Could Amgen’s Biosimilar Wezlana Pose a Challenge to Johnson & Johnson’s Stelara

Dec 01, 2023

The FDA recently approved Amgen’s Wezlana (ustekinumab-auub) for various inflammatory conditions, marking the first biosimilar approval referencing the popular J&J drug Stelara (ustekinumab). Wezlana, mirroring its reference product, is approved for treating multiple inflammatory diseases in adults, including moderate to severe plaque psoriasis, active psoriatic arthritis, and moderately to severely active Crohn’s disease and ulcerative colitis. Additionally, this biosimilar is suitable for use in children aged six years and above with active psoriatic arthritis and moderate to severe plaque psoriasis.

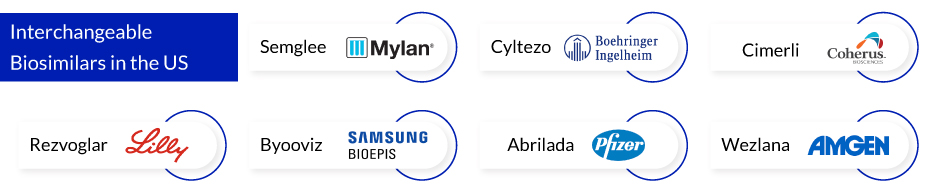

Amgen’s Wezlana joins the ranks of interchangeable biosimilars, becoming the seventh in line after Semglee, Cyltezo, Cimerli, Rezvoglar, Byooviz, and Abrilada. The green light for Wezlana came after a thorough examination of data from a phase III trial, initially identified as ABP 654. This trial, a multicenter, randomized, double-blinded study, conclusively met its primary efficacy endpoint, confirming that Wezlana mirrored Stelara regarding safety and efficacy with no clinically meaningful differences. Nonetheless, the approval raises questions about its potential effect on the ongoing Medicare drug price talks.

Amgen’s Biosimilar Shifts Dynamics, Offering J&J’s Stelara a Path Around Medicare Negotiations

In the wake of the FDA’s recent approval of Amgen’s Stelara biosimilar, Johnson & Johnson may find a silver lining. The impending arrival of a more affordable generic opens up an opportunity for J&J to avoid Medicare price negotiations mandated by the Inflation Reduction Act (IRA). According to court documents released by the Department of Health and Human Services (HHS) last month, under the upcoming price negotiation framework set to commence in 2026, a drug could be excluded if a relevant biosimilar or generic hits the market. HHS pointed to Stelara as a prime example, emphasizing that a biosimilar to J&J’s blockbuster immunology therapy is anticipated to launch by early 2025 at the latest.

Downloads

Article in PDF

Recent Articles

- Systemic Lupus Erythematosus (SLE) – Market Is Expected to Grow with Upcoming Therapies

- J&J’s COVID-19 Vaccine; GigaGen COVID-19 therapy; FDA approved Abbott’s POC test...

- Axovant rely on gene therapy; CAR-T treatments; Pfizer’s dacomitinib; Adaptimmune construct manif...

- Colony Stimulating Factor 1 Receptor (CSF1R) and Its connection with Memory Retention

- Novartis, slammed by Korean scandal; FDA tweaks; Dendreon eyes; Amgen adds

The stage is set for Wezlana to emerge as the primary biosimilar rival to Stelara, with a projected launch in early 2025 following the Amgen-J&J settlement in May. Amgen is well-positioned to capture a significant market share, given Stelara’s robust performance with $9.72 billion in revenue across diverse indications in 2022, encompassing plaque psoriasis, psoriatic arthritis, and Crohn’s disease.

Stelara was initially listed among the drugs slated for the initial round of negotiations by the Centers for Medicare & Medicaid Services, alongside J&J’s Imbruvica and Xarelto, Bristol Myers Squibb’s Eliquis, Merck & Co.’s Januvia, and others. Although the emergence of biosimilars for Stelara poses a potential threat to J&J’s revenue, as it is the company’s highest-selling drug, the removal of this immunology blockbuster from the negotiation table by HHS would enable the company to bypass a process that has been a source of concern for leading companies in the industry.

Following the enactment of the bill last summer, numerous pharmaceutical companies, industry associations, and even the US Chamber of Commerce have contested the imminent price negotiations through legal means. Novartis, AstraZeneca, and Boehringer Ingelheim have recently initiated their own legal challenges, joining a slew of lawsuits from Merck, BMS, and J&J. Meanwhile, Astellas Pharma from Japan chose to withdraw its legal challenge to the IRA in early September. Despite strong anticipation among industry experts that Astellas’ Pfizer-partnered cancer drug Xtandi would be part of CMS’ price negotiations list, the drug fell short of expectations. This disappointment led Astellas to retract its lawsuit. Despite the pharmaceutical sector’s general dissatisfaction with the pricing provisions in the IRA, all the newly added drugmakers for the 2026 term have agreed to engage in the ongoing negotiation proceedings.

