15 Prominent Indications for Oncolytic Virus Therapy

Jul 31, 2024

Table of Contents

As cancer continues to be a leading cause of mortality worldwide, there is a growing urgency to develop innovative oncolytic virus therapies that can effectively target and eradicate cancer cells. With its unique ability to selectively infect and replicate within tumor cells, oncolytic virus therapy has emerged as a promising avenue in cancer treatment. Key factors driving oncolytic virus treatment market growth include increasing research and development activities, growing investments from pharmaceutical companies, and expanding oncolytic virus clinical trial pipelines.

With ongoing advancements and strategic collaborations, oncolytic virus therapy is positioned to play a pivotal role in the future of oncology, providing patients with new hope and facilitating the development of more effective and personalized cancer therapies.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Top 7 Emerging Vaccinia Virus-associated Oncolytic Virus Therapies

- 7 HSV-associated Oncolytic Virus Therapies in Late and Mid-Stage

- Is Gene Therapy the Next Cancer Treatment Revolution?

- Oncolytic Virus Cancer Therapy: Transforming Cancer Treatment

- Oncolytic Viruses: Can Be The Next Frontier in Cancer Immunotherapy?

Marketed Oncolytic Virus Therapies

At present, there are only three approved oncolytic virus therapies: Oncorine (Shanghai Sunway Biotech), IMLYGIC (Talimogene laherparepvec/T-VEC, Amgen), and DELYTACT (teserpaturev/G47∆, Daiichi Sankyo). Among these three, there is only one FDA-approved oncolytic virus therapy, IMLYGIC. In 2015, the FDA approved IMLYGIC oncolytic virus therapy by Amgen, the first oncolytic virus, for the local treatment of unresectable cutaneous, subcutaneous, and nodal melanoma lesions in patients whose cancer had recurred after initial surgery.

Later that year, in December, the European Commission also approved for its use in adults with unresectable melanoma that is either regionally or distantly metastatic (Stage IIIB, IIIC, and IVM1a), provided there is no involvement of bone, brain, lung, or other visceral organs. IMLYGIC is a genetically modified herpes simplex virus type 1 engineered to replicate within tumors and produce an immunostimulatory protein called granulocyte-macrophage colony-stimulating factor (GM-CSF).

DELYTACT oncolytic virus therapy is a genetically engineered herpes simplex virus type 1 (HSV-1) with three mutations designed to replicate exclusively in cancer cells. In 2021, it was granted conditional and time-limited approval by the Japan Ministry of Health, Labour and Welfare (MHLW) for use exclusively in hospitals participating as trial sites for treating malignant glioma, valid for 7 years.

This approval was based on results from a single-arm Phase II trial demonstrating that DELYTACT increased one-year survival rates in patients with residual or recurrent glioblastoma, who had previously undergone radiotherapy and temozolomide chemotherapy. It is the first oncolytic virus therapy approved globally for brain cancer and the third oncolytic virus therapy available to patients worldwide.

Oncorine oncolytic virus therapy is a genetically engineered adenovirus known as H101 (E1B-deletion), developed by Shanghai Sunway Biotech in China. It is used alongside chemotherapy to treat nasopharyngeal carcinoma and head and neck cancers. The approval and effective use of Oncorine have significantly advanced the field of oncolytic virus immunotherapy using oncolytic viruses.

Also called Recombinant Human Adenovirus Type 5 Injection, Oncorine was the first oncolytic virus cancer therapy approved by the CFDA for oncolytic viruses in cancer treatment in November 2005. Since its introduction, Oncorine has demonstrated a favorable safety profile and notable anti-tumor effectiveness against various tumors and malignant pleural effusion. It has also been explored in clinical research for treating liver malignancies, pancreatic cancer, cervical cancer, malignant melanoma, and metastatic liver cancer.

Additionally, oncolytic virus cancer therapy is currently only approved for melanoma and malignant glioma (in Japan). Nonetheless, the pipeline for oncolytic virus therapies indicates its potential to become a treatment option for a range of cancers, such as ovarian cancer, non-small cell lung cancer, breast cancer, and renal cell carcinoma, among others.

15 Notable Indications for Oncolytic Virus Therapy

Oncolytic virus therapy is an emerging and promising field in oncology that utilizes genetically modified viruses to selectively infect and kill cancer cells while sparing normal tissue. This innovative approach leverages the natural ability of viruses to infect cells and introduces genetic modifications to enhance their ability to target tumors.

