According to a statement from the biotech, additional data from the study, which is looking at overall survival as a secondary endpoint, will be shared later this year. The biotech has stated that it hopes to file for FDA approval in the first half of next year.

The hope of Actinium is that Iomab-B will replace these non-targeted approaches, making BMT more accessible. It also has a shorter conditioning time (12 days versus 42 days), can be administered with a single intravenous infusion, and reduces conditioning therapy side effects such as sepsis, febrile neutropenia, and mucositis, according to prior data.

Sandesh Seth, Actinium’s Chairman and CEO, said, “This is a significant milestone in Actinium’s lifecycle and a testimony to the quality of our team who undertook a pioneering study in a patient population that is considered largely futile to treat. Despite being perennially under-staffed and under resourced, their passion and perseverance has yielded a clinically meaningful dividend. Our recently strengthened team is executing to enable our mission to disrupt the field of bone marrow conditioning with Iomab-B, first in r/r AML and then by building upon its robust prior clinical results in several hematological diseases. We look forward to sharing additional clinical data from the SIERRA trial by year end.”

Santhera Seeks FDA Review for its DMD Therapy Vamorolone

Santhera has completed a rolling application in the United States for its Duchenne muscular dystrophy (DMD) therapy vamorolone, paving the way for approval and launch in the second half of 2023. The Swiss biotech is requesting a priority review for vamorolone, which was licensed from US biotech ReveraGen BioPharma in 2020 after Santhera’s previous DMD therapy candidate, idebenone, failed clinical testing and was withdrawn.

Santhera should hear from the FDA within the next 60 days whether the expedited review has been granted, and if so, the review time will be reduced from ten to six months. Its lead drug has already received FDA fast-track and rare pediatric disease designations.

The timeline for possible US approval has slipped slightly from predictions made earlier in the year, as has a recently completed filing in the EU, but Santhera remains on track to bring the drug to market in both territories in 2023. The company, which has previously stated that it will require additional funding to prepare the product for market entry, has previously stated that vamorolone could generate more than USD 500 million in DMD alone.

“Completion of the vamorolone NDA submission is a major step towards our goal of bringing this investigational therapy to patients living with DMD and represents a vital milestone for Santhera,” said Dario Eklund, CEO of Santhera. He added, “We look forward to working closely with U.S. regulators to advance vamorolone toward approval.”

If vamorolone is approved, it will represent a dramatic improvement in Santhera’s fortunes after idebenone failed a phase III trial in DMD in 2020.

After receiving approval from European regulators, Johnson & Johnson’s BCMAxCD3 has now secured approval from U.S. FDA for treatment of multiple myeloma. The FA covers factors that appear less favorable for the BCMA-targeted bispecific drug Tecvayli and has now granted accelerated approval for Tecvayli to treat multiple myeloma. The eligibility criteria for treatment with Tecvayli include patients that have received prior treatment of at least four prior lines of therapies, including an immunomodulatory agent like Bristol Myers Squibb’s Revlimid, a proteasome inhibitor such as Takeda’s Velcade, and a CD38 antibody such as Johnson & Johnson’s Darzalex. A single line of therapy can refer to several combinations of drugs.

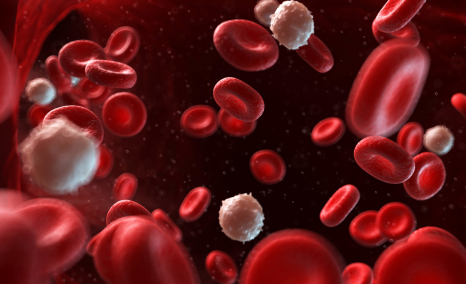

Multiple myeloma is a cancer of plasma cells. In general, when plasma cells become cancerous and grow out of control, this is called multiple myeloma. The plasma cells make an abnormal protein (antibody) known by several names, including monoclonal immunoglobulin, monoclonal protein (M-protein), M-spike, or paraprotein. Normal plasma cells are found in the bone marrow and are a significant part of the immune system. Multiple myeloma is the second most common blood cancer diagnosis, after non-Hodgkin lymphoma, in the United States.

As per the U.S. indication, patients can receive therapy only if they have received three prior therapies, unlike the European label. The three therapies, including Tecvayli and Legend Biotech’s BMCA-targeted CAR-T therapy Carvykti, have almost the same label for usage. The price of Tecvayli set by Johnson & Johnson is expected to be approximately USD 39K per month. The analysis as per clinical trials indicates that the duration of the course is about nine to 10 months; therefore, the complete course cost is almost USD 390K, which doesn’t include any discounts.

