How Emerging Pipeline Therapies Will Unfold the Severe Asthma Treatment Market Dynamics?

Sep 12, 2022

Key Highlights

- Tezspire (tezepelumab) with no phenotypic (eosinophilic or allergic) or biomarker restriction will be the new game-changer in the severe asthma market

- Depemokimab is an excellent market replacement for GSKs’ Nucala as of its improved binding affinity and longer duration of action as a single dose

- Non-eosinophilic asthma (NEA), which is an orphan asthma endotype, has a scarcity of effective specialized therapies

Asthma is the most prevalent chronic illness in children and is a serious non-communicable disease (NCD) that affects both children and adults. People with asthma may require emergency medical attention if their asthma symptoms are severe, and they may also need to be admitted to the hospital for monitoring and asthma treatment. Asthma can cause death in its most extreme forms.

According to data from the Centers for Disease Control and Prevention (CDC), the National current asthma prevalence was observed to be 7% for people aged <18 years and 8% for people aged 18+ years in the US. Similarly for Europe, according to the second edition of the Global Atlas of Asthma report published by the European Academy of Allergy and Clinical Immunology, the diagnosed prevalence of adult asthma was observed to be 4.4% in Germany, 5.5% in France, 6.3% in Spain, and 8.4% in the UK.

As per DelveInsight analysis, the total diagnosed prevalent cases of asthma in the 7MM were found to be approximately 42 million cases in adults and approximately 11 million cases in the pediatric population in the year 2021. These cases are expected to rise significantly by 2032. Moreover, the US accounted for the highest number of diagnosed prevalent cases of asthma in the 7MM in 2021.

Downloads

Article in PDF

Recent Articles

- Notizia

- Understanding Asthma Diagnostic Devices: Enhancing Management and Care

- Asthma: Rising Prevalence And The Key Challenges In The Management

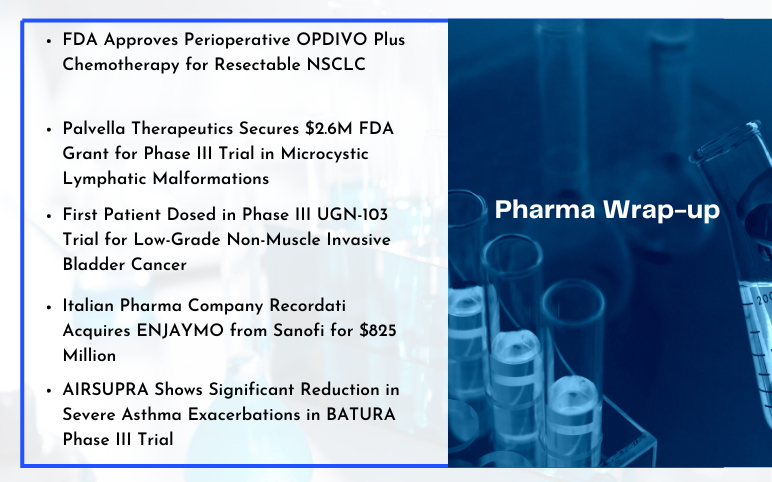

- BMS, and Exelixis’s Opdivo + CABOMETYX in First-Line Advanced Renal Cell Carcinoma; AIRSUPRA Now ...

- ATS 2023 Updates: Dupixent – A Ray of Hope For Moderate To Severe Chronic Obstructive Pulmo...

Asthma severity is the inherent intensity of the disease process, and there is no single universally accepted definition for severe asthma. NAEPP/EPR guidelines broadly classify asthma into intermittent or persistent. According to various studies, persistent asthma prevalence is higher than intermittent asthma in the US and EU-5. Persistent asthma is further subdivided based on severity into mild, moderate, and severe. Individuals with severe asthma often have frequent nighttime symptoms and persistent airflow obstruction with a forced expiratory volume (FEV1) of less than 60% predicted before treatment.

Based upon response to treatment, severe asthma is further classified into type-2 inflammation and non-type-2 inflammation. Type-2 inflammation mainly includes allergic asthma and eosinophilic asthma (or e-asthma), while non-type-2 inflammation includes non-eosinophilic asthma. The severe asthma diagnosis is complex and largely depends on the symptoms and the response to the current severe asthma treatment being administered.