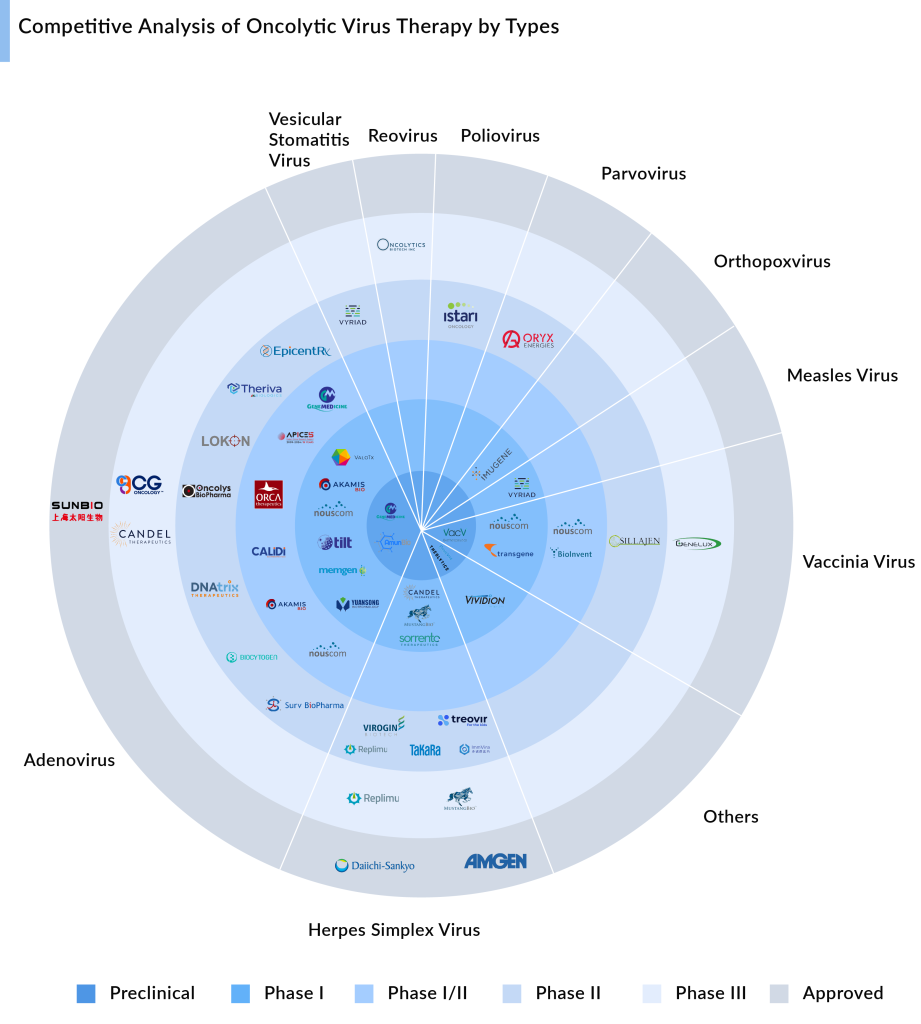

The development pipeline for oncolytic virus treatment is strong, with leading oncolytic virus manufacturers actively working to improve the cancer therapeutic segment. Various types of oncolytic viruses such as Adenovirus oncolytic virus, Herpes Simplex Virus, Vaccinia Virus, and others are under investigation for cancer therapy. Each type has distinct mechanisms of action and therapeutic possibilities, presenting a promising opportunity for novel cancer treatments.

