Strategic Importance of Portfolio Management in the Pharma and Healthcare Industry

Jun 20, 2022

Table of Contents

The rising cost of medication development has put pressure on R&D organizations to contribute to greater efficiency in developing novel drugs. In recent years, the pharmaceutical industry has made tremendous efforts to solve these issues and improve the efficiency of the drug development process. Indubitably, some of the initiatives have resulted in significant advances. Early evaluation of a drug’s toxicological profile and early studies to determine whether a new drug candidate is suitable for oral delivery or once-daily dosing are two examples. It is no longer a question of how skilled we are at what we do but rather whether we are doing the right things. Further changes to the overall process should emphasize the efficiency of the procedures used rather than attempting to improve effectiveness. Portfolio management is heavily emphasized in this scenario.

What is Portfolio Management?

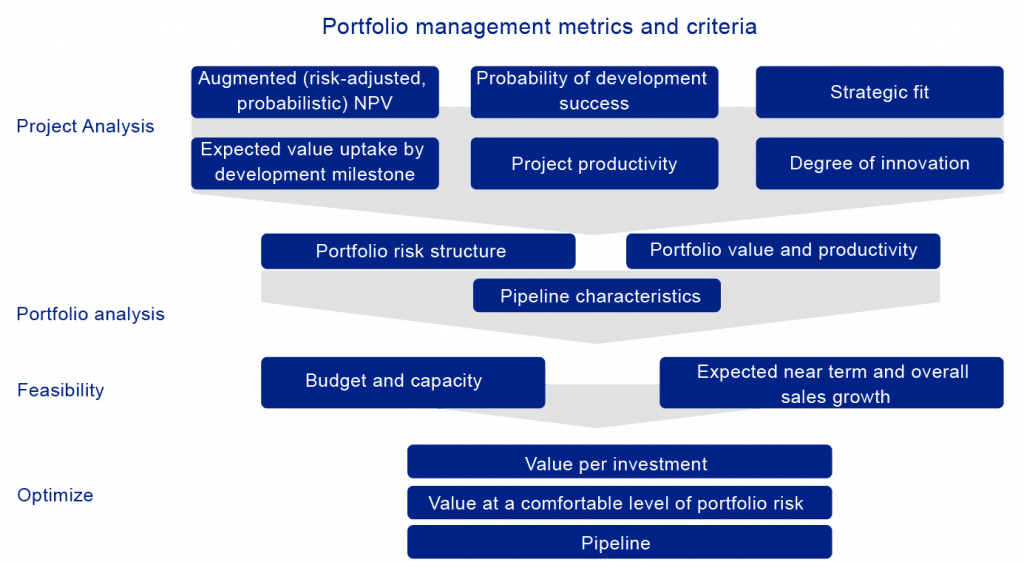

Portfolio management, in its broadest terms, is the act of maximizing the value of R&D portfolios through efficient resource allocation, while Strategic Portfolio Management (SPM) is a set of business procedures and competencies aimed at determining the best investments to make to attain the organization’s overall strategy. Individual projects and portfolios are subjected to quantitative finance and risk analysis as part of the value-driven project and portfolio management. Such assessments provide alternatives for increasing the value and risk structure of individual projects, and therapeutic areas, and entire corporate portfolios, on the one hand, and therapeutic areas or total corporate portfolios, on the other.

Downloads

Click Here To Get the Article in PDF

Recent Articles

Generally, a pharmaceutical R&D portfolio is built by integrating various assets. It can encompass small molecules and biologics (Phase I–IV) in the discovery, preclinical, and development stages, as well as medical devices. Less mature biotech companies are likelier to own a single project or platform with no significant R&D portfolio to manage. Large pharmaceutical and biotech companies have active portfolio management with various projects in varying stages of development. Portfolio decisions, such as medication candidate selection, portfolio prioritization, and optimization, are the most critical factors in determining the company’s total shareholder value.

However, the difficulty in R&D portfolio planning methods is that they are generally used as short-term budgeting tools rather than strategic ones. Budgeting exercises are important in pharma, but they do not help organizations objectively establish their portfolio goals over longer time horizons and assess success against them. Executives who seek to implement a long-term-focused R&D plan and explain it to employees, investors, and journalists face obstacles due to a lack of well-articulated, long-term ambitions backed up by quantitative measurements.

