Prader-Willi Syndrome Drug Market Heats Up: 5 Upcoming Challengers to Soleno’s VYKAT XR

Apr 11, 2025

Since the FDA approved recombinant human growth hormone (rhGH) for Prader-Willi syndrome in 2000, numerous companies have faced challenges in developing more advanced treatments for hyperphagia, the uncontrollable hunger associated with PWS.

However, in March 2025, Soleno Therapeutics marked a major milestone with the approval of VYKAT XR (diazoxide choline), making it the first FDA-approved Prader-Willi syndrome drug for hyperphagia. VYKAT XR is indicated for patients aged 4 years and older with PWS, a disorder characterized by low muscle tone, short stature, and cognitive and developmental difficulties.

Before that, multiple companies have encountered obstacles in their efforts to develop treatments for hyperphagia in Prader-Willi syndrome. In 2016, Alize Pharma achieved positive results in a Phase II trial with AZP-531, a first-in-class unacylated ghrelin peptide analog, but was unable to advance the treatment further.

Downloads

Article in PDF

That same year, Zafgen demonstrated beloranib’s efficacy—a MetAP2 inhibitor—in a Phase III trial, but safety concerns ultimately led to its discontinuation. Saniona developed Tesomet, a combination of the monoamine reuptake inhibitor tesofensine and the beta blocker metoprolol. Although Tesomet received Orphan Drug designation from the FDA in 2021, its development was discontinued in 2022 due to funding constraints.

Meanwhile, Acadia Pharmaceuticals pursued intranasal carbetocin, but the FDA rejected the treatment in 2022. Acadia had previously acquired the candidate through a $10 million purchase of Levo Therapeutics.

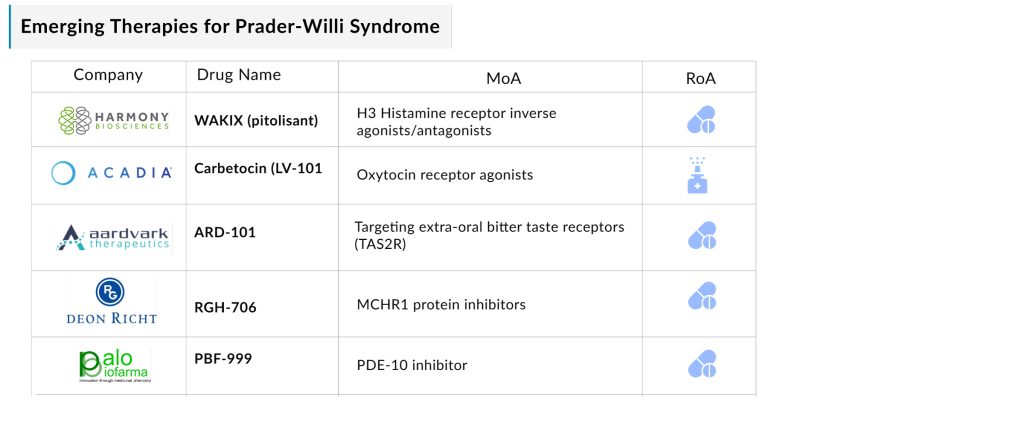

Several Prader-Willi syndrome drugs are currently in mid and late-stage development, with potential approvals on the horizon. The evolving treatment landscape includes a diverse array of therapeutic options, such as H3 histamine receptor inverse agonists/antagonists (WAKIX [pitolisant]), oxytocin receptor agonists (Carbetocin [LV-101]), therapies targeting extra-oral bitter taste receptors (TAS2R) (ARD-101), MCHR1 protein inhibitors (RGH-706), and PDE-10 inhibitors (PBF-999), among others.

Let’s take an in-depth review of these upcoming Prader-Willi syndrome drugs and how they will challenge Soleno’s recently approved VYKAT XR.

Harmony Biosciences’s WAKIX

WAKIX (pitolisant) is a selective histamine 3 (H₃) receptor antagonist/inverse agonist. While its exact mechanism of action remains unclear, its effectiveness is believed to stem from its interaction with H₃ receptors, leading to increased histamine synthesis and release, a key neurotransmitter involved in wakefulness.

Developed by Bioprojet (France), Harmony Biosciences holds the exclusive US rights to develop, manufacture, and commercialize pitolisant. WAKIX is FDA-approved for the treatment of excessive daytime sleepiness or cataplexy in adults with narcolepsy, but it is not yet approved for Prader-Willi syndrome and remains under evaluation for this condition.

In February 2024, the FDA granted Orphan Drug designation to pitolisant for PWS treatment. Currently, WAKIX is the only therapy being studied for PWS patients with EDS, which affects approximately 50% of PWS patients. Given the high unmet medical need, limited competition, and established efficacy in narcolepsy, WAKIX is expected to gain strong commercial traction and have an extended market uptake period if approved for PWS.