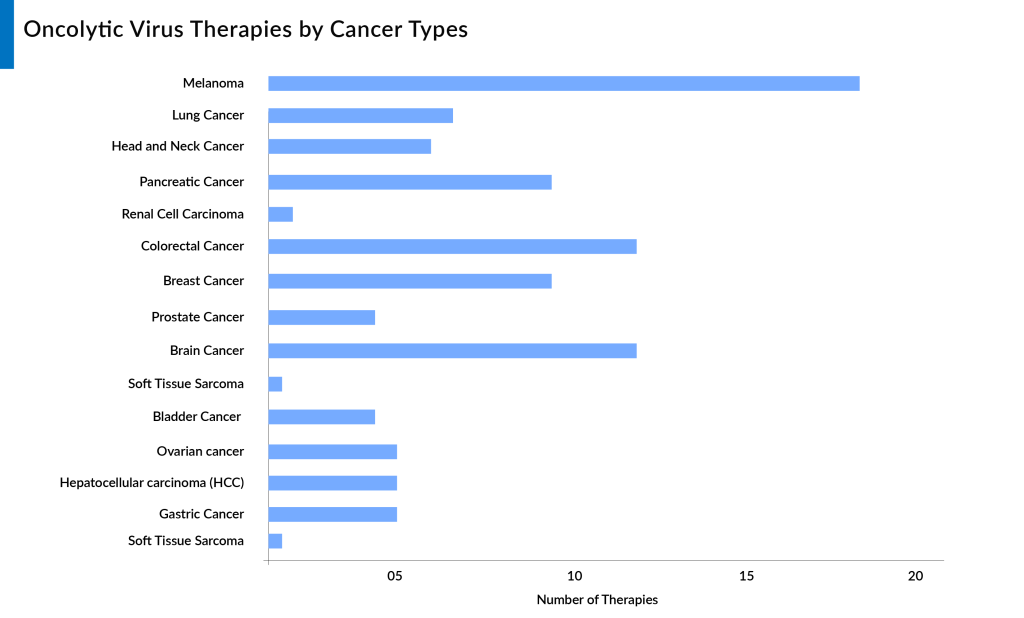

Here are 15 key indications for oncolytic virus therapy based on the number of products in the pipeline, reflecting its potential and versatility in treating various cancer types.

Melanoma

Melanoma of the skin represents 5.6% of all new cancer cases in the U.S. According to the American Cancer Society, if melanoma has spread to other, distant parts of the body, the survival rate is lower, about 27%. Approximately 4% of cases are diagnosed at this stage.

As per DelveInsight analysis, among the 7MM, the highest cases of invasive melanoma were observed in the US, which was ~100,000 in 2023. Melanoma is slightly more common in men than women with ~60% of cases in men in the US.

The treatment of melanoma focuses on prolonging survival, eliminating cancer, shrinking or stopping the growth of known metastases, and controlling symptomatic or risky sites of disease, thereby providing comfort. The treatment landscape of melanoma comprises immunotherapy, targeted therapy, intralesional therapy, chemotherapy, and radiation therapy.

However, surgery is also considered an option in some instances. In February 2024, the FDA approved the first TIL therapy i.e. AMTAGVI, developed by Iovance Biotherapeutics. The other approved therapies include KEYTRUDA (Merck) and TECENTRIQ + COTELLIC + ZELBORAF (Genentech).

Although there are already numerous treatment options available for melanoma today, ongoing research is actively exploring even more innovative approaches. Several melanoma oncolytic virus therapies are currently being investigated at different stages of development.

The melanoma oncolytic virus therapies in the pipeline include Lokon Pharma’s LOAd 703 (Phase II), GeneMedicine’s GM 103 (Phase I/II), Valo Therapeutics’ PeptiCRAd-1 (Phase ), TILT Biotherapeutics’ TILT-123 (Phase I), Replimune’s RP1 (Phase III), Replimune’s RP2 (Phase I), Immvira Pharma’s MVR-T3011 (Phase II), Takara Bio’s Canerpaturev (Phase II), SillaJen’s PEXA-VEC (Phase II), BioInvent International/Transgene’s BT 001 (Phase I/II), Vyriad’s Voyager-V1 (Phase II), Istari Oncology’s Lerapolturev (Phase II), Nouscom’s NOUS-PEV (Phase I), Hangzhou Converd Co., Ltd.’s CVD 1301.H03 (Preclinical), Theolytics’ THEO310 (Preclinical), and PrimeVax Immuno-Oncology PV001 DV (Preclinical).

Emerging melanoma oncolytic virus therapies offer a groundbreaking approach to melanoma treatment by selectively targeting and killing cancer cells while sparing healthy tissue. These therapies not only enhance local tumor destruction but also stimulate a broader immune response against melanoma, potentially improving overall treatment outcomes and reducing the reliance on traditional therapies.

Colorectal Cancer

Globally, colorectal cancer is the third most commonly diagnosed cancer in males and the second in females, with 1.9 million new cases and almost 935,000 deaths in 2020, according to the World Health Organization Global Cancer Observatory (GLOBOCAN) database. As per DelveInsight, in 2023, the total incident cases of colorectal cancer were around 550,000 cases in the 7MM, which might increase by 2034.

ASCO recommends that all people with mCRC who may receive an EGFR inhibitor must have their tumors tested for RAS gene mutations. If a tumor has a mutated form of the RAS gene, ASCO strongly recommends not to use EGFR inhibitors. Furthermore, the FDA now recommends that both cetuximab and panitumumab only be given to people with a tumor with non-mutated, sometimes called wild-type, RAS genes.

