Dry AMD Treatment- An Underserved Market With Billion-Dollar Potential

Jun 07, 2024

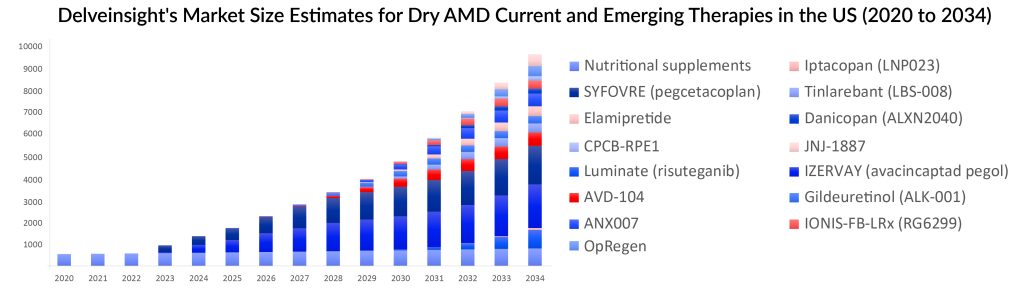

Wet AMD, comprising around 10% of the total AMD population, is primarily the target of pharmaceutical companies, representing a market worth billions of dollars. With only two FDA-approved treatments, dry AMD presents a substantial market potential, encompassing approximately 90% of all AMD patients.

Key players such as Alkeus Pharmaceuticals, Belite Bio, Aviceda Therapeutics, Johnson & Johnson Innovative Medicine, Allegro Ophthalmics, Lineage Cell Therapeutics (CellCure Neurosciences), Roche, Cognition Therapeutics, Stealth BioTherapeutics, Evergreen Therapeutics, Annexon Biosciences, NGM Biopharmaceuticals, AstraZeneca, Alexion Pharmaceuticals, Ionis Pharmaceuticals, Novartis, Regenerative Patch Technologies, and others are developing novel dry AMD treatment options that can be available in the dry AMD market in the coming years.

Capitalizing on Dry AMD Treatment Market – Apellis and Astellas’ Quest for Commercial Success

The therapeutic landscape of intermediate AMD is devoid of any approved treatment. The current dry AMD treatment approach revolves around dietary vitamins and supplements. Most novel treatments currently under development aim to manage geographic atrophy. Currently, only two significant players, Novartis with Iptacopan and Allegro Ophthalmics with Risuteganib, are actively involved in the pipeline for intermediate AMD.

Downloads

Article in PDF

Recent Articles

- EU Approves Galderma’s NEMLUVIO for Atopic Dermatitis and Prurigo Nodularis; GSK’s Penmenvy Wins ...

- Entry of Izervay: First Geographic Atrophy Treatment to Slow Progression

- AstraZeneca’s Voydeya FDA Approval; Akebia’s Vafseo FDA Approval; Bristol Myers Squibb’s Phase II...

- Edwards’ Sapien 3 with Alterra Prestent; Koios Medical’s breast, thyroid cancer-spotting AI; Line...

- Novartis on AMD drug; Hospira recall of vials; Takeda wraps up; FDA bans imports

