Nonalcoholic Steatohepatitis Treatment Market: Which Pipeline Therapy Will Steal the Spotlight?

Sep 04, 2024

Nonalcoholic steatohepatitis is one of the most common causes of liver disease in the United States. As per the National Institute of Diabetes and Digestive and Kidney Diseases, only a small number of NAFLD patients possess NASH. In 2023, the United States reported the highest number of diagnosed prevalent cases of NASH, totaling 9.7 million cases. The EU4 and the UK followed with around 3.8 million cases, while Japan had about 2.6 million cases. Gender-based analysis revealed that males had a higher prevalence of NASH, accounting for 56% of the total cases in 7MM. Japan represented about 16% of the total NASH cases in the 7MM for 2023, with the prevalence expected to rise throughout the study period from 2020 to 2034.

Severity-specific prevalent cases of Nonalcoholic steatohepatitis (NASH) are divided into the following groups: F0 Stage, F1 Stage, F2 stage, F3 stage, and F4 stage. In the United States, a higher number of cases were observed in the F1 stage compared to others, comprising around 38% of the total diagnosed cases in 2023.

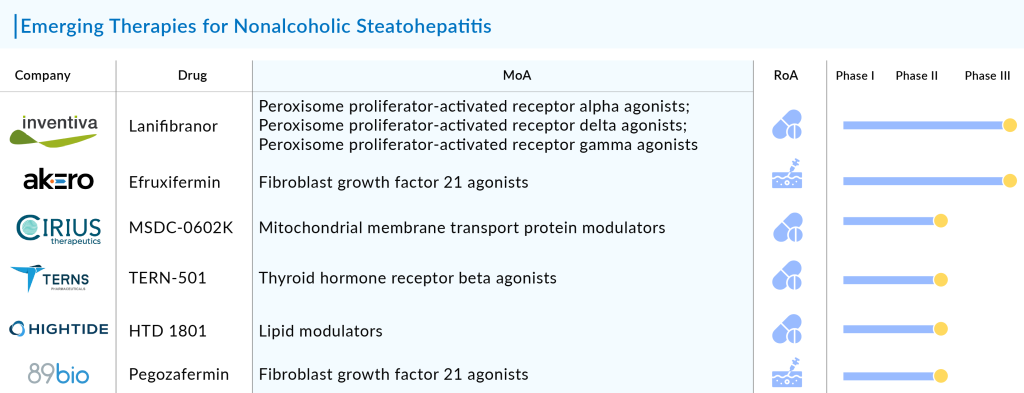

Currently, the pipeline of the NASH treatment market consists of a great deal of drugs. FXR Agonists, FGF21 Stimulants, FGF19 Analog, Glucagon-like Peptide-1 (GLP-1) Agonist, Peroxisome Proliferator-activated Receptor (PPAR) Regulators, THR-β Agonists, and some others are the most highlighted class of this indication. Ongoing research and current trials have the potential to change the market.

Downloads

Article in PDF

Recent Articles

- Off-label therapies dominate NASH Market Share

- Algernon’s NP-120; FDA nod to 4DMedical tool; SaNOtize’s NORSTM trial; Pole’s c...

- Notizia

- TLX66 in AL Amyloidosis; Takeda’s Dengue Shot; Innovent’s Cholangiocarcinoma Clinical Trial; Anot...

- Advances in NASH Therapeutics Space: Latest Breakthroughs in Drug Development

In 2023, prominent liver disease organizations, including the American Association for the Study of Liver Diseases (AASLD) and the European Association for the Study of the Liver (EASL), officially redefined Nonalcoholic Steatohepatitis (NASH) to Metabolic Dysfunction-Associated Steatohepatitis (MASH), aligning the name more closely with its metabolic roots. For the most up-to-date insights, explore our comprehensive MASH Market Report.

Medications, including the recently FDA-approved REZDIFFRA (resmetirom), should complement diet and exercise. Liver biopsy remains the definitive diagnostic tool to confirm NASH and assess liver damage. Managing associated conditions like obesity, diabetes, and metabolic syndrome is vital for overall treatment efficacy. However, achieving sustained lifestyle changes and ensuring medication adherence pose significant challenges in NASH management.

More than 130 key players, including pharma giants such as Inventiva Pharma, Zydus Therapeutics, Novo Nordisk A/S, Eli Lilly and Company, Madrigal Pharmaceuticals, Inc., Terns, Inc., Intercept Pharmaceuticals, Enyo Pharma, 89bio, Inc., Akero Therapeutics, Inc., and others are working to bring novel therapies that overcome the roadblocks of NASH treatment pipeline.

Emerging Therapies for Nonalcoholic steatohepatitis

Pegozafermin: 89bio, Inc

Pegozafermin or BIO89-100 is a compound that specifically targets and activates a receptor known as fibroblast growth factor 21 (FGF21). FGF21 is a hormone involved in regulating glucose and lipid metabolism, and it has been shown to have potential therapeutic effects in NASH.

- Preclinical studies and early-stage clinical trials of BIO89-100 have shown promising results in improving metabolic parameters and reducing liver fat accumulation in patients with NASH.

