Roche’s TNKase — First New Acute Ischemic Stroke Drug in Nearly 30 Years

Mar 10, 2025

For nearly three decades, Genentech has been the sole provider of an approved medication for acute stroke treatment. On 03 March 2025, the Roche subsidiary expanded its stroke treatment portfolio with FDA approval for TNKase (tenecteplase).

TNKase (tenecteplase) is a thrombolytic, clot-dissolving tissue plasminogen activator. Administered as a single five-second intravenous bolus, it triggers a biochemical reaction that breaks down fibrin, a key component of blood clots. The most common side effects of tenecteplase include bleeding and hypersensitivity. TNKase is now approved for treating acute ischemic stroke (AIS) in adults, with dosing guidelines recommending administration as soon as possible, within three hours of symptom onset. It is also indicated for reducing mortality risk in patients with acute ST-elevation myocardial infarction (STEMI), with treatment initiation advised as early as possible after symptoms appear.

Initially approved in 2000 for reducing mortality in acute heart attack patients, TNKase offers a simpler and faster administration compared to Activase, which requires an IV bolus followed by a 60-minute infusion. To support its new AIS approval, Genentech plans to introduce a 25 mg vial configuration in the coming months.

Downloads

Article in PDF

Recent Articles

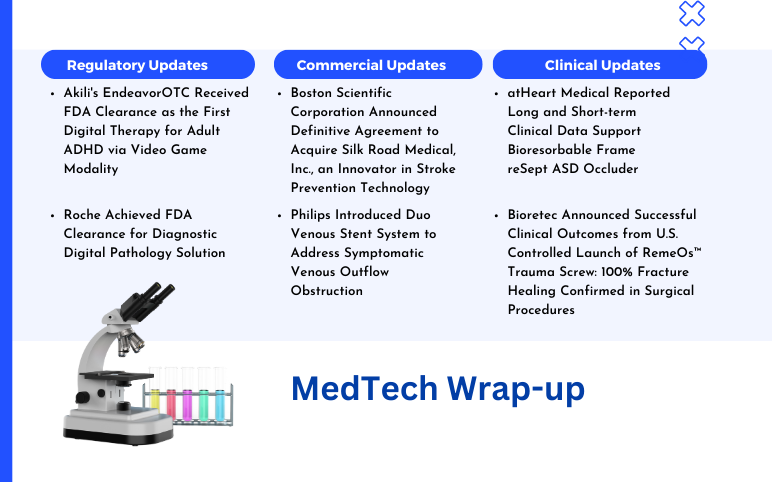

- Prolong’s PP-007 Fast-Tracked for Stroke; FDA Expands JYLAMVO Pediatric Approval; Corcept’s Cushi...

- Wider Administration Window – Need of the Moment for Acute Ischemic Stroke Patients

- Boston Scientific Corporation Agreement to Acquire Silk Road Medical; Philips Introduced Duo Veno...

- Cerenovus Launched Next-Gen Stroke Revascularization Catheter; Dexcom Launched New ONE+ CGM Syste...

The approval of TNKase represents Genentech’s second authorization for stroke treatment, highlighting the company’s ongoing commitment to advancing stroke care. As the developer of the only two FDA-approved medications for acute ischemic stroke—TNKase and Activase (alteplase)—Genentech continues to play a pivotal role in the field. Activase is specifically approved for treating patients with acute ischemic stroke, a condition caused by a blood clot blocking blood flow in the brain. It can only be administered within three hours of symptom onset and after confirming that no brain bleeding is present.

Genentech markets and supplies both alteplase and tenecteplase in the US and Canada under the brand names Activase and TNKase, while Boehringer Ingelheim distributes them outside the US, Canada, and Japan under the brands Activase and Metalyse. Roche reported total sales of 1.202 billion Swiss francs ($1.34 billion) for Activase and TNKase in 2024, reflecting a 5% year-over-year increase.

An acute ischemic stroke occurs when there is a sudden disruption of blood flow to a specific part of the brain, leading to a lack of oxygen and nutrients to that area. This disruption is typically caused by a blockage in one of the brain’s blood vessels, which can be due to a blood clot or an atherosclerotic plaque (a buildup of fatty deposits in the arteries). As a result, brain cells in the affected area begin to die, leading to a range of neurological symptoms.

Stroke ranks as the fifth leading cause of death and the primary cause of long-term disability in the US, impacting over 795,000 individuals annually. During an AIS, brain damage progresses rapidly, making timely medical intervention essential to prevent the irreversible loss of nervous tissue.

As per DelveInsight analysis, in 2023, the total incident cases of AIS were 1.6 million in the 7MM. These cases are projected to increase during the forecast period (2025–2034). A high degree of mortality and morbidity associated with ischemic stroke are two major factors likely to impede the market success of the upcoming therapies.

The approval is supported by a large, multi-center, non-inferiority study showing that TNKase is comparable to Activase in both safety and efficacy for AIS patients. The AcT (Alteplase compared to Tenecteplase) trial evaluated TNKase versus Activase in patients with acute ischemic stroke who exhibited a disabling neurological deficit. This investigator-led study, conducted by the University of Calgary and funded by the Canadian Institute of Health Research, involved patient enrollment across 22 stroke centers in Canada.

