Exploring the Nonalcoholic Steatohepatitis (NASH) Landscape

Sep 04, 2024

Table of Contents

Nonalcoholic Steatohepatitis (NASH) is a severe form of nonalcoholic fatty liver disease (NAFLD), characterized by liver inflammation and damage due to fat accumulation in the liver. Unlike simple fatty liver, NASH can progress to more serious conditions such as fibrosis, cirrhosis, and even liver failure. This chronic liver disease is increasingly recognized as a global health concern, with a rising prevalence linked to the growing incidence of obesity, type 2 diabetes, and metabolic syndrome. Children and adults alike are affected by NASH, with the disease often remaining asymptomatic until it reaches an advanced stage, making early diagnosis and intervention crucial.

In 2023, prominent liver disease organizations, including the American Association for the Study of Liver Diseases (AASLD) and the European Association for the Study of the Liver (EASL), officially redefined Nonalcoholic Steatohepatitis (NASH) to Metabolic Dysfunction-Associated Steatohepatitis (MASH), aligning the name more closely with its metabolic roots. For the most up-to-date insights, explore our comprehensive MASH Market Report.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Amgen’s IMDELLTRA FDA Approval; J&J’s Proteologix Acquisition; Bristol Myers Squibb’s B...

- Astellas & AviadoBio’s Exclusive Deal for AVB-101; GSK’s Depemokimab Shows Positive Res...

- Business cocktail

- Everything You Need to Know About Acute Kidney Injury

- Prosecutors rope Pfizer; Pharma groups to FDA; Regeneron simulates; Otsuka & Lundbeck revive...

As a major contributor to liver-related morbidity and mortality, NASH poses a significant burden on healthcare systems worldwide. The disease’s pathogenesis is complex, involving a combination of genetic, environmental, and metabolic factors. Despite its increasing prevalence, there are currently no FDA-approved treatments for NASH, creating a significant unmet medical need. The absence of approved therapies has spurred substantial research and development efforts, with numerous drugs in various stages of clinical trials. The nonalcoholic steatohepatitis market is poised for significant growth, driven by the anticipated approval of novel therapies and increasing disease awareness among healthcare providers and patients.

NASH Diagnosis

Diagnosing non-alcoholic steatohepatitis is challenging due to the often asymptomatic nature of the disease in its early stages. Currently, a combination of clinical assessment, imaging techniques, and liver biopsy is used to diagnose NASH. Imaging techniques such as ultrasound, magnetic resonance imaging, and transient elastography are commonly employed to detect liver fat and assess fibrosis. However, liver biopsy remains the gold standard for diagnosing NASH, as it allows for the direct examination of liver tissue to assess inflammation and fibrosis. Despite its accuracy, liver biopsy is invasive, costly, and associated with potential complications, limiting its widespread use.

The development of non-invasive diagnostic methods is a critical area of research in NASH, as early and accurate diagnosis is key to managing the disease and preventing its progression to more severe stages. Biomarkers, such as specific blood tests that can indicate liver inflammation or fibrosis, are being explored as potential tools for diagnosing NASH without the need for a biopsy. The introduction of reliable non-invasive diagnostics could significantly improve the management of NASH, allowing for earlier intervention and better monitoring of disease progression, which is essential given the growing prevalence of this nonalcoholic steatohepatitis.