As per Global Initiative for Asthma (GINA) report 2021, severe asthma, a subset of difficult-to-treat-asthma, is defined as asthma that is uncontrolled despite adherence to optimized high dose ICS-LABA therapy and treatment of contributory factors or that worsens when high dose therapy is decreased. Despite being far less prevalent than mild and moderate asthma, severe asthma accounts for over 60% of the expenditures connected with the condition, largely attributable to drug costs.

The current severe asthma treatment mainly focuses on controlling the symptoms, managing airway inflammation, and preventing lung damage. Besides inhalers, inhaled corticosteroids are the mainstay treatment for persistent asthma in severe asthmatics; however, relievers or rescue drugs such as SABAs are administered to ease airway bronchoconstriction. Long-acting beta 2 agonists (LABA), montelukast, or theophylline are used if asthma still isn't controlled. With improved disease understanding, tailored IgE-directed therapies or other biologic treatments are being prescribed.

What’s the current severe asthma treatment market scenario?

Currently, the US FDA approved six monoclonal antibodies as maintenance therapies for treating severe asthma (both allergic and eosinophilic). Xolair (omalizumab) by Novartis/Genentech, Cinqair (reslizumab) by Teva Pharmaceutical, Dupixent (dupilumab) by Sanofi/Regeneron, Nucala (mepolizumab) by GlaxoSmithKline, Fasenra (benralizumab) by AstraZeneca/ Kyowa Kirin and the latest approved Tezspire (tezepelumab) by AstraZeneca/Amgen.

Xolair, the first licensed biologic, is a recombinant IgG1 monoclonal antibody that targets and interrupts the IgE-mediated asthma inflammatory cascade at an early stage. In 2019 it also became accessible in prefilled syringes, making it more convenient than reconstituted vials. However, the old player is facing multiple brand threats and competition from the newly branded Glaxo’s Nucala and Sanofi/Regeneron’s Dupixent, which might limit its global expansion and drive flat sales as they compete in the core asthma indication. Shortly, Xolair could also be theoretically vulnerable to biosimilars due to patent expirations, albeit the landscape is currently restricted, and there is no strong generic competition in the severe asthma treatment market.

According to analysts at DelveInsight, there has been an increasing demand for personalized therapy for severe asthma treatment. Severe asthma is treatable, but it requires therapies and support that differ from those for mild or moderate asthma. This personalization requires professional assistance; therefore, increasing demand for personalization will increase the severe asthma treatment market.

According to DeleveInsight analysis, the severe asthma market is expected to grow with approximately 5% CAGR in the study period 2019─2032, owing to a higher patient pool, higher treatment cost, and increasing demand for personalized/targeted therapies in the 7MM.

The anti-IL-5 space is crowded with Astra's Fasenra approved in November 2017, Teva's Cinqair in early 2016, and GlaxoSmithKline's Nucala in 2015. These severe asthma therapies are particularly for patients with severe, uncontrolled asthma who exhibit an eosinophilic phenotype.

GSK has a substantial severe asthma market share because of its first-mover advantage and strong entrenchment in the respiratory field. Being subcutaneously administered, it has an advantage compared to Cinqair’s IV only. However, Astra's Fasenra received approval for eight-week dosing, which is better than Nucala's four-week period. Also, while comparing clinical data results, Nucala depicted superiority over Fasenra and Cinqair. With Fasenra’s patent expiring in 2024 and Nucala’s in 2026, their severe asthma market share is expected to shrink, giving space to Sanofi/Regeneron’s broad labeled mAb, Dupixent, to dominate the anti-IL market.

Dupixent, the only biologic that blocks two key drivers of type 2 inflammation, IL-4, and IL-13, is a monoclonal antibody that targets the α-subunit of the IL-4 receptor. It is the most effective therapy option for individuals who have high BEC and/or FeNO levels and is also the only mAb approved for children with oral corticosteroid-dependent asthma. With a better asthma profile than IL5 antibodies and biweekly subcutaneous dosing, Dupixent is a tough competitor for the available biologics in a similar niche.