Levi Garraway, M.D., Ph.D., Genentech’s chief medical officer and head of Global Product Development, emphasized the importance of this approval, highlighting it as a major advancement in stroke treatment. He noted that TNKase offers a quicker and more straightforward administration, which is crucial for patients experiencing an acute stroke.

This label expansion adds to Roche’s recent streak of regulatory successes. For example, just last month, the company’s SMN2 splicing modifier, EVRYSDI, became the first FDA-approved tablet for spinal muscular atrophy, a rare motor disorder. At the time, Garraway highlighted that the pill “combines established efficacy with convenience,” making it easier for patients to take.

Earlier, in September 2024, Roche and its partner Sanofi secured FDA approval for the first-ever biologic treatment for chronic obstructive pulmonary disease. Their blockbuster IL-4 alpha antagonist, DUPIXENT, received clearance after Phase III trials showed a 30% to 34% reduction in exacerbation rates compared to placebo. This approval increases DUPIXENT’s US indications to six, with its first approval occurring seven years ago for atopic dermatitis.

Additionally, in April 2024, Roche’s Genentech gained approval for ALECENSA as the first and only ALK inhibitor for adjuvant treatment in early-stage ALK-positive non-small cell lung cancer patients who had undergone surgical resection.

Although Roche is on a winning streak and solidifying its position, particularly in the acute ischemic stroke space, several companies will still pose strong competition. The evolving acute ischemic stroke pipeline, featuring candidates such as glenzocimab (Acticor Biotech), DM199 (DiaMedica Therapeutics), milvexian (BMS-986177) from Bristol Myers Squibb and Janssen Pharmaceuticals, Nerinetide (NoNO), LT3001 (Lumosa Therapeutics), and AST-004 (Astrocyte Pharma), among others.

The competitive landscape is intensifying as these emerging therapies leverage diverse mechanisms of action to address the complexities of acute ischemic stroke. While traditional thrombolytics like alteplase and tenecteplase remain the standard of care, newer agents such as glenzocimab, a platelet glycoprotein VI inhibitor, and milvexian, an oral factor XIa inhibitor, are designed to improve efficacy while minimizing the risk of bleeding. Additionally, neuroprotective candidates like Nerinetide and AST-004 are exploring novel pathways to enhance patient outcomes beyond reperfusion strategies.

Regulatory approvals, real-world efficacy, and market penetration will ultimately determine which therapies gain a competitive edge. With Roche expanding its footprint, companies in this space must navigate clinical trial hurdles, demonstrate superior patient benefits, and secure strategic partnerships to establish a stronghold in this rapidly evolving market. In particular, companies developing next-generation stroke therapies are focusing on combination approaches, pairing anticoagulants with neuroprotective agents to address both clot dissolution and neuronal damage mitigation.

Beyond clinical advancements, commercialization strategies will play a crucial role in shaping market dynamics. Partnerships with healthcare systems, reimbursement negotiations, and physician adoption rates will heavily influence the success of emerging therapies. Additionally, companies with strong real-world evidence demonstrating cost-effectiveness and improved long-term patient outcomes are likely to gain the upper hand in securing regulatory approvals and market share.

As the acute ischemic stroke treatment paradigm continues to shift, the race for innovation remains highly competitive. With numerous promising candidates in development, the coming years will likely witness a transformation in stroke management, with therapies that go beyond thrombolysis to address broader aspects of stroke pathology and recovery.

Downloads

Article in PDF

Recent Articles

- Prolong’s PP-007 Fast-Tracked for Stroke; FDA Expands JYLAMVO Pediatric Approval; Corcept’s Cushi...

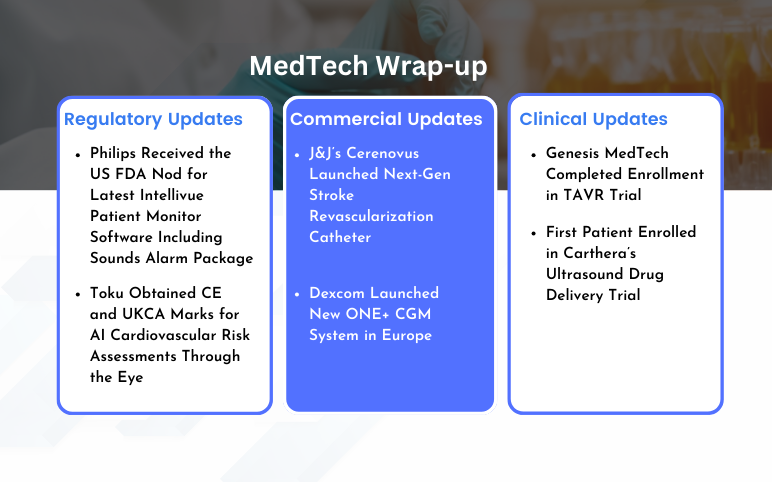

- Boston Scientific Corporation Agreement to Acquire Silk Road Medical; Philips Introduced Duo Veno...

- Cerenovus Launched Next-Gen Stroke Revascularization Catheter; Dexcom Launched New ONE+ CGM Syste...

- Wider Administration Window – Need of the Moment for Acute Ischemic Stroke Patients