NASH Epidemiology

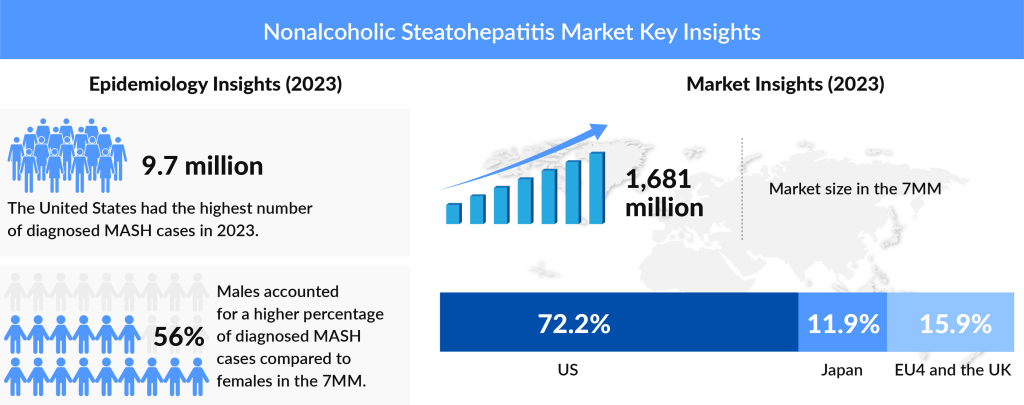

The epidemiology of nonalcoholic steatohepatitis reflects its status as a widespread and growing public health issue. According to various studies, NASH is more prevalent in males than females across the 7MM, which includes the United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan. According to DelveInsight estimates, in the 7MM, the total prevalence of NASH in 2023 was around 43 million; out of these, the diagnosed cases were 37%. The disease is often associated with metabolic disorders, and its prevalence is expected to increase in parallel with the rising rates of obesity and diabetes. Studies indicate that nearly 25% of individuals with NAFLD progress to NASH, highlighting the significant risk that fatty liver poses in the development of more severe liver diseases.

Epidemiological data also suggest that the majority of NASH patients are diagnosed at stage F1, where liver fibrosis is mild, while the smallest proportion is found at stage F4, where cirrhosis is present. The burden of NASH is not uniformly distributed, with certain regions showing higher prevalence rates due to lifestyle factors, genetic predispositions, and healthcare access disparities. For instance, studies have shown that in Italy, the prevalence of NAFLD is between 20% and 30%, with a substantial proportion progressing to NASH. This data underscores the need for region-specific strategies to manage and treat NASH, considering the varying prevalence and risk factors across different populations.

NASH Treatment Landscape

The treatment landscape for nonalcoholic steatohepatitis is currently characterized by a lack of approved therapies except for REZDIFFRA, with most patients relying on lifestyle interventions such as weight loss, dietary changes, and exercise to manage the condition. These lifestyle modifications aim to reduce liver fat and improve insulin sensitivity, which can slow the progression of NASH. However, many patients struggle to achieve and maintain the necessary lifestyle changes, underscoring the urgent need for effective pharmacological treatments. The only drug that is approved for the treatment of NASH is REZDIFFRA, which received FDA approval in March 2024. Other than this, in the absence of approved drugs, off-label use of medications such as vitamin E, pioglitazone, and statins is sometimes recommended, although these treatments have varying degrees of efficacy and are not without side effects.

NASH Market Outlook

The market outlook for nonalcoholic steatohepatitis is one of rapid growth and significant potential, driven by the high unmet need for effective treatments and the increasing prevalence of the disease. The global NASH market is expected to expand significantly between 2020 and 2034, particularly in the United States, Europe, and Japan. According to DelveInsight’s analysis, the NASH market size was highest in the United States, reaching approximately USD 1,214 million, and this figure is expected to rise significantly by 2034. Within the spectrum of disease severity, the F1 stage accounted for the largest proportion of diagnosed cases, representing about 38% of the total in the US. Other than this, The market size of NASH in Japan was approximately USD 200 million in 2022, which is anticipated to increase by 2034. This growth is anticipated to be fueled by the introduction of new therapies, many of which are currently in late-stage clinical trials. As these drugs gain approval and enter the market, they are expected to generate substantial revenue, making NASH one of the most lucrative areas in the pharmaceutical industry.

However, the NASH market is also expected to face several challenges, including high competition among emerging therapies, the need for better diagnostic tools, and potential pricing and reimbursement issues. The high cost of some of the new therapies may pose barriers to widespread adoption, especially in markets with strict pricing regulations. Additionally, the success of these therapies will depend on their ability to demonstrate superior efficacy and safety compared to existing off-label treatments. Despite these challenges, the NASH market holds significant promise, with the potential to address a major unmet medical need and improve the lives of millions of patients worldwide.

