Gene therapy: Following Pfizer’s Unexpected Failure, Sarepta is celebrating its much-awaited full approval! Sarepta’s stock price has shot up over 32%

Jun 19, 2024

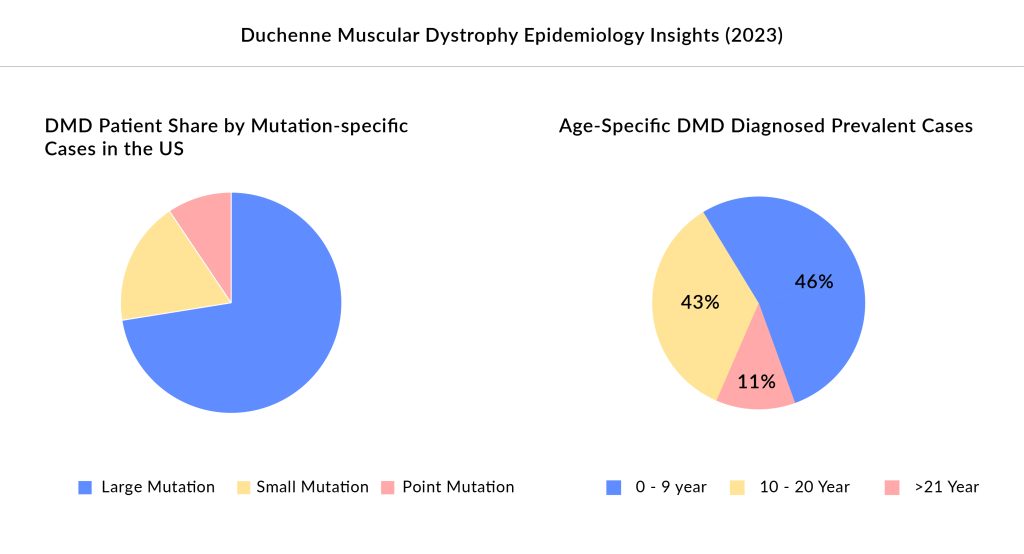

Duchenne muscular dystrophy (DMD) is a severe genetic disorder primarily affecting young boys between the ages of two and three. As per Delveinsight’s estimates, there were approximately 16K DMD patients in 2023 in the United States, with ˜75% of the patients below the age of 15. This condition leads to progressive muscle degeneration, initially presenting as muscle weakness and difficulties with movement. DMD is caused by mutations in the gene responsible for producing dystrophin, a crucial protein for muscle stability and function.

Market entrants before approval of first DMD gene therapy

The treatment landscape of DMD has majorly centered around managing symptoms and slowing the progression of the disease. Corticosteroids have been the cornerstone of DMD management with more than 70% of the patients on steroids. Beyond steroids, other treatments have focused on supportive care measures.

“They’re all these sophisticated modalities with exon skippers or gene therapies coming in. They always come in addition to steroids, so they’re not replacing steroids.”