ACADIA Pharmaceuticals’ Carbetocin

Carbetocin nasal spray is an investigational treatment being developed to address hyperphagia in Prader-Willi syndrome. Compared to oxytocin, carbetocin offers enhanced drug properties, including a longer half-life and greater selectivity for oxytocin receptors over vasopressin receptors, which may lead to improved efficacy and a favorable safety profile for PWS patients.

Since PWS primarily affects the central nervous system, a nasal formulation of carbetocin was designed to enable direct drug delivery to the brain, significantly minimizing systemic exposure and reducing the risk of side effects.

In June 2022, Acadia acquired Levo Therapeutics, securing global rights to ACP-101 as a potential treatment for hyperphagia in Prader-Willi syndrome. In November 2023, the company launched the pivotal Phase III COMPASS PWS clinical trial to assess the efficacy and safety of carbetocin nasal spray for managing hyperphagia in PWS.

Aardvark Therapeutics’ ARD-101

Aardvark’s lead candidate, oral ARD-101, is a potent pan-agonist of bitter taste receptors (TAS2R) that stimulates enteroendocrine cells in the digestive tract, triggering the release of gut-peptide hormones like GLP-1 and cholecystokinin (CCK), a satiety hormone that activates gut-brain signaling to regulate hunger. ARD-101 has demonstrated hunger reduction both as a monotherapy and in combination with existing GLP-1 therapies.

Based on encouraging clinical data from its ongoing trial, the FDA has granted ARD-101 both Orphan Drug Designation and Rare Pediatric Disease Designation for Prader-Willi syndrome. The Phase II trial evaluating oral ARD-101 in young adults with PWS remains open for additional enrollment. In August 2023, Aardvark Therapeutics announced that the FDA granted ARD-101 a Rare Pediatric Disease Designation for PWS, following its Orphan Drug Designation received in June 2023.

Gedeon Richter’s RGH-706

RGH-706 is an investigational once-daily oral capsule developed by Gedeon Richter for the treatment of Prader-Willi syndrome. The drug functions by blocking melanin-concentrating hormone (MCH), a key regulator of the brain’s food-seeking behavior. MCH, when binding to specific receptors in the brain, stimulates hunger. By inhibiting MCH, RGH-706 has the potential to suppress appetite.

Gedeon Richter is currently evaluating RGH-706 in a Phase II PWS clinical trial, known as KITE-PWS (RGH-706-003), marking the first proof-of-concept study using this approach to address hyperphagia in individuals with PWS. The primary goal of the study is to assess the efficacy, safety, and tolerability of RGH-706 in patients with PWS.

Palobiofarma’s PBF-999

PBF-999 is an innovative PDE10 inhibitor developed by Palobiofarma, which has shown potent and selective inhibition of the PDE10 enzyme in preclinical studies. PDE10 plays a crucial role in regulating cyclic nucleotide levels, which are key signaling molecules in the brain. A Phase II PWS clinical trial evaluating PBF-999 is currently ongoing.

PBF-999 has already undergone three clinical studies, where an appetite-suppressing effect was observed. Based on these findings, Palobiofarma has designed a new clinical trial to evaluate the safety and efficacy of PBF-999 in reducing hyperphagia in adults with Prader-Willi syndrome.

In March 2024, Pamplona announced that both the FDA and EMA had granted Orphan Drug Designation (ODD) to PBF-999 for treating PWS. Additionally, in November 2023, Palobiofarma received a Rare Pediatric Disease Designation (RPDD) from the US FDA for PBF-999 in PWS treatment.

The anticipated launch of emerging therapies in the Prader-Willi syndrome landscape is expected to reshape the competitive dynamics, posing both challenges and opportunities for Soleno’s VYKAT XR. The introduction of new therapies—particularly those with novel mechanisms of action or broader symptom coverage—may fragment prescriber preferences and intensify competition for patient share. This could pressure VYKAT XR’s pricing flexibility, market uptake, or label expansion strategies, particularly if newer entrants demonstrate superior efficacy, safety, or convenience.

On the flip side, the entry of additional therapies may also help validate the commercial viability of the PWS space, attracting greater attention from payers, clinicians, and advocacy groups. If VYKAT XR maintains a first-to-market or best-in-class status, it can leverage early relationships with key stakeholders and real-world data to defend and expand its market position.

Furthermore, Soleno’s accumulated experience in navigating the unique regulatory and access challenges in PWS may offer a strategic edge over newer players. Ultimately, the evolving competitive landscape will require Soleno to invest in post-marketing evidence, targeted physician engagement, and differentiation strategies to retain leadership in this rare but high-need therapeutic area.

Downloads

Article in PDF