Syncona to Acquire AGTC for USD 23.5 Million

As per the newest updates by Syncona Limited, the company has announced the acquisition of Applied Genetic Technologies Corporation (AGTC), which is a 23.5 million deal. AGTC is a clinical-stage biotechnology company focused on developing and commercializing adeno-associated virus (AAV)-based gene therapies focused on treating rare and debilitating diseases. The 23.5 million deal accounts for approximately USD 0.34 per share.

The acquisition, being termed as a “low ball bid,” will be the company Syncona’s third company focused on retinal gene therapy after the other two companies, Nightstar and Gyroscope, which were previously acquired by Biogen and Novartis. The company AGTC currently has its lead candidate AGTC-501 (laruparetigene), an AAV gene therapy for X-linked retinitis pigmentosa that majorly results from mutations in the RPGR gene, responsible for progressive vision loss that leads to blindness in men.

The center of focus of the treatment therapies of AGTC majorly includes novel discoveries on ophthalmic, otologic, and central nervous system (CNS) diseases. AGTC has deliberately entered into strategic collaborations with companies such as Bionic Sight, Inc. and Otonomy, Inc. Apart from the USD 23 million deal, there is also potential for an additional USD 50 million, which accounts for USD 73 per share in contingent value rights to AGTC’s stockholders upon the accomplishment of certain milestones regarding the medical products of the company.

The chief investment officer of Syncona Investment Management Limited, Chris Hollowood, stated that “We have followed AGTC for a number of years and are very familiar with its lead programme focused on XLRP. It is a disease we know very well because of our previous investment in Nightstar and we are very excited by the data. We believe [AGTC-501] has the potential to be a best-in-class product that could transform the lives of patients suffering with this devastating blinding condition.”

Whereas the president and CEP of AGTC, Sue Washer, stated, “This transaction allows continued progress in advancing an important therapy for XLRP patients, while also maximising immediate and potential long-term value to our shareholders. We look forward to transitioning the AGTC-501 XLRP product candidate to Syncona’s experienced stewardship with the goal of advancing this differentiated product candidate to patients.”

Seres Therapeutics Announces Completion of Rolling BLA Submission to FDA for SER-109

On October 26, 2022, Seres Therapeutics announced that the US federal health regulatory agency, FDA, has accepted to review its Biologics License Application (BLA) for investigational oral microbiome therapeutic candidate SER-109. Seres’s SER-109 is an investigational microbiome therapeutic and is designed to treat recurrent C. difficile infection (rCDI). SER-109 is composed of purified Firmicutes spores, which shows promise to improve the current standard of care for rCDI. The FDA has granted SER-109 Breakthrough Therapy designation and Orphan Drug designation for the prevention of rCDI.

Seres had further updated that the application has been granted Priority Review designation with a Prescription Drug User Fee Act (PDUFA) action date of April 26, 2023. Furthermore, the FDA advised that they are not currently planning to hold an Advisory Committee Meeting to discuss the SER-109 application.

SER-109 is designed to reduce the recurrence of CDI by modulating the disrupted microbiome to a state that resists C. difficile colonization and growth. Seres Therapeutics has received the BLA acceptance and priority reviews based on data readouts from two vital studies: ECOSPOR III (SERES-012) and ECOSPOR IV (SERES-013). ECOSPOR III was a multicenter, randomized, placebo-controlled study with 182 adults enrolled with rCDI. ECOSPOR IV study investigated the therapy, SER-109, over 24 weeks in 263 patients. As per the data presented, nearly 91% of participants had a sustained clinical response at eight weeks, with 86% still having the sustained response at 24 weeks after being treated with SER-109.

In the United States, about 170,000 rCDI cases are registered annually. It is one of the leading causes of hospital-acquired infection and the most urgent bacterial threat in the country. The approval and launch of the SER-109 raise hope for better treatment for patients with rCDI in the US.

Bristol Myers Squibb Announces Positive Topline Results of Phase 3 COMMANDS Trial

Bristol Myers Squibb (BMS) announced the topline result from the COMMANDS trial result evaluating Reblozyl (luspatercept-aamt) in adult patients with very low-, low- or intermediate-risk myelodysplastic syndromes (MDS) who require RBC transfusions. BMS’s phase 3 COMMANDS trial is an open-label, randomized study evaluating Reblozyl versus epoetin alfa. As per the updates from the BMS, Reblozyl met its primary endpoint, demonstrating a highly statistically significant and clinically meaningful improvement in red blood cell transfusion independence (RBC-TI) with concurrent hemoglobin (Hb) increase in the first-line treatment of adult patients. BMS is developing Reblozyl through a global collaboration with Merck following Merck’s acquisition of Acceleron Pharma, Inc. in November 2021.