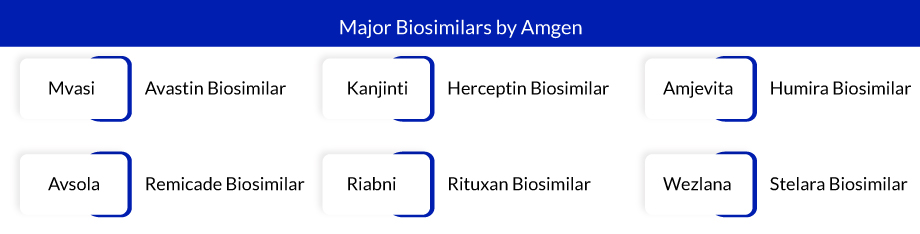

Dominance of Amgen in the Biosimilar Space

So far, Amgen has developed many biosimilars of many blockbuster drugs that have revolutionized the biosimilars market landscape. Earlier in the current year, Amgen gained significant attention with the introduction of a biosimilar. Amgen achieved a noteworthy milestone by being the first company in the US to release a biosimilar version of AbbVie’s renowned autoimmune drug, Humira. The launch of Amgen’s interchangeable biosimilar, Amjevita, a Humira biosimilar, gave the company a six-month lead over a multitude of other companies preparing to release their biosimilar versions of Humira. Up to this point in the year, Amjevita by Amgen has accumulated $466 million in revenue.

While other major players in the biopharma industry are divesting their biosimilar and generics units, Amgen is bucking the trend. In the latest quarterly report, the company announced that its application for the approval of a biosimilar version of Regeneron and Bayer’s macular degeneration drug, Eylea, has been accepted by the FDA. Moreover, Amgen highlighted an augmented investment in the development of its biosimilar iteration of Bristol Myers Squibb’s cancer drug, Opdivo.

Moreover, Amgen’s Stelara biosimilar approval comes with an additional benefit, as it has attained interchangeable designation. This designation empowers pharmacists to substitute it for Stelara without requiring explicit approval from a healthcare professional. Achieving interchangeable status necessitates a comprehensive switching study, demonstrating the biosimilar’s equivalence to the reference product in terms of safety, potency, and purity.

Other Promising Stelara Biosimilars in the Pipeline

Stelara biosimilars are also being developed by several other companies such as Samsung Bioepis, Celltrion, Biocon, and through a collaborative effort between Bio-Thera Solutions and Hikma Pharmaceuticals, BioFactura, Dong-A ST, Accord Biopharma, Meiji Seika Pharma, Intas Pharmaceuticals, Alvotech, JAMP Pharma Group, and others that are going to change the dynamics of the global biosimilars market.

Recently, Samsung Bioepis and Celltrion jointly shared their clinical Phase III findings at the European Academy of Dermatology and Venereology meeting in Berlin, Germany, on Oct. 11. Specifically, they presented comprehensive data on their Stelara biosimilars. Samsung Bioepis unveiled the clinical Phase III outcomes for its Stelara biosimilar, named “SB17,” marking the first public disclosure of these results. The company affirmed, “We have verified clinical equivalence in both efficacy and safety when compared to the original drug.” Notably, Samsung Bioepis concluded its Phase III clinical trials for SB17, involving 503 psoriasis patients across eight countries, including South Korea, in November of the previous year. Additionally, the company recently solidified partnership agreements with Sandoz for the North American and European distribution of SB17 and successfully reached a patent agreement with Janssen, the original developer of Stelara.

BioFactura, Inc. has also released findings from the phase I study of BFI-751, a biosimilar candidate to Stelara. Additionally, on July 10, 2023, the company announced that CuraTeQ Biologics Private Limited, a wholly-owned subsidiary of Aurobindo Pharma Limited, has secured an exclusive global license for the commercialization of BFI-751.

Dong-A ST, the pharmaceutical division of South Korea’s Dong-A Socio Holdings, has officially filed a Marketing Authorization Application with the European Medicines Agency for DMB-3115, its biosimilar counterpart to Stelara. Upon approval of the marketing authorization, DMB-3115 is set to be distributed through Accord Biopharma in the United States and Accord Healthcare in Europe and Canada. The manufacturing and supply of DMB-3115 will be carried out by Dong-A ST and its Japanese collaborator, Meiji Seika Pharma, with distribution overseen by Intas Pharmaceuticals.

Apart from that, Alvotech and JAMP Pharma Group also disclosed that Health Canada has approved JAMP Pharma’s marketing application for AVT04. This Stelara biosimilar, designed by Alvotech, has received marketing clearance and will be available to consumers under the name Jamteki. In June 2023, an agreement was reached between J&J and biosimilar developers Alvotech and Teva, providing them with a license for their planned Stelara biosimilar, AVT04, in the US. The settlement specifies that the biosimilar can be introduced to the market by the manufacturers by no later than February 21, 2025.

The anticipated launch of these biosimilars will give a boost to the biosimilar market not only in the US but also across the globe, but at the same time, they will give fierce competition to Amgen’s Wezlana. Now, it will interesting to see how Wezlana will deal with these biosimilars and stand out as a potential biosimilar to Stelara in the coming years.

Downloads

Article in PDF

Recent Articles

- Off-label Therapies Dominating the Behcet’s Syndrome Treatment Market

- Immune Checkpoint Activators (ICA): Dynamic Therapeutic Targets

- Novartis signs; Sosei passes; Amgen remunerates; J&J remunerates for RSV drug

- Taltz (Ixekizumab) in Treatment of Plaque psoriasis

- AgomAb Therapeutics raises $23.5M; Allergan’s eye drug; Good news for the patients; Dyne Th...