitors under investigation are telomerase inhibitor (imetelstat), BCL-XL/BCL-2 inhibitor (navitoclax), MDM2 protein inhibitor (navtemadlin), BET inhibitor (pelabresib), and others which may cover the patient need and provide an alternative myelofibrosis treatment for the patients. In addition to this, there is a growing focus on combining JAK inhibitors with other therapies to improve outcomes. Two Phase III trials showed adding drugs to ruxolitinib significantly increased spleen volume reduction compared to ruxolitinib alone. MANIFEST-2 added pelabresib, a BET inhibitor, while TRANSFORM-1 added navitoclax, a BCL2 inhibitor, leading to a doubling in patients achieving ≥35% spleen volume reduction at 24 weeks.

Conclusion

JAK inhibitors have significantly transformed myelofibrosis treatment since the approval of JAKAFI in 2011. Subsequent approvals of INREBIC, VONJO, and OJJAARA provided additional options, each with unique benefits and risks. OJJAARA, approved in 2023, offers a promising alternative, especially for anemic patients, and poses a potential challenge to JAKAFI’s dominance. However, the need for better myelofibrosis treatments remains. Current research explores novel therapies and combination treatments, which have shown the potential to improve outcomes. The myelofibrosis treatment market is attractive, driving substantial investments and acquisitions. The future of myelofibrosis treatment lies in these innovative approaches, aiming to overcome the limitations of existing JAK inhibitors and enhance patient quality of life.

Downloads

Article in PDF

Recent Articles

- Myelofibrosis Treatment Market Heats Up with GSK’s Momelotinib Entry

- Myelofibrosis Therapeutics Market

- JAK Inhibitors Market

- EMA to review Cidara Therapeutics’ Rezafungin; EU Approves Gilead Sciences’ Sunlenca; FDA Approve...

- FDA Approves Ojjaara for Myelofibrosis; EMA Grants PRIME Designation to Iopofosine I-131; EBGLYSS...