The pipeline of colorectal cancer oncolytic virus therapy is quite promising with leading companies with their candidates including Lokon Pharma’s LOAd 703 (Phase II), GeneMedicine’s GM 103 (Phase I/II), Akamis Bio’s Enadenotucirev (Phase I/II), Beijing Bio-Targeting Therapeutics Technology Co., Ltd’s BioTTT001 (Phase I), Replimune’s RP2 (Phase II), Replimune’s RP3 (Phase II), SillaJen’s PEXA-VEC (Phase I), BioEclipse Therapeutics’ CRX-100 (Phase I), Oncolytics Biotech’s Pelareorep (Phase II), Nouscom’s NOUS-209 (Phase I/II), VacV Biotherapeutics VacV002 (Preclinical), and BullFrog AI’s HSV-1 oncolytic virus therapeutic (Discovery).

These emerging colorectal cancer oncolytic virus therapies offer a novel approach to colorectal cancer by specifically targeting and destroying cancer cells while stimulating the immune system to fight tumors more effectively. This innovative treatment could enhance efficacy, reduce side effects, and potentially improve outcomes for patients with colorectal cancer.

Brain Cancer

Brain tumors account for 85–90% of all primary CNS tumors. Among the 7MM, the US accounted for the highest incident cases of primary brain tumors in 2023, with around 23,000 cases; these numbers are expected to increase by 2034.

Treatment options for brain cancers include surgery, radiation therapy, chemotherapy, and targeted therapy. The treatment options and recommendations depend on several factors like the size, type, and grade of the tumor, whether the tumor is putting pressure on vital parts of the brain if the tumor has spread to other parts of the CNS or the body, the possible side effects and finally, the treatment preferences and overall health of the patient.

Several key players are undergoing different oncolytic virus clinical trials for brain tumors. The promising brain cancer oncolytic virus therapies include Candel Therapeutics’ CAN-3110 (Phase I), DNAtrix’s DNX-2401 (Phase II), Apices Soluciones’ AloCelyvir (Phase I/II), Calidi Biotherapeutics’ CLD-101 (Phase I/II), Shanghai Yuansong Biotechnology’s YSCH-01 (Phase I), Treovir’s G207 (Phase II), Immvira Pharma’s MVR-C5252 (Phase II), Mustang Bio’s MB-108 (Phase I), Oncolytics Biotech’s Pelareorep (Phase II), Oryx GmbH’s ParvOryx (Phase I), and Mustang Bio’s MB-109 (Preclinical).

These upcoming brain cancer oncolytic virus therapies are expected to combat the current unmet needs faced by patients with brain tumors and add to the overall growth of the brain tumors market size.

Breast Cancer

Breast cancer is one of the most common cancers worldwide and a leading cause of cancer-related deaths among women. According to the WHO, it accounts for ~25% of all cancer cases in women. The breast cancer subtype HR+/HER2- is the most common subtype with a total incident population of nearly 476,000 cases in the 7MM in 2023.

The stage of breast cancer is an essential factor in making treatment decisions. Most women with breast cancer in Stages I, II, or III are treated with surgery, often followed by radiation therapy. Among the approved therapies, CDK4/6 inhibitors (palbociclib, ribociclib, and abemaciclib) have attracted the most attention. CDK4/6 regulates cell cycle progression by their reversible interaction with cyclin D1. Approximately 29% and 14% of patients with HR+/HER2- BC were found to have amplification of cyclin D1 and CDK4, respectively.

The future of breast cancer treatment is looking promising. Leading breast cancer oncolytic virus therapies in the pipeline include GeneMedicine’s GM 103 (Phase I/II), Valo Therapeutics’ PeptiCRAd-1 (Phase I), Shanghai Yunying Medical Technology’s R130 (Phase I), BioEclipse Therapeutics’ CRX-100 (Phase I), Oncolytics Biotech’s Pelareorep (Phase III), Imugene’s CHECKVacc (Phase I), Codagenix’s CodaLytic (Preclinical), AmunBio’s AMUN-003 (Preclinical), and PrimeVax Immuno-Oncology’s PV001 DV (Preclinical).

The launch of these breast cancer oncolytic virus therapies will not only propel the market growth but also enhance immune system responses, offering a more precise and effective approach compared to traditional methods.