Industry Experts

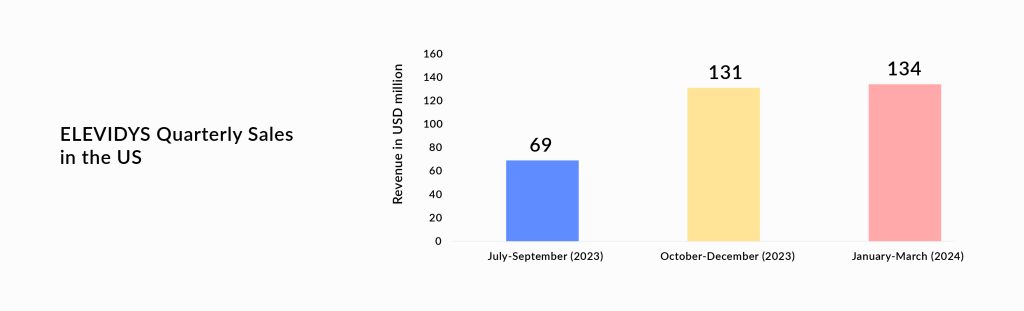

In 2016, the barren DMD treatment landscape witnessed the approval of its first exon-skipping therapy, Sarepta’s EXONDYS 51 for a subset of DMD patients (gene deletions amenable to exon 51 skipping) comprising ˜14% of the total DMD patient pool, followed by the approval of VYONDY S53, VILTEPSO, and AMONDYS 45 each targeting ˜8% of DMD patients. Except for VILTEPSO, all the other Exon skipping therapies are Sarepta’s, making it the leading player for this hard-to-treat muscular dystrophy in children. Considering weight-based pricing (avg. wt. of 30kg), these Exon skipping therapies were launched at an annual cost of ˜USD 700,000 in the United States. After making a strong position in the DMD space, in June 2023 last year, Sarepta’s first one-time gene therapy, ELEVIDYS received approval at a whooping time cost of USD 3.2 million, falling next to Hemgenix’s (approved for Hemophilia B) USD 3.5 million onetime cost, making it the second most expensive gene therapy.

Sarepta’s wins full approval for ELEVIDYS, and Pfizer’s unfortunate failure

Last year in June 2023, Sarepta received accelerated approval of ELEVIDYS (delandistrogene moxeparvovec-rokl), a pioneering gene therapy that delivers a truncated version of the dystrophin gene. Yesterday, the company received full approval based on which the therapy will be available to patients who are at least 4 years old, regardless of whether they can walk. This expands the previous accelerated approval in 4-5-year-old ambulatory patients only.

In an unfortunate event, Pfizer’s much-awaited DMD gene therapy, fordadistrogene movaparvovec, failed in a Phase III (CIFFREO) trial, expected to address the underlying cause of DMD by delivering a shortened but functional copy of the dystrophin gene, which supposedly was expected to give a tough fight to Sarepta’s ELEVIDYS. The candidate used an AAV9 capsid delivery mechanism to specifically target muscle tissue. However, post fatality issues in a related study, Pfizer’s gene therapy did not cause any improvement in motor function in patients aged 4 to 7 years, thereby providing ELEVIDYS with full opportunity to target patients who are at least 4 year old irrespective of their ambulatory status.

What went wrong with Pfizer’s DMD gene therapy?

Pfizer revealed that Phase III CIFFREO failed to hit its primary goal of improving motor function when compared to placebo at one year of treatment. Key secondary endpoints, such as 10-meter run/walk velocity and time to rise, also failed to demonstrate a significant difference between fordadistrogene movaparvovec and placebo. Thus, revealing that the treatment failed to meet the main and secondary goals of the study. Before this trial failure, the company reported the death of a young boy participating in the Phase II (DAYLIGHT) trial. The series of failures is a setback for Pfizer as it has added uncertainty around the effectiveness of the therapy. The company will present data from its failed study at a medical meeting later. Additionally, this caused the stocks of Sarepta Therapeutics to go up.

“We are extremely disappointed that these results did not demonstrate the relative improvement in motor function that we had hoped. We plan to share more detailed results from the study at upcoming medical and patient advocacy meetings, with the goal of ensuring that learnings from this trial can help improve future clinical research and development of treatment options that can improve care for boys living with Duchenne muscular dystrophy.”

– Development Head for DMD at Pfizer

It looks like an unfortunate scenario for Pfizer, considering the strong unmet need in this DMD treatment space. However, this is not the first time that any therapy has lacked strong evidence. It was not an easy road for ELEVIDYS as well, over its six-year development period, it was put on two clinical holds, one in 2018 and another in 2021, both as a result of safety concerns as it had also suffered a primary endpoint miss in one of its Phase III studies, however, it’s a win for the company after receiving full approval. Previously, approval of VYONDYS53 and sister medicine EXONDYS51 also fueled concerns for some pharma watchers as they lacked the evidence to show that the drugs could actually improve symptoms or delay disease progression. When there was a data drop during the confirmatory trial of ELEVIDYS, Pfizer got excited and anticipated fordadistrogene movaparvovec to be the main game in the competitive landscape. However, fate had something else planned for this therapy.

Downloads

Article in PDF

Recent Articles

- Chimerix Submits Dordaviprone NDA for Accelerated Approval in Recurrent H3 K27M-Mutant Diffuse Gl...

- Roche, Sarepta collaborates; FDA approval for Merck’s Ervebo, and Allergan’s Ubrelvy

- 5 Promising Exosome-based Therapies Paving the Way for Personalized Medicine

- Exosomes: Tiny Messengers with Big Potential in Medical Science

- An in-depth Assessment of the Top Drugs Launched by Leading Global Companies in the First Half of...