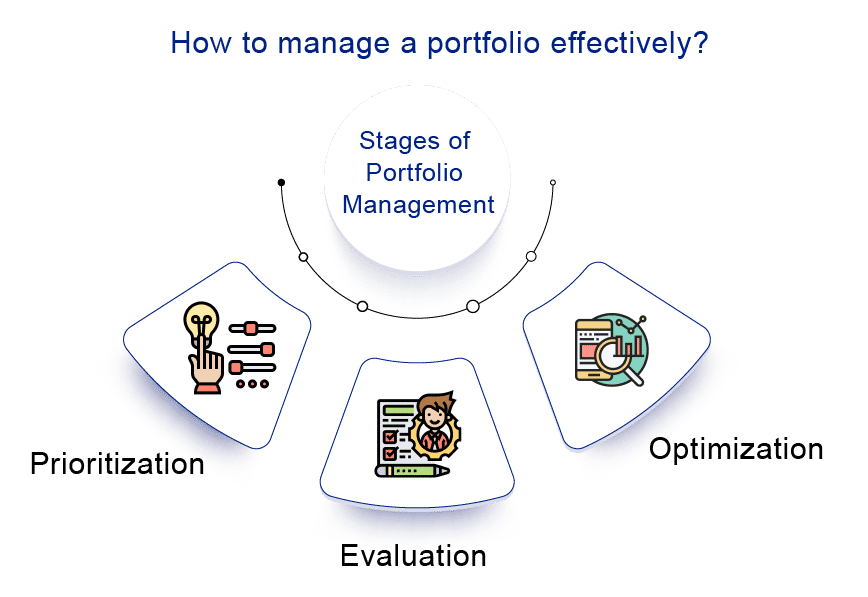

Portfolio Management by Stages

Evaluation

Development, manufacturing, commercial expenses, clinical risk-benefit, intellectual property (IP), and competitive landscape analysis are all provided by both R&D and commercial teams. The portfolio team produces outputs such as business valuations and related parameters used by executive leadership to make decisions. Executive leadership evaluates asset development plans, risks, PTRS (Probability of Technical and Regulatory Success), and commercial assumptions, including Internal Rate of Return, peak sale, peak revenue, market access limits, and so on.

Prioritization

Project portfolio management is achieved through prioritizing projects according to the scientific and commercial aspects as well as associated risk and uncertainty. The creation of the agent with the best chance of succeeding should be given high priority. There should be no resource limitations for the most important projects (budget and FTEs).

Optimization

Pharmaceutical businesses utilize specified selection criteria to choose and move their assets from medication discovery through preclinical testing and eventually development. The finest portfolios include a variety of early-stage candidates and backup agents that can be useful if the lead compound’s development is halted. In any case, risk assessment is an important aspect of portfolio management and development decisions. Pharma executive teams guarantee that only the most promising compounds make it to the clinical stage by using a tight selection of preclinical agents. Strategic decisions are made about which compounds will be in-licensed, out-incensed, or abandoned during the process. Portfolio optimization should always be a dynamic process that includes periodic re-evaluation.

Pharmaceutical Portfolio Management Techniques

The economic analysis formed a basis for one of the first project portfolio management methodologies used in the pharmaceutical sector. According to Chapman and Ward (1996), project planning can benefit from starting a risk management process early in the project life cycle rather than delaying it until the end. This approach can handle a project properly while also being risk-efficient for the company.

Discounted cash flow (DCF) is the most commonly utilized PfM technique, although it has the issue of not generating enough quantitative insights about the risks associated with a drug candidate. DCF is a valuation approach that considers future cash flows to determine the value of an investment. If it is more than the present investment cost, the project may yield positive benefits.

In addition, more techniques were followed in the later years like the Economic Analysis method, Data Envelopment Analysis (DEA), Real Option Valuation (ROV) Method, and Decision Tree Method, which were presumed to provide real value to corporate growth opportunities in the pharmaceutical firms. The way biopharmaceutical companies manage R&D portfolio and how project planning is affected is based on certain parameters like asset types, frequency of mechanism of action, primary technology used, size, and the number of transaction deals, etc. Based on the same, an example of a pharmaceutical company is detailed below.

Assessing Roche’s Portfolio Management Strategies

Roche is a Swiss-based multinational healthcare corporation with two core divisions: pharmaceuticals and diagnostics. Due to essential data companion diagnostics grants in terms of efficiency and effectiveness of a possible drug leading to the development of focused, tailored therapy for patients, the latter accounts for roughly two-thirds of total R&D initiatives. Roche’s most well-known portfolio is cancer, which is followed by neurology and infectious disease. With billions of dollars spent on R&D, the oncology portfolio is considered among the strongest in the industry.

The company prefers to use small molecules (frequency = 97). As a result, it has embarked on a strategy to build the necessary launching capabilities for medications formulated using small molecules. The frequency of transaction deals Roche made at each clinical stage, with discovery (frequency = 60) being the most frequent, followed by preclinical (frequency = 33) and Phase II (frequency = 24). Roche is primarily interested in licensing clinical and technical skills in the discovery stage as part of its strategic portfolio management to advance the early stages of its therapeutic pipeline. Roche prefers to acquire products that show promise for its cancer and neurology portfolios in the preclinical and Phase II stages.

In 2009, Roche signed an agreement with ImmunoCellular Therapeutics to license the product ICT-69 antibody, which was still in the preclinical stage, adding a potentially promising medication to its cancer portfolio and increasing sales revenue (Reuters Staff, 2009). Moreover, in one of the acquisitions, Roche completed the USD 450 million acquisition of Santaris Pharma in 2014, giving them access to the locked nucleic acid (LNA) medication platform allowing the discovery and development of new classes of medicines using RNA-based treatments.