Pancreatic Cancer

Pancreatic cancer is one of the most lethal cancers throughout the globe and majorly affects men compared to women. Pancreatic cancer types can be divided into two larger categories: exocrine pancreatic cancer, which includes adenocarcinoma, and neuroendocrine pancreatic cancer. The analysis from DelveInsight suggests that the stage-specific incident cases of pancreatic cancer in the US were maximum for distant, with nearly 50% cases, followed by regional and localized cases in 2023.

The chemotherapy drugs used for the treatment of pancreatic cancer include XELODA (capecitabine), 5-FU (fluorouracil), GEMZAR (gemcitabine), CAMPTOSAR (irinotecan), and others.

Targeted therapies such as TARCEVA (erlotinib) were approved by the FDA for people with advanced pancreatic cancer in combination with the chemotherapy drug gemcitabine. Another drug, LYNPARZA (olaparib) is approved for people with metastatic pancreatic cancer associated with a germline (hereditary) BRCA mutation.

The development pipeline for pancreatic cancer oncolytic virus therapy is robust, with significant involvement from key players including Candel Therapeutics’ CAN-2409 (Phase III), Theriva Biologics’ VCN-01 (Phase II), Lokon Pharma’s LOAd 703 (Phase II), Akamis Bio’s NG-350A (Phase I), Sorrento Therapeutics’ STI-1386 (Phase I), Oncolytics Biotech’s Pelareorep (Phase III), Oryx GmbH’s ParvOryx (Phase II), GeneMedicine’s GM102 (Preclinical), and VacV Biotheraputics’ VacV001 (Preclinical).

With the expected launch of these pancreatic cancer oncolytic virus therapies, the market will witness an upsurge in growth in the coming years.

Lung Cancer

With more than 500,000 cases in the 7MM region, lung cancer is one of the leading causes of death worldwide. This condition is often diagnosed when the patient reaches the advanced, inoperable, or metastatic stage, adversely affecting their quality of life.

According to the American Cancer Society, out of the total lung cancer cases, ~80─85% of lung cancers are metastatic NSCLC. As per DelveInsight’s mNSCLC market report, NSCLC is slightly more common in men than in women.

The existing NSCLC treatment is mainly dominated by checkpoint inhibitors such as KEYTRUDA, and OPDIVO. Both KEYTRUDA and OPDIVO were introduced in 2014 and had a sizable time advantage over rival drugs. The year 2018 marked a 4-year delay in approving the third PD-1 LIBTAYO. As far as EGFR-positive NSCLC market size is concerned, third-generation EGFRs such as AstraZeneca’s TAGRISSO is expected to dominate.

As more targetable mutations are discovered, and new targeted drugs are developed, patients and oncologists will have an expanding array of treatment options. As a result, several companies are working with their oncolytic virus therapy treatment candidates.

The promising lung cancer oncolytic virus therapies in the pipeline include Candel Therapeutics’ CAN-2409 (Phase II), Valo Therapeutics’ PeptiCRAd-1 (Phase I), TILT Biotherapeutics’ TILT-123 (Phase I), Memgen’s MEM-288 (Phase I), Transgene’s TG6050 (Phase I), Oncolytics Biotech’s Pelareorep (Phase II), and Vyriad’s Voyager-V1 (Phase II).

Approval of these lung cancer oncolytic virus therapies will provide new and different treatment options to the patients and will hence drive the market in the coming years.

Ovarian Cancer

Ovarian cancer accounts for only 3% of cancers in women. Ovarian cancer can be malignant or cancerous, cells that affect tissues in the ovaries. According to DelveInsight’s estimate, the total diagnosed incident cases of ovarian cancer in the 7MM comprised ~57,000 cases in 2023 and are projected to reach up to ~42,000 cases by 2034.

At present, AVASTIN (bevacizumab; Genentech), ZEJULA (niraparib; GlaxoSmithKline), RUBRACA (rucaparib; Clovis Oncology), LYNPARZA (AstraZeneca), are a few approved drug therapies for the treatment of ovarian cancer.

Several treatments can be effective in ovarian cancer, but still, there are many unmet needs in terms of both efficacy and safety, with a cure for the disease being the most important unmet need in the market. To redress the existing issues, currently, many possible new treatment options are emerging from recent ovarian cancer oncolytic virus clinical trials, based both on the modifications of standard approaches and on the addition of new biological drugs to the standard treatment.