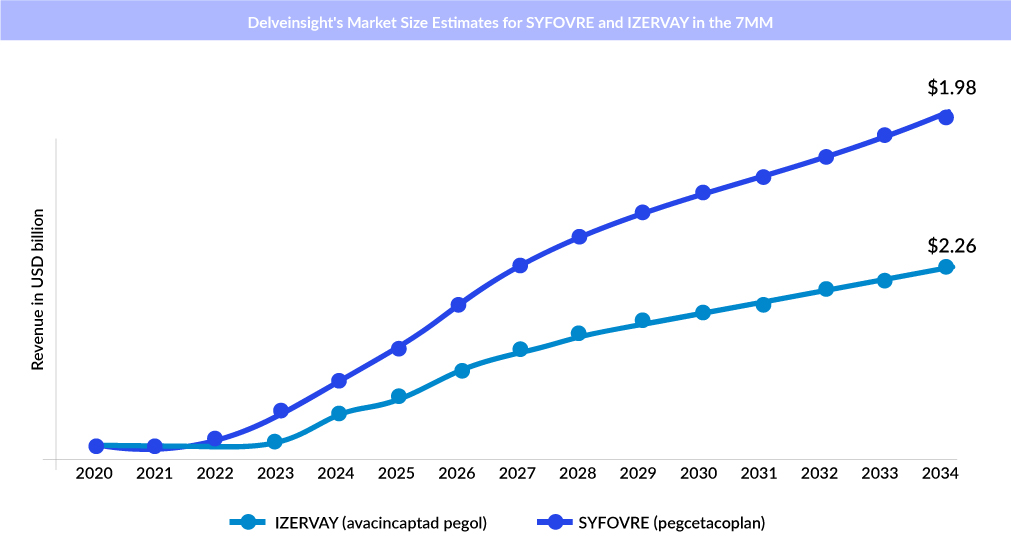

However, geographic atrophy, the advanced stage of dry AMD, has emerged as a prominent research focus. New treatments for geographic atrophy took center stage in the retina community in 2023. With the approval of SYFOVRE (pegcetacoplan) by Apellis Pharmaceuticals in February, followed by IZERVAY (avacincaptad pegol) by Iveric Bio/Astellas Pharma in August, the emerging pipeline of geographic atrophy is full of mid-stage and early-stage drugs.

Now, with these two medications being the only options for geographic atrophy treatment, a rivalry has emerged between the two companies as they compete for dominance in treating this condition. Both treatments target complement proteins via different mechanisms. SYFOVRE works slightly further upstream, targeting C3 and C3b, and IZERVAY targets C5.

Independent studies have confirmed that both SYFOVRE and IZERVAY effectively slowed the progression of geographic atrophy in pivotal Phase III trials. The OAKS (NCT03525613) and DERBY (NCT03525600) trials investigated the impact of pegcetacoplan on geographic atrophy lesions, both subfoveal and nonsubfoveal, using various dosing schedules. In contrast, the GATHER2 trial (NCT04435366) assessed the effects of avacincaptad pegol on nonsubfoveal geographic atrophy lesions with monthly dosing.

Apellis’ press release upon SYFOVRE’s approval highlighted the drug’s well-demonstrated safety profile after approximately 12,000 injections. However, shortly after Astellas completed its acquisition of Iveric, Apellis faced a setback in the geographic atrophy race. The company received concerning news regarding the potential side effects of SYFOVRE. Apellis announced that updated labeling information for its FDA-approved eye disease therapy SYFOVRE now includes risks associated with an inflammatory condition called retinal vasculitis. These details were added to the “Warnings and Precautions” and “Adverse Reactions – Post-marketing Experience” sections in the US prescribing information of the drug.

In the latest updates on the competition between Apellis and Astellas, both companies presented additional data on SYFOVRE and IZERVAY at the American Academy of Ophthalmology (AAO) 2023 meeting.

The competition between Astellas and Apellis has been a major point of discussion lately. However, predicting the ultimate winner is challenging, given that both companies’ treatments for geographic atrophy have encountered data that might hinder their progress.

Although Astellas’ IZERVAY met its primary objective, it fell short of achieving a prespecified objective related to reducing vision loss. However, the US FDA, in April 2024, accepted the supplemental New Drug Application (sNDA) to include positive 2-year data in the US Prescribing Information for IZERVAY. Under the Prescription Drug User Fee Act (PDUFA), the FDA has set a target action date of November 19, 2024. Meanwhile, side effects are a significant consideration in the competition between the two drugs. Given the safety concerns surrounding Apellis’ SYFOVRE, particularly regarding occlusive retinal vasculitis, this setback has potentially given IZERVAY a slight advantage in the battle for supremacy in the geographic atrophy treatment market; however, new safety data from the AAO 2023 meeting indicating zero events of retinal vasculitis, following more than 24,000 SYFOVRE injections to date has improved the situation for SYFOVRE. The safety incident hampered SYFOVRE’s progress and dampened its first-mover advantage. Apellis has already received a negative opinion on the marketing authorization application (MAA) of intravitreal pegcetacoplan for the treatment of geographic atrophy by the EMA. In the case of avacincaptad pegol, the MAA is under regulatory review. Nonetheless, Apellis reported excellent Q4 2023 sales figures with SYFOVRE.