- In May 2024, 89bio initiated Phase III ENLIGHTEN-Cirrhosis Trial of Pegozafermin in NASH patients with compensated cirrhosis.

Efruxifermin (EFX): Akero Therapeutics, Inc.

Efruxifermin (EFX), is Akero’s lead product candidate for NASH. It is a differentiated Fc-FGF21 fusion protein engineered to mimic the balanced biological activity profile of native FGF21, an endogenous hormone that alleviates cellular stress and regulates metabolism throughout the body. EFX is designed to offer convenient once-weekly SC dosing. The consistency and magnitude of observed effects position EFX to be a potentially best-in-class medicine, if approved, for treating NASH.

- In June 2024, the company initiated the SYNCHRONY Outcomes study, a Phase III trial evaluating the efficacy and safety of efruxifermin (EFX) in patients with compensated cirrhosis, F4 due to NASH.

Belapectin: Galectin Therapeutics

Belapectin a complex carbohydrate drug, targets galectin-3, a critical protein in fatty liver disease and fibrosis pathogenesis. Galectin-3 plays a major role in organ scarring diseases, including the liver, lung, kidney, heart, and vascular systems fibrotic disorders. The drug binds to galectin-3 proteins and disrupts its function.

- In April 2024, the company reported the positive outcome of its fifth independent data and safety monitoring board (DSMB) meeting for NAVIGATE, its seamless, adaptive, Phase IIb/III study of belapectin in patients with cirrhotic portal hypertension caused by NASH. The topline results from the interim analysis of the Phase IIb (Stage 1) portion of NAVIGATE is expected in the fourth quarter of 2024.

The other promising assests in the NASH pipeline include Obeticholic acid (OCA) (Intercept Pharmaceuticals), MSDC-0602K (Cirius Therapeutics, Inc.), Semaglutide (Novo Nordisk A/S), Aramchol (Galmed Research and Development, Ltd.), Saroglitazar Magnesium (Zydus Therapeutics Inc.), HU6 (Rivus Pharmaceuticals, Inc.), EYP001 (Vonafexor) (Enyo Pharma), TERN-501 (Terns, Inc.), PXL065 (Poxel SA), HPG1860 (Hepagene (Shanghai) Co., Ltd.), Efinopegdutide (MK-6024) (Merck), Mitiperstat (AZD4831) (AstraZeneca), Denifanstat (formerly TVB-2640) (Sagimet Biosciences Inc.), Leronlimab (PRO 140) (CytoDyn, Inc.|Amarex Clinical Research), Icosabutate (NorthSea Therapeutics B.V.), Aldafermin (NGM282) (NGM Biopharmaceuticals, Inc), LPCN 1144 (Lipocine Inc.), HTD1801 (HighTide Biopharma Pty Ltd), Rencofilstat (Hepion Pharmaceuticals, Inc.), and others.

Developments and Advancements in Nonalcoholic steatohepatitis Domain

- In June 2024, Eli Lilly & Company released Phase II SYNERGY-NASH trial results, showing that 51.8%, 62.8%, and 73.3% of participants on 5 mg, 10 mg, and 15 mg of tirzepatide, respectively, achieved an absence of Nonalcoholic steatohepatitis (NASH) without worsening fibrosis, compared to 13.2% on placebo after 52 weeks. This data, presented at the EASL Congress 2024 and published in NEJM, met the study’s primary endpoint.

- In March 2024, Madrigal Pharmaceuticals’ groundbreaking product, REZDIFFRA , a once-daily, oral THR-β agonist, received accelerated endorsement from the US FDA based on results from the Phase III MAESTRO-NASH trial. This approval marks a significant stride in the medical landscape, as REZDIFFRA becomes the inaugural and sole FDA-sanctioned therapy for adults afflicted with non-cirrhotic NASH, accompanied by moderate to advanced liver scarring (fibrosis) corresponding to stages F2–F3 fibrosis.

What’s Ahead in the Nonalcoholic Steatohepatitis Market?

NASH can progress to cirrhosis, hepatocellular carcinoma, and other severe conditions. Most NASH patients are asymptomatic, highlighting the urgent need for effective screening strategies to identify high-risk individuals. Additionally, noninvasive tests that accurately predict disease progression or response to treatment are needed to reduce dependence on repeat liver biopsies.

Currently, only one FDA-approved product, REZDIFFRA, is available for treating NASH with moderate to advanced fibrosis. As NASH can progress to severe conditions like cirrhosis and hepatocellular carcinoma, effective screening and noninvasive testing methods are crucial. The absence of FDA-approved therapies to resolve NASH and reduce fibrosis underscores the need for new treatments. Ongoing development efforts are expected to impact the NASH treatment landscape in the coming years significantly.

Downloads

Article in PDF

Recent Articles

- Notizia

- 6 Promising Late-stage NASH Drugs to Challenge REZDIFFRA’s Supremacy

- Orchard licenses gene therapy tech from GSK; Glympse raises $46M; FDA voted to recommend Terlipre...

- Empowering Change: REZDIFFRA’s Trailblazing Journey in NASH Treatment

- Intellia’s Quest with CRISPR; Innovent, Synaffix ADC Tech Deal; Lilly’s Diabetes Bloc...