The ovarian cancer oncolytic virus therapy pipeline is filled with candidates such as Lokon Pharma’s LOAd 703 (Phase II), TILT Biotherapeutics’s TILT-123 (Phase I), Genelux Corporation’s Olvi-Vec (Phase III), BioEclipse Therapeutics’ CRX-100 (Phase I), and Oncolytics Biotech’s Pelareorep (Phase II).

The expected introduction of these emerging ovarian cancer oncolytic virus therapies with improved efficacy, more awareness initiatives programs, and a further improvement in the diagnosis rate are likely to boost the growth of the ovarian cancer market in the 7MM.

Head and Neck Cancer

Head and neck cancer refers to several types of cancers that affect the head and neck areas of the body. These cancers account for ~3–5% of all cancers in the US and are common in men and people over the age of 50.

HPV infection is an increasingly common risk factor for HNSCC. HPV infection is associated with most oropharyngeal cancers (>70%) and a small minority of cancers at other anatomical sites in the head and neck. In 2023, ~35% of HPV-specific incident cases of head and neck cancer were found to be HPV-positive in the United States, as per DelveInsight estimates.

Currently, no approved therapy in neo, and adjuvant settings exists, whereas the first-line therapy for R/M-HNSCC has been revolutionized by the introduction of immune-checkpoint monoclonal antibodies inhibitors (ICIs).

Key players are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their head and neck cancer oncolytic virus therapy products to improve the treatment landscape.

The head and neck cancer oncolytic virus therapies in the development pipeline include Oncolys Biopharma’s OBP-301 (Phase II), GeneMedicine’s GM 103 (Phase I/II), TILT Biotherapeutics’ TILT-123 (Phase I), Immvira Pharma’s MVR-T3011 (Phase II), Vyriad’s Voyager-V1 (Phase II), and others.

The anticipated launch of these head and neck cancer oncolytic virus therapies are poised to revolutionize HNC treatment by selectively targeting and destroying cancer cells while sparing healthy tissue. These head and neck cancer oncolytic virus therapies offer the potential for enhanced efficacy and reduced side effects compared to traditional treatments, paving the way for more personalized and effective cancer care.

Prostate Cancer

Prostate cancer is the third most prevalent type of cancer in the US and the fourth most common worldwide. Prostate cancer is one of the most common types of cancer in men. As per DelveInsight estimates, the total prevalent population of prostate cancer in the 7MM was nearly 8 million cases in 2023.

Established therapies in the metastatic prostate cancer market include Astella/Pfizer’s and Jansenn’s blockbuster products XTANDI and ZYTIGA, respectively, approved for metastatic patients for over a decade now. Even though ZYTIGA’s generics entered the US market in 2019, and the EU in late 2022, leading to a drastic decline in the revenue mainly in the US, the product is extensively being evaluated in combination with novel emerging therapies, leading to an increase in patient share on the compound abiraterone acetate.

Several prostate cancer oncolytic virus therapies are being investigated in different stages of development. The prostate cancer oncolytic virus therapies in the pipeline include Candel Therapeutics’ CAN-2409 (Phase III), ORCA Therapeutics’ ORCA 010 (Phase I/II), SillaJen’s PEXA-VEC (Phase II), and Oncolytics Biotech’s Pelareorep (Phase II).

These emerging prostate cancer oncolytic virus therapies promise to revolutionize treatment by targeting and destroying cancer cells while sparing healthy tissue, potentially offering more effective and less invasive options.

Bladder Cancer

Bladder cancer was ranked 10th among all cancers worldwide, with 549,000 new cases and 200,000 deaths each year, accounting for 3.4% of the global cancer burden. The prevalence of bladder cancer is higher among males than females, as per DelveInsight.

Bladder cancer treatment options depend on the stage and type of cancer and may include surgery, chemotherapy, immunotherapy, and targeted therapies. Approved drugs for bladder cancer include cisplatin, gemcitabine, and newer agents like nivolumab and atezolizumab, which are used in various combinations to manage and treat the disease.

Over the past few years, the bladder cancer treatment space has heated up. Several key companies are developing novel bladder cancer oncolytic virus therapies. The therapies in the pipeline include CG Oncology’s Cretostimogene grenadenorepvec (Phase III), Akamis Bio’s Enadenotucirev (Phase I/II), Vyriad’s MV-NIS (Phase I), and Vaxiion Therapeutics’s VAX 014 (Phase I).

The expected introduction of these emerging bladder cancer oncolytic virus therapies with improved efficacy, more awareness initiatives programs, and a further improvement in the diagnosis rate are likely to boost the growth of the bladder cancer market in the 7MM.