Table 1: Preference of asset types at each clinical stage |

|

Clinical Stages |

Asset Type |

Discovery |

Product, Technology |

Preclinical |

Product |

Phase I |

Product |

Phase II |

Product |

Phase III |

Product, Company/Business Unit |

Approved |

Company/Business Unit |

Roche’s preferred asset is a product, which is often licensed for several years by a biotechnology company to further explore the medicine's potency and evaluate its economic success. Roche tends to buy companies/business units at Phase III and approved stages in order to have direct access to their technology platforms and drug pipelines, thereby boosting their portfolio.

Roche is committed to improving the quality of life for individuals suffering from various diseases by studying and producing cost-effective precision medicines. It diversifies internationally through new reimbursement mechanisms and pricing strategies by providing access to medicines.

Benefits of Strategic Portfolio Management in Pharmaceutical Companies

Transparency

One of the tenets of R&D portfolio management is that projects must be consistently evaluated for investment portfolio management i.e., investments may be aggregated throughout the portfolio or compared against each other. Without portfolio management, these appraisals are often carried out separately by the finance or project executives assigned to each project, with nothing to preclude the financial approaches used from being modified from project to project. Consistency is ensured, and metrics are made more trustworthy by creating a portfolio management approach. Furthermore, the assumptions are no longer hidden on someone’s hard drive, providing for greater transparency into the assumptions and a higher degree of validation when they can be easily compared across projects.

Strategic Alignment

At its most basic level, R&D portfolio management is about deciding which initiatives should be funded and which should be terminated. On the surface, the former is more crucial; potential winners must not fall through the pits. Continuing to fund unnecessary initiatives diverts resources from more productive projects, resulting in resource shortages, delays, greater costs, and lost revenue. Portfolio management equips businesses with methods and tools that allow them to identify potential blockbusters and grasp the opportunity costs of continuing to support multiple projects with low prospects. Lastly, a lot of businesses cancel initiatives that had been hanging for years during their first portfolio review (Cooper Robert et al., 2002).

Understanding the Potential

Pharmaceutical and biotech start-ups create their first products with a laser-like focus, making whatever judgments are best for each product individually. As these businesses expand, they continue to make product decisions in isolation, oblivious to the consequences for their other products. This eventually leads to a crisis, most commonly a scarcity of early-stage products. Portfolio management’s holistic view of the R&D pipeline ensures that funding decisions are not solely based on a product’s potential peak sales; instead, projects may be funded because they add value from a timing (e.g., filling a gap in the early-stage pipeline) or market (e.g., expanding a key therapeutic area) standpoint.

Even Distribution and Valuation

Each company in a portfolio focuses on a specific program, frequently a single medicine. Unlike huge corporations, which have several assets in development at any given moment, each firm in a portfolio can focus on a single asset or a small group of assets. Governance and resource allocation are simplified when a team is solely focused on one program that impacts the success or failure of the entire firm. Investors evaluating early-stage firms sometimes focus on the lead asset, with the remainder of the pipeline unfairly devalued. Strategic valuation of the asset may be more accurate as a result.

Conclusion

The drug development pipeline is determined by corporate strategy, with selected projects at various stages forming an organization’s medication portfolio. The primary must-have components and enablers of every pharmaceutical company’s commercial success are an optimized portfolio strategy and a suitable drug portfolio management methodology. To avoid choice bias and investment hazards, it is advised that the industry use modern decision-making procedures, and structured portfolio management.

Portfolio decisions, such as medication candidate selection, portfolio prioritization, and optimization, are the most essential factors in determining the company’s total shareholder value. Research and development portfolio requires evaluation of expenditure, clinical risk–benefit, intellectual property, peak sales, profit, and other factors to move ahead. Prioritization of projects helps assess the risks and success of the project, while optimization ensures that only the most promising compounds make it to the clinical stage by strategic decisions to license or abandon the product mid-way.

Moreover, portfolio management techniques like the Economic Analysis Method, Data Envelopment Analysis (DEA), Real Option Valuation (ROV) Method, and Decision Tree Method have been discussed over years. The techniques enlisted are tools that divide a project’s time into a few data-gathering sections, which are further divided into gates that act as information for moving forward, holding, or terminating the project. With the example of the company Roche the portfolio strategies and schemes that the company follows to rule the market are discussed with major market access in oncology and investments over time.

In sum, strategic portfolio management provides transparency, strategic alignment, potential choices, and affective valuation in the project decisions and growth. Given the high stakes of drug research and how well it lends itself to portfolio management techniques, pharmaceutical strategic portfolio management is expected to play an increasingly important role.

Downloads

Article in PDF

Recent Articles

- Genetically Engineered Salmon : Are you up for dinner?

- Security Breach: A Growing Concern For The Healthcare Industry

- Outbreak of Companies Challenging New Pathways for Treatment of Pulmonary Arterial Hypertension

- Systemic Lupus Erythematosus: An autoimmune disease

- What Impact Does Speech and Voice Recognition Technology Bring to the Healthcare System?