NASH Pipeline and Drug Development

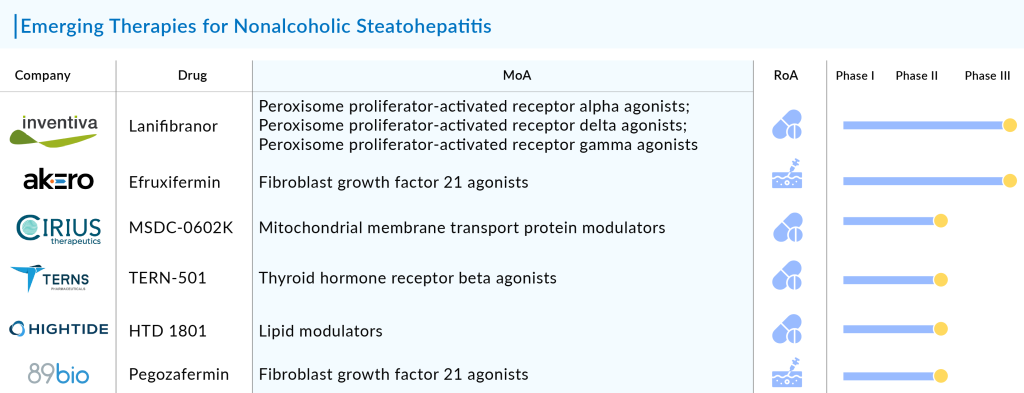

The pipeline for NASH is one of the most active in the pharmaceutical industry, with a wide range of drug candidates in various stages of development. These include novel therapies targeting key pathways involved in NASH pathogenesis, such as FXR agonists, FGF21 stimulants, and THR-β agonists. Some of the most advanced candidates, such as lanifibranor by Inventiva Pharma and REZDIFFRA by Madrigal Pharmaceuticals, showed promising results in Phase II and III trials, demonstrating their potential to address the unmet needs in NASH treatment. The medical community and investors closely watch the development of these drugs, given the significant market potential.

Then, in March 2024, Madrigal Pharmaceuticals’ groundbreaking product, REZDIFFRA (resmetirom), received accelerated endorsement from the US FDA based on Phase III MAESTRO-NASH trial results. This approval marked a significant stride in the medical landscape, as REZDIFFRA became the inaugural and sole FDA-sanctioned therapy for adults afflicted with non-cirrhotic NASH, accompanied by moderate to advanced liver scarring (fibrosis) corresponding to stages F2–F3 fibrosis. Based on the robust efficacy and safety data generated in two large Phase III MAESTRO studies, it is believed that REZDIFFRA will become the foundational therapy for patients with NASH with moderate to advanced liver fibrosis. Also, now that the FDA has approved REZDIFFRA for NASH, pharmaceutical companies will better understand the thresholds they must meet to get future approvals.

Other than this, the NASH pipeline features emerging drugs like GLP-1 agonists: Semaglutide (Novo Nordisk A/S) and Tirzepatide (Eli Lilly and Company), THR-β agonists: MGL-3196 (Resmetirom) from Madrigal Pharmaceuticals and TERN-501 from Terns, Inc., FXR agonists: Vonafexor (EYP001) by Enyo Pharma, Obeticholic acid by Intercept Pharmaceuticals, and FGF21 stimulants: Pegozafermin from 89bio, Inc. and Efruxifermin from Akero Therapeutics, Inc.