Renal Cell Carcinoma

Renal cell carcinoma is the eighth most common cancer in the United States, early-stage disease can often be asymptomatic, and 16% of patients present with metastatic RCC. Renal cell carcinoma accounts for 2% of global cancer diagnoses and deaths.

Renal cell carcinoma is the most common type of kidney cancer. Approximately, 20–40% will progress to Stage IV. As per DelveIsight analysis, the incident cases of renal cell carcinoma were highest in the United States among the 7MM in 2023.

The treatment landscape of advanced renal cell carcinoma is governed by targeted therapies and immunotherapies. Some FDA-approved renal cell carcinoma drugs are AFINITOR (everolimus), AVASTIN (bevacizumab), BAVENCIO (avelumab), WELIREG (belzutifan), and others.

Key oncolytic virus manufacturers are working toward the development of potential therapies for renal cell carcinoma to fulfill the unmet medical needs of the currently used therapeutics. The promising emerging renal cell carcinoma oncolytic virus therapies include GeneMedicine’s GM 103 (Phase I/II) and SillaJen’s PEXA-VEC (Phase II). The predicted launch of these oncolytic virus therapies will give a boost to the renal cell carcinoma market in the future.

Hepatocellular Carcinoma

Hepatocellular carcinoma occurs in ~85% of patients diagnosed with cirrhosis. HCC is now the fifth most common cause of cancer worldwide. Five-year survival of HCC is 18% and second to pancreatic cancer. As per DelveInsight’s analysis, 41,200 incident cases of HCC were observed in 2023 in the US.

Current therapies mainly target angiogenesis using multikinase, VEGF, TKIs, and the tumor microenvironment with immune checkpoint inhibitors. Although many clinicians consider TECENTRIQ (atezolizumab) + AVASTIN (bevacizumab) as the first-line standard of care, patient-specific factors might lead to the selection of other first-line options like NEXAVAR (sorafenib), LENVIMA (lenvatinib), or IMFINZI (durvalumab) + IMJUDO (tremelimumab). With various choices available in both first and second-line settings, including TKIs or immunotherapy, the best sequence for administering these therapies remains uncertain.

Pharmaceutical companies are working toward the development of potential hepatocellular carcinoma oncolytic virus therapies to fulfill the unmet medical needs of the currently used therapeutics. The key hepatocellular carcinoma oncolytic virus therapies in the development pipeline include Oncolys Biopharma’s OBP-301 (Phase I), Replimune’s RP3 (Phase II), and Virogin Biotech’s VG161 (Phase II).

The introduction of a hepatocellular carcinoma oncolytic virus therapies approach promises to enhance treatment efficacy and reduce side effects, offering new hope for patients with this challenging liver cancer.

Gastric Cancer

Gastric cancer is the sixth most common cancer worldwide and is also the third leading cause of cancer deaths. The five-year survival rate is relatively good only in Japan, where it reaches 90%. Among the 7MM, Japan had the highest number of incident cases of gastric cancer in 2022, i.e., 126K. Although the incidence of gastric cancer is decreasing in Western countries including the US, there is an increasing incidence of gastroesophageal junction (GEJ) cancer.

The treatment of gastric cancer involves a combination of methods tailored to the cancer’s stage and location. Several approved drugs for gastric cancer include ENHERTU (AstraZeneca/Daiichi Sankyo), CYRAMZA (Eli Lilly), OPDIVO (Bristol-Myers Squibb), KEYTRUDA (Merck), AYVAKIT (Blueprint Medicines), HERCEPTIN (Genentech), and others.

At present, there are a decent number of gastric cancer oncolytic virus therapies under investigation to improve the treatment space. The oncolytic virus therapies in the pipeline include Oncolys Biopharma’s OBP-301 (Phase II), Beijing Bio-Targeting Therapeutics Technology Co., Ltd’s BioTTT001 (Phase II), and Virogin Biotech’s VG161 (Phase I/II). The anticipated launch of these gastric cancer oncolytic virus therapies will give a boost to the overall market growth in the future.

Soft Tissue Sarcoma

Soft tissue sarcoma is a rare entity, and it accounts for ~1% of all cancer incidence in the US and represents ~2% of cancer-related deaths. According to the DelveIsnight assessment, the US contributed the highest number of STS cases among the 7MM.

Currently, surgery is the only potential cure for many patients with STS, but the cancer often comes back within five years. Some of the approved drugs for soft tissue sarcoma include VOTRIENT (pazopanib) by GlaxoSmithKline, TECENTRIQ (atezolizumab) by Genentech, AYVAKIT (avapritinib) by Blueprint Medicines, and TAZVERIK (tazemetostat) by Ipsen.