This result were based on a pre-specified interim analysis conducted through an independent review committee. Safety results of the drug in the COMMANDS trial were consistent with the safety profile in the previously conducted MEDALIST study, and no new safety signals were reported. BMS will complete a full evaluation of the COMMANDS data and work with investigators to present detailed results at an upcoming healthcare conference and medical, as well as discuss these results with health authorities.

Boehringer Moves PDE4B drug into Late-stage Clinical Testing for ILDs

Boehringer Ingelheim has now moved its drug oral phosphodiesterase 4B (PDE4B) inhibitor BI 1015550 into late-stage clinical testing for interstitial lung diseases (ILDs) and idiopathic pulmonary fibrosis. The drug is one of the most promising candidates among 15 new medicines at Boehringer’s R&D update earlier this year. Moreover, Boehringer Ingelheim will spend almost EUR 25 billion on the launch in the market by 2025. The first patient has already enrolled in the drug’s FIBRONEER phase 3, and the positive phase II trials persisting 12 weeks showed improved lung function in patients suffering from IPF. The further program majorly includes two trials, namely FIBRONEER IPF and FIBRONEER-ILD, recruiting patients across which will recruit patients across 40 countries.

Idiopathic pulmonary fibrosis (IPF) is one of the most common forms of progressive fibrosing ILDs. Its symptoms include breathlessness during activity, a dry and persistent cough, chest discomfort, fatigue, and weakness. Boehringer Ingelheim has its name in the treatment market of IPF comprising Ofev (nintedanib), which stands among one of the top-selling drugs.

Ofev alone had a market share of EUR 2.5 billion in 2021, marked by a 25% gain from the previous year. However, the drug’s patents will expire in the year 2029. Therefore, Boehringer is considering maintaining the BI 1015550 franchise to improve the treatment of IPF, which remains incurable. BI 1015550 is the first molecule in the PDE4B inhibitor class to be examined for treating Idiopathic pulmonary fibrosis and other progressive fibrosing interstitial lung diseases.

IPF and other progressive fibrosing interstitial lung diseases are irreversible lung damage, leading to loss of function and permanent inflammation. IPF is one of the deadliest sarcoma countings for the patient’s death within two to three years of diagnosis.

“As the global market leader in pulmonary fibrosis, our ambition is to move beyond slowing down disease progression and one day provide a cure for this devastating condition,” stated Dr. Donald Zoz, senior clinical program leader for pulmonary fibrosis at Boehringer. He further added, “Enrolling the first patient in our phase 3 program is a critical step to help bring forward this next generation of treatment to those in need as quickly as possible.”

FDA Rejects Gilead’s Hepatitis D Therapy Hepcludex

Gilead Sciences’ novel drug therapy Hepcludex has been rejected by FDA. The drug had promised to bring the first hepatitis D virus (HDV) drug therapy to the US market. As per Gilead’s chief medical officer Merdad Parsey, the FDA has concerns about the “manufacture and delivery” of Hepcludex but has not asked for new safety or efficacy clinical trials of the drug. “We plan to resubmit as quickly as possible, and we’ll work with the agency on the path forward,” he stated.

In certain cases, HDV is unusual and co-exists as a co-infection with the hepatitis B virus, which is mainly seen in 5% of patients amongst the 257 million diseased population. The combination of both hepatitis B virus (HBV) and hepatitis D virus (HDV) has been reported to increase the risk of liver disease-related death and liver cancer. The existing treatment using pegylated interferon alpha products is less effective.

HBV and HDV are both more common transmitters from the affected mother to the child during birth. Both diseases are also frequently transmitted sexually and by sharing of body syringes. Gilead filed for FD approval based on Hepcludex showing significant hepatitis D virus RNA declines and improvements in liver damage biomarkers at 24 weeks during clinical trials. The rejection came after the company reported increasing growth across its hepatitis, HIV, and oncology categories, which drove product sales up 11% to USD 6.1 billion. Moreover, COVID-19 antiviral Veklury plunged 52% to the highest USD 925 million on the lowest number of COVID-19 hospitalization cases.