The recently approved AstraZeneca/Amgen’s Tezspire (tezepelumab) is a first-in-class monoclonal antibody targeting an upstream master cytokine, thymic stromal lymphopoietin (TSLP), an alarmin, is likely to be a tough competitor to Dupixent in the coming years. It is the only biologic with no phenotypic (eosinophilic or allergic) or biomarker restriction in its authorized label and is for asthmatics regardless of their blood eosinophil levels, allergic status, or fractional exhaled nitric oxide process. Tezspire presents a much-needed new treatment for those underserved and who continue to struggle with severe, uncontrolled asthma. In its phase III studies, the severe asthma drug had a remarkable reduction in exacerbation among patients with high levels of inflammatory biomarkers. This broad base anti-alarmin biologic, one of the most exciting innovations, will most likely be a game-changer in the current interleukin market.

What’s ahead in the severe asthma treatment market?

Several severe asthma therapies are currently under investigation for treating patients with severe asthma. Some of the promising therapies in the severe asthma pipeline include GSK3511294 (depemokimab) by GlaxoSmithKline, PT010 (Breztri/Trixeo/BGF MDI (budesonide-glycopyrrolate-formoterol inhalation)) by AstraZeneca, and PT027 (BDA MDI/Budesonide/albuterol sulfate metered-dose inhaler) by AstraZeneca and Bond Avillion. They are in the late stage of development and are expected to launch soon.

GSK’s Depemokimab offers an advantage over similar anti-IL5 Nucala due to its improved binding affinity and longer duration of action as a single dose. With Nucala’s patent expiring, Depemokimab is an excellent severe asthma market replacement for GSK.

AstraZeneca/Avillion’s PT027, a SABA/ICS fixed-dose rescue therapy for moderate to severe asthma with excellent phase III results, is being developed as a pressurized metered-dose inhaler. With regulatory submissions expected in 2022, it has the potential to be the go treatment to control asthma exacerbation. With a larger target patient pool and an early entry, the severe asthma drug will have an advantage over other emerging therapies once approved.

AstraZeneca’s PT010 is a triple LAMA/LABA/ICS combination therapy. Currently being evaluated in multiple phase III severe asthma clinical trials to assess the safety and efficacy for severe asthma, the combination is already approved for COPD and marketed as Breztri Aerosphere. With the respiratory industry becoming increasingly competitive, it is expected that the medicine would struggle to stand out sufficiently to achieve considerable market share. Trelegy from GlaxoSmithKline is likely to make significant competitive inroads, making it difficult for Breztri to win severe asthma treatment market share.

Other companies are also developing drugs for severe asthma treatment, which include Novartis (CSJ117), 4D pharma (MRx-4DP0004), Roche (RG6173), Pieris Pharma, and AstraZeneca (PRS-060/AZD1402), Biosion (BSI-045B), and others. Because of their ubiquity and recognized cellular and molecular targets, most of these innovative severe asthma treatment options primarily focus on allergic and eosinophilic asthma. Non-eosinophilic asthma (NEA), which is an orphan asthma endotype, has a scarcity of effective specialized therapies. Individuals with non-type-2 inflammation generally do not respond well to inhaled corticosteroids. Avalo Therapeutic’s anti-LIGHT monoclonal antibody, AVTX-002 is in the early phase for the treatment of poorly controlled Non-Eosinophilic Asthma.

However, biologics are approved for curing different phenotypes of severe asthma, it has been highlighted that, with few exceptions, the monoclonal antibodies market is restricted to developed and high-income countries. Poor awareness and proficiency regarding severe asthma, as well as the lack of proper tools to assess and manage it, potentially limit the routine use of biologics in low and middle-income countries besides their costs. Also, there is a dire need for an effective severe asthma treatment option that could properly cure the patients affected with severe asthma compared to current therapies, which are just symptomatic severe asthma treatments. In the coming years, deep research with appropriately defined outcomes to develop effective and targeted therapies will help strengthen the severe asthma treatment market growth.

Downloads

Article in PDF

Recent Articles

- The Evolving Landscape of COPD Treatments: New Hope for Patients

- Neurotech’s ENCELTO Becomes First FDA-Approved Treatment for MacTel Type 2; Plus Therapeutics’ Rh...

- Global Allergic disease market

- Immunocore’s Kimmtrak; Samsung Acquires Biogen’s Biosimilar Unit; Novavax’s COVID-19 Vaccin...

- DUPIXENT Receives First-Ever Biologic Approval for COPD: Adds Another Jewel in its Crown