Over the decades, there has not been much improvement witnessed in the PH treatment market. The treatment begins with citrates, vitamin B6, and hyperhydration. PH patients with advanced kidney failure are left with the only option of kidney transplantation. Thus, there is a clear need for novel and effective therapy options specifically for patients who have reached ESRD. On the other hand, a lack of effective therapies and limited drug options in Primary Hyperoxaluria offers immense opportunities to pharmaceutical and biotech companies to invest in the Primary hyperoxaluria market and develop innovative, pocket-friendly therapies with better safety profiles and patient adherence.

Recently, in November 2020, a small interfering ribonucleic acid (RNAi) therapy, Oxlumo (Alnylam Pharmaceuticals) entered the PH therapy market in the US and EU for the treatment of PH1 to lower urinary oxalate levels in pediatric and adult patients. The approval marked a breakthrough in the Primary Hyperoxaluria therapy market giving an advantage to Alnylam Pharmaceuticals in the US and European PH markets; however, Japan’s PH therapy market still has no approved therapies.

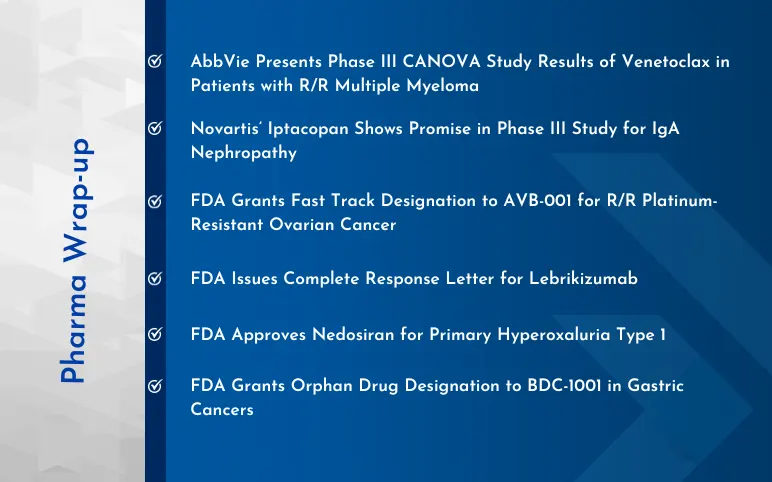

The company may be enjoying a monopoly in the PH market as of now, but there are several competitors such as Oxthera, Dicerna Pharmaceuticals, Inc., Allena Pharmaceuticals, Biocodex, and others, trailing behind with their novel therapies in the late stage of clinical trials. At present, the Primary hyperoxaluria pipeline comprises two pipeline therapies in Phase III of the clinical trial namely Oxabact (OxThera) and Nedosiran (Dicerna Pharmaceuticals). These therapies are expected to get launched in the PH market in the next decade and are anticipated to negatively impact the market share of Oxulmo attributable to their efficiency in all types of PH and promising clinical activity.

DelveInsight estimates that the Primary hyperoxaluria market size is expected to soar at a CAGR of 40.40% during the study period 2018-30 in the 7MM.

Even so, the overall PH market size shall experience a positive shift owing to an increase in the prevalence, a surge in the PH therapeutic clinical activity, and emerging pipeline therapy options. A lack of approved therapies in Primary hyperoxaluria gives room to pharma and biotech companies to explore with their novel innovative approaches towards addressing the rare disease, PH. Clearly, better diagnostics modalities and a better understanding of the disease clinical course shall further augment the addition of revenue to the PH market share.