With the rise in cases, there is a high demand for novel therapies for soft tissue sarcoma, but there is only one company is working in the soft tissue sarcoma oncolytic virus therapy segment. BioInvent International in collaboration with Transgene is evaluating their drug candidate BT 001 in the Phase I/II soft tissue sarcoma oncolytic virus clinical trials. The emergence of this soft tissue sarcoma oncolytic virus therapy will add to the market growth in the future. In addition, persistently rising cases of STS in the forecast period will help increase the STS treatment market.

Bone Cancer

Bone sarcoma is a rare and aggressive cancer that originates in bone tissue. The chances of being diagnosed with primary bone sarcoma and the outlook for recovery vary based on individual factors. In 2023, it is anticipated that ~4,000 people in the United States diagnosed with primary bone sarcoma, including 2,000 males and 1,800 females.

Treatment options often involve a combination of surgery, chemotherapy, and radiation therapy. Several drugs have been approved for managing bone cancer, including methotrexate, doxorubicin, and ifosfamide, which are often used in chemotherapy regimens. Additionally, targeted therapies and novel agents like denosumab and trabectedin are being explored to improve outcomes and reduce side effects. Despite advances in treatment, bone cancer remains a challenging condition requiring a multidisciplinary approach for effective management.

Currently, Surv BioPharma Inc. is evaluating its lead bone cancer oncolytic virus therapy Surv.m-CRA-1 in the Phase II stage of development. With the expected launch of this bone cancer oncolytic virus therapy, the market will witness an upsurge in growth in the coming years.

Conclusion

Oncolytic virus therapy represents a promising and evolving field in cancer treatment with the potential to address a wide range of indications. These indications include solid tumors such as melanoma, brain cancer, and pancreatic cancer, as well as breast cancer, lung cancer, bone cancer, head and neck cancer, and others. The success of oncolytic virus therapy in these contexts is attributed to its ability to specifically infect and lyse cancer cells, stimulate anti-tumor immune responses, and overcome conventional treatment limitations.

Many pharma companies such as Akamis Bio, Amgen, AmunBio, Apices Soluciones, Beijing Bio-Targeting Therapeutics Technology Co., Ltd, BioEclipse Therapeutics, BioInvent International, BullFrog AI, Calidi Biotherapeutics, Candel Therapeutics, CG Oncology, Codagenix, Daiichi Sankyo Company, DNAtrix, EpicentRx, Genelux Corporation, GeneMedicine, Hangzhou Converd Co., Ltd., Immvira Pharma, Imugene, Istari Oncology, Lokon Pharma, Memgen, Mustang Bio, Nouscom, Oncolys Biopharma, Oncolytics Biotech, ORCA Therapeutics, Oryx GmbH, PrimeVax Immuno-Oncology, Replimune, Shanghai Sunway Biotech, Shanghai Yuansong Biotechnology, Shanghai Yunying Medical Technology, SillaJen, Sorrento Therapeutics, Surv BioPharma Inc., Takara Bio, Theolytics, Theriva Biologics, TILT Biotherapeutics, Transgene, Treovir, VacV Biotheraputics, Valo Therapeutics, Vaxiion Therapeutics, Virogin Biotech, Vyriad, and other are currently working with their lead assets to treat several cancers.

With the involvement of these companies along with the rise in healthcare spending across the globe will propel the oncolytic virus therapy market growth. According to DelveInsight’s estimates, the total oncolytic virus therapy market size in the 7MM is projected to grow at a CAGR of 33.3% during the study period (2020–2034)

Furthermore, as research progresses, the identification of additional indications and the refinement of therapeutic strategies will likely expand the applicability of oncolytic virus therapy, offering new hope to patients with a variety of challenging malignancies. Ultimately, this approach holds promise for significantly improving outcomes and advancing personalized cancer treatment.

Downloads

Article in PDF

Recent Articles

- Top 7 Emerging Vaccinia Virus-associated Oncolytic Virus Therapies

- 8 Late and Mid Stages Adenovirus-associated Oncolytic Virus Therapies To Watch Out

- Oncolytic Virus Cancer Therapy: Transforming Cancer Treatment

- Oncolytic Viruses: Can Be The Next Frontier in Cancer Immunotherapy?

- 7 HSV-associated Oncolytic Virus Therapies in Late and Mid-Stage