The success of these pipeline drugs will not only depend on their clinical efficacy but also on their ability to differentiate themselves in an increasingly crowded market. This includes demonstrating advantages in terms of safety, tolerability, and patient compliance, as well as securing favorable pricing and reimbursement terms. Additionally, ongoing research is exploring combination therapies that target multiple pathways involved in NASH, which could offer enhanced efficacy compared to monotherapy. The companies working in the pipeline include Guangdong Raynovent Biotech, Dr. Falk Pharma GmbH, Enyo Pharma, Viking Therapeutics, Eli Lilly and Company, Sagimet Biosciences, Terns, Sinew Pharma, Madrigal Pharmaceuticals, Hepion Pharmaceuticals, Poxel SA, Pfizer, CytoDyn, Altimmune, Oramed, Ltd, PharmaKing, Can-Fite Biopharma, and Cirius Therapeutics, among others. The NASH pipeline is thus a dynamic and evolving landscape with the potential to bring much-needed innovation to the treatment of this challenging and widespread disease.

Reimbursement and Pricing Considerations

Reimbursement and pricing strategies are critical for the successful commercialization of NASH therapies, especially with the anticipated approval of REZDIFFRA (resmethrin) on March 14, 2024, as the first drug for NASH (or MASH). While revenue projections for resmetirom vary, with many analysts expecting peak sales to exceed a billion dollars, the true challenge will be securing favorable reimbursement terms in markets with tight healthcare budgets. Payers are likely to implement utilization management hurdles, making it essential for companies to engage payers early and develop pricing strategies that balance value with competitiveness. Beyond this, the key to success lies in generating sufficient demand by effectively engaging physicians and patients to advocate for reimbursement, ensuring that these emerging treatments can meet the needs of the growing NASH patient population.

Patient Advocacy and Awareness

Patient advocacy and awareness play a critical role in the management and treatment of NASH. Given that NASH often progresses silently and is underdiagnosed, raising awareness among patients, healthcare providers, and policymakers is essential for improving early diagnosis and treatment. Patient advocacy groups are instrumental in these efforts, providing education, support, and resources to those affected by NASH. They also play a vital role in lobbying for increased research funding, better access to diagnostic tools, and the development of new therapies.

Furthermore, patient advocacy groups often collaborate with pharmaceutical companies to ensure that the patient perspective is incorporated into the drug development process. This can include input on clinical trial design, patient recruitment, and the development of patient-reported outcomes that accurately reflect the impact of NASH on quality of life. By amplifying the voice of patients, advocacy groups help to ensure that new therapies address the real-world needs of those living with NASH. As the market for NASH therapies continues to grow, the role of patient advocacy and awareness will become increasingly important in shaping the future of NASH treatment and care.

Looking Ahead: The Future of NASH Treatment

The future of NASH treatment is poised to be shaped by advances in precision medicine, improved diagnostic tools, and a deeper understanding of the disease’s pathophysiology. Precision medicine, which tailors treatments to individual patient characteristics, holds great promise for NASH, given the heterogeneity of the disease. By identifying specific biomarkers and genetic factors associated with NASH, researchers can develop targeted therapies that are more effective and have fewer side effects. This approach could revolutionize the treatment landscape, offering patients personalized options that address the root causes of their condition.

Additionally, the development of non-invasive diagnostic tools is expected to play a crucial role in the future of NASH management. These tools, which include imaging technologies and blood-based biomarkers, could replace the need for liver biopsies, making it easier to diagnose NASH early and monitor disease progression. Early diagnosis is critical, as it allows for timely intervention and the possibility of reversing or halting the progression of NASH before it leads to more severe liver damage. As the understanding of NASH continues to evolve, the combination of precision medicine, innovative diagnostics, and new therapeutic options will likely lead to more effective and comprehensive treatment strategies, ultimately improving outcomes for patients worldwide.

Downloads

Article in PDF

Recent Articles

- Eli Lilly’s ZEPBOUND Surpasses WEGOVY in SURMOUNT-5 Trial; Verastem Oncology Secures FDA Approval...

- GSK consolidates DT and TT vaccine, AZ gears up for FDA filing, Novartis comes up with flex prici...

- Phase 1 data of CYC065; Lysogene delays phase 3 study; Genetic disorders Diagnosis; PD-1 resistan...

- DelveInsight launches Indication Active Pharmaceutical Ingredient (API) Reports

- Advances in NASH Therapeutics Space: Latest Breakthroughs in Drug Development