One challenge for clinicians is that the efficacy data from the two drugs cannot be directly compared due to differences in their study designs. A retina specialist compared the efficacy of IZERVAY and SYFOVRE based on an anchored matching-adjusted indirect comparison of Phase III trial findings. When both the OAKS and DERBY results were compared to the GATHER2 results, a 30% greater reduction was seen that favored pegcetacoplan monthly, which was significant compared with avacincaptad pegol at the same frequency. The caveat that there are limitations to this type of analysis included individual patient-level data were only available for the OAKS and DERBY trials and not for the GATHER2 trial. In addition, other differences may exist in unobserved characteristics, such as in the study design and enrollment criteria.

What Lies Ahead in the Dry AMD Treatment Market?

Both SYFOVRE and IZERVAY are significant treatments, yet they are surrounded by controversy. There is still a pressing demand for superior products that deliver enhanced efficacy, safety, and prolonged duration of action. Despite not being the first to market, emerging therapies with improved safety and efficacy that are expected to enter the dry AMD treatment market, even with a tiny market share, may have significant market potential.

Aviceda Therapeutics’ product AVD-104 is striving to be the third therapy approved by the FDA for treating geographic atrophy secondary to AMD. AVD-104 targets both macrophage/microglial-mediated inflammation and the complement pathway. If this dual-mechanism approach remains safe and effective, it could significantly change the treatment approach for geographic atrophy.

Gene therapies and stem cell therapies are anticipated to become part of the treatment landscape for dry AMD. Cell-based therapies aiming to deliver retinal pigment epithelial (RPE) cells derived from stem cells into the sub-retinal region are being developed to replace or restore damaged RPE cells. Stem cell transplants have shown promise in treating geographic atrophy by regenerating RPE and compromised photoreceptors, preserving visual function. OpRegen (RG6501, Lineage Cell Therapeutics/Genentech/Roche), an allogeneic RPE cell therapy, and CPCB-RPE1 from Regenerative Patch Technologies are examples of such cell therapies. Among cell therapies, OpRegen offers better financial opportunities, particularly in light of the fact that complement inhibition’s effects have recently received a lot of attention (in terms of safety).

There are now trials being conducted to treat geographic atrophy, including gene therapy. AAV vector-based gene therapy currently under investigation by Johnson & Johnson Innovative Medicine, JNJ-81201887 (JNJ-1887), is being assessed in a phase II clinical study (NCT05811351). JNJ-81201887 aims to augment the expression of a soluble form of CD59 (sCD59) to prevent the formation of the membrane attack complex (MAC), the final step in complement-mediated cell lysis.

However, gene therapy for geographic atrophy may not be available shortly. Novartis recently discontinued research on GT005 (PPY988), a gene therapy that was being tested in many clinical trials, including the Phase II EXPLORE study (NCT04437368), to treat geographic atrophy. In addition, the effectiveness of complement inhibition needs to be established. If successful, gene therapy might become available in about 5–10 years. Predicting the impact of these emerging therapies on geographic atrophy treatment is challenging, as it is unclear if they will target specific populations or have eligibility criteria.

Emerging key players have a great chance for expansion and growth by implementing strategies to tap into the larger AMD pool. The approval of new drugs after 2025–2027 is expected to change the landscape of dry AMD, particularly geographic atrophy. Currently, no medication poses an immediate threat to SYFOVRE or IZERVAY, and it will be interesting to see how the field evolves.

Downloads

Article in PDF

Recent Articles

- Entry of Izervay: First Geographic Atrophy Treatment to Slow Progression

- AstraZeneca’s Voydeya FDA Approval; Akebia’s Vafseo FDA Approval; Bristol Myers Squibb’s Phase II...

- Dry AMD Market: Pegcetacoplan or Zimura, Which Therapy Will Dominate the Market?

- Mapping The Pipeline Development In The Geographic Atrophy Market

- Edwards’ Sapien 3 with Alterra Prestent; Koios Medical’s breast, thyroid cancer